The three must-haves angel investors look for

Nine prolific names in the angel investing business talk about their three common investment philosophies: Ideas, people and scalability

In 2011, angel investors Rehan Yar Khan and Anupam Mittal came across an “interesting” investment opportunity: An online marketplace for cabs and car rental services. To them, the model made perfect sense in India where commuters are constantly seeking convenient travel options. Khan and Mittal together invested nearly Rs 1 crore in the venture.

Three years later, in the startup’s latest funding round in October 2014, where it raised $210 million from Japan’s SoftBank Corp and others, Mittal’s minority stake offered returns most investors don’t dare to dream of. His investment is worth around Rs 25 crore now, an increase of 40.7 times.

Of course, the startup being discussed is Ola Cabs.

And, of course, alpha returns such as these are drawing seasoned entrepreneurs and executives to the world of angel investing. (Angel investors are the first port of call—after friends and family—for fundraising entrepreneurs with big business ideas.) Over the last three to four years, there has been a substantial increase in the number of angel deals in India. In 2005, there were six angel/seed investment deals, according to VCCEdge, which tracks investment activity in India. In 2014, there were 200 such deals.

“The ecosystem has evolved. There are a lot more opportunities now as entrepreneurship is a top career choice. HNI (high net worth) portfolios have changed and new networks (angel networks) are opening up,” says Padmaja Ruparel, president of Indian Angel Network (IAN), the country’s foremost angel investor group with over 280 investors. IAN, which started in 2006, looks at investing up to $1 million in a project, with an average ticket-size of about $400,000 to $600,000, and exiting over a three to five year period through a strategic sale.

The success of startups such as Flipkart, Mu Sigma, Ola Cabs and InMobi—in terms of scale, valuation, attention from global investors and strong exits—has also created a positive sentiment. “Everyone sees how valuations have got marked up in subsequent rounds and exits, and everyone wants a piece of the action,” says K Ganesh, a serial angel investor and chairman and co-founder of Portea Medical, an in-home health services provider.

The flipside is that exits for angel investors, much like in the venture capital and private equity space, are few and far between. Exits for angel deals typically occur when firms raise their series A round (the first institutional funding). In India, only about one-fourth of angel-backed companies end up reaching this point.

“People are trying their hand at angel investing. It’s a different ball game. It’s a long journey. Investments are just the first day of a Test match,” says Rajan Anandan, managing director, Google India, and also a prominent angel investor.

In their bid to safeguard their capital risks, angel investors are increasing investing in groups with ‘lead investors’, who are industry experts. When a lead or anchor investor decides to back a startup, four to six others pool in capital, spreading the financial risk. Experts say that while angel investments are on the rise, lead investors are far fewer than regular investors. For example, IAN has 60 lead investors and 226 regular investors. While angels may shy away from individual deals, it’s rare that a deal won’t find takers once a lead investor shows interest.

The hurdles, however, haven’t dampened the rise in angel investing with everyone betting big on new ideas and enterprise. Even successful promoters like Kunal Bahl (Snapdeal), Phanindra Sama (redBus), Naveen Tewari (InMobi) and Manav Garg (Eka Software) are becoming active in this space.

Then there are those who have already made their presence felt as leading angels for Indian entrepreneurs.

Forbes India has prepared a list, in no particular order, through conversations with early stage investors, entrepreneurs and angel networks. We also deep-dive into their investment strategies and find their sweet spots. Rajan Anandan, 46

Rajan Anandan, 46

Managing Director, Google India

Much sought-after by tech startups, Rajan Anandan has built a portfolio of over 50 angel investments since he started funding enterprises back in 2006. He has a clear focus on technology—“It’s very important for angels to have expertise,” he says—and invests through different platforms, including Indian Angel Network and LetsVenture. He is typically the lead investor who chooses the startup to invest in and others join in.

According to him, the success of companies like Flipkart, Snapdeal and InMobi, which have seen valuations go beyond the coveted $1 billion mark, has unwittingly evangelised the angel investment space. “People are realising that successful companies can be very precious. There are six to seven such startups today that have $1 billion valuation. [Investors] realise that it makes sense to invest in new ideas,” he says.

