Jaitley's income tax proposals bring cheer to small taxpayers

The personal income tax rate for individuals in the lowest slab has been halved to 5 percent

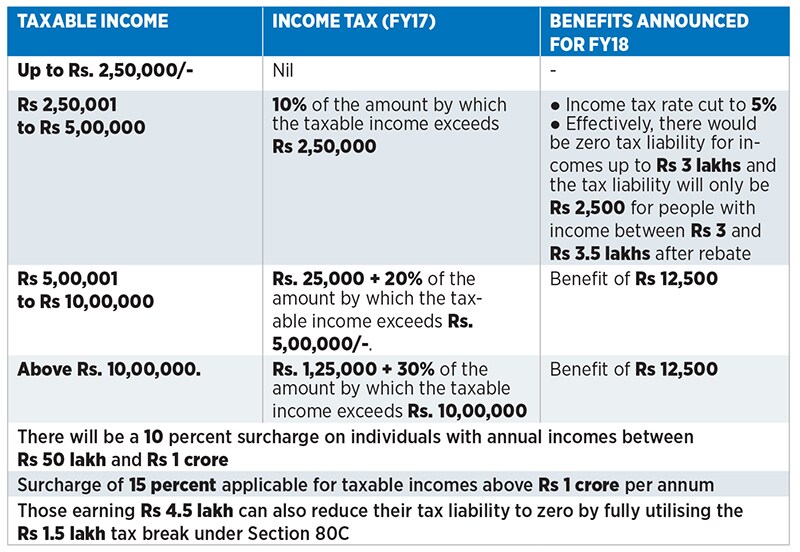

Finance Minister Arun Jaitley, while presenting the Union Budget for fiscal year 2017-18 on Thursday, announced sops for individuals in the lower end of the tax bracket. Those with taxable incomes between Rs 2.5 lakh and Rs 5 lakh per annum will be taxed at 5 percent from the next financial year instead of the current 10 percent. Combined with the Section 87A rebate, tax for those with income up to Rs 3 lakh would be zero.

In the subsequent tax slabs, there will be a benefit of Rs 12,500.

In an attempt to simplify the filing of income tax returns, the FM announced that those with an annual income below Rs 5 lakh will have to file only a single-page document, provided there is no business income. Moreover, there will be no scrutiny of returns for first-time filers, he added.

A 10 percent surcharge on individuals with annual incomes between Rs 50 lakh and Rs 1 crore has been introduced. For those with incomes above Rs 1 crore per annum, the surcharge will continue to be 15 percent.

First Published: Feb 01, 2017, 15:59

Subscribe Now