PI Industries: Focusing on small details to win big

By focusing on custom research for global agriculture companies, PI Industries has carved a niche for itself and grown faster than competition

When Mayank Singhal sits down to talk about the history of PI Industries, he speaks with infectious enthusiasm. From a small edible oil business founded 77 years ago by his grandfather PP Singhal, the business has created the most value for its founding family and shareholders.

Listening to Singhal, 51, as he recounts the twists and turns of its long journey, the inflection points, the breakthroughs and the quest to push the accelerator on growth makes it clear why PI, in all likelihood, has a long runway ahead. As an entrepreneur, Singhal is constantly looking for new growth opportunities. The business now has a market cap of ₹58,000 crore, but investors think it is still good for 18 to 20 percent growth every year, and are pricing that in.

The spike in market cap that has come in the last decade is primarily on account of PI Industries becoming big in the custom synthesis and manufacturing business (CSM). In this business, it offers process research, analytical development and manufacturing for global agri-chem companies. “We managed to break into this market as global companies were comfortable that their intellectual property (IP) would be protected. They see us as a knowledge partner," says Singhal. It is a key advantage the company has over rivals from China. This business (the other being the domestic agri chemicals business) brought in 75 percent of revenues in FY23, up from 59 percent in FY15 and 37 percent in FY10.

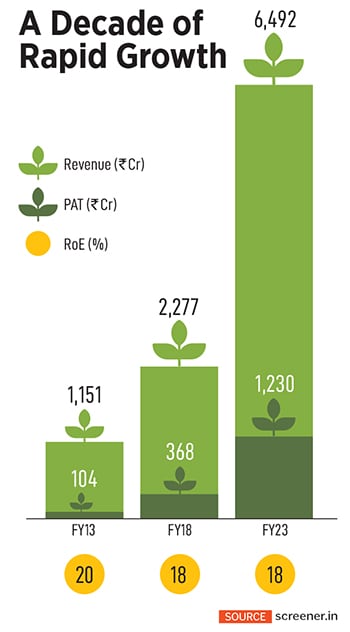

The last decade has seen revenues compound at 19 percent a year to ₹6,492 crore in the year ended March 2023. In the same period, profitability has grown faster at 29 percent a year to ₹1,230 crore. This rapid growth has resulted in the stock moving up 31 percent a year, taking its market cap to ₹58,000 crore. PI’s CSM business has become a strong moat as no other Indian agri-chem company offers this service at the scale that PI does.

The company has added more scientists and researchers in the last two years—from 228 in FY21 to 473 in FY23. The Indian agri-chem export market is also a direct beneficiary of the global China + 1 strategy. As per the World Trade Organization, India is now the world’s second largest agri-chem exporter with exports totalling $5.5 billion in FY23.

Singhal is already planning his next move. PI has announced plans to enter into the CSM business for pharma companies. “They’ve shown they can do complex chemistry well, manufacture and scale up as well as distribute products," says Amit Khurana, head of equities at Dolat Capital. PI’s story is based on taking a commodity business and turning it into a knowledge-based company.

When Singhal came back from university to enter the family business in 1996, he saw a company that had about ₹50 crore in sales. Margins were low and the business had an extended credit cycle. But the young and aggressive third-generation owner knew that all was not lost. “I said to myself, ‘It takes a generation to build what we have built. Let’s see what we can do with it’," he says.

That was when he took baby steps into the CSM business. The company had been working with Japanese companies, and Singhal wanted to check if they could convince them that PI would do their research for them. After making several trips to Japan, a young Singhal got an order. Remember this was the time of no IP protections in India and PI managed to get this business only on account of prior relationships.

While Singhal declined to disclose the name of the product, he did say that this order required significant financing and the $700,000 order needed a plant that cost ₹30 crore. The existing business barely made ₹5 crore a year. Singhal managed to secure money on account of their existing banking relationships. Once the product was made (it took two-and-a-half years to get the first batch right) and dispatched, PI earned the trust of its Japanese counterparts who were happy with the quality and consistency of the supplies. The supplies continued till 2008 and sowed the seeds for a leap PI would make in the decade starting 2010.

During this period, Singhal worked at reorienting the company from a commodity play to one with a strong scientific backbone. He’d seen the business operating as a distributor of agri-chem products and knew that he’d have to deal with poor business economics. That was not a game he was interested in playing. Instead, he would work with global players and licence their products for India—get their price points lower—and distribute them. It was a high-risk gamble. If it succeeded, the payoffs were high, but there was also the risk of a blow-up if it failed.

During this period, Singhal worked at reorienting the company from a commodity play to one with a strong scientific backbone. He’d seen the business operating as a distributor of agri-chem products and knew that he’d have to deal with poor business economics. That was not a game he was interested in playing. Instead, he would work with global players and licence their products for India—get their price points lower—and distribute them. It was a high-risk gamble. If it succeeded, the payoffs were high, but there was also the risk of a blow-up if it failed.

The company then came up with the 4C philosophy: Have the courage to take the next bold step be curious, creative and caring for the community around you. A research and development centre was set up in Udaipur.

PI decided to eschew me-too versions of products already in the Indian market. “We wanted to work with patented molecules and then build brands around them. We then go and explain the value proposition to the Indian farmer," says Rajnish Saran, joint managing director of PI Industries.

Between FY16 and FY23, domestic revenues of PI Industries grew at 9 percent a year. According to Motilal Oswal, the reason for this was patent expiry for Nominee Gold, increased competition in the generic portfolio and the discontinuation of phorate (a pesticide). The brokerage expects PI’s domestic business to grow at 12 percent a year between FY23 and FY25 on account of new product launches. PI also has strong relationships with global companies Bayer, BASF, Mitsui, and could bring in more products from their portfolio for the Indian market.

The company is most excited about the export market. Its CSM business saw revenue growth of 28 percent between FY18 and FY23, and is expected to grow at 21 percent in FY23-25. Margins have also expanded from 20 percent in FY16 to 24 percent in FY23. While the company doesn’t share names of the products it is working on, its pipeline is said to be 25 molecules strong. The global agri-chem market has faced a subdued two years on account of overcapacity in the Chinese market, but PI, which makes only patented molecules, has managed to buck the trend due to the fact that clients trust them with their IP.

With strong research capabilities in the agri-chem segment, PI entered the pharma space recently. Here too the plan is to offer custom research solutions to global companies and then manufacture for them in India and export. This is arguably a much bigger market opportunity—$29 billion versus the $6 billion opportunity size of the global agri-chem business. Two acquisitions—Therachem Research and Archimica—should help it capitalise on the opportunity soon.

As Singhal looks back at his almost-three-decade stint at PI, he admits he is thankful for the way things have gone. He’s still young (and experienced) and has easily a decade or two more to go. An early riser, he travels 15 to 20 days a month and is constantly on the lookout for what the company can do. His biggest sounding board are the company’s board of directors, each of whom he can call up any time and bounce ideas off. But unlike others who have created large companies, Singhal says he focuses on the small things that can make or break his business. “For the big things I have enough people. It is the details that decide the success or failure of an initiative."

First Published: Apr 23, 2024, 13:33

Subscribe Now