Professor Eichengreen cautions emerging markets against liberalising capital flo

The American economist says capital accounts should be liberalised only after strengthening domestic financial markets and institutions

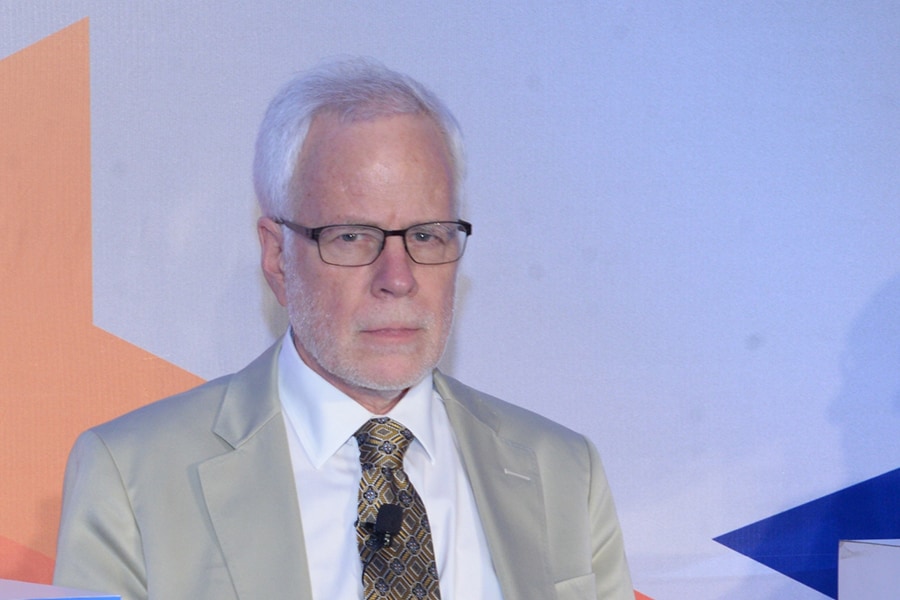

Barry Eichengreen, professor of economics and political science at the university of California

Barry Eichengreen, professor of economics and political science at the university of California

Barry Eichengreen, professor of economics and political science at the university of California, Berkeley delivered Exim Bank’s 32nd Commencement Day Annual Lecture in Mumbai on Monday. He spoke on the topic ‘Capital Flows: What do we know?’ The session was moderated by SS Mundra, deputy governor, Reserve Bank of India.

At the event, Eichengreen explained the roadmap for capital account management for different countries. This mainly dealt with foreign direct investment (FDI), portfolio flows and bank borrowings. He said that capital account of the balance of payments should be liberalised only gradually as other measures are taken, in the mean time, to strengthen domestic financial markets and institutions, and as policies, including policies for the exchange rate, are adapted to the more open capital account. Regulations affecting FDI should be relaxed first, since FDI remains the least volatile form of capital flow. But even a limited fall in FDI inflows can cause problems when gross FDI inflows are financing a large current account deficit, as in Turkey.

Eichengreen is taking a leaf out of Bayes theorem which advocates decision makers to gradually change their mind with changing data. Decision makers need to be careful about taking hasty decisions where data takes time to trend and this could lead to major mishaps if the trends are uncertain.

Eichengreen highlighted that capital outflows from emerging markets have grown not just larger but also more volatile and cautioned emerging markets regarding their treatment towards capital flows.

He lauded India’s efforts in moving gradually and incrementally when liberalising the capital account in the course of the last 25 years, starting with policy toward FDI inflows, followed by policy toward portfolio equity inflows and then debt inflows, and turning last toward policy toward outflows, gradually raising ceilings and increasing the range of transactions subject to automatic approval. He said that India has been wise to accompany that move with a more flexible exchange rate.

Eichengreen, in his lecture, gave five points that countries may adopt when dealing with capital flows:

1. Open the capital account only after financial markets have been liberalised and decontrolled. If interest rates are not decontrolled and create a wedge between onshore and offshore rates, then capital account liberalisation can become a vehicle for capital flight.

This is a problem that China encountered recently, when the relaxation of capital controls got out ahead of domestic interest rate decontrol. The Chinese authorities then responded by tightening up capital account restrictions and speeding domestic deposit rate control, which makes sense. (Better late than never, one might say.)

In addition, if the banking system is poorly regulated or undercapitalised, management will have an incentive to engage in excessive risk taking and use offshore funding available through the capital account to lever up its bets—more so, to the extent that bank liabilities are explicitly or implicitly guaranteed by the authorities.

2. Liberalise foreign direct investment first. This is the form of investment that most plausibly comes packaged with organisational and technological knowledge. It is the form least likely to aggravate weaknesses in the banking system. It is less footloose than portfolio capital and less likely to flee in a panic. All this points to the wisdom of freeing foreign direct investment early in the capital account liberalisation process.

3. Liberalise stock and bond markets next. Foreign investment in securities poses fewer risks than foreign deposits. Because bank deposits are a contractual obligation to repay at par, the withdrawal of foreign deposits can pose an immediate threat to the stability of the banking system. When foreign investors liquidate their positions in stock and bond markets, in contrast, their actions just affect the prices of those securities. Falling equity and bond prices can still cause problems, to be sure, for local investors and entities like the government with funding needs. But the evidence is clear that the term structure of portfolio capital flows (specifically, the share of short-term flows in total capital inflows) is a leading indicator of crisis risk.

4. Liberalise offshore bank borrowing last. This was the fundamental lesson of the Asian crisis. Banks are the weak link in the financial chain. Access to offshore markets allows them to lever up their bets. One only wishes that the United States and Europe had remembered this lesson in the run-up to the Global Financial Crisis.

5. Rely on market-friendly instruments for managing the capital account. Efforts to fine tune the capital account carry their own risks. As people in India will be aware, they can create a burdensome administrative bureaucracy conducive to rent seeking and corruption. Interventions that rely on markets rather than bureaucrats minimise these dangers. A widely-cited example is Chile’s policy of imposing a 30 per cent non-interest-bearing deposit requirement for one year on all capital imports, subsequently removed as the country’s financial markets deepened and matured. The brilliance of the one-year term was that it implied a heavier tax on investors with short horizons than those prepared to stay for the duration. It was transparent and insulated from administrative discretion. A large literature grew up analysing the effectiveness of these policies.

The measures in question had at least some effect in lengthening the maturity structure of external debt while doing little to slow economic development and growth, Eichengreen said.

First Published: Mar 28, 2017, 14:35

Subscribe Now