Chaotic bond markets to continue to combat inflation and recession fears in 2024

Last year, global bond markets toggled between persistent inflation and recession in an aggressive rates-tightening era. Will the 2024 playbook be the same?

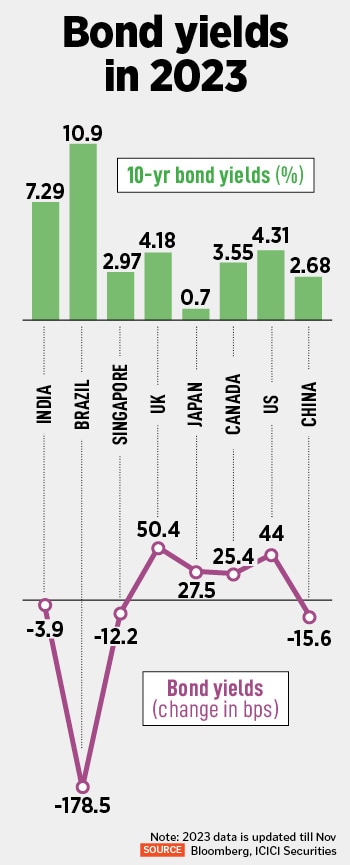

If there was one asset class that gave global central bankers and investors a varying sense of caution and exuberance in 2023, it was bonds. Navigating through the fears of widening inflation and interest rate tightening cycle, the 10-year bond yields in the US spiked to multiple-year highs while investors rushed to the safety of fixed income. The playbook of bond markets in 2024 is expected to stay the same, at least in the first half, as the scenario has changed just a little. The era of aggressive rate cycle may have ended or is ending soon, but inflation remains sticky.

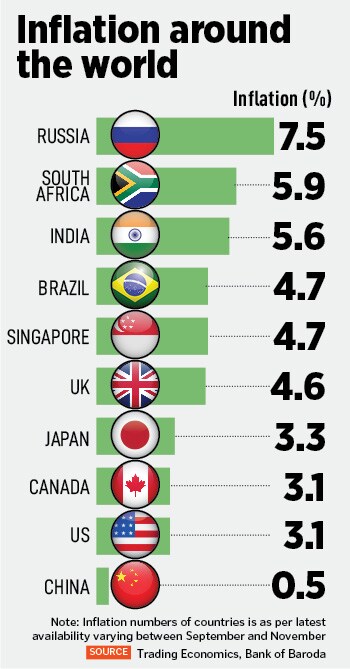

“In the first half of the year, bond yields would tend to be elevated for sure and then come down depending on how the US Federal Reserve plays out its plans. Inflation has been coming down for sure, but until the Fed is convinced of the trajectory and sustainability of the same, there will be no change in policy. We should remember that as the world economy moves forward, there would be some push given to commodity prices," says Madan Sabnavis, chief economist, Bank of Baroda.

He explains that 2023 was a year when central banks tended to either increase their policy rates or provide indirect guidance of not being in a position to lower rates due to inflation concerns. “The markets have been reading into the language of central bankers and responding accordingly. Hence there has been a tendency for bond yields to increase across the world. This will continue until such time there is a definite reversal in policy stance of the central banks. However, it has been seen towards the end of the year that signals of no more rate hikes have tended to assuage yields and lift prices. Albeit marginally," Sabnavis elaborates.

Bond markets went through a topsy turvy phase across all regions in 2023, the impact of which was felt in equities and gold as investors shifted to alternative assets as a safe bet. In the US, the yield on 10-year government bonds, the benchmark for asset prices across the globe, rose to hit 5.02 percent. This is the highest level the 10-year bond yields has hit, since July 2007. However, yields dropped to 4.35 percent by November-end on hopes of lower interest rates if inflation continues to fall.

According to him, the rate hiking cycle of 2022-23 is now at its peak. In the US and many other developed economies, interest rates have gone too far from their natural levels. It will be difficult for interest rates to sustain at these levels for long without causing serious problems in the financial sector and the economy. Pathak expects interest rates to revert in 2024, and the reversal could be quick and sharp.

