Eureka Forbes Purifies Water for Rural India

Inconsistencies in impurities pose a challenge but Eureka Forbes is using data and local communities to get a foothold in the rural water market

Minty-fresh it may well taste, but there’s a reason you don’t swallow your fluoride toothpaste. If consumed at more than 1.5 milligram per litre, the mineral poses serious health hazards. But in the Mahbubnagar district, just south of Hyderabad, fluoride contamination has been a persistent problem and its cause cannot be linked to an affinity for toothpaste.

You need to dig just a little deep to learn that the soil and groundwater in the region have some of the highest levels of fluoride in India. Consequently, in some villages, 92 percent of residents suffer from ailments such as stiff joints and bone deformity, symptoms of fluorosis—a condition caused by ingesting excessive fluoride from untreated groundwater.

The good news: There has been a marked improvement in the health of the villagers in recent times, courtesy a joint initiative by Eureka Forbes and World Vision. They have evolved a rural water business model that serves a dual purpose: It alleviates the problem by involving the community, and also creates brand awareness for Eureka Forbes.

Since 2007, they have set up around 70 ‘community water plants’ in Andhra Pradesh alone and the benefits to local health have been marked. In Chatanpally, for instance, a village which saw the highest adoption rate of the Reverse Osmosis (RO) purified water at 44 percent, the local health worker reported a 60-percent reduction in diarrhoeal cases and a 100-percent reduction in enteric fever—classic fluorosis symptoms.

For the enterprising local who runs the plant, it is a win-win too: Goodwill, and up to Rs 6,000 per month from the 66 containers (each with 20 litres costing Rs 3) he sells every day. Eureka Forbes has installed hundreds of large purifiers called Water Shops in villages, and trained locals—like our businessman in Chatanpally—to run the plants and sell the water.

The Technology

Using advanced monitoring systems and central diagnostic centres, Eureka can track the level of impurity in each plant in real-time at their main lab, the Aquadiagnostics Water Research Technology Centre in Bangalore—the first Water Quality Association-certified laboratory outside the US.

By purifying the water at the borewell extraction stage and attaching sensors to the filter, it can monitor the quality of water being accessed by the community.

Sixteen regional labs, which analyse the water, have the ability to calibrate the plant to change its purification methods. This gives technicians a real-time understanding of the state of each plant and the option to send engineers to remote villages to address malfunctions. Further, the labs conduct water mapping of aquifers (the nature, structure and availability of underground water tables) on an ongoing basis. This information helps Eureka Forbes deliver better products.

For instance, in industrial areas, heavy metals like iron and chromium get dissolved in water. To tackle this, Eureka Forbes’s resin technology has a manganese oxide iron exchange that removes the heavy metal.

“Water changes its constituents season to season, month to month, year to year,” says Dr AV Suresh, CEO of Forbes Professional, the company’s cleaning services and water purification arm. “The challenge is what does the customer do if the water quality changes?” Citing the example of his home in Mumbai, he explains that the UV filter is effective only when municipal water flows from the taps. But, during water shortages, tanker water is added to the mix and, as a result, the ‘total dissolved solid’ goes up and the taste gets adversely affected.