Preferred sectors: Technology, including internet, ecommerce, software and cloud services.

Must-haves: For Anandan, the team is the most important parameter. Two to three co-founders are ideal, he says. “A great tech bent is a huge plus. They should have a track record and should have been around for some time,” he says.

The other non-negotiable factor is whether the startup is solving a genuine problem. Anandan tends to back companies that have already launched their product or offering. “I need to see a product which is out there and has 100 users or, at least, one to two customers. It gives a sense about whether or not what they are offering makes market sense,” he says.

As an investor: He tends to be involved with his portfolio firms and typically helps in making strategic decisions and identifying new business markets. Anandan also opens the doors to potential clients and advisors.

Major investments: Phantom Hands, Capillary Technologies, Sourceeasy, 24/7 Techies, TargetingMantra, Instamojo, CultureAlley, Mobilewalla, Druva, Sapience, Frrole, MyShaadi.in, Jigsee (acquired by Vuclip), Goonj, TaxSpanner.com, eTechies, Exclusively.in (acquired by Myntra), Digilogues, Videa Capital (acquired by Allegro), Hungry Zone (acquired by JustEat), Peel-Works, Kwench, Athorstream (acquired by WizIQ), skoolshop.com, WizIQ.com, authorGEN (acquired by Educomp), BuyThePrice (acquired by Tradus).

Sunil Kalra, 51

Full-time independent angel investor

Sunil Kalra, who has been investing since 2002, has a portfolio of close to 50 startups. The New Delhi-based Kalra started his career in the exports business in 1987 and set up a leather apparel manufacturing firm in 1992 which worked with global designers like Donna Karan, Ann Taylor and J Crew. He exited the export industry in 2002 and has been operating as an angel investor since then.

Kalra, whose first angel investment was in a real estate firm, has maintained “a fairly sector-agnostic approach” with a leaning towards technology ventures. “I am not from a tech background. However, tech-based companies have the ability to prove their concept with less capital. They are also leaner and far more scalable. Therefore, I am concentrating more on tech for now,” he says.

He tends to be pernickety about his choice of investments, typically zeroing in on one out of 20 companies. Also, he prefers to co-invest. “One person can’t solve all the problems of a startup. Therefore, it is good to invest in groups. If I can’t find a solution and answer to a promoter’s issues, someone else should be able to do it,” he says.

Preferred sectors: Technology (though he will look at other ventures on a case-by-case basis).

Must-haves: “A big (scalable) idea and a great team are key,” says Kalra. Also, the fundamental due diligence of an idea is necessary while the market size needs to be big enough to lure him. “I would not invest in an idea where the market size is restricted. It should have the potential to grow and be able to give better than the [average] market returns,” he says.

As an investor: He is always available for his portfolio companies and helps them across the board—from hiring talent to documentation for new funding rounds to legal assistance.

Major investments: Instamojo, CultureAlley, Aurality, Blume Ventures, Mobilewalla, Druva, Jigsee, Innoveda, Airwoot, HashCube, Sapience, Frrole, Crayon Data, Wishberry, MyShaadi.in, Kwench, Unbxd, Vayavya Labs, Jigsee, OrangeScape, TaxSpanner.com, Goonj, BuyThePrice, Aurus Network, SkoolShop, Team Indus, UPES, Reservoir Capital, LetsVenture.

