But the real issue is, are these banks ‘privatisation-ready’? There is very little evidence to suggest it. The second wave of the Covid-19 pandemic has affected profitability, productivity, asset quality and financial management at these banks.

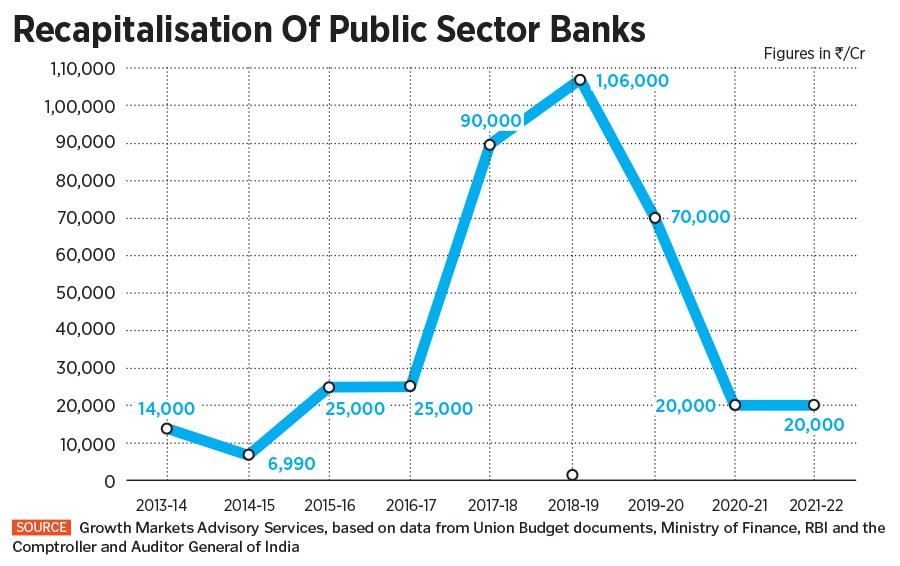

A new investor will need to infuse sizeable fresh capital, even after years of government support through recapitalisation for these banks. Sourcing the right talent has also been a battle for PSBs banks that were part of the government-induced 2019 mega-merger are still struggling to find the right talent to manage complex risk management issues and leverage new-age fintech solutions.

Any move to retrench the existing workforce during privatisation will be met with stiff resistance at all these unionised banks. Legislative changes to bring these banks under the Companies Act 2013 are being debated, but we are also far from evaluating the accurate valuations for these banks, beyond book value and financials.

It will be a tough haul for the government machinery, lawyers and investment bankers to complete all of this smoothly over the next nine months. And, in reality, the bank management and employees are unlikely to have a meaningful say in the privatisation process.

Privatisation: A rarity

India has, since the liberalisation of its economy, disinvested government stakes in various public-sector enterprises through initial public offerings (IPOs) or offers for sale and strategic sales. In 2017 came the merger of five of State Bank of India’s associate banks with the parent bank. Since 2019, there have been additional mega mergers of PSBs, consolidating them to just 12, from 27 in 2017.

The reality, then, is that privatisation of a government-owned enterprise—let alone a bank—is a rarity in India. “As such, there has been no sizeable privatisation of PSBs in India," says Ashvin Parekh, managing partner of Ashvin Parekh Advisory Services. The evolution of IDBI Bank. from a development financial institution into a lender, and its 2019 re-classification as a private sector bank, after being acquired by LIC, is, strictly, not privatisation.

