A joint loan application can improve your chances of getting a Home Loan

You are more likely to meet the loan eligibility criteria laid down by financial lenders by clubbing your loan application with a co-applicant.

We are sure you will agree that buying your own home is a lifelong dream. And while the government does its bit to make housing more affordable, many still perceive the Home Loan application process as a complex procedure that is far from easy.

To begin with, banks and non-banking financial companies (NBFCs) are strict when it comes to the Home Loan eligibility criteria for aspiring borrowers. Secondly, the home buying process requires multiple rounds of documentation approvals, which may seem confusing.

But let us consider the process from the lender’s perspective. The financer is in the risk business and has to be careful about who it is providing money to. The company has to determine the credit worthiness of the borrower to make sure the loan amount and the interest will be repaid.

Usually, the ideal borrower must fulfill the following criteria:

Enhance your eligibility with a joint Home Loan

What if your credit score does not meet the Home Loan eligibility criteria? Does that mean you are not likely to secure financing? Not quite. Fewer affordable homes and low income mean many young professionals fall short of some of these loan eligibility parameters.

But there are ways to enhance your loan eligibility – you can consider taking a joint Home Loan .

If you were to club your income with that of a co-applicant, such as your spouse, parent or sibling, the chances of meeting the Home Loan eligibility criteria are higher. This is so because the lender considers your joint eligibility. This also increases the loan amount you are eligible for.

Repayment tenure

Taking a joint loan affects your repayment tenure too. For instance, if you were to apply for a joint loan with your spouse, the maximum loan tenure you can avail is 20 years. This may vary based on the age of the older spouse. If you co-apply with a parent or a sibling, the loan tenure cannot exceed 10 years. If a working parent is a co-applicant on the loan, the repayment tenure may be restricted to the number of years he or she has left in service.

Dispute resolution

The law requires co-borrowers to specify the liability of each borrower. They need to draft a legal document stating this liability. The draft must also bear the stamp of approval of the lending institution. Disputes may arise at times owing to a divorce, an untimely death, or insolvency. In such cases, the lender will carry out the recovery based on the liability of each borrower.

Is your co-borrower your spouse? Do both of you share equal responsibility for the Home Loan? Then it is prudent to take adequate life insurance cover. This is a safeguard in case of untimely death of one partner. The insurance will ease the financial burden of the Home Loan on the surviving spouse.

Greater tax benefit

A joint Home Loan also brings in greater tax benefits to the two co-applicants. The co-borrowers can individually claim tax benefits on the repayment of the principal. This is available under Section 80C for a joint Home Loan taken for a self-occupied property. There is a further benefit on interest repayment under Section 24 of the Income Tax Act.

You could avail tax deductions of up to Rs.1.5 lakh each under Section 80C and Rs.2 lakh under Section 24. Thus, joint applicants could together reap tax deductions of up to Rs.7 lakh on the repayment of their Home Loan.

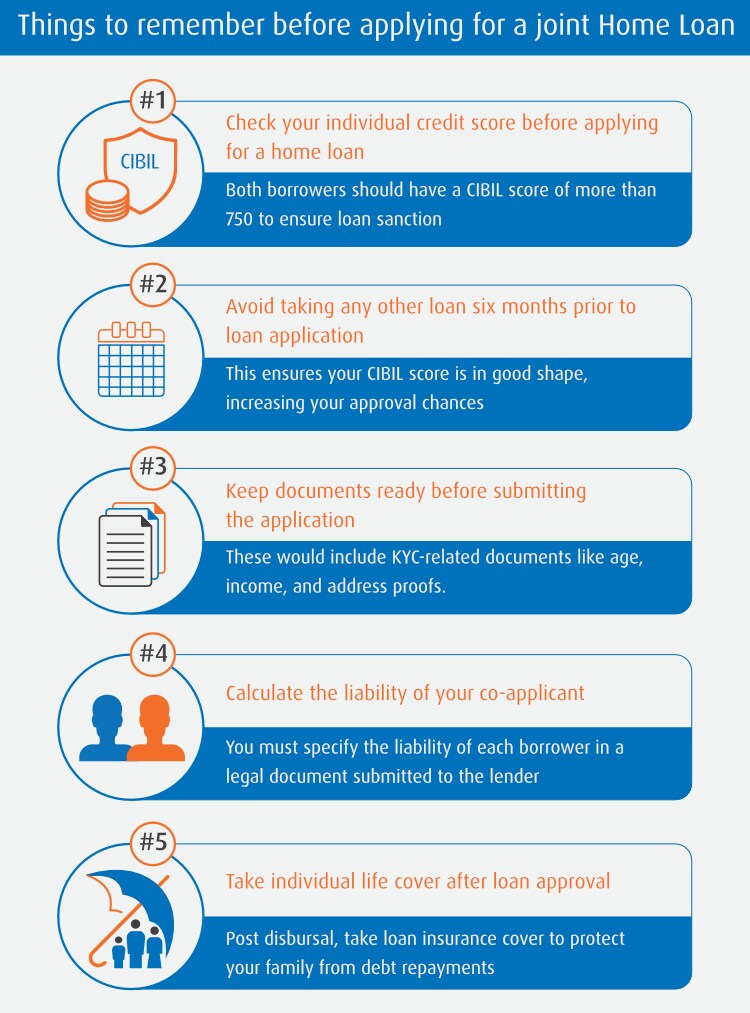

Now that you are aware of the benefits of taking a joint Home Loan with a family member, here is what you must remember before you apply for one.  It makes sense to take a joint Home Loan

It makes sense to take a joint Home Loan

There are several benefits of getting a Home Loan with a co-applicant – it greatly improves your odds of getting approval. Start your Home Loan application journey by checking your Home Loan eligibility . Once you are clear about your objective, you can even calculate your Home Loan EMIs using an online calculator.

Here are some simple steps that you can take before you approach a lender for a Home Loan.

First Published: Feb 27, 2017, 06:18

Subscribe Now