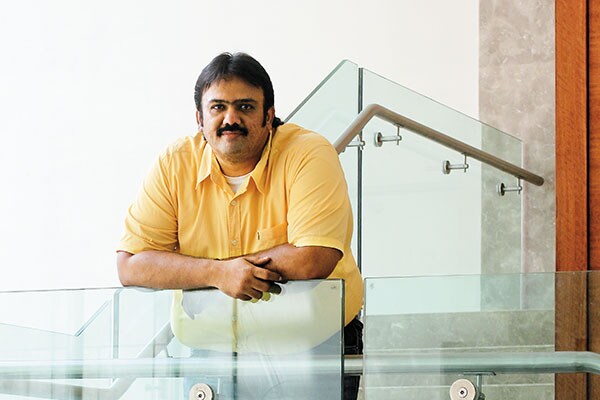

K Ganesh, 53

K Ganesh, 53

Serial Entrepreneur, chairman and co-founder, Portea Medical

With a strong sales and market orientation, Ganesh has made over 20 angel investments since 2011. In 1990, he founded his first company, IT&T, a top multi-vendor IT services and support company. The business was acquired by IGATE (a listed company) in 2003. Another venture called CustomerAsset, which was started in mid-2000, was acquired by ICICI Bank and is now a listed RP-SG Group company Firstsource Solutions. Ganesh also founded a data analytics BPO firm called Marketics, which was acquired in March 2007 by NYSE-listed WNS Global, a business process management company, for $63 million. TutorVista, an online tutoring company, was acquired by publishing and education conglomerate Pearson Plc for $213 million.

Image: BMAXIMAGE

“As an entrepreneur, I get to relive the entrepreneurial dream vicariously through my angel investments without [having to] spend time on it,” he says. Ganesh is bullish on India’s entrepreneurship scenario over the next five to 10 years, where valuations of billions of dollars, jobs, business models and solutions will be created. “I want a piece of that action,” he says.

Greed is another reason for the spurt in angel investments, he points out. “As an asset class, I believe this gives highest returns (with the highest risk, including loss of full capital),” he says.

Preferred sectors: Invests only where technology, digital marketing and mobile are an essential and core part of the business.

Must-haves: Passionate entrepreneurs and a large market—something that addresses a big pain point and has a clear monetisation model, he says. There has to be disruption, he adds. “I feel that unless we disrupt the current status quo with technology, it is very difficult to succeed as a startup. There is no scope for doing anything new or better than the established players. So the only solution is to disrupt the model by bringing in technology and leapfrogging the challenges of current business models,” he says.

As an investor: Involved and known to facilitate matters for his portfolio firms. He is also renowned for his risk-taking ability and often takes bets on diversified ideas.

Major investments: Mustseeindia.com, delyver.com, onlineprasad.com, SilverPush, Oximity, BookAdda, Little Eye Labs, Browntape, HackerEarth.

Rehan Yar Khan, 42

General Partner, Orios Venture Partners, an early stage fund

Rehan Yar Khan started his angel investments journey in 2008 with Druva, which provides data protection for computer networks. He has since led over 19 startup investments. Seven ventures have gone on to raise further funding from investors such as Sequoia Capital, Tiger Global and Nexus Venture. He says 15 of his 19 portfolio companies are “hits”, which means they have either given him the option of full or partial exits.

Last year, Khan launched an early stage fund, Orios Venture Partners, with a Rs 300 crore corpus to back technology entrepreneurs who are building the next generation of multi-billion dollar companies from India. “There is a gap between late angel and series B (second round of institutional investment) funding. Orios can fill that gap and we are looking to invest from Rs 3 crore to Rs 10 crore,” Khan says.

Preferred sectors: Technology, payment space, ecommerce ancillaries.

Must-haves: A strong, connected team and a disruptive business idea are critical. “Remarkable companies are due to their teams,” he says. Khan also believes that a company should try to scale fast as competition could mar its chances of success.

As an investor: Known to be extremely hands-on, Khan is said to be a great advisor to startups. He always plays a pivotal role in the scaling up of companies he mentors them in their expansion to developed markets, and in the setting up of global operations and teams in Silicon Valley.

Major investments: Exclusively.in, Ola Cabs, PrettySecrets, Jigsee, Snaplion, Sapience, Docsuggest, Druva Software, Kwench Library Solutions, Unbxd, Groffr, Reach Accountant, BuyThePrice, TaxSpanner, Polama. Anand Ladsariya, 57

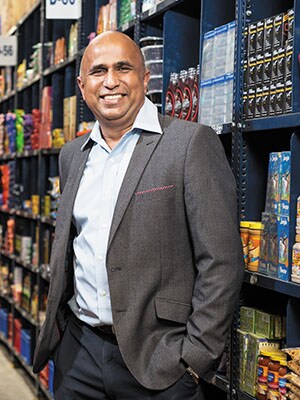

Anand Ladsariya, 57

Founder of Everest Flavours Ltd

Anand Ladsariya started angel investing in 2007 with the help of son Siddharth, who is 30 years old. The duo has invested in over 50 companies so far. His own experience as a first-generation entrepreneur led him to angel investing, says Ladsariya. And the decision seems to have paid off. He has seen multi-bagger returns in over 20 investments with as much as 43x to 45x in one company.

