But what could derail that bull run of Indian markets outperforming global peers are delayed monsoon and weak consumption demand. Of course, political uncertainty will also come knocking as general elections are expected in May next year.

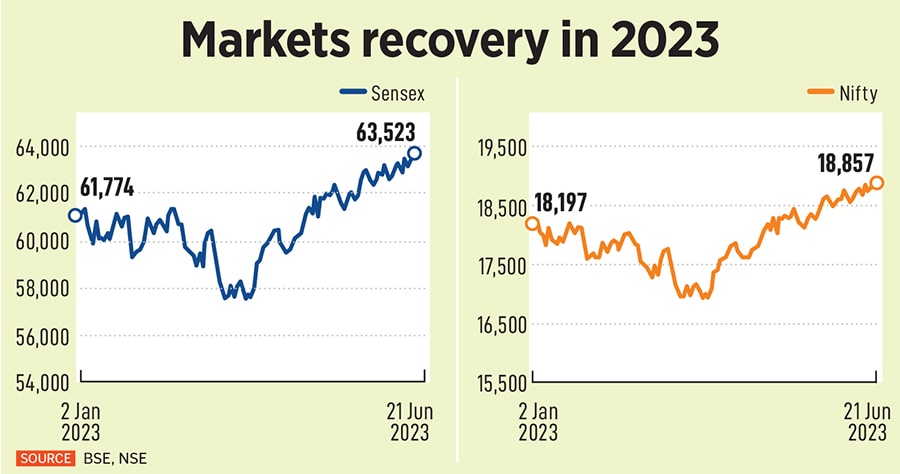

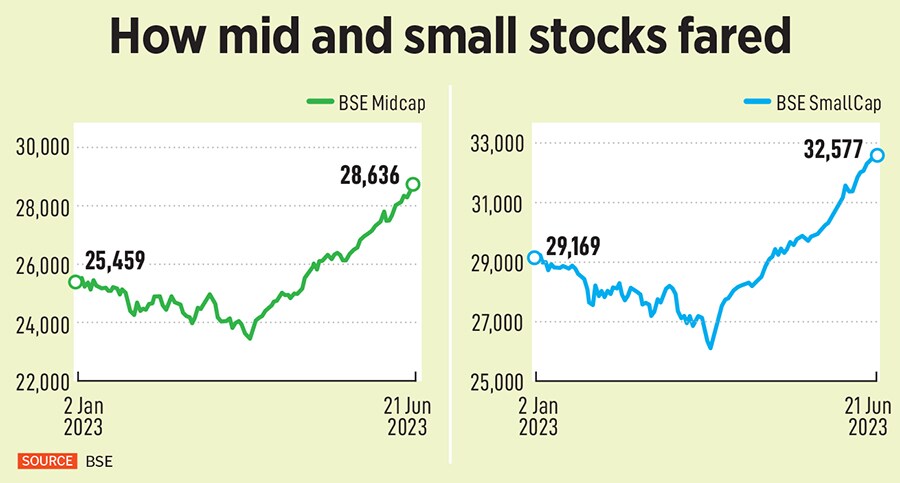

Indian markets hit a record high, with the benchmark Sensex hitting a high of 63,601.71 on June 22, while the Nifty is just shy away from its previous high of 18,888. What is interesting is both the indices were struggling in the beginning of this year, after the peak in December 2022. Both the Sensex and Nifty sparked off a rally starting March-end, as institutional investors started buying stocks. Even as both the Sensex and Nifty have rallied around 4 percent from January till now, they have surged around 10 percent from March-end which has led to a bull-run. Smaller stocks in the BSE Midcap and BSE Smallcap also participated in the rally with both the indices jumping nearly 13 percent this year so far.

“Markets’ rally is a function of earnings trajectory, market sentiments, participation structure and liquidity. We are witnessing a confluence of all the four factors simultaneously," says Jiten Doshi, co-founder & chief investment officer, Enam Asset Management Company. According to him, unlike its global peers, India used every crisis as an opportunity.

