Life hacks you need to know to save money while studying abroad

Indian students studying and working abroad share their tips and tricks to save money while living on a shoestring budget

Generation Z (Gen-Z) can be credited with popularising the word ‘adulting’. That phase begins when people move out of their homes for higher studies, and eventually jobs. For Gen-Zs (people born between late 1990s and early 2010s), adulting refers to living like responsible adults—paying bills, buying groceries, taking care of your home and looking after yourself.

Adulting often gets more difficult when you are in an another country. For students studying and working abroad, it is all about how to manage expenses on a budget, strike a work-study balance and come up with hacks to save money.

When Chaya Upadhyay, 23, moved to Leeds, England, seven months ago, she didn’t think there’ll be so many hurdles to overcome. She comes from a nuclear family in Navi Mumbai and moved to England to pursue a master’s in corporate communications, marketing and public relations from the University of Leeds.

The UK is known for its high cost of living, and its ongoing recession only adds to the concerns of students like Upadhyay who have taken a student loan. “Besides the loan, my parents help me pay half my accommodation rent. I bear the other daily expenses too," says Upadhyay, who has taken up a part-time job as a bartender at a local brewery.

Her typical week consists of six-seven hours of classes every day except Tuesdays and Saturdays, which have lesser classes, allowing her to take up shifts at the brewery. “My shift starts at about 6 pm and goes on till midnight. I come home by 1 am. With early morning classes the next day, managing both gets exhausting," says Upadhyay, who, as per regulations, can only work for 20 hours a week as a student in the UK. On Saturdays—a college holiday—she works a 12-hour shift starting from 9 am.

According to a report by the Ministry of External Affairs, more than 55,000 Indian students went to the UK to pursue higher education in 2022. As difficult as fending for yourself in any city/state/country outside your hometown can be, the UK can be a bit more difficult, as it ranks among the top countries with the highest cost of living. As per rules in the UK, if a student is below 23, they get paid 10 pounds and 43 pence per hour, which increases to 10.5 if you are 23 and above.

“I earn around 210 pounds per week and that is roughly about 840 pounds a month. I take care of all my expenses from this income," says Upadhyay, adding that a lot of students in the UK get monthly allowances from their family amounting to 1,000-1,500 pounds. The other jobs that Indians take up include waitressing, store salespersons or bartending. “Anything else, like a desk job for instance, is difficult to do in the 20 hour per week window."

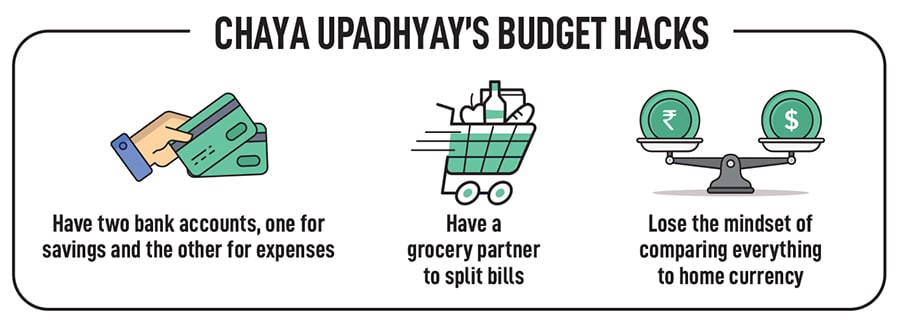

A hack that Upadhyay uses to keep track of her expenses is creating two bank accounts. In one, she keeps her savings, which will become her due rent, and in the other, she keeps money for her daily expenses. Besides this, Upadhyay suggests having a grocery partner. “It helps as the bill gets split... groceries are really expensive here."

Another suggestion is to lose the mindset of comparing everything with home currency. “If you come with that mindset, you will never save, you will never shop and you’ll go crazy," she says, reminiscing about her initial days when she used to stop herself from buying coriander, because it cost `20 in India, but two pounds, or almost `250, in the UK.

Taking an off from work to focus on sudden assignments/exams poses a challenge for Upadhyay. “Because I survive on a budget, I cannot afford to miss my shifts. If I do, I need to have some amount saved. If not, I have no money for that particular week."

Upadhyay also had to deal with racism initially, but says that one learns how to tackle it better with time.

Her mantra to survive abroad is to plan better, have a strong mindset, and keep motivating herself. “There is a recession, it’s perpetually cold, gloomy, and depressing. Initially, I would question my choice of moving to the UK. But I realised that it’s all about keeping a positive outlook. You can cry about it or get up again because every day is a new day, and it gets better," she adds.

Krutika Gopalakrishnan, 23, is currently pursuing a master’s in management from ESCP Business School, Paris.

Krutika Gopalakrishnan, 23, is currently pursuing a master’s in management from ESCP Business School, Paris.