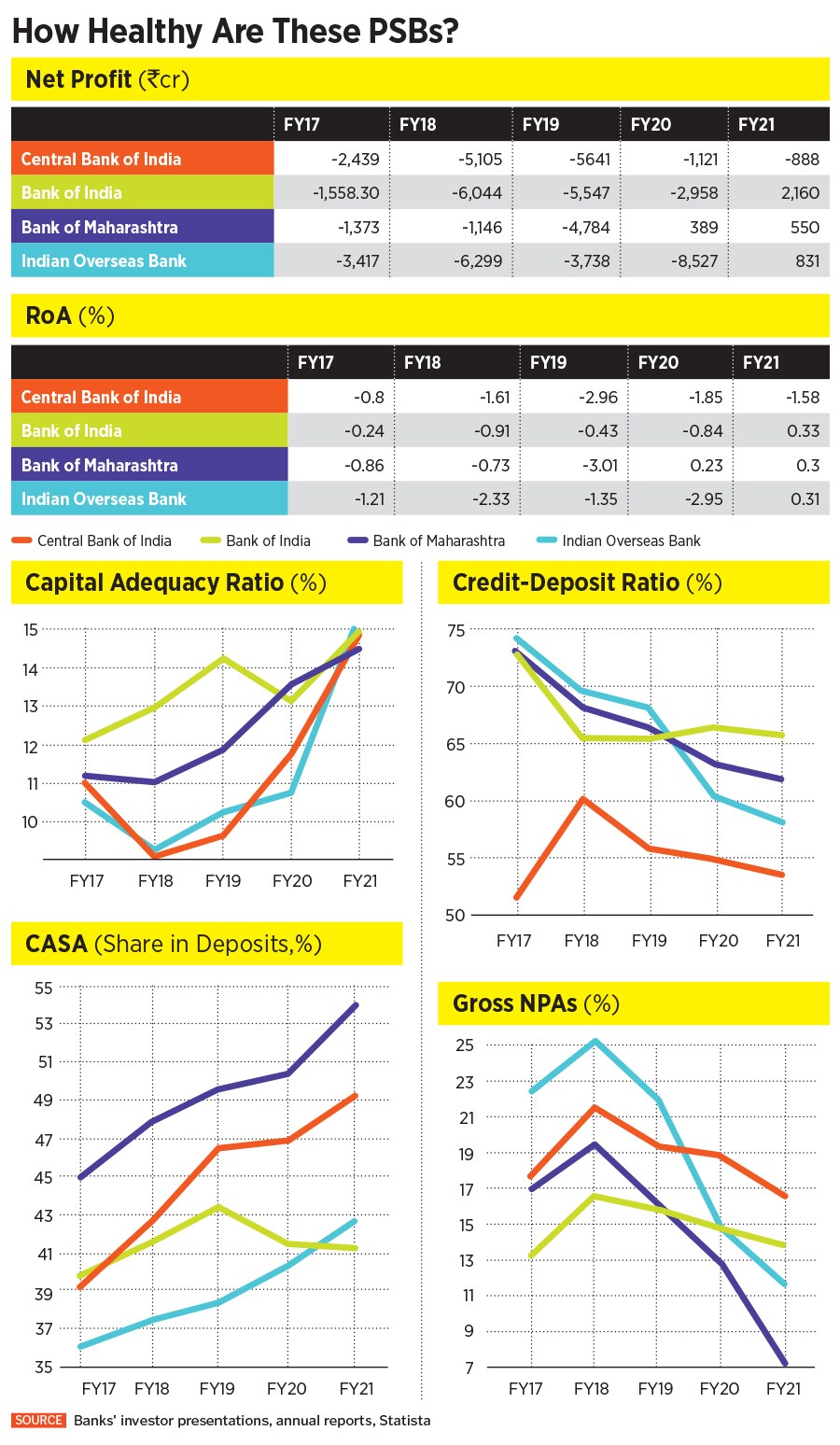

A closer look at the financial health of the banks being considered for privatisation is a cause for concern. Central Bank of India, Indian Overseas Bank and Bank of India reported annual losses between April 2016 and March 2020. These three, and Bank of Maharashtra, however fared better in the 12 months ended March 2021, emerging profitable on the back of lower non-performing assets (NPAs).

But even as privatisation takes place, the acquirer will need to infuse fresh capital into these banks, clean up the books and insulate their balance sheets against future stress. There will be need for additional provisioning, including contingency provisions and capital for growth. “The potential banks [for privatisation] will need recapitalisation. There is hardly any contingency buffer left, while there will still be a need for residual provisioning on the legacy NPL book," says Saswata Guha, senior director, banks, Fitch India Services.

![]()

Indian Overseas Bank and Central Bank of India are still under the restrictive Prompt Corrective Action (PCA) framework. This has meant restrictions in lending, business expansion and accessing costly deposits. The measures have hit both growth and income for these banks. Guha says if macro conditions weaken any further—and lending conditions have not improved during the second pandemic wave—their P&Ls will be vulnerable, again, to further asset quality shocks. “Most of these banks have already used up their contingency provisions," he adds.

Krishnan Sitaraman, Crisil’s senior director and deputy credit ratings officer, and Fitch’s Guha say it will be challenging to complete these two privatisations, and IDBI’s disinvestment by March 2022. The government will need to rely on the proceeds of the proposed LIC IPO to generate earnings for itself in a tough business cycle. The need for fiscal assistance for badly hit sectors and low-incomes cannot be ruled out, as economic activity continues to be hit. Barclays has projected India’s pace of growth—in a bear case scenario—at 7.7 percent, with most of the impact to be felt in the current April to June 2021 quarter.

Revenue collections for the government have improved in recent months. Net direct tax collections between April 1 and June 15 have doubled, from a year ago, to Rs 1.85 lakh crore, said the Income Tax Department in June. This was due to improved personal income tax and advance tax collections. In the case of Goods and Services Tax (GST), the gross collections for May 2021 were 65 percent higher year-on-year at Rs 1.02 lakh crore, marking eight successive months of GST collections above the Rs 1 lakh crore level.

Collections from disinvestment will be an additional kicker, providing more elbow room for the government to help meet its fiscal deficit target, now pegged at 9.3 percent of GDP. India has kept a disinvestment target of Rs 1.75 lakh crore for FY22.

