The next show: PVR's game plan to consolidate its pole position

India's largest multiplex chain PVR has adopted a customer-first approach to retain loyalists and grab a larger share of out-of-home entertainment

If trailers of Christopher Nolan’s upcoming film Dunkirk (based on the famous Dunkirk evacuation during World War II) have whetted your appetite for more war movies, you could take your pick from the likes of The Guns of Navarone, Where Eagles Dare or Saving Private Ryan. But, as any film buff will tell you, watching these classics on DVD or TV is no match for a theatre experience, where roaring enemy jets swooping down on the Allies can send you ducking for cover too.

PVR Ltd is set to change that. Come October, and it will bring screens to the beck-and-call of moviegoers, allowing them to schedule a show of their favourite film at a screen of their choice and a time of their convenience. Welcome to Vakaoo, a new platform that the company is beta-testing. While a show can be scheduled only if a minimum threshold of tickets is sold, Vakaoo also helps a user reach out to others through social media and tie up with those who are interested in the movie. “People today want to consume content when they want, at their convenience and at a place of their choice,” says Kamal Gianchandani, chief of strategy, PVR. “With Vakaoo, we are offering them such an option.” For this purpose, the company is offering its library of over 1,000 films (Hollywood, Bollywood, and regional movies).

Vakaoo is just one element in the large-scale transformation that India’s biggest multiplex chain is undergoing. Rapid growth (it tripled its screens in the last four years) is no more its sole objective. It is deploying latest technology, data analytics (to understand customers better) and unique food and beverages (F&B) options to offer customers an unmatched movie experience. In doing so, PVR has flipped a switch not just to beat competition from other multiplex chains like Inox, Cinepolis or Carnival, but also from all other forms of ‘out of home’ entertainment that the rising ranks of aspirational Indians are warming up to. Says CEO Gautam Dutta, “How do I go beyond my content to attract someone for a three-hour break at PVR is the challenge.”

GROWTH MACHINE

PVR Chairman and Managing Director Ajay Bijli’s father, Kishan Mohan Bijli, who was running a trucking business, acquired Priya Cinema in the 1970s. In 1995, Ajay exited the trucking business and launched PVR, which set up its first multiplex in Delhi in 1997. Its initial growth was sedate. It took the company a decade-and-a-half to reach 213 screens in 2012. Then it exploded. It acquired Cinemax (138 screens) in 2012, and DT Cinemas (29) earlier this fiscal for a combined cost of Rs 1,000 crore. By the first quarter of the current fiscal, PVR had 557 screens across 121 properties in 48 cities. Inox, its nearest competitor, had 430 screens, while Carnival and Cinepolis had 325 and 265, respectively. In just four years, PVR’s annual footfalls have risen from 25 million (in 2011-12) to 70 million. In the same period, its revenues have more than tripled, from Rs 529.80 crore to Rs 1,897.10 crore. “Earlier, we focussed on build, build and grow. Now we have got scale. In the next 12 to 18 months, our focus is in retaining existing customers,” says Chief Financial Officer Nitin Sood.

In just four years, PVR’s annual footfalls have risen from 25 million (in 2011-12) to 70 million. In the same period, its revenues have more than tripled, from Rs 529.80 crore to Rs 1,897.10 crore. “Earlier, we focussed on build, build and grow. Now we have got scale. In the next 12 to 18 months, our focus is in retaining existing customers,” says Chief Financial Officer Nitin Sood.

While PVR has pushed back its target of reaching 1,000 screens from 2018 to 2020, Ajay is quick to clarify that their appetite for growth has not diminished. “We are joined at the hip with real estate development. The slowdown in that sector is delaying our organic growth a bit,” he tells Forbes India at his office in Gurugram. His brother Sanjeev Kumar Bijli, joint MD, agrees. “India is a heavily under-screened and hugely untapped market. If we compromise on growth we will be left behind,” he says. “We will be adding 50 to 60 screens this year.”

India ranks fifth among the top 10 international box office markets, with an annual collection of $1.6 billion (the US is the largest at $11.10 billion). But the number of screens in India is paltry compared to the global powerhouses: At 9,600 screens for 1.3 billion people, India has 6.5 screens per million people, against China’s 23, Spain’s 84 and US’s 123. The extent of under-screening can be gauged from the fact that Germany, whose box office collections are at $1.3 billion (lower than India’s) has 58 screens per million people. The UK, with slightly higher collections ($1.9 billion), boasts of even more screens—60 per million.