“It has been a very exciting journey. We have had a lot of learnings on the way, the first of which is that it takes time for companies to mature. They don’t mature in two to three years it can take up to five years,” says Ladsariya who believes the model of investing in packs works well for both investors and promoters.

Image: Joshua Navalkar

While he has seen huge successes, there have been failures too. A few of the companies backed by him had to shut down. Ladsariya’s angel investment portfolio includes businesses in the US, Singapore and Germany.

Preferred sectors: Largely sector-agnostic but tech-oriented.

Must-haves: A strong team and a truly disruptive idea, says Ladsariya. Son Siddharth points out that a reasonable valuation is also critical as it often establishes the pattern for how other investors will gauge the company in its next rounds of funding.

“We look forward to risk-adjusted investments keeping in mind capital preservation, sound returns and growth possibilities,” says Ladsariya.

As an investor: Both father and son are accessible to promoters but are non-interfering. Siddharth believes angel investments are more about working with an entrepreneur rather than just capital infusions.

Major investments: Exclusively.in, Aurality, DEXL, Speakwell, Framebench, TONBO, Mobiquest, Algorhythm, Trikal, Svasti Microfinance, Talent Bridge, GreenDust (earlier Reverse Logistics), Orio Hotels, Appsbaily.

Sharad Sharma, 50

Sharad Sharma, 50

Co-founder, iSPIRT Foundation former CEO of Yahoo! India (R&D)

A hardcore research and development (R&D) person, Sharad Sharma is among the active technology angel investors in India with around 22 investments. He started on this path in 2006, years before such transactions became fashionable. He is an active member of Indian Angel Network and prefers to co-invest.

“It’s a winner-takes-it-all kind of a market. One needs a technology background to be an angel. I am an R&D guy at heart. I team up with people from a sales background. Success does not come easy in angel investments,” he says. Sharma defines success as making money from the investment and a majority of angel deals are yet to do that. “Everyone focuses on how many deals they do. The more pertinent question is how many of your firms raise [funds] in follow-on rounds. Of the 200 angel investments in 2014, only 40 will raise in the series A round. Is your ratio better than that of the market?” he asks.

Preferred sectors: Disruptive tech, cloud, digital, software infrastructure.

Must-haves: He considers investment opportunities only in the areas of his preference—disruptive tech, cloud, digital, software infrastructure. “The use of technology can completely change how a business is done. The key to a bright future will be in enabling small businesses to adopt technology,” he says.

As an investor: He tends to be hands-off but is available to advise, handhold and open doors.

Major investments: Mobilewalla, HashCube, Druva Software, Kwench, Unbxd, Vayavya Labs, Aurus Network, Birds Eye Systems, i7 Networks, Peel-Works, TaxSpanner, Ezetap, Stayzilla, TechFetch.com, Silvan Innovation Labs, iKen Solutions.

Image: BMAXIMAGE

Ravi Gururaj, 48

Chairman, Nasscom Product Council

A serial entrepreneur with five ventures and two public exits, Ravi Gururaj today mentors entrepreneurs and backs them financially. He put on his investor hat about two-and-a-half years ago and has made 18 angel investments so far. “It’s much more than money for me, it’s about helping entrepreneurs, coaching them and connecting them. Value-addition has a very high impact at the very early stage,” he says.

Gururaj, who knows that angel investments are a high risk asset class, says he would still let promoters run their companies in their own style. “Ideas can be tweaked and worked around,” he points out.

He acknowledges that exits are an issue in angel investments. “[But] I will stay invested longer,” he says, adding that he wants the company to have enough time to stand on its feet and then take it up a notch. Gururaj prefers technology as it tends to be capital efficient. “In tech, one can get good outcomes from smaller investments. Hundred thousand dollars can take me a long way in tech. In retail, it would make one restaurant,” he says.

