Within its Asia-Pacific, excluding Japan/emerging markets portfolio, India is now the most preferred market for Morgan Stanley as it has leapfrogged to number one from sixth position. Japan continues to be its top pick in global equities.

According to analysts at Morgan Stanley, India is arguably at the start of a long wave boom at the same time as China may be ending one. It reasons that India’s relative valuations are now less extreme than in October, while trends are supporting foreign direct investment (FDI) and portfolio flows, with India adding a reform and macro-stability agenda that underpins a strong capex and corporate profit outlook. Earlier in March, Morgan Stanley had upgraded India to equal-weight from underweight.

“Simply put, India"s future looks to a significant extent like China"s past. Our economics team thinks trend gross domestic product (GDP) growth in China is likely to be around 3.9 percent to the end of the decade versus 6.5 percent for India," Morgan Stanley analysts say.

Morgan Stanley has also upgraded its stance on Greece while moving China and Taiwan down to equal-weight. Korea, Mexico and the UAE remain overweight-rated. It has downgraded Australia to underweight and retained underweight ratings across New Zealand, Malaysia, Thailand, Qatar and Colombia, but moved up Hungary to equal-weight.

Tiger and dragon story

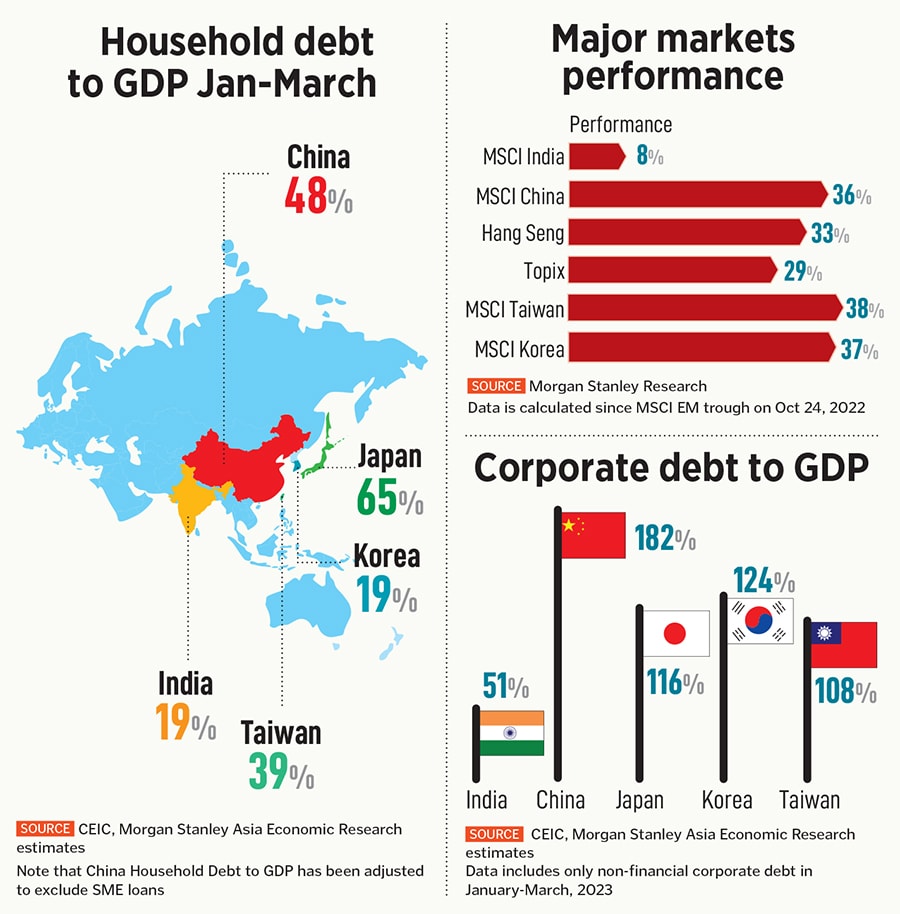

Considering equities among India and China as a pair in US dollar terms and using the MSCI Indices as the benchmark, the beginning of a new era of Indian outperformance compared to China appears to be dawning, says Morgan Stanley.

From 2003 to 2020, the two markets performed remarkably in line with each other—both having a tendency to outperform MSCI EM over the cycle. From early 2021, however, India has broken out dramatically to the upside, having outperformed China by over 100 percent.

What works in favour of Indian equities are significantly higher US dollar earnings per share (EPS) growth, return on equity (ROE), structural reforms taking place in the last few years and currently bearing fruit, unlocking growth opportunities that were previously stagnant.

“We reiterated our incremental bullish stance on India in our mid-year outlook given constructive fundamentals and narrower valuation premiums to emerging markets. Valuation premiums to EM and China have moderated significantly from last October"s high and started to spike up again," Morgan Stanley says.