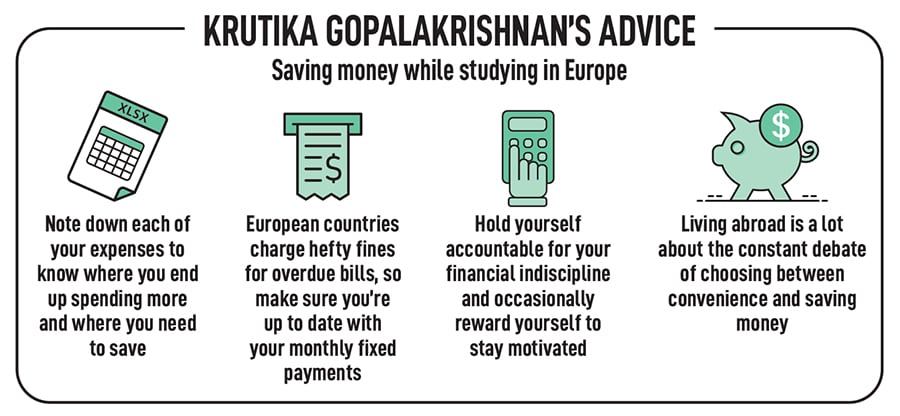

Just like the UK, European countries are also known for their relatively higher costs of living. Krutika Gopalakrishnan, 23, is currently pursuing a master’s in management from ESCP Business School, Paris.

The curriculum, she tells Forbes India, is structured in a way that the students can study in four campuses. The course is two years long, but students can choose to take a gap year/semester to do internships. She started her first year in the Madrid campus and has now taken a gap year to do internships. “I did my first six months of internships in Berlin at Mercedes and now I am doing my next six months in Paris at Pernod Ricard," says Krutika.

Krutika’s internship includes working on major campaigns for the Cognac brand Martell across markets, helping in the design, structure, execution and coordination of the campaign along with other agencies.

Unlike Upadhyay who took up a part-time job to fend for herself, Krutika’s main reason for taking a gap and doing internships is to fulfil college requirements. Finding a job in Europe without international experience is not easy though. While working to gain experience as a college mandate in one thing, Krutika doesn’t deny its monetary benefits. “A lot of us take up internships or working student roles to pay off our living expenses. I earn 1,400 euros per month, almost the average in Paris, which helps me in managing my expenses."

While the UK has a time regulation when it comes to students working part-time, European countries have other problems. Krutika says in the European Union (EU), it’s not common to get a part-time job. “It’s only in Germany that you get some opportunities, as a postal agent or a food delivery person. This is due to language barriers. It gets difficult to find a part-time job without language fluency in a lot of client-facing roles," she says.

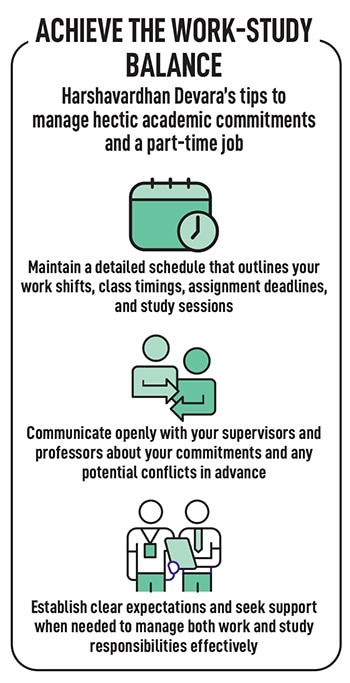

In the US, Harshvardhan Devara has found work within his field of education. He is doing his master’s in management information systems at the CT Bauer College of Business, University of Houston Texas, and dedicates three days per week, totalling 20 hours, to work as an instructional assistant within the management and leadership department.

In the US, Harshvardhan Devara has found work within his field of education. He is doing his master’s in management information systems at the CT Bauer College of Business, University of Houston Texas, and dedicates three days per week, totalling 20 hours, to work as an instructional assistant within the management and leadership department.

A significant portion of his role involves help with data collection for research purposes. He also uploads course materials for undergraduate courses onto the learning platform. He earns $1,200 per month. “While financial considerations were a factor, my primary motivation was to gain relevant work experience and contribute meaningfully to the university community," he says.

According to him, in Texas, many Indian students gravitate towards on-campus employment opportunities, particularly roles under professors such as teaching, research and instructional assistants. They are favoured due to their alignment with academic interests, minimal physical labour requirements and competitive remuneration packages. Another sought-after part-time job among Indian students is proctoring undergraduate student exams. Working in college canteens and popular eateries like McDonald’s, Chick-fil-A and Panda Express are also options for those seeking part-time employment.

Devara emphasises that relying solely on part-time work to cover university fees is unrealistic. While the income from part-time jobs can alleviate financial burdens to an extent, it’s often insufficient to fully fund tuition fees in the US. “In my personal experience, the earnings from my part-time job primarily support my day-to-day living expenses, such as accommodation, groceries, transportation and other essentials. However, the substantial cost of tuition fees is predominantly covered through educational loans or other forms of financial aid," he says.

It’s essential for international students to approach their financial planning with a realistic understanding of the expenses involved. For instance, food is a significant expense and eating out often can quickly deplete financial resources. By preparing meals at home rather than eating out, students can manage their expenses and allocate funds more efficiently. Having a roommate who can help with cooking and other household expenses can also contribute to more savings.

Working while studying in a different country can be exhausting. “At times, the workload from my part-time job, particularly during busy periods such as exam seasons or when project deadlines coincide, can become quite hectic," says Devara. “Juggling work shifts with classes, assignments and studying requires careful time management and prioritisation to ensure that neither aspect suffers."

First Published: Apr 19, 2024, 12:03

Subscribe Now