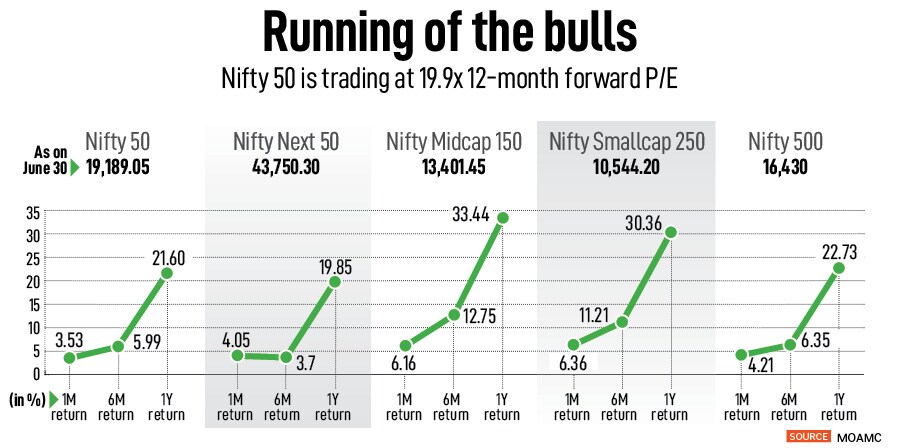

Confoundingly, unlike most bull-runs in the past, the current rally in stock prices is not being driven by the large-cap stocks. Consider this: The top 10 Nifty 50 stocks contributed 41 percent of the index returns in the past three months. While Nifty 50 stocks returned 21.6 percent over a one-year period, Nifty Smallcap 250 rose over 30 percent during the same period (see table).

Sanjeev Prasad, managing director and co-head, Kotak Institutional Equities, notes, “We are not sure how to explain or interpret the odd movement in the Indian stock market. Large-cap stocks typically lead mid and small-cap stocks in bull-market rallies, but the current rally is the other way around."

Though investors may argue the performance of the small caps is due to liquidity, Prasad isn’t convinced. “That presumably reflects bullish sentiment among domestic institutional and retail investors. Foreign institutional investors are unlikely to chase smaller stocks and passive retail investors will deploy money into ETFs with a disproportionate weight of large-cap stocks," he states.

The lacklustre performance of several large-cap stocks in the last three to six months has been a drag on the market. However, there is a recent pick-up in a few large caps as investors seek safety should there be a correction. In fact, many market mavens believe the market has topped out.

![]()

“Valuations are expensive in India—a natural headwind for the market," Prasad warns. Nifty 50 Index is trading at 19.9x one-year forward price-to-earnings ratio and breached the 19,000-level to hit a fresh lifetime high since its previous peak in December 2022.

Sunil Singhania, founder, Abakkus Asset Manager, says, “Markets are now trading at a slight premium to its 10-year average but not at an overly exuberant level. Yes, there are pockets of smaller companies and theme-based stocks that have moved up sharply and here surely there is scope for correction. Investors should refrain from chasing themes and momentum as a slight change in sentiments can lead to a sharper correction in such stocks."

But Singhania says he is optimistic about the markets, more so on corrections, as he expects a strong growth in domestic GDP over the next two to three years. Nevertheless, he recommends caution at this stage.

“Discretion is definitely the need of the hour as many stocks have been moving up much ahead of their fundamentals. However, mid- and small-cap investing is all about individual stock picking and there are still opportunities to generate decent longer-term returns," he adds.

Ankit Jain, fund manager, Mirae Asset AMC, sees balanced risk-reward opportunities in the medium term. He believes overall supportive macros and the underlying improvement across many sectors augur well for corporate earnings growth and investment returns in the coming quarters. “Despite the market run-up, we continue to find enough opportunities in the market with decent margin of safety across sectors like financials, consumer discretionary, insurance and pharmaceutical sector," Jain says. “Earnings growth outlook for the mid- and small-cap segment remains good over the medium term, which might continue to lend support to premium valuations in this segment."

In June, Nifty 500 returned 4.21 percent to investors. The top five sectors that contributed were financial services (1.17 percent), consumer discretionary (0.78 percent), industrials (0.64 percent), health care (0.46 percent) and commodities (0.22 percent).

