Is the exit poll euphoria here to stay?

The market rally may eventually narrow further, so focus only on the winners who stand tall amid the ruins

Highlights:

- Between 2014 and 2019, earnings growth was much lower than nominal GDP growth

- Valuations today are more expensive as compared to May 2014

- Consumption and government investment were key drivers in the past few years

- Consumption is slowing and the government does not have enough funds

- Tall task for the new government to revive growth

- Investors ought to get out of weak stocks post exit poll/poll result rally

- Market rally will eventually narrow down to stocks with earnings visibility

-------------------------------------------------

The exit poll forecast has come as a big relief for stock market bulls, most of whom were expecting the BJP-led National Democratic Alliance (NDA) to scrape home.

The final numbers are awaited, but if they are in line with the exit poll trends share prices could rally some more as fence sitters too join the party.

But is it time to bet on a fundamental re-rating of Indian equities, or should one be more discerning?

The return of NDA will remove any lingering doubts about political uncertainty and investors would be justified to expect a continuity in policies. And yet, the moot question remains: is policy continuity in itself good enough to trigger a re-rating in the stark absence of strong earnings growth.

The 'Modi magic', unlike in 2014, may be short-lived as the market will soon be up against ground realities — weak corporate earnings and lack of enough levers with the government to reverse the situation in a hurry.

How did earnings fare between 2014 and 2019?

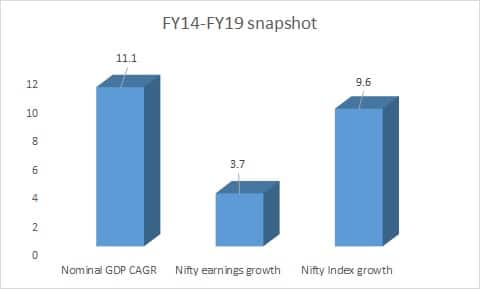

Let us rewind to May 2014; the market's prayer for a stable government was answered. But earnings never kept pace with expectations. While nominal GDP grew at 11 percent compounded annually from 2014 to 2019, aggregate Nifty earnings grew only 3.7 percent. The earnings picture beyond the Nifty stocks was even more dismal. But that was no dampener for the stock market bulls, as the Nifty rose 9.6 percent compounded annually in the last five years.

Source: Moneycontrol Research

At 19.8 times one-year forward earnings, the market today is a little more expensive compared to 17.2 times one-year forward earnings before the last election result in 2014. This shows that there is still a fair bit of optimism among investors.

Die-hard bulls will argue that the valuation is reasonable given the likelihood of over 20 percent growth in Nifty earnings in FY20. This is in stark contrast to the low to mid-single-digit earnings growth seen in the past many years.

But a closer look at projected FY20 Nifty earnings suggests that incremental growth in the current fiscal over the previous year is almost entirely driven by corporate lenders as provisions decline. If broader growth in the economy continues to be on a slow lane and global growth outlook remains tentative, a broad-based earnings recovery may remain a pipe dream for a while.

Two out of the four engines that were firing are now faltering

In the past few years, growth was mainly driven by consumption and the government's focus on affordable housing, roads and urban infrastructure. This optimism of a recovery in the investment cycle had led to some improvement in capacity utilisation.

However, the slowdown is now evident. March IIP (industrial growth) momentum remained soft on the back of sluggish domestic demand. Most of the weakness came on the back of capital goods, intermediate goods and consumer durables, indicating a mix of consumption and investment-related slowdown.

Source: RBI

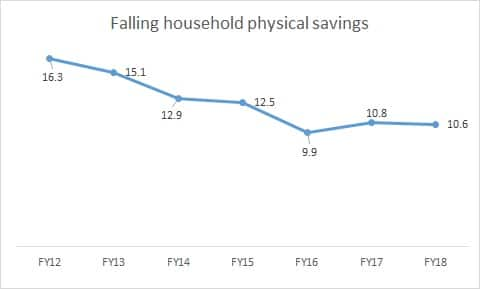

An analysis of household savings data (household physical savings rate down to 10.6 percent in FY18 from 15.1 percent in FY13) as well as sector and company volume data suggest that households may have gradually cut back on consumption due to insufficient income growth.

