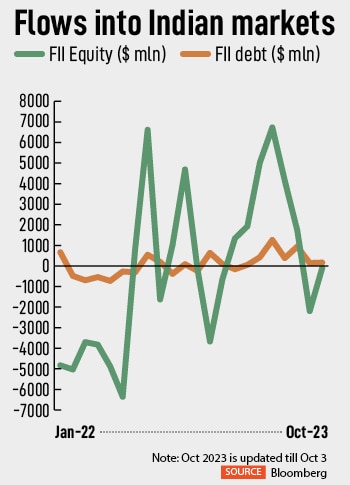

Indian equities suffered a withdrawal of $2.2 billion of FII money in September, in one of the sharpest single-month declines since January, as the rapid rise in US borrowing costs weighed on risk assets. This follows a robust pump of FII funds worth $20.85 billion in the previous six months, which drove the Sensex and Nifty to record highs multiple times. In fact, FIIs poured in as much as $6.72 billion and $5 billion in June and May respectively, shows a Forbes India analysis based on Bloomberg data.

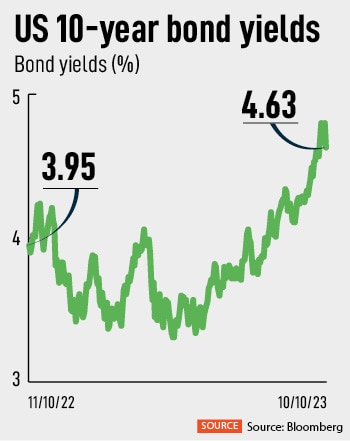

However, as US 10-year bond yields continued to rise, investors rushed to dump Indian equities, which are typically considered to be riskier assets and hence less attractive. The sell-off by FIIs in Indian equities has continued in October and is feared to intensify if the geopolitical crisis in West Asia escalates or US bond yields continue to flare up, as has been the case in the past several months.

A sharp rise in US bond yields above the 4.25 percent mark and the acceptance of the ‘higher for longer interest rate’ narrative has led to the massive FII outflow from Indian equities, explains Vinod Karki, head-equity strategy and quantitative research, ICICI Securities.

As bond yields in the US start to rise, investors increasingly switch out of foreign markets, especially the EMs, to hunt for better opportunities at home this inevitably puts pressure on equities. The yield or rate on US treasury bonds for a 10-year period has risen to a 16-year high of 4.8 percent as the US Federal Reserve is expected to keep interest rates sufficiently higher for longer. This has a direct influence on financing costs for households and businesses.

![]() “The global equity markets in the past few weeks is witnessing some sort of a risk-off environment amid persistently high interest rates, recent increase in crude oil prices that can lend upward pressure on inflation, some weakening of macro data globally and rise in US bond yields after not-so-encouraging comments from the US Fed, which led to the street reducing their expectations of quantum of rate cuts in 2024. This led to selling by FIIs in global equities, and EMs in particular this had a bearing on the FII activity in India as well," says Rupen Rajguru, head, Equity Investment and Strategy, Julius Baer India.

“The global equity markets in the past few weeks is witnessing some sort of a risk-off environment amid persistently high interest rates, recent increase in crude oil prices that can lend upward pressure on inflation, some weakening of macro data globally and rise in US bond yields after not-so-encouraging comments from the US Fed, which led to the street reducing their expectations of quantum of rate cuts in 2024. This led to selling by FIIs in global equities, and EMs in particular this had a bearing on the FII activity in India as well," says Rupen Rajguru, head, Equity Investment and Strategy, Julius Baer India.

Rajguru adds that an uneven monsoon, slight deterioration in the macro data and significant valuation premium could also have prompted FIIs to book some profits in India amid an uncertain global environment.

In contrast, FIIs have started to nibble on debt instruments in India. Data showed FIIs’ net inflow into debt markets were at $147 million in September, while investing $3.90 billion in the year so far. This, of course, is comparably very little to net FIIs’ inflow worth $14.26 billion in equities in 2023 so far.

Debt instruments in India are gradually attracting foreign money, as for the first time JP Morgan will include India government bonds (IGBs) in the Global Bond Index-Emerging Markets from June 2024. The inclusion is likely to benefit India by around $20-40 billion in the next 18- to 24-month period. The inclusion will start from June 28, 2024, in a staggered manner. A 1 percent weightage per month over a total of 10 months (through March 2025) will be added, before India reaches the maximum weighting of 10 percent in the GBI-EM GD index.

