Champion Of Free Markets Talks to Forbes India

French Economist, author and philosopher Guy Sorman tells Forbes India there is no growth without innovation and there is no innovation without crisis

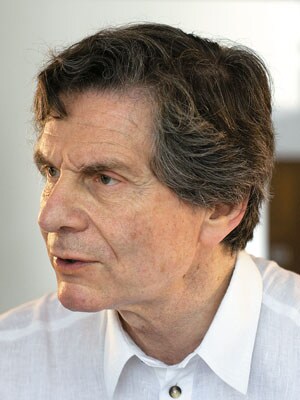

Guy Sorman

• Sorman (66) has authored more than 25 books on contemporary issues

• He has held many public offices, including advisor to the prime minister of France (1995-1997) and global advisor to the

• President of South Korea

• He is known to be an Indophile and has also written a book in 2009 on India, titled The Genius of India

• In his spare time, Sorman likes to be with his family

Unveiling the latest book by noted French economist and philosopher, Guy Sorman, Gurcharan Das introduced him as “my kinda guy.” That is, an unapologetic and ardent supporter of the free market system.

Here is a peak into Sorman’s world view and why he thinks India will even outrun China in the long term.

What prompted you to write the book and what is the meaning of the title: Economics Does Not Lie?

What prompted me was [the reaction] of all the commentators, politicians and even some economists saying that this is the end of capitalism. So I felt that all these reactions were not motivated by actual analysis of the crisis [hence the title]. They are mostly motivated by a desire for political power. So I wanted to show that everyone forgets that crisis is built into the system and that there is no growth without innovation and you have no innovation without a crisis and that the major threat to the global economy at that time [when the crisis had started] was over-reacting.

The book was an attempt to bring the debate on a more solid and scientific ground, understand the crisis for what it is: It is a crisis in the system and not a crisis of the system. What I say may shock many people, but this crisis was not such a big crisis after all. If you compare [this] to former crises and look at the decline in production or the level of unemployment, it is nowhere near.

What is the case for the free market system here? Are you saying that there is no other system and hence we should stick to it?

What we call free market and globalisation has been found to have two virtues. Firstly, it is a system that works. Secondly, and more importantly, it works in every civilisation. This essentially means that it is really rooted in the human spirit and not in the Western culture.

Now about the critics. Nobody seemed to complain when the Indian economy was growing at the ‘Hindu growth rate’.

The debate becomes heated when things start improving and there is a rise in expectations at all levels. To people who say “What about poverty? Are you sure that trickle down works?”

I am ready to discuss about that and I would make two main observations. First, trickle down works. It works better than what we think. Of course we look at the number of people who are leaving poverty and joining the middle class. But [it works] even in the poorest and remotest areas. For example, the poor fisherman in Tamil Nadu now has a cell phone; he knows what the prices are in the market and therefore he is less dependent on intermediaries and dishonest merchants. So this is the kind of trickle down effect that is not taken into consideration by the various statistics.

So trickle down takes place more deeply than what we think. And also trickle down raises aspirations. There is an incentive to send their children to school. So this is also part of the trickle down effect.

How do you characterise the crisis? Do you think it was simple as a cyclical downturn?

It is not that simple, and there is not one answer. Cycle is not the right term because nobody has been able to make predictions about cycles.

Derivatives have worked very well for 25 years and they have been extremely useful, and many investments in emerging countries like India would not have been possible without derivatives because the quantity of credit was not sufficient to finance risky investment.

The financial meltdown has not been provoked by the derivatives. It has been provoked by a recession that started in 2007. There was a huge demand for oil, energy, gas, copper and many other basic resources because India and China and many other countries were fighting for the limited resources. And you had very high spikes in gas and oil prices. And these hikes provoked a change in behaviour in many consumers, mostly in the US.

To make a long story short, it all depends on where you start. Some people start with the Lehman Brothers bankruptcy. But if you start before, then you see this oil spike in 2007 and you see the consumer demand going down, real estate prices going down and then you have the Lehman Brothers crisis.

When a centralised government run system, like Soviet Russia, fails, there are no markets that come to its rescue while when the Free Market system fails; governments are there to protect it. Isn’t there an anomaly in the way you analyse the two systems?

Yes (laughs). But there is a debate among the free market economists. The pure laissez-faire economists say let the markets clean its own mess; which, from a theoretical point of view is right, but from a political or social perspective, doesn’t work. And then you have more classic liberals saying you also have to take into consideration other parameters like the society, political demand, and democracy and then you have to adapt and adjust and have some kind of a regulation or state intervention. I’d rather belong to the second school. The problem is that the second school shouldn’t go too far (laughs).

And what is important is to know in advance, if possible, which rules will change and will never change. For example, bailing out “too-big-to-fail” banks. Is it a permanent rule? If it is not a permanent rule then we have what is known as a “moral hazard” and you encourage bankers to take risk without consideration because they won’t pay for the risks.

So some economists are very rigid and theoretical. Some, like me, who have been advisors to governments, have to take into consideration the real life. And sometimes it can be embarrassing when you advise because you know that the government needs to go on television and say “look, we are acting” when it would be better not to act. The best way, which I recommended to the President of South Korea, was to go on TV and pretend to act, and do nothing; and that’s what South Korea did actually.

You have stated in your book “development depends on making good economic decisions.” However, as we can see in India’s case, an efficient economic decision may not be socially or politically acceptable, at least not in the short term...

We have two possibilities, to make things simpler, the Indian way or the Chinese way. In the Chinese way, you do not respect private property and you go ahead and build a road or a dam or a factory and this seems perfectly rational from purely economic standpoint except that you introduce a major risk in the society because the economic decision is not being built on consensus.

The Indian way is perhaps the other extreme that you take years to make a decision but it’s sustainable. For example, the economic policy decision to open up was taken in (as late as) 1991 but once taken the direction of economic policy has remained the same irrespective of the party ruling the country. Plus the way media debates everything, the number of NGOs and social activists involved in decision-making — so it takes 25 years to take a decision but the decision is based on consensus and is here to stay.

Both the models are essentially based in the two different civilisations. I am very much in favour of sustainability and, like Amartya Sen says, taking in consideration the non-quantitative factors.

So is the Chinese model bound to fail because of the lack of consensus that is embedded in their decision making?

It is bound to fail if it doesn’t change. Which is to say that system which is based on anti-consensus, exploitation of the people leads to three weaknesses.

First, you don’t know what the people think and you don’t know how long will the regime last.

Second, they are overly dependent on the global market. In 2008, you may recall that Wal-Mart customers would stop buying things and the very next day 300 factories would be shut down in China.

Also, they still have to prove their capacity for innovation. You can’t quote one innovative industry, you can’t quote one Chinese brand.

In India, poverty is a huge problem, one estimate even pegged poverty as high as 75 percent of the population. What is the role of government intervention in a free market setup when it comes to issues like these?

The problem in India, is about what kind of government and what kind of intervention. In India is that it is not the free market that is sick, but the public institutions that are sick. The perfect example of that are the elementary schools. So I am very much in favour of any kind of intervention if it works. But [in India] the problem is that the intervention is unproductive.

(This story appears in the 13 August, 2010 issue of Forbes India. To visit our Archives, click here.)