![]()

Meanwhile, on Wall Street

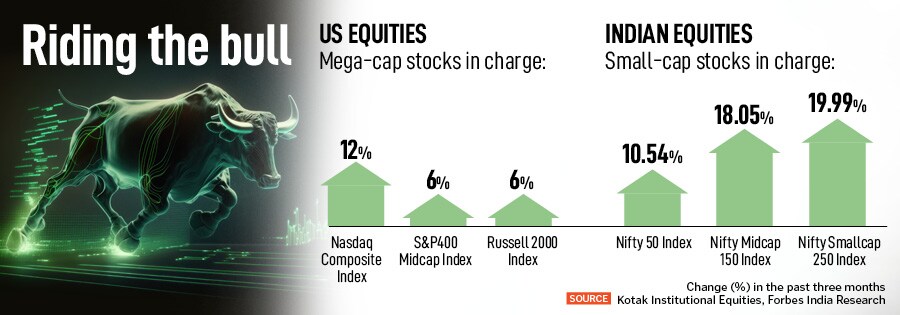

If small caps are leading the charge on Dalal Street, it’s the mega-cap stocks that are fuelling the stock rally on Wall Street (see table). If valuation is a concern in India, it’s the economic challenges in the US that could stop the bull-run.

“The divergent performance between large-cap, and mid- and small-cap stocks in India and the US markets in the past few months may reflect a combination of hype and reality regarding certain developments in the two markets. The large-cap stocks continue to be general laggards in a recovering economy in India, while the mega-cap stocks are leaders in a slowing economy in the US. Both markets could be reaching their limits," Prasad explains.

![]()

Strikingly, the top 10 S&P 500 Index stocks contributed the bulk, roughly 75 percent, of the index returns in the previous quarter. Notably, the strong performance of six to eight technology stocks that rose powered by the promise that they could lead the evolving AI (artificial intelligence) scene although there are several other dominant players in this area.

“Each of the segments such as consumer electronics, cloud, ecommerce, search and social media has only one or two dominant players even now. AI will see each of these entities pitted against each other, a very different landscape compared with the landscape when these companies and industries first emerged and achieved scale," Prasad highlights.

US mega-cap tech shares have been on a tear for nearly six months after the tech meltdown last year thanks to the fanfare around AI as the next-big-theme to drive innovation and value creation. It’s a stock rally that no market expert saw coming given the chatter around an imminent US recession which hasn’t set in yet. In fact, analysts’ market forecasts are wide-ranging with a high margin of difference.

A Bloomberg analysis shows that the rise in the S&P 500 hasn’t been more concentrated in six to eight stocks since the early 2000s. Also, six of the largest companies of Nasdaq-100, a key barometer of the technology sector, account for nearly 51 percent. Nasdaq-100 recorded the highest six-month return since the internet bubble of the late 1990s. Such asymmetry dangerously tilts towards the heft of the top six tech giants—Microsoft, Apple, Alphabet, Nvidia, Amazon and Tesla—and limits the scope for portfolio diversification and distribution of risk.

![]()

Importantly, Nasdaq announced a ‘special rebalance’, effective July 24, to address overconcentration in the index by redistributing the weights without removing or adding new companies.

Moreover, brokerages are sceptical if the AI-fuelled rally on Wall Street can withstand the pressure of ‘higher-for-longer’ interest rates as the US Federal Reserve is likely to raise rates by 25 basis points as its battles stubborn core inflation which has declined to 3 percent from 9.1 percent in June 2022. The US Fed has hiked rates by 500 basis points since March last year. High interest rates could dampen consumption and dent business confidence.

“There is a narrative that is emerging that inflation might be more persistent than it is thought to be at this juncture, going by the conditions that prevail in the US and also Europe, and the consequent rate action will be north-bound. This will have its impact, causing some turbulence in the immediate term," says Joseph Thomas, head of research, Emkay Wealth Management.

In June, the S&P 500 rose 6.47 percent, mainly led by growth in IT stocks (1.84 percent), consumer discretionary (1.22 percent), industrials (0.93 percent), financials (0.79 percent), and health care (0.58 percent).

*****

India is the fastest-growing world economy and one of the most attractive emerging markets despite rich valuations at current levels. “I think this is going to be a fantastic decade for investing in India provided the corporates do reasonably well. Local money is guaranteed to come and if some bit of global money also comes in, we’ll have a big party. Global news flow is not very good, but India is outperforming markets. India has a very unique growth story," ace investor Raamdeo Agrawal, chairman and co-founder of Motilal Oswal Financial Services, said in an earlier interview on Forbes India Pathbreakers.

China’s reopening trade has fizzled out and foreign investors are shifting portfolio allocations to other emerging markets like India for better long-term returns. Foreign investors, who were on a selling spree and exited Indian equities to the tune of $20 billion since September 2021, have turned net-buyers. In the June quarter, foreign institutional investors pumped in around $12.5 billion on the back of corporate earnings growth and relatively stable macros.

“We remain optimistic about the market for the foreseeable future, but there could be certain risks and concerns in the upcoming one to two quarters. Despite the fact that small- and mid-cap indices are trading at all-time-high levels, it is crucial to avoid index investing, and instead adopt a bottom-up stock-picking strategy and focus on businesses that benefit from any of the dominant long-term themes, such as financialisation of savings, import substitution, capital expenditures, green energy, digitalisation, consumption-led," say analysts at Rockstud Capital.