RIL Q2 profit rises 0.6% to Rs 9,516 cr QoQ, GRM stands at $9.50/bbl

Good petrochemical and telecom businesses offset lower other income and weak refining business.

Image: Qamar Sibtain/India Today Group/Getty Images

Image: Qamar Sibtain/India Today Group/Getty Images

Moneycontrol News

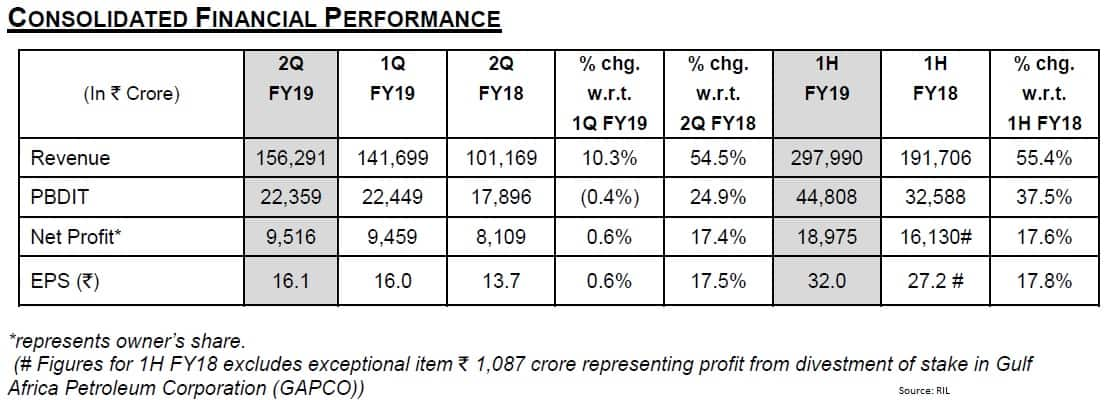

Telecom-oil-to-retail conglomerate Reliance Industries has reported a 0.6 percent sequential growth in consolidated profit to Rs 9,516 crore for the quarter ended September 2018. Good petrochemical and telecom businesses offset lower other income and weak refining business.

Consolidated revenue during the quarter grew by 11.3 percent to Rs 1.43 lakh crore driven by growth across segments QoQ.

Profit on year increased 17.35 percent and revenue jumped 56.66 percent in second quarter.

"Company delivered robust operating and financial results for the quarter despite macro headwinds, with strong growth in earnings on YoY basis," Mukesh Dhirubhai Ambani, Chairman and Managing Director said.

Read the latest updates on Reliance Industries here.

World-class petrochemicals assets contributed record earnings; endorsing benefits of diversified feedstock, integration and superior product portfolio, he added.

Petrochemical business during the quarter grew by 8.6 percent sequentially (up 56.2 percent YoY) to Rs 43,745 crore due to increase in volumes and price realisations.

Petchem EBIT (earnings before interest and tax) rose 3.3 percent QoQ (up 63.7 percent YoY) to a record level of Rs 8,120 crore in Q2. The growth was driven by strong YoY volume growth led by successful stabilisation of the world's largest ROGC, its downstream units and new PX facility.

Sharp increase in segment performance also reflects improvement in the integrated polyester chain margins partly offset by the softer polymer margins, Reliance said.

Refining segment revenue during the quarter increased 3.25 percent QoQ (up 41.6 percent YoY) to Rs 98,760 crore with its EBIT growing only 0.13 percent QoQ (down 19.6 percent YoY) to Rs 5,322 crore.

Refining and marketing performance was impacted by significantly higher crude price (up 47 percent YoY), tighter light-heavy differential and adverse movement in light distillate cracks on Y-o-Y basis and shutdown of Fluid Catalytic Cracking Unit (FCC), the company said.

Mukesh Ambani Group company further said gross refining margin for the quarter stood at $9.50 a barrel, outperforming Singapore complex margins by $3.4 a barrel. GRM for June quarter was $10.5 a barrel.

On the operational front, company's EBITDA (earnings before interest, tax, depreciation and amortisation) grew by 2.2 percent quarter-on-quarter to Rs 21,108 crore. Margin for the quarter stood at 14.7 percent against 16 percent in June quarter.

Other income during the quarter declined nearly 30 percent sequentially to Rs 1,250 crore.

Mukesh Ambani said the financial performance of both Retail and Jio reflect the benefits of scale, technology and operational efficiencies. "Retail business EBITDA has grown three fold on YoY basis whereas Reliance Jio EBITDA has grown nearly 2.5 times."

Jio has now crossed 250 million subscriber milestone and continues to be the largest mobile data carrier in the world, he added.

Reliance Jio

Reliance Jio's second quarter profit increased to Rs 681 crore in Q2FY19, a growth of 11.3 percent over Rs 612 crore reported in June quarter, driven by consistent addition in subscriber base.

Revenue during the quarter grew by 13.9 percent sequentially to Rs 9,240 crore, the company said, adding subscriber base was 252.3 million as of September 2018.

Average revenue per user for the quarter stood at Rs 131.70 against Rs 134.5 in previous quarter.

Jio's EBITDA in second quarter increased 13.5 percent to Rs 3,573 crore QoQ.

Strategic Investments

Reliance Industries announced strategic investments in and partnership with cable television service operators Den Networks and Hathway Cable.

Hathway Cable

Jio will acquire 51.34 percent stake in Hathway Cable by investing Rs 2,940 crore through a preferential issue.

Hathway Cable will issue 90.8 crore shares to Jio at Rs 32.35 per share.

Den Networks

Reliance Jio will acquire 66.01 percent stake in Den Networks by investing Rs 2,045 crore via a preferential issue and also through a share purchase agreement of Rs 244 crore with the existing promoters.

SkyTran Inc

Reliance Industrial Investments and Holdings, a wholly owned subsidiary of Reliance Industries, acquired 12.7 percent shareholding in SkyTran Inc, a US incorporated venture-funded technology company developing state of the art technology in the field of Personal Rapid Transit Systems.

Retail Segment

Retail business registered a healthy 25.3 percent sequential growth (up 121.5 percent YoY) at Rs 32,436 crore in Q2. Accelerated store expansion, strong value proposition and focus on customer experience across all consumption baskets has resulted in this robust growth, RIL said.

Retail EBIT rose 16.4 percent QoQ (up 272.5 percent YoY) to Rs 1,244 crore for the quarter ended September 2018.

Reliance said the outstanding debt as of September 2018 was Rs 2,58,701 crore compared to Rs 218,763 crore as of March 2018. Cash and cash equivalents as of September 2018 were at Rs 76,740 crore against Rs 78,063 crore as of March 2018, it added.

The stock rallied 29 percent during the quarter and gained 26 percent year-to-date. It has, though, corrected nearly 12 percent since August 28, when the market touched record high.

The stock closed at Rs 1,148.90, down Rs 14.75, or 1.27 percent ahead of quarterly earnings announced after market hours.

Disclaimer: Reliance Industries Ltd, which owns Jio, is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Original Source: https://www.moneycontrol.com/news/business/markets/ril-q2-profit-up-0-6-qoq-grm-at-9-50bbl-to-buy-controlling-stake-in-hathway-cable-den-networks-3056771.html