“The rally can have multiple legs," Doshi adds, explaining that as we come off a difficult three-year period from multiple headwinds, a better operating structure and improved balance sheets make a case for better earnings momentum as demand comes back in a near-normal year. “We are sitting on multiple positive vectors such as near-inflection GDP per capita, stable macro, strong local market anchor, reasonable cost of capital and a proactive policy regime. Sentiments are better than ever—given standout economic delivery and multi-legged growth opportunity in India. The market structure too is balanced with institutions (local & global), retail and HNI investors. The sustained inflows to DIIs and renewed interest of global investors make liquidity favourable too. The transformation is being duly noticed by the investing world," Doshi elaborates.

![]()

Others concur. “We believe the markets could continue to do well, led by several factors such as receding inflationary concerns, interest rate cycle peaking out, earnings growth sustaining & strong economic growth in the context of the global slowdown. The market rally has been broad-based recently, with 40 percent of stocks in NSE500 delivering 9 percent median returns in the past three months. Notably, sectors that have participated strongly in this rally are leading earnings growth too," says Sushant Bhansali, CEO, Ambit Asset Management.

Among the Nifty-50 constituents, 28 stocks are trading higher from the December 2022 peak. ITC, Tata Motors, Bajaj Auto, Ultratech Cements and Nestlé are the top gainers. However, 22 stocks are lower from the peaks hit in December. These stocks are Adani Enterprises, Infosys, Adani Ports, UPL and Cipla, shows an analysis by Motilal Oswal Financial Services.

“Bounce back is not limited to Indian equities alone. In fact, we have seen equity markets in most developed markets surge significantly and some of them are trading at 52-week highs. The global rally is triggered by the opening of the liquidity taps by US Federal Reserve and ECB to limit the contagion of the banking crisis earlier this year. India has outperformed most developed margins on the back of resilience in the Indian economy and healthy growth in corporate earnings. Accordingly, the foreign inflows have been positive for the past three consecutive months and supported the rally," explains Gaurav Dua, SVP, head-Capital Market Strategy Sharekhan at BNP Paribas.

What may derail the rally?

“Below-normal monsoon and sluggish rural recovery could derail the market momentum. Monsoon progress has been below normal and needs to be monitored closely. The critical factors are the US & Europe recession and Fed’s stance on interest rates," says Bhansali.

The Indian Meteorological Department (IMD) has forecast below-average rains for June, with the monsoon expected to pick up in July, August and September. Since June 1, there has been 54 percent rain deficiency in the country with 53 percent deficiency over the south peninsula, 80 percent deficiency over central India, 10 percent deficiency over northwest India and 53 percent deficiency over east and northeast India.

IMD had projected rainfall for the upcoming June-September monsoon season at 96 percent of the Long Period Average (LPA), within the ‘normal’ range (96-104 percent of LPA). This contrasts slightly from the forecast of private forecaster Skymet, which sees ‘below-normal’ monsoon at 94 percent of LPA, due to El Nino conditions. The IMD downplayed the El Nino impact, expecting such conditions to develop in the second half of the season and stating that there was normal or above-normal rainfall in 40 percent of El Nino years.

Chandraprakash Padiyar, senior fund manager, Tata Asset Management, believes that market rallies can never sustain if the fundamentals are not strong. “Our view is that the current market rally is on the back of positive earnings growth by corporate India and earnings outlook remains on the positive side for the foreseeable future," Padiyar says.

He sees many similarities with the past periods in the current rally as well and some differences. For example, we are at the early stages of capex cycle along with the financial services (banking) sector and the realty sector doing well which we have seen in the 2004-2008 cycle as well. “On the other hand, we believe India stands a good chance to gain market share in the global manufacturing ecosystem over the next decade if we execute well. This opportunity was not as appealing in the past cycles as it is today," he explains.

According to Padiyar, crude price is the biggest risk for India’s equity markets. As of now, crude price is rangebound and hence manageable. However, if there is