Lower property purchases by households over FY13-18 sustained consumption for the past few years before low household income growth forced consumers to tighten their purse strings. This trend can be seen in the weak demand for both discretionary (cars, two-wheelers etc) items and staples (as seen in the recent FMCG results). The liquidity crunch in the non-banking financial company (NBFC) space and farm sector concerns may have also impacted consumption.

Investment (as measured by gross fixed capital formation), which grew an average 16.2 percent between FY04 and FY08, has fallen to 3.7 percent between FY14 and FY18. A step-up in capex spending by the government, alone could not improve the investment rate in the economy.

Going forward, the fiscal space (from government budget) to support capex in FY20 will be constrained given the tall ask from Goods & Service Tax (GST) collections and higher revenue expenditure. The country may have to increasingly rely on farm income schemes, if it is unable to move a substantial number of its agriculture workforce to other sectors.

The Indian agriculture sector is already grappling with the problem of stagnant farm incomes as higher output volumes have typically resulted in lower prices over the past two-to-three years. This problem may intensify as agriculture yields rise further in India.

Given that the government is struggling to fund capital expenditure, it may constrain broader investment in the economy because of the decline in overall savings and household savings rate over the past few years. Private sector investment is unlikely to see a sharp recovery given the still-weak balance sheets and limited scope for the private sector to invest in infrastructure.

Can the new government wield a magic wand?

The priority for the next government will be to revive economic growth although the macroeconomic set-up is not very favourable. So far, going by the BJP manifesto, there is no hint of a drastically different economic policy, which can quickly salvage the situation.

India's fiscal position has hardly improved over the past few years given growing demands on government budgets to support both consumption and investment. So, the room for fiscal support to revive growth is limited. The government needs to address few critical areas - surplus workforce in the agriculture sector, health of state-run undertakings and NBFCs, inadequate private sector investment and generating jobs for the millions entering the work force. Most of these issues are structural with no quick fix solution.

The only predictable fall out of the slowdown is the space for more rate cuts by the Reserve Bank of India. But the monetary policy transmission channel may remain weak as the fiscal deficit remains stubbornly high and liquidity challenges continue because of the NBFC crisis.

Also, the ability to cut rates may be constrained in the event of a deficient monsoon due to El Nino. If food prices soar, it may exert further pressure on government finances and could turn out to be inflationary.

Crude oil that had provided the much needed relief in 2014 could also turn out to be the joker in the pack. The road to recovery can get more challenging should crude oil persist at elevated levels.

The recent noise over the US-China trade war, however, can partially alleviate the commodity price inflation-related concerns and benefit India by giving it room for a rate cut. The dovish stance of the global central banks may lead to higher capital flows to emerging markets (the only silver lining) and this could support the markets once the political instability is out of the way.

The other medium-term hope from a stable government is if it could use the US-China spat to its advantage to push manufacturing exports from India, which could support growth as well as turn out to be an effective engine for job-creation that a largely service-oriented economy has failed to generate in recent times.

What to do post the election verdict?

A sentiment-driven rally after the election verdict cannot be ruled out. A large section of the market would choose to overlook the near-term headwinds and start valuing the markets on imaginary earnings estimates of FY21 and beyond. For savvy investors, such a hope rally could be an ideal opportunity to exit weak positions in the portfolio.

Markets at the end of the day are slaves of earnings, so the wise should stick to sound businesses with strong earnings visibility that can reasonably weather a slowdown. The market rally may eventually get even narrower, so focus only on winners who stand tall amid the ruins.

Original Source: https://www.moneycontrol.com/news/business/moneycontrol-research/is-the-exit-poll-euphoria-here-to-stay-3999041.html