How Marc Beer Scipted Aegerion Pharma's Success Story

Marc Beer was done starting companies—until he met a doctor who could help patients with a rare and terrible disease. Investors couldn't be happier

When Marc Beer sold his ï¬rst public company, the biotech ViaCell, to PerkinElmer for $300 million in 2007 it seemed like the beginning of an amazing entrepreneurial career. But just months later it was cut short: His wife of 18 years died suddenly from a pulmonary embolism at the age of 42, and he committed himself to parenting his three teenagers full-time.

Two years later, his 14-year-old daughter told him to start another company. “Dad, you’ve been preaching purpose to me my entire life,” she said. “I don’t think purpose is driving me home from school.”

Just a few weeks after that conversation, Daniel Dubin, a physician, old friend and vice chairman of Leerink Swann, told him about a promising drug being shunned by investors but backed by one of cardiology’s best minds: Daniel Rader, chief of translational medicine and human genetics at the University of Pennsylvania. Beer called Rader and found himself sold. “All I did was listen,” Beer says. “He just needed to be listened to.”

The result of that listening is one of this year’s biggest biotech success stories: Aegerion Pharmaceuticals. On Christmas Eve, less than two years after Beer took the helm, the tiny company won approval from the Food & Drug Administration to sell its drug, Juxtapid, as a treatment for patients with a rare genetic disease that frequently causes fatal heart attacks before age 20.

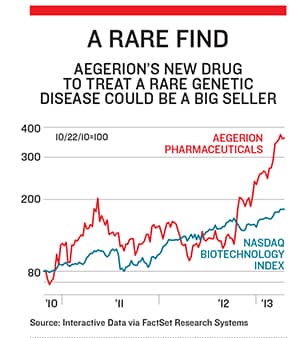

Juxtapid costs $295,000 per patient. Analysts at Cowen & Co forecast that by 2015, there will be 767 patients on Juxtapid, giving Aegerion sales of $200 million and proï¬ts of $62 million. Investors have fallen in love: Shares are up 160 percent over the past 12 months, giving Aegerion an enterprise value of $1.1 billion.

Rader ï¬rst heard about Juxtapid a decade ago from Richard Gregg, then an executive at Bristol-Myers Squibb, whom he had known when both worked at the National Institutes of Health. At the NIH, Gregg had studied patients with another rare disease that made their cholesterol super-low. Because of the disease, they couldn’t properly use fat-soluble vitamins like vitamin E and vitamin A, which led to damage to their nervous systems and eyes.

At Bristol, Gregg had realised that a protein called the microsomal triglyceride transfer protein (MTP) had gone defective in his old patients, and he set out to come up with a drug that blocked it in heart disease patients. The idea was that it would lower cholesterol enough to prevent heart attacks in otherwise healthy people without doing harm. Rader signed up to run an early clinical trial of the drug, which would eventually become Juxtapid.

The medicine worked incredibly well, lowering low-density lipoprotein (LDL), the bad cholesterol, by 70 percent. But it also caused diarrhoea and a build-up of fat in the liver, which could mean liver damage. There was no potential this would become a big mass-market drug like Bristol’s then popular Pravachol. Execs at the drug giant killed the project.Rader appealed. The drug would be perfect for patients with homozygous familial hypercholesterolemia (HoFH), a rare disease in which patients have no functioning genes for making the LDL receptors that suck cholesterol out of the blood. An LDL of 120 milligrams per decilitre is considered high but in FH patients levels can soar to 1,000 mg/dL, causing a build-up of orange deposits in patients’ skin and blockages in their arteries.

Rader and Gregg toiled to get the drug out of Bristol. Executives there eventually decided to give the drug to the University of Pennsylvania for free. Their only condition, Gregg says, was that the contracts be clear that if any patients were harmed by liver toxicity due to the medicine, Bristol would not be liable.

Rader got funding from the Doris Duke Charitable Foundation to test the drug in six patients with HoFH. He showed that slowly increasing the dose could reduce the drug’s liver and gastrointestinal side effects. The results were published in the New England Journal of Medicine. That was enough to get David Scheer, a prominent biotechnology venture capitalist, interested in starting a company around the drug.

But the first chief executive left, and Aegerion twice failed in attempts at an initial public offering. Nobody could believe this piece of damaged goods was worth anything.

By the time Beer came calling, the plan was to just sell the drug. Beer told the board he wasn’t the guy for that job but asked to be allowed in the closed room where the data on Juxtapid were kept in the meantime. When the sale failed, he had a business plan ready. Beer started as chief executive in August 2010 and took Aegerion public in October. He had to cut the IPO price by a third but still raised $47 million. That the IPO happened at all was partly due to famed biotech investor Kris Jenner, then at T Rowe Price, who says his decision was based in part on the fact that he trusted Marc Beer. He knew Beer had come out of retirement after a family tragedy. “I knew this had to be an opportunity that he felt very strongly about,” Jenner says.

Beer spent the next two years making sure that all the FDA’s questions were answered. The backbone of Aegerion’s new drug application was a study of just 29 patients with HoFH that Rader had led. When the FDA convened an advisory committee in October 2012 to help it decide whether to approve the drug, one patient, a 20-year-old man named Christian Jacobs, described being so terriï¬ed by his disease that he often had written goodbye notes to his family before going to bed. The panel voted 10 to ï¬ve that the medicine should be approved.

Once there is a drug to treat an illness, there are often more patients than anyone expected. That’s the case here. Previous estimates said there were only 400 HoFH patients in the US but included only those people conï¬rmed to have two defective copies of the LDL receptor gene.

The FDA allows the drug to be given to any patient with an LDL over 300 who is already on other therapies. Identiï¬ed this way, Aegerion thinks there may be as many as 3,000 patients. As of March 6, 85 patients have been prescribed the drug and insurers have been willing to pay for it. “It’s been incredibly gratifying to take this dream and make it a reality,” says Beer. Adds Rader, who owns some stock and gets consulting fees from the company: “Hopefully it is going to make a big difference in the lives of these patients.”

First Published: May 23, 2013, 06:01

Subscribe Now