According to him, the rate hiking cycle of 2022-23 is now at its peak. In the US and many other developed economies, interest rates have gone too far from their natural levels. It will be difficult for interest rates to sustain at these levels for long without causing serious problems in the financial sector and the economy. Pathak expects interest rates to revert in 2024, and the reversal could be quick and sharp.

Suyash Choudhary, head-fixed income, Bandhan Mutual Funds, also feels that 2023 was supposed to be the year for bonds as animal spirits fatigued against the onslaught of rapid monetary tightening, greed turned to fear, and investors rushed to the safety of fixed income. “Indeed, a trailer for this movie did play for some weeks early in the year, triggered by crises at some banks in the US and Europe. However, this proved to be a false start and we rapidly went back to the narrative of sticky inflation and continued rate tightening," Choudhary adds.

Going into the new year, investors are expecting a soft landing of rates, a period of below trend growth with inflation falling back towards target, allowing for significant monetary policy easing. Choudhary says that markets are pricing for the Fed to deliver approximately 125-150 basis points of rate cuts over 2024 with the first one latest by May. Expectations with respect to the European Central Bank are also broadly similar.

The Indian bond market was relatively resilient in 2023. Notwithstanding all the chaos in the global bond market and wild swings in the commodity prices, the bonds remained relatively stable. The 10-year Indian government bond yield was trading between 7.1 percent and 7.4 percent for most part of 2023.

“There were also some important policy changes worth noting from taxation of MLDs (market linked debentures), debt mutual funds and insurance premiums—all which will have a lasting impact on the demand supply in the bond market," Pathak adds.

Pathak finds Indian bonds an extremely attractive bet for 2024. He reasons falling core inflation, softer commodity prices, turning global interest rate cycle, global bond index inclusion are all supportive for the bond market going into 2024. Real interest rates are reasonably high and there is also a potential to generate capital gains over the next one or two years.

Others concur. In the second half, Sabnavis sees the 10-year bond moving to 6.75 to 7 percent provided the Reserve Bank of India lowers the repo rate by 25-50 basis points. This is the best possible scenario if inflation remains benign for an extended period of time which is hard to guess today, he adds.

As the year goes by, a strong gush of foreign institutional investors’ (FII) money is expected to hit Indian bonds. In a significant and first-ever move, index provider JP Morgan will include India Government Bonds (IGBs) in the Global Bond Index-Emerging Markets from June 2024. The inclusion in the widely-tracked index is likely to benefit India by roughly around $20-40 billion in the next 18 to 24 months as Indian bonds will be accessible to foreign investors while the rupee is likely to be strengthened, thus boosting the economy. The inclusion, which starts from June 28, will be in a staggered manner. A 1 percent weightage per month over a total of 10 months (through March 2025) will be added, before India reaches the maximum weighting of 10 percent in the GBM-EM GD index

As the year goes by, a strong gush of foreign institutional investors’ (FII) money is expected to hit Indian bonds. In a significant and first-ever move, index provider JP Morgan will include India Government Bonds (IGBs) in the Global Bond Index-Emerging Markets from June 2024. The inclusion in the widely-tracked index is likely to benefit India by roughly around $20-40 billion in the next 18 to 24 months as Indian bonds will be accessible to foreign investors while the rupee is likely to be strengthened, thus boosting the economy. The inclusion, which starts from June 28, will be in a staggered manner. A 1 percent weightage per month over a total of 10 months (through March 2025) will be added, before India reaches the maximum weighting of 10 percent in the GBM-EM GD index

As a result, FII flows have consistently been on the rise in the debt segment, even as the equity segment saw a decline in fund flows.

However, retail participation in bonds is still low. “Retail participation will always be a challenge because of liquidity issues," says Sabnavis. We have seen that generally only the benchmark securities trade well. Now if a person buys a benchmark this year, it will lose the status next year with the tenure changing. It then becomes hard to sell as liquidity is not there in non-benchmark securities. Therefore, individuals will not find this convenient. They will be involved through debt schemes of mutual funds, Sabnavis explains.

First Published: Dec 28, 2023, 15:46

Subscribe Now