Will equities be shunned now?

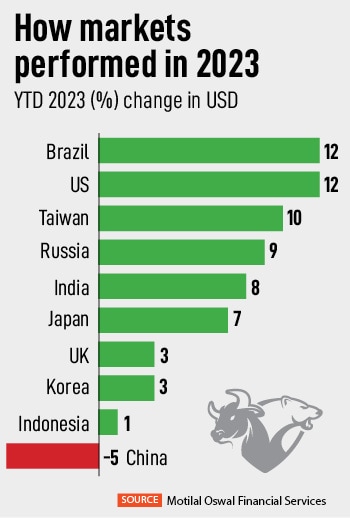

As elevated bond yields are expected to weigh on growth equities from a valuation perspective, companies with weak profitability and low cash flows will be particularly impacted. According to Hou Wey Fook, chief investment officer, DBS Bank, the shifting macro and geopolitical landscape warrants a recalibration in the three remaining months of 2023 and he believes themes such as e-emergence of “higher for longer", preference for bonds over income equities, and a dire need of policy clarity in China will play out.

![]() With bond yields staying “higher for longer", Fook expects equity markets to stay subdued in the fourth quarter of 2023, with little differentiation in performance among the key regions. “The huge run-up in 2Q23 was predominantly driven by expectations of peak Fed. But the rhetoric at Jackson Hole suggests that this is not the case and hence, the initial enthusiasm for interest-rate sensitive plays will see some tapering in the months ahead," he explains.

With bond yields staying “higher for longer", Fook expects equity markets to stay subdued in the fourth quarter of 2023, with little differentiation in performance among the key regions. “The huge run-up in 2Q23 was predominantly driven by expectations of peak Fed. But the rhetoric at Jackson Hole suggests that this is not the case and hence, the initial enthusiasm for interest-rate sensitive plays will see some tapering in the months ahead," he explains.

Others concur. As the conflict between Israel and Palestine continues, Chetan Seth, equity strategist, Nomura, says geopolitical events in West Asia necessitate a cautious stance. However, Seth feels that if the conflict is not prolonged it might be a buying opportunity for India stocks. “In the Asian equities space, assuming oil prices surge in the days ahead, some major Asian net-oil importers like India and the Philippines may underperform. That said, assuming this conflict does not turn into a wider and a prolonged conflict, we think it might ultimately be a buying opportunity for India stocks given the strong structural outlook and ongoing investor concerns over Hong Kong and China stocks," he elaborates.

![]() The Palestine-Israel conflict may still present a risk for stocks, as it may possibly lead to a surge in oil prices, which had surged more than 30 percent in less than two weeks when Russia invaded Ukraine in February 2022. Brent crude oil prices have been rising, closing to $100 per barrel last month.

The Palestine-Israel conflict may still present a risk for stocks, as it may possibly lead to a surge in oil prices, which had surged more than 30 percent in less than two weeks when Russia invaded Ukraine in February 2022. Brent crude oil prices have been rising, closing to $100 per barrel last month.

While Rajguru remains positive on the India equity markets over the medium to longer term, he is slightly cautious in the short term with few concerns that can trigger intermittent volatility, mostly in the small and microcap space if liquidity flows slow down. “This would be a function of the recent headwinds turning for the better. Apart from this, other factors that can support flows could be a significant improvement in India-specific factors [versus expectations], including corporate earnings, macro-economic indicators, demand environment [especially rural demand], political environment in the upcoming state elections," Rajguru adds.

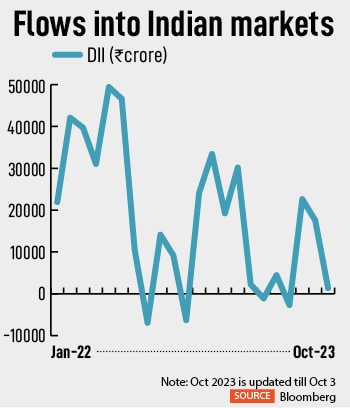

In the past, domestic institutional investors’ (DIIs) flows into equity have helped keep Indian stock markets’ momentum somewhat intact. In September, DIIs pumped in Rs 17,561.15 crore into equities following a net inflow of Rs 22,610.76 crore in August. Since January, DIIs which include mutual funds, insurance, banks, etc have net invested Rs 127,218.88 crore into equities.

The hot bond story!

