How to check ITR refund status online

Wondering about the status of your ITR refund? This comprehensive guide will help you understand the process and decode your refund status

When you file your income tax return in India, you might have paid more tax than you owe. This could be due to tax deducted at source, advance tax, or self-assessment tax. The excess tax paid is eligible for a refund. Once you"ve filed your income tax return and claimed a refund, the Income Tax Department processes said refund.

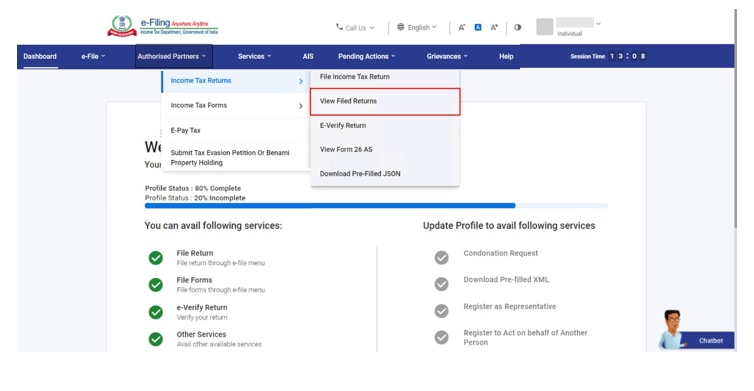

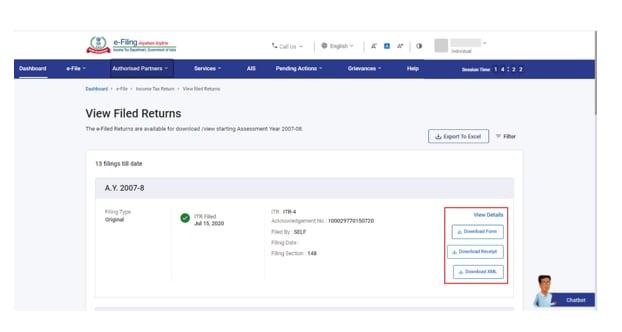

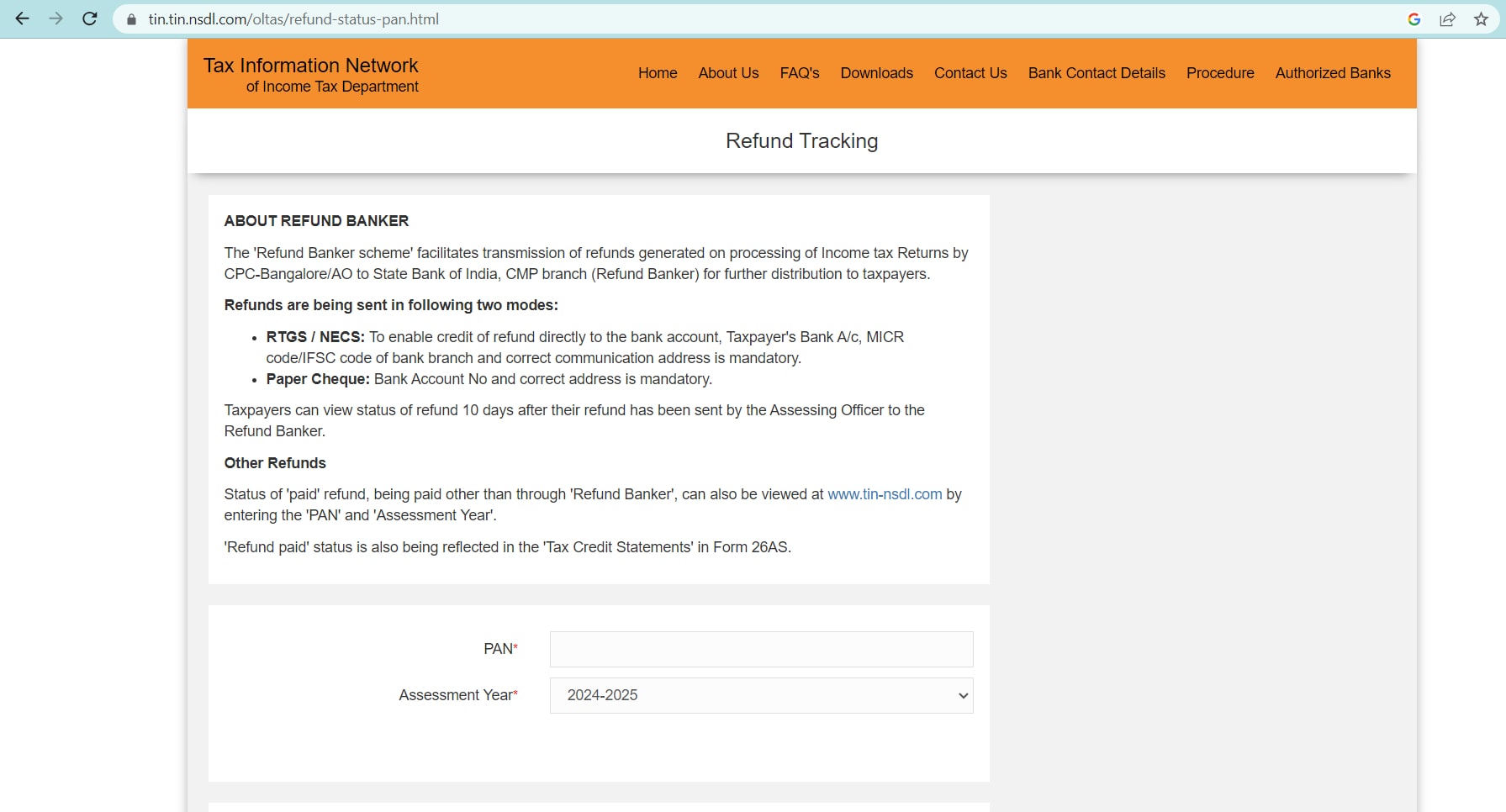

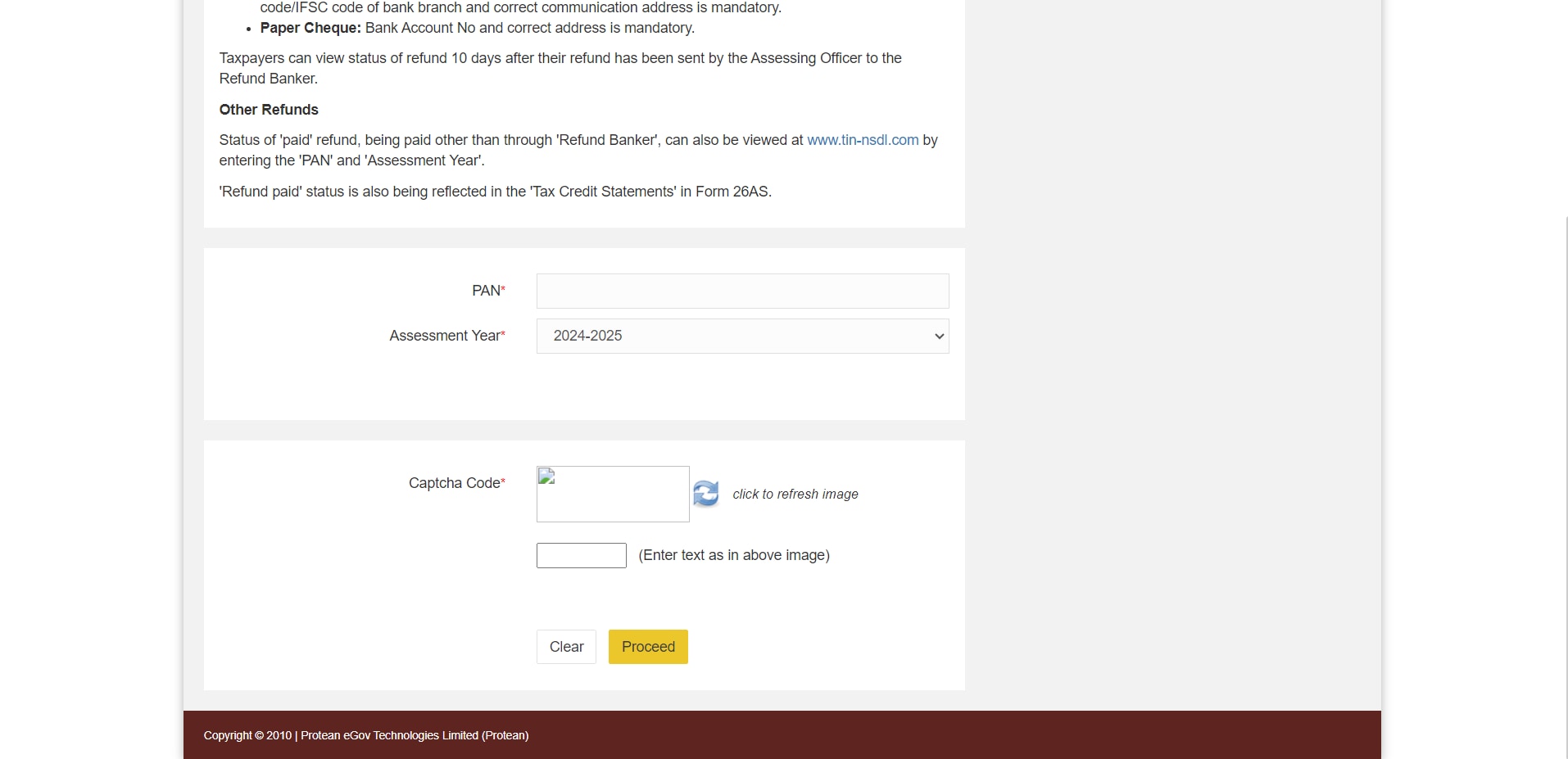

When dealing with taxes, it is crucial to stay informed about your Income Tax Return (ITR) refund status. This way, you can keep track of where your refund stands in the processing pipeline. To assist you in this matter, we have created a comprehensive guide to help you navigate both the e-Filing and TIN NSDL portal, check your ITR refund status in India, and better understand the various refund statuses.

The ITR refund status is a crucial component of your income tax return. It indicates the processing stage of your refund: whether it"s been issued, is under process, or has some issues that need your attention. It"s a tool that helps taxpayers keep track of their refunds and plan their finances accordingly.

The ITR refund status can vary from being processed to being issued, and understanding each status is essential for effective tax planning. The ITR refund status also provides insights into any issues or discrepancies that might have arisen during the refund processing. This could include issues like incorrect bank details, discrepancies in the tax return, or a demand for additional tax payment. By regularly checking the ITR refund status, taxpayers can ensure they are up-to-date with their tax obligations and refunds.

You might encounter several tax refund statuses while checking your ITR refund status. These statuses provide insights into the processing stage of your refund and any issues that might have arisen during the process. Understanding these statuses is crucial for effective tax planning and ensuring the refund process is smooth and efficient.

First Published: Jul 27, 2023, 17:30

Subscribe Now