PVR’s customer-centric approach comes at a time when the industry is rapidly evolving. “Today, competition for multiplexes comes from multiple fronts. When it comes to entertainment and content, the competition is from TV and on-tap demand (OTD) platforms such as Netflix, Hotstar, iTunes,” says Jehil Thakkar, head, media and entertainment, KPMG. “Then, there are other outdoor entertainment activities like a stroll in the park, a visit to the beach, shopping or eating out.”

Agrees Kiran Reddy, MD, SPI Cinemas, the largest multiplex chain in Chennai (PVR was recently in acquisition talks with SPI Cinemas but the deal fell through). “We are competing for people’s time and money,” he says. “It is important for theatre chains to be relevant to occupy a sufficient part of people’s leisure time.”

PVR has adopted a multi-pronged approach to achieve this. And technology is top priority. Almost a decade ago, it shifted to the digital projection system. Today, it has fitted 4K projectors, which offer better resolution than the earlier 2K versions. When it comes to sound, technology has evolved from 5.1 Surround Sound to 7.1 to 11.1 and now Dolby Atmos (strategically placed speakers make viewers feel that the sound is flowing around them). Most of the PVR properties have Atmos as well as second-generation 3D systems. Its Noida property offers the 4DX technology (where all five senses are stimulated). “Cinema has been around for the last 100 years, but it is only in the last decade or more that we have seen massive development on the technology front, especially after the advent of digital cinema,” says Sanjeev. “We are taking full advantage of this.”

The company is testing futuristic technologies with top-of-the-line Barco laser cinema projectors and screens in Bengaluru, which could well be the precursor to virtual reality in cinema. “We want to ensure that when it comes to watching a film, the theatre experience we offer is unmatched,” adds Sanjeev.

BEYOND CINEMA

For the urbane crowd, going to the movies is not just about what’s on screen, but a cinema-plus experience. For this, PVR has created five theatre formats—Director’s Cut, Gold Class, Premiere, PVR Cinemas and PVR Talkies. “No two properties are similar when it comes to design. Our investment cost per screen is much higher than our competition’s,” says Sanjeev. PVR’s experiment with its Luxury Collection—PVR Gold Class and Director’s Cut—has seen some success. It has rolled out PVR Gold Class (these 28 screens have reclining seats, gourmet menu with live kitchen, and top-end projection and audio systems) where the average ticket price is Rs 1,800 on a blockbuster weekend. “Customers here are a pampered lot,” says Renaud Palliere, who handles the Luxury Collection and International Development for the company.

PVR Director’s Cut, at Ambience Mall in New Delhi’s Vasant Kunj, is a notch above Gold Class. “People come to Director’s Cut for the experience. It is a seven-star movie experience with fine dining,” says Palliere. Employees here have been hired from five-star hotels and the ticket price on a blockbuster weekend can go up to Rs 2,400. But that hardly seems to matter as the average footfall is similar to other formats. “Director’s Cut spoils you. After experiencing it, I do not go to any other cinema,” says Vir Sanghvi, journalist and food critic. Not just the theatre, but Sanghvi has another reason to love the format—the food. “The sushi bar called Simply Sushi is very good. Sushi is an idea whose time has come,” he says. “And the choice of chef Yutaka Saito is the best thing that could have happened to PVR, which had been struggling with F&B options at Director’s Cut.”

CFO Sood is happy too. PVR’s Luxury Collection is helping the company increase its average ticket price and F&B spend per head. “Elsewhere in the world, luxury cinemas lose money as costs are very high. We have been able to crack the code and generate margins that are similar to other formats,” says Sood.

