Forbes India Pathbreakers

Advertisement

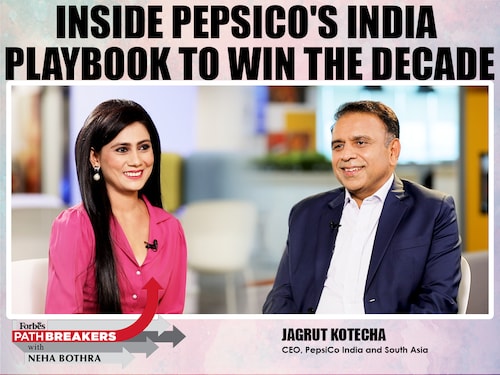

How PepsiCo India plans to win Cola wars and rule snack shelf: Pathbreakers S3

With Reliance bringing back Campa Cola, is Pepsi ready for round two of the cola wars? Snacks or soda- where's the real money for PepsiCo in India? How is Gen-Z redefining PepsiCo in India? From marke

Advertisement

Advertisement

Explore More Categories

- Home /

- Forbes India Pathbreakers

Latest News

Advertisement

Advertisement

Advertisement