According to the global brokerage house, India is benefiting from a surge in inward FDI, including from the US, Taiwan and Japan firms looking to its own large domestic market as well as a much-improved export infrastructure situation vis-à -vis more-efficient ports, road and electricity supply. Private equity firms are expanding in India (and ASEAN) at the same time as they are struggling with exits in China, it explains.

Fitch cuts US credit ratings: Implications

The downgrade of US credit ratings by Fitch led to a massive sell-off in equities across the globe and US Treasuries, triggered by investors who panicked and feared an impending recession. The cut in ratings by Fitch follows two months after US president Joe Biden and the Republican-controlled House of Representatives reached a debt ceiling agreement that lifted the government"s $31.4 trillion borrowing limit.

Investors in India lost a notional wealth amounting to Rs3.56 lakh crore as benchmark indices Sensex and Nifty slipped over 1 percent at closing on Wednesday. The National Stock Exchange’s (NSE) India VIX index or volatility index surged 10 percent, indicating investors expect a major correction at least over the next month.

On Wednesday, Fitch Ratings downgraded the United States of America"s Long-Term Foreign-Currency Issuer Default Rating (IDR) to AA+ from AAA. This is first time that the US lost its top-tier AAA rating by Fitch. AAA is the highest credit quality and denotes lowest expectation of default risk. They are assigned only in cases of exceptionally strong capacity for payment of financial commitments and are highly unlikely to be adversely affected by foreseeable events.

Analysts at Nomura attribute the sell-off in US Treasuries to several factors that possibly added up, leading to a renewed pressure in US bonds and eventually also impacting US equities. “We note that since the strong US GDP data release last week, US 10-year nominal and real yields have risen by 22 basis points each. While tech/growth stocks have largely been ignoring the move in bond yields for several weeks now (due to stock investors’ focus, in our view, on the perceived structural attraction of the AI thematic), it seems to us the reason for sell-off in US stocks was the sudden realisation of the surge in US bond yields," Nomura analysts say.

![]()

Overall, Nomura does not think these events mean a lasting fundamental impact on Asian equities. While India’s growth has been holding up and the economy is relatively less exposed to US growth, Nomura feels that the beta of Indian equities to US equities is relatively high and global investors’ positioning does not appear to be light. “Thus, Indian equities remain at risk from a scenario of global investors likely ‘deleveraging’ their global stock positions," Nomura reiterates.

Trend analysis of the US credit downgrade in 2011 suggests that stocks are likely to be volatile over the next few days, but eventually they tend to stabilise. For example, during the S&P credit downgrade on August 5, 2011, US stocks were quite volatile through early October, but eventually recovered.

“The downgrade of the US credit rating to AA+ can have significant implications for the financial markets, both domestically and globally," says Jayden Ong, senior market analyst, APAC, Vantage. As the US Treasury bonds are considered a benchmark for safe-haven assets worldwide, the downgrade may result in higher yields on US government debt as investors demand higher compensation for perceived increased risk.

“This could lead to a sell-off of US Treasuries by investors seeking higher returns, potentially driving down bond prices. Since Fitch began to lower the evaluation to AA+, it proves that the uncertainties of the US economic system will gradually increase in the future, which will put pressure on the Indian equities market in the short term and one can expect the gold market to continue to be beneficial in this circumstance," explains Ong.

The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to AA and AAA rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions, Fitch says.

According to Fitch, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025.

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. In addition, the government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process. These factors, along with several economic shocks as well as tax cuts and new spending initiatives, have contributed to successive debt increases over the last decade," Fitch adds. Additionally, there has been only limited progress in tackling medium-term challenges related to rising social security and Medicare costs due to an ageing population.

Fitch projects that tighter credit conditions, weakening business investment, and a slowdown in consumption will push the US economy into a mild recession in the fourth quarter of 2023 and first quarter of 2024. The rating agency sees US annual real GDP growth slowing to 1.2 percent this year from 2.1 percent in 2022 and overall growth of just 0.5 percent in 2024.

However, Mukesh Kochar, national head-wealth, AUM Capital, feels that Fitch had already signalled a possible downgrade in May before the debt ceiling agreement, but the timing may have surprised the markets.

“Anything happening in the US always impacts the world market. However, we believe that the impact should be short-lived as one rating agency S&P has already downgraded the US to AA+. This time the impact should be for a couple of days and the market may focus on other fundamental factors. The impact on the Indian market should also be short-lived and other factors such as earnings, crude prices, and Reserve Bank of India policy and fund flows will be key to the market," Kochhar explains.

US Treasury Secretary Janet Yellen disagreed with Fitch"s downgrade, calling it "arbitrary and based on outdated data", in a statement.

Analysts, meanwhile, will watch out how higher borrowing costs impact the trajectory of US growth over the next several months.