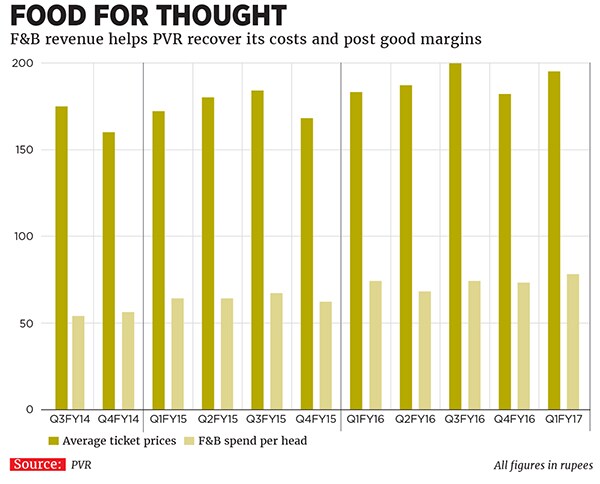

F&B is a focus area not just at Director’s Cut but across all formats. There are good reasons for this. Says Palliere, “We have no control over the film. Its quality is subjective. Good F&B options will ensure that customers still have a good overall experience even if the movie is not up to their expectation.” The company invests a lot to identify what sells where and tries to push out unique products in different locations. Its F&B spend per patron has risen from Rs 40 in 2011-12 to Rs 72 in 2015-16, and it even acquired gourmet popcorn brand 4700BC last year.

The formula seems to have worked as F&B spend as a percentage of average ticket price has increased from 25 percent in 2010-11 to 38 percent in 2015-16. At 25 percent, it is also the second-biggest revenue earner for the company after tickets (64 percent) and way ahead of advertisements (11 percent).

Sood admits that F&B sold at PVR theatres are expensive. “We do not recover ours costs from tickets. It is only from F&B that we recover them fully,” he says. “We want to grow F&B faster in the next five years. We want to get it to 50 percent of the average ticket price.” (Internationally it is as high as 59 percent.) In its August 2016 research report, Edelweiss has said that “it remains enthused by PVR’s pricing power with regard to average ticket price, F&B and advertising”. “We expect the company to be a key beneficiary of a possible uptick in urban consumption.”

CUSTOM-MADE

PVR’s biggest initiative yet is in the digital space. In 2015-16, 34 percent of the 70 million tickets were sold online through its website, app and in partnership with Paytm, BookMyShow and Justdial. This year that is expected to rise to 50 percent. It also gives them an opportunity to track customer behaviour and tweak their offerings. “Since the customers are buying from us online, there is a whole lot of data that we can analyse to understand them better. What genre of movies they like, their language and food preferences [if they book the same online] can be mined from the data,” says Ajay.

“If a high-value customer books a show, the theatre manager concerned is alerted about the customer’s preferences. We also want to individually reach out to customers and offer them a unique experience,” says Chief Information Officer Rajat Tyagi.

PVR has also deployed data analytics to make its back-end efficient. Algorithms tell the management what the optimum pricing of a ticket for a particular show should be, when a movie should be scheduled for best occupancy, how many shows should a particular genre have in a day and so on. The top management at PVR have an app called Insights that provides real-time data on footfalls, F&B sales, occupancy levels and movie-wise collection.

Dutta attributes these developments to the innovation mindset that has been created within PVR. “We try to find out enough and more as to what will kill PVR. If we do that, no one will disrupt us. This is a routine exercise,” he says. Four months ago, the top team did a recce of the market in South Korea to get customer insights. Dutta is just back from London and if you ask him what he did there, he opens his laptop to show pictures of the uniforms that workers at the upscale Hakkasan Restaurant wore, how biscuits were packaged (in a rotating box with chiming music) at Fortnum & Mason, an iconic department store. “We want to see if our gourmet popcorn can be packaged this way with Bollywood music,” he says. He even visited a hologram maker to see if the hologram of a top star can be created to receive customers at the theatre. “Ideas come from everywhere. Not all these ideas will work out but we are constantly learning,” says Dutta.

But the fear of disruption remains. “Technology is evolving so fast that people can increasingly watch high quality content at home. Constant innovation is critical,” says Reddy.

A movie buff, Ajay knows what the customers want and has his ears to the ground to understand where disruption could come from. He travels a lot and independently walks various markets. He has been regularly meeting studios and exhibitors across the world. “Over 60 percent of the overall revenue a film gets is through theatres. Any effort to bypass this will not work,” he says. “Big studios have shown their commitment by producing large, blockbuster films, which are more suited for theatre viewing.” He is confident that PVR will stay ahead of the curve.

Ask him why then there was a media report of him selling out to international cinema chain Dalian Wanda Group, and his expression changes dramatically. “That is wrong news. We are focussed on making PVR the first choice when it comes to ‘out of home’ entertainment,” he says. “Nothing will come in its way.”

First Published: Oct 13, 2016, 08:09

Subscribe Now