Preferred sectors: Technology, particularly tech products.

Must-haves: A full-time team and a clear solution to a substantial problem are necessary, says Gururaj, adding that “sales skills” are a must. “A pure business guy doesn’t work. You have to sell it,” he says.

As an investor: Gururaj is extremely involved with his investee startups but doesn’t like micro management. Providing access to potential clients and advisors is touted to be his biggest strength.

Major investments: GrexIt, Tookitaki, Socialblood.org, Graymatics, Gridcentric, PrettySecrets, Core Mobile, SyncUsUp, VMLogix, Aurus Network Infotech Pvt Ltd, Handy Elephant, Imly, Systemantics, HomeKart, Routo.

Anupam Mittal, 40

Anupam Mittal, 40

Founder, CEO, People Group

Mittal started his entrepreneurial journey by founding the People Group, which owns businesses such as shaadi.com, makaan.com, Mauj Mobile and People Pictures. Known for his eye for detail, he is among the most active angel investors in the country and has backed over 45 startups and seen their valuations rise over tenfold in the last couple of years. Mittal started angel investing in 2007 and his debut deal was Interactive Avenues. He has exited four or five investments with high returns and says another five or six exits will take place in the next 12 months.

As an investor, initially, Mittal had a preference for digital ventures, but now he is gravitating towards tech businesses. He, however, doesn’t view angel investments through rose-tinted glasses and acknowledges that mortality is a part of this business. (Five of his investee firms have shut down.) “It’s a part of the game. It is not about the entrepreneur. Sometimes it’s about the market, about the industry. It’s better to shut down sooner than later,” he says.

Mittal continues to be bullish about the future of Indian startups and is willing to bet that by 2020, three to four of the world’s most valued companies would be from the country.

Preferred sectors: SaaS, consumer internet, mobile and market places.

Must-haves: He likes to back businesses that have huge market potential and a strong, experienced team. He avoids those that don’t indicate sustainability and scalability. Also, entry barriers need to be charted out well to attract his attention.

As an investor: He is non-interfering and tends to mentor his investee teams. He is known for connecting young entrepreneurs to others in the startup ecosystem.

Major investments: Tushky.com, Kae Capital, Ola Cabs, PrettySecrets, Sapience, Druva Software, Zepo, Peel-Works, TaxSpanner, Cafe Zoe, Interactive Avenues.

Sanjay Mehta, 43

Sanjay Mehta, 43

CEO, Founder, MAIA Intelligence

Sanjay Mehta started angel investing three years ago and has funded 25 startups so far, including education, health care, media, online, travel, food and beverages and retail. He, however, stays clear of businesses that need large capex to scale up. The early stage investment ecosystem is changing rapidly, he points out. “Earlier, it was very investor-driven. The investor would select a company to invest in. Now, it’s the entrepreneurs who select because a large number of options are available to them,” he says.

Mehta invests through various platforms and is an active member of Indian Angel Network, Mumbai Angels, B2B 1K Ventures & Venture Nursery. “I invest in my personal capacity when the deal is too early to take to a network. No network invests in an idea on paper. They need consumers,” he says.

Having seen 30x returns, Mehta is confident that 1,000x should happen in the next three to five years. “There would be a couple of unicorns in the Indian ecosystem. The only challenge is patience to stick around for long enough. We are still not as good as 2,000x returns that angels in the US see,” he says.

Preferred sectors: Sector-agnostic.

Must-haves: There is nothing more important to Mehta than a strong, well connected, experienced and passionate team. He believes other aspects of a business can be managed, but is wary of ventures where founding members cannot come together on a decision or thought.

As an investor: He works closely with various teams, but is non-interfering. He is also well-connected and happy to help his portfolio firms.

Major investments: OYO Rooms, PrettySecrets, Klip.in, Talview (formerly Interview Master), Unbxd, OrangeScape, Consure Medical, FabAlley, EcoSense Sustainable Solutions, Poncho.in.

Images: Joshua Navalkar

First Published: Jan 30, 2015, 06:46

Subscribe Now