Asset quality, growth capital concerns

Loan products and services hardly differ for these four banks—from personal, home, education and vehicle loans, loans against property, a range of agriculture and gold loans, to lending to small and micro-businesses. Among PSBs, State Bank of India has been a leader in providing digital products and the total number of digital transactions through the UPI platform.

A well-established retail franchise is a given for these four banks, and in 2020 they were aided by the moratorium on loan repayments, a liquidity boost through the emergency credit lines offered by the Reserve Bank of India (RBI) and a fresh restructuring of loans. But fresh slippages to NPAs have risen in the March-ended quarter for these banks, from a year earlier, despite improved provisioning levels.

Matam Venkata Rao, the CEO of Central Bank, said at an analysts call in June that in order to improve credit decisions, it has pushed for speedy approvals of loans so that on-ground disbursals can improve. The bank has also entered a co-lending agreement with Indiabulls Housing Finance and IIFL Home Finance.

But on the loan book side, fresh loan growth will continue to be challenging in months ahead, even as the pandemic’s second wave recedes. With Indian Overseas Bank and Central Bank still under the PCA, the biggest challenge for any potential acquirer will be to bring in a substantial amount of capital. Even when the banks emerge from the PCA, it will be a challenge for their managements to improve the low or negative return on assets.

![]()

Central Bank of India, at Rs 24.2, is trading at a 20.8 percent discount to its book value of Rs 30.59, while Indian Overseas Bank, at Rs 23.6, is trading at almost three times its book value of Rs 8.76. Both these stocks have surged around 19 percent on Monday, on reports of being shortlisted for disinvestment. Bank of India is trading at 32 percent to its book value of Rs 118.8, while Bank of Maharashtra is trading at Rs 26.6, above its book value of Rs 16.97.

One of the first steps towards privatisation will be amending the Banking Companies (Acquisition and Transfer of Undertakings) Acts of 1969 and 1980, when 14 large commercial banks were first nationalised. Banks, once privatised, will have to be brought under the Companies Act, 2013. The debate to amend several banking legislations is on, say experts.

Attracting investors….

Raising capital and improving asset quality are, no doubt, keeping potential investors at bay. “There is lack of interest from investors due to unresolved HR issues, ongoing merger-conflicts and unknown sizes of NPAs," says Vaishali Basu Sharma, consultant at New Delhi-based think-tank Policy Perspectives Foundation.

Sharma calIs for a better assessment of the market value of the assets of these banks, to boost valuations. “In most valuations of existing PSU sale processes, only the book value of assets and current revenues are being valued, leaving out market value of assets, including massive land parcels in the heart of metropolitan cities," she says.

The immediate way ahead will be for these banks, besides others, to earmark the bad loans that can be transferred to the National Asset Reconstruction Company Ltd (NARCL), for resolution of the NPA problem that banks face. Through this ARC and asset management company model, the "bad bank"—as it is informally called—will manage and dispose of these assets to alternate investment funds and other potential investors for a particular price.

Central Bank of India has earmarked Rs 2,560 crore through seven accounts, and Bank of India has identified Rs 5,500 crore to be transferred to the NARCL. For the banks it will mean a quick cleaning up of their books, which would boost their valuations for potential buyers.

If the assessment committee of the NARCL finds these accounts suitable, it will make an offer to buy them. So far, all banks have identified a total of 22 accounts, with an exposure of Rs 89,000 crore, to be transferred. The NARCL is set to commence operations in a few weeks.

…after battling unions

All these banks are heavily unionised and, to be fair, their concerns over job security are real, once the privatisation process starts. The government maintains that no jobs were lost during the previous mega PSB mergers. “The interest of the workers will absolutely be protected, whether it be salaries, skills or pension… all of it will be taken care of," said Sitharaman, earlier in June.

Soumya Datta, general secretary of the All India Bank Officers’ Confederation (AIBOC) is combat-ready. Besides strikes and possible appeals to courts, AIBOC will be fighting the battle on social media platforms and has the signature support of 5 crore people. “There was a failure to convince the general public regarding the merger of PSBs. We are saying that if banks are privatised, [people"s] money will not be safe," says Datta.

He fears that the proposed privatisation might force bank employees to take voluntary retirement. There would be an indirect loss of jobs, when bank ATMs and branches are consolidated, he adds.

There are various moving parts even at the regulatory end. The RBI will obviously carry out its ‘fit and proper’ exercise of the potential acquirer. But now, as per the revised RBI guidelines for private sector banks, the tenure of managing directors and CEOs will be capped at 15 years. This will apply to whole-time directors too. These rules will also apply to PSBs that will be privatised.

For the government to have any success with the privatisation of banks, it needs to speed up the creation of the NARCL, so that once the transfer of bad loan accounts is done, the balance sheets of the potential PSBs to be acquired will be cleaner. The route towards complete privatisation is a long one, with litigations not ruled out. But the toughest task will be to change the mindset, DNA and skill sets of the organisations, to make them nimble enough to take prudent credit risks and think like a new-age bank.