UPI Credit Line explained: How it works, who can use it, and why it matters

Learn what a UPI Credit Line is, how it works, who can apply, supported banks and apps, and how to set it up for digital payments

India’s digital payment ecosystem has transformed how people transact - fast, simple, and cashless. The UPI (Unified Payments Interface) has played a significant role in this shift, facilitating billions of UPI payments each month through various mobile applications. UPI has made money movement seamless and accessible to anyone with a bank account and smartphone.

UPI has undergone several upgrades over the past few years, including features such as UPI Lite, UPI Tap & Pay, and UPI Circle, which simplify group payments. Another addition is the UPI Credit Line - a feature that brings short-term credit directly into the ecosystem.

With ongoing changes in digital payments, new features are transforming the way people pay, borrow, and manage their finances in everyday life. In this post, we’ll discuss the basics, key features, how to set up a credit line in UPI, and what it could mean for everyday users exploring newer ways to pay.

A UPI Credit Line is a pre-approved loan facility that lets you (user) borrow money through UPI and use it for regular digital payments. It works much like a flexible loan, where you’re given a sanctioned credit limit by your bank, and can use as much or as little as you need. Interest is charged only on the amount used, not the entire limit.

What makes the credit line in UPI useful is how seamlessly it fits into everyday payments. Just like savings accounts or debit cards are linked to UPI, you can now set up a credit line as your payment source. It’s available in both secured and unsecured variants, with some banks offering it against fixed deposits.

The UPI Credit Line combines the convenience of UPI payments with the flexibility of short-term borrowing. Here are some of the key features that make it useful for everyday digital payments:

The UPI Credit Line brings several benefits:

A UPI Credit Line gives you access to funds just like a credit card, but without the need for a physical card. It’s linked directly to your UPI ID, which means you can use it for UPI payments across supported merchants without carrying anything extra.

Unlike credit cards, there are usually fewer setup costs, and the process to set up a credit line is simpler. It also differs from Buy Now, Pay Later options that are often limited to specific platforms.

To apply for this loan via UPI, you must be at least 18 years old, hold an active savings account with the issuing bank, and have UPI activated on your registered mobile number. You should also have a clean history without any criminal record. Some banks may display pre-approved offers within their app or on your UPI app screen.

To set up a credit line, you may need to accept digital consent terms and agree to the repayment structure. Once approved, the credit line gets linked with your UPI account and can be used for digital payments.

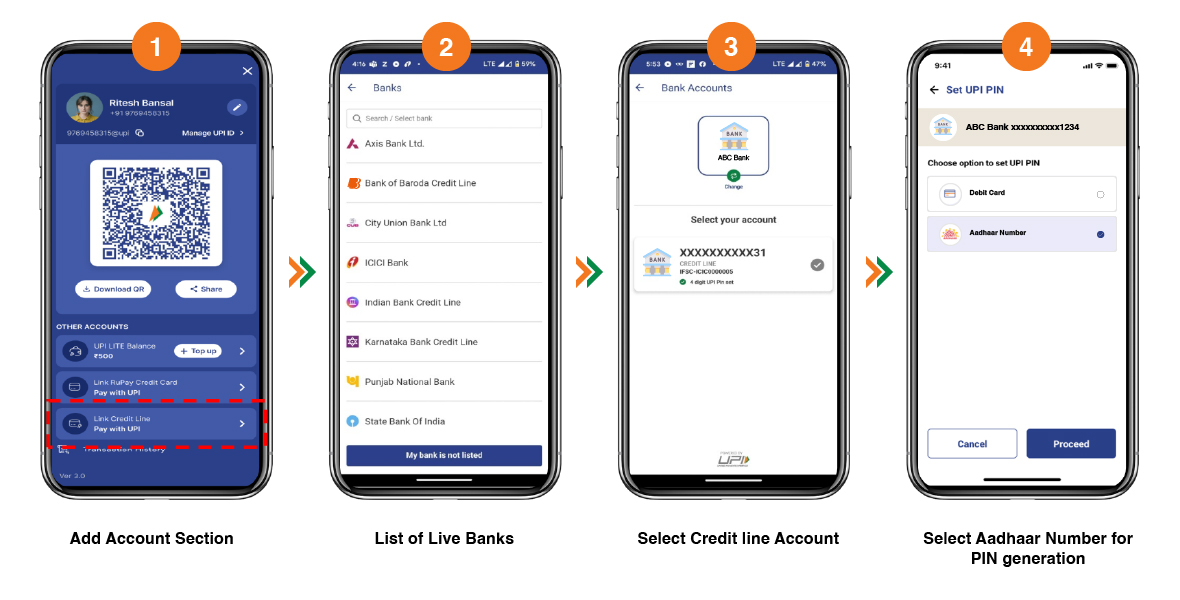

Setting up a UPI Credit Line is simple:

Can the Credit Line on UPI be removed after using the service?

Yes, you can remove the UPI Credit Line from your selected digital payment app after completing your transactions or once you no longer wish to use the service.

Which digital payment apps currently support the UPI Credit Line?

Several apps, including PhonePe, Google Pay, Paytm, BHIM, PayZapp, CRED, Lazypay, Navi, MobiKwik, and Tata Neu, support credit lines in UPI.

Which banks have gone live with Credit Line on UPI?

You can set up a credit line with banks like HDFC Bank, ICICI Bank, SBI, Axis Bank, PNB, Indian Bank, Kotak Bank, Karnataka Bank, and Federal Bank.

First Published: Jul 22, 2025, 15:21

Subscribe Now