Since the global financial crisis in 2008, the US Federal Reserve adopted a “zero interest rate" policy by cutting rates close to the zero bound. This, followed by years of quantitative easing, kept long-term treasury yields in the US anchored to the lows. Despite a brief reprieve during 2017-2018, yields in the US resumed their downward spiral as the Covid-19 pandemic struck economies worldwide. To rescue fledging economies hard hit by the crisis, central banks took out their usual playbook and slashed policy rates again.

![]() From 2001-2010, the average yield for US 10-year treasuries was 4.1 percent. However, aggressive monetary easing and overall economic instability drove the average yield to 2.1 percent from 2011-2021, a decline of 200 basis points. From 2011-2021, corporate bonds garnered an average yield of 2.6 percent.

From 2001-2010, the average yield for US 10-year treasuries was 4.1 percent. However, aggressive monetary easing and overall economic instability drove the average yield to 2.1 percent from 2011-2021, a decline of 200 basis points. From 2011-2021, corporate bonds garnered an average yield of 2.6 percent.

Then came the post-pandemic inflation surge as a result of the Russia-Ukraine crisis and the supply chain disruption that took central bankers by surprise. US headline inflation rose and hit a peak of 9.1 percent in June 2021 (the highest since the early-1980s), compelling the Fed to pivot from its “transitory inflation" narrative to hawkish monetary tightening.

Fook says with rates back to 2007 levels, the near 6 percent annual coupon income from holding investment grade (IG) bonds is preferred over dividend-yielding equities and cash deposits as the next yield play. “We believe the bar for rate cuts is set sufficiently high and the Fed will likely keep rates on hold [at elevated levels] in the forthcoming months until recessionary signals emerge," says Fook.

“The global equity markets in the past few weeks is witnessing some sort of a risk-off environment amid persistently high interest rates, recent increase in crude oil prices that can lend upward pressure on inflation, some weakening of macro data globally and rise in US bond yields after not-so-encouraging comments from the US Fed, which led to the street reducing their expectations of quantum of rate cuts in 2024. This led to selling by FIIs in global equities, and EMs in particular this had a bearing on the FII activity in India as well," says Rupen Rajguru, head, Equity Investment and Strategy, Julius Baer India.

“The global equity markets in the past few weeks is witnessing some sort of a risk-off environment amid persistently high interest rates, recent increase in crude oil prices that can lend upward pressure on inflation, some weakening of macro data globally and rise in US bond yields after not-so-encouraging comments from the US Fed, which led to the street reducing their expectations of quantum of rate cuts in 2024. This led to selling by FIIs in global equities, and EMs in particular this had a bearing on the FII activity in India as well," says Rupen Rajguru, head, Equity Investment and Strategy, Julius Baer India. With bond yields staying “higher for longer", Fook expects equity markets to stay subdued in the fourth quarter of 2023, with little differentiation in performance among the key regions. “The huge run-up in 2Q23 was predominantly driven by expectations of peak Fed. But the rhetoric at Jackson Hole suggests that this is not the case and hence, the initial enthusiasm for interest-rate sensitive plays will see some tapering in the months ahead," he explains.

With bond yields staying “higher for longer", Fook expects equity markets to stay subdued in the fourth quarter of 2023, with little differentiation in performance among the key regions. “The huge run-up in 2Q23 was predominantly driven by expectations of peak Fed. But the rhetoric at Jackson Hole suggests that this is not the case and hence, the initial enthusiasm for interest-rate sensitive plays will see some tapering in the months ahead," he explains. The Palestine-Israel conflict may still present a risk for stocks, as it may possibly lead to a surge in oil prices, which had surged more than 30 percent in less than two weeks when Russia invaded Ukraine in February 2022. Brent crude oil prices have been rising, closing to $100 per barrel last month.

The Palestine-Israel conflict may still present a risk for stocks, as it may possibly lead to a surge in oil prices, which had surged more than 30 percent in less than two weeks when Russia invaded Ukraine in February 2022. Brent crude oil prices have been rising, closing to $100 per barrel last month. From 2001-2010, the average yield for US 10-year treasuries was 4.1 percent. However, aggressive monetary easing and overall economic instability drove the average yield to 2.1 percent from 2011-2021, a decline of 200 basis points. From 2011-2021, corporate bonds garnered an average yield of 2.6 percent.

From 2001-2010, the average yield for US 10-year treasuries was 4.1 percent. However, aggressive monetary easing and overall economic instability drove the average yield to 2.1 percent from 2011-2021, a decline of 200 basis points. From 2011-2021, corporate bonds garnered an average yield of 2.6 percent.