IndusInd Bank – as steady as it gets

We view Q1 FY19 as a continuation of the well-charted out strategy of building a solid business with a focus on high yielding/good quality assets, backed by retail focused low cost liability.

Image: Shutterstock

Image: Shutterstock

Madhuchanda Dey

Moneycontrol Research

IndusInd Bank (IIB) kicked off the Q1 FY19 earnings season with its predictably consistent performance. Headline profitability growth in mid-20s has been accompanied by an improvement in business parameters and pristine asset quality. A slight moderation in interest margin and low-cost deposits growth were the only soft spots. The bank is gearing up for the merger with micro finance lender Bharat Financial Inclusion and is in the process of wrapping up its latest acquisition in the capital market space: IL&FS Securities Services.

In the past three months, the stock price has rallied close to 4.6 percent in line with the Nifty's performance. The stock appears fully priced at 4 times FY20e adjusted book. In the absence of a multiple re-rating, its future performance would closely track earnings growth. We expect the same to be in the high 20s.

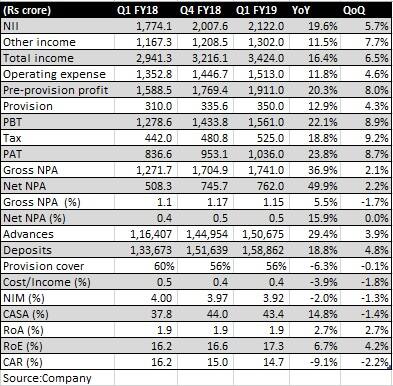

Quarter at a glance

Net interest income (NII, the difference between interest income and expenses) grew 20 percent year-on-year, led by a 29 percent growth in loans and a tad soft interest margin at 3.92 percent. While core fee income grew close to 20 percent, the 29 percent decline in treasury gains due to further hardening of bond yields resulted in softer growth in non-interest income.

Despite lower credit cost (relating to non-performing loans), provisions grew as it contained an Rs 86 crore mark-to-market impact on its bond portfolio.

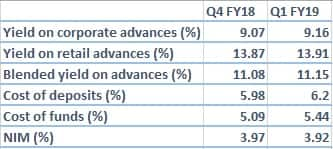

What is interesting to note is the quarter-on-quarter improvement in core performance, with NII growth of 6 percent outpacing credit growth of 4 percent, thereby suggesting that part of the benefit of upward revision in marginal cost based lending rate (MCLR) has started flowing in.

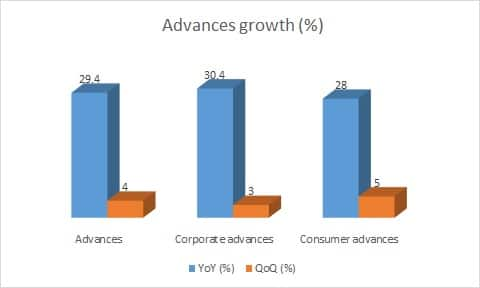

Traction in loan book

The bank is witnessing strong demand for working capital from corporates as well as the commercial vehicle lending businesses.

Source: Company

We feel the void created by the troubles in the public sector banking space has been well capitalised by smarter entities like IIB.

Market share gains

IIB is well-capitalised (Capital adequacy ratio: 14.7 percent) and has gained market share in both loans and deposits. Its market share in incremental business of deposits and loans in the past 1 year stood at 3.1 percent and 3.5 percent, respectively, which is much higher than its absolute share of 1.4 percent and 1.8 percent, respectively.

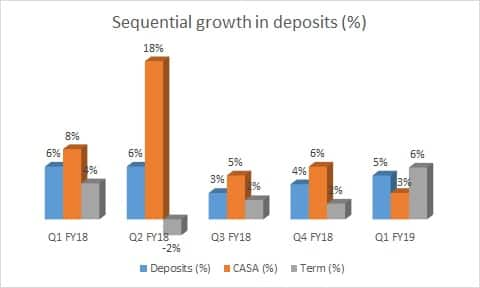

CASA and NIM a tad softer

While the performance on most business parameters leaves little room for complaint, the lone soft spot was the lacklustre growth in low-cost deposits – current and savings accounts - whose share fell a tad over the previous quarter.

Source: Company

The exceptionally high incremental credit-to-deposits ratio (at 136 percent) and the slow accretion of CASA (especially current deposits) has contributed to softness in interest margin despite improvement in lending yields both on the corporate as well as retail side. The management is confident of maintaining margin in the 3.9 percent to 4 percent band. We feel access to high yielding assets of Bharat Financial as well as efforts to add new depositors should help realise this objective.

Source: Company

No complaint on asset quality

Asset quality showed a great deal of improvement with slippages falling to a normalised quarterly level of Rs 475 crore after the spike witnessed in the previous quarter. In fact, total delinquency (gross NPA and restructured assets) fell to 1.20 percent from 1.23 percent reported in the previous quarter.

We view Q1 FY19 as a continuation of the well-charted out strategy of building a solid business with a focus on high yielding/good quality assets, backed by retail focused low cost liability. The merger with Bharat Financial will be in continuation of this journey and should enable the bank to report earnings in high 20s. We expect the stock returns to follow.

Original Source: https://www.moneycontrol.com/news/business/moneycontrol-research/indusind-bank-as-steady-as-it-gets-2695871.html