The Market

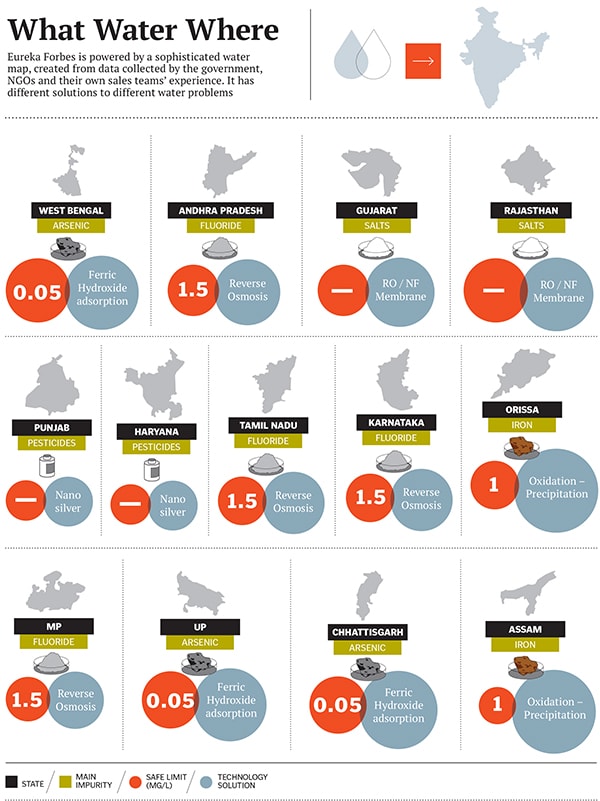

There is obviously a clear need for water purification across the country. The contaminants are different— fluoride in the south, arsenic (from iron mining) in the east, salt and nitrates in the west and pesticides/fertilisers (from agricultural activity) in the north. Even in the slums of Chennai, Hyderabad, Delhi and Mumbai, 56 percent of borewell and 37 percent of tanker water exceed permissible limits of contamination, according to a Monitor report.

The requirement, thus, is esta-blished. But what about the market?

Enough players are evincing interest in the rural water business. While brands like Tata’s Swach and Hindustan Unilever’s Pureit are predominantly selling home water purification solutions, Doshion Veolia is making larger-scale solutions available. Eureka Forbes has focussed on a target that lies in-between individuals and large-scale consumers—the community.

It is too early to ascertain how the rural population will consume purified water in the long run—individually or en masse. But Eureka Forbes has committed to venture on a different path. They want communities of 5,000 to own and run their own water plants, while the company monitors them through their water labs.

What emerges is that water purification isn’t a ‘one size fits all’ game groundwater from various parts of the country requires specific filtration equipment, settings and recalibration. Eureka Forbes is powered by a sophisticated water map created on the basis of data collected from the government, NGOs and their own sales teams’ experience in the field. The map is constantly updated with information from the labs.

The Business

Though Eureka Forbes has taken baby steps with an investment of around Rs 50 lakh till date, they insist their rural plan is not about corporate social responsibility (CSR) alone. It is also a business decision.

Here’s how it works: Eureka Forbes provides the hardware, the panchayat provides the land, the state provides the water, and locals are trained by NGOs to run the plant and sell the potable water. The model may change from state to state but the basics remain the same.

Dr Rajesh Roy, head of strategic partnerships at Eureka Forbes, says, “The plants are either subsidised by the government, CSR initiatives, microfinance agencies or NGOs. We have got different business models with different partners.” In Madhya Pradesh, the government has subsidised the plant cost and Eureka Forbes recovers the operational expenditure by running the plants and selling water. In case of CSR partnerships, the company pays for the plants as well as the running cost.

As far as microfinance agencies go, Eureka Forbes has a 50:50 partnership model. In one case, a microfinance agency has subsidised the plant and is recovering the cost by selling water to the community.

The model, however, is fraught with challenges. For one, not all villagers are willing to pay for pure water when they can get regular water free from the government. In some villages, less than 20 percent of the people pay for the RO-filtered water even after the plant has been operational for two years. Additionally, disease rates have not gone down across the board because many continue to cook with the untreated water even though they drink purified water. Eureka Forbes’s own research shows that there was no significant fall in cases of diarrhoea.

Only when a large percentage of villagers use the water plants and pay the correct fee can the Water Shops become sustainable. Otherwise, external subsidies will be needed to keep the plants running.

Suresh and Roy remain optimistic. According to Eureka Forbes’s field research, rural families have an average monthly income of Rs 4,000 of which they spend Rs 200 on medicines to treat diseases caused by drinking impure water. They also spend Rs 200 on a mobile phone. They feel these families are ready to spend Rs 3 for a 20-litre container when water transported from safe areas costs as much as Rs 10. Also, Suresh believes that establishing a brand name at the community level through their Water Shops will give them a boost.

Part of the Shapoorji Pallonji group, Eureka Forbes generates revenues of Rs 1,800 crore with water purification accounting for 75 percent of that. The rural market is still a small fraction of its 30-year-old water purification business. But it is too early to jump to conclusions. This is a relatively new problem, Suresh says, pointing out: “Until now, the main challenge has been educating people because the issue was always the availability of water rather than its treatment. You can only treat water provided it’s there.”

First Published: Aug 01, 2013, 06:51

Subscribe Now