Live well while the market tanks

A smart spending plan to protect yourself during retirement

Image: Viktoe Koen for Forbes A nail-biter for new retirees: What if the next market correction arrives soon?

Even if stocks and bonds do well over the long term, a bear market early on can do permanent damage to a retiree’s living standard. The experts call this sequence risk. “It’s not the average return but the timing of the returns” that can kill you, says Dan Keady, who oversees financial planning strategies at TIAA.

Say you have $1 million in your IRA and quit your job at 66. If you knew there would be no down markets and knew you and your spouse wouldn’t live past 91, you could live pretty well. You could draw out $40,000 the first year, give yourself annual raises to keep up with the cost of living, and be reasonably assured of never running out of money.

But you don’t know how long you’ll live and you don’t know about the timing of the next correction. What if stocks retreat from their lofty level to a historically normal multiple of earnings? What if interest rates spike, destroying a bond portfolio? If such misfortune occurs early in a retirement lasting 30 or 35 years, those $40,000-plus-COLA withdrawals will evaporate your savings.

There are ways to cope with these uncertainties. Learn them and you won’t overspend. You also won’t make the opposite mistake of living penuriously and having regrets.

The cure for sequence worries lies partly in portfolio legerdemain, partly in psychology. If you can adapt to the market’s vicissitudes by moving your spending up and down, you can spend more. If you can’t adapt, you have to be very frugal.

“Someone who has to have a certain amount of money every year needs to be more conservative with the withdrawal,” says David Blanchett, head of retirement research at Morningstar. If you want a very predictable income keeping pace with inflation, and a high confidence in not outliving your savings, then your draw from $1 million has to be more like $30,000.

At the other extreme: The rare retiree content to have an income riding up and down as violently as the market. For such a spender, a 5 percent withdrawal rate is not too lavish. But this means drawing 5 percent out of assets that might go down sharply in value. The formula starts you off at $50,000 on a $1 million account but then, after a 40 percent bear market (what we’ll get if multiples retreat to their normal level), chops you back to $30,000.

There’s a happy middle ground between starvation and volatility. The key to finding it, Blanchett says, is to compartmentalise your spending. Some spending, for housing, medicine and food, is mandatory. The rest is discretionary. Cover the first part with low-risk sources of income, he says. Cover the second with risk assets.

You have, potentially, four sources of low-risk income. Social Security is inflation-protected and, despite the system’s funding shortfall, presumably reliable. A married couple, both high earners and both deferring benefits to age 70, can pull down a combined $88,750 a year.

Next on the list of fixed-income generators is the old-style monthly pension, if you’re lucky enough to have one of those.

Third on your list of potential sources of fixed income is a bond ladder. Buy a collection of Treasury bonds maturing at annual intervals over the next 30 years and you have a very predictable flow of cash. For the ultimate peace of mind you could make them inflation-protected. A $1 million TIPS investment buys approximately $36,000 a year in spending power for 30 years, after which there is nothing left.

Last to be contemplated is a fixed annuity. You plunk down, say, $100,000 at age 66 and an insurance company vows to hand you $550 a month for as long as you live. The 6.6 percent payout is high but not indexed for inflation.

There are a lot of reasons why retirees aren’t in love with fixed annuities, including a lack of inflation protection and a rotten return for the buyer who dies young. But annuitising a portion of your IRA, thereby making it an account you can’t outlive, does have this positive result, Blanchett says: It allows you to take more risk with the rest of your portfolio.Let’s presume that, with or without help from those unappetising annuities, you have your mandatory spending covered with stable income. Now you can venture the rest of your savings in something riskier, perhaps a classic 60/40 blend of stocks and bonds. How fast should you pull money out of the risk pile?

Needed: A system for spending that stretches those risk assets over a lifespan and also takes some of the edge off their volatility. There are a lot of formulas that do that, some rather complicated. Here’s a method that is easy to follow.

The starting point is a series of divisors published by the IRS as part of tax rules requiring minimum distributions from a traditional IRA, beginning at age 70½. The first number in the series is 27.4. If you have $274,000 in risk assets, you’d liquidate $10,000, putting the cash in a money market fund.

The IRS divisors descend a scale, at a rate a little slower than one notch with each passing year. Note: The IRS divisors relate to life expectancies beginning at 70, but you can borrow them to create a stretch-out plan that works fine beginning in your 60s.

The next number is 26.5. If the risk money remaining after the first liquidation grows 5 percent to $277,200, in the second year you sell off $277,200/26.5, or $10,460. Again, the proceeds go into the money market bucket. Continue every year, moving an ever-larger fraction of what’s left of the risk account into cash.

Do your spending from the cash bucket. Beginning four years in, draw off a fourth of the bucket annually for high living. So if you want to retire at 66, you’d start moving money out of the risk account at 63.

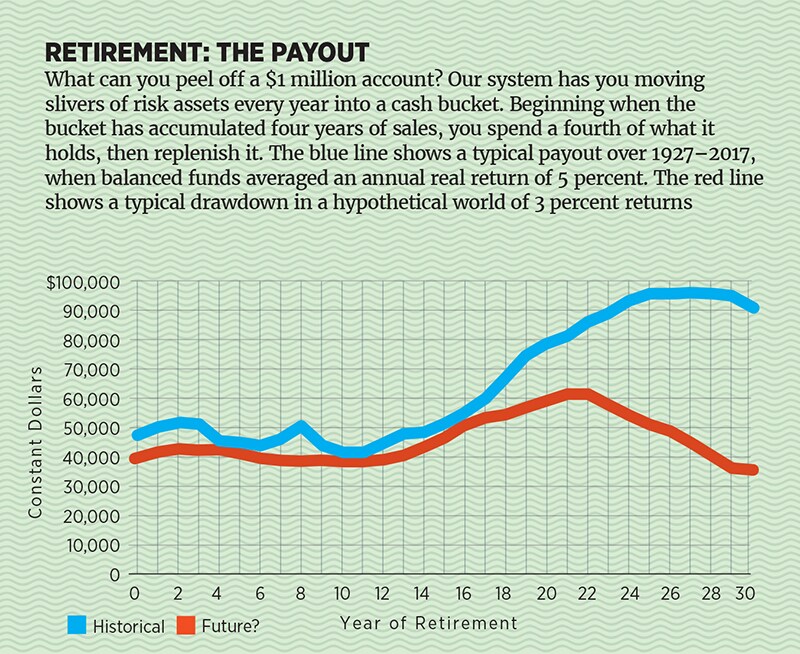

What kind of a payout pattern does this deliver? We applied the formula to historical returns on a moderately risky investment account to see what a typical payout looked like (see chart). There is uncertainty here—there’s no getting around that—but it’s tolerable for discretionary spending.

At this point, Blanchett jumps in with the admonition that history paints too rosy a picture of what we can expect from Wall Street now. He’s right. So we added the red line. For that we did some dice-throwing for 2018 to 2048 using greatly lowered expectations for stock and bond returns. The chart displays the random payout that came closest to matching the median result.

Cover your basic needs with safe income, take a chance with the rest of your assets, and sit tight through the next crash. You don’t want to outlive your savings. But neither is it your objective to be the richest person in the cemetery.

First Published: Mar 26, 2018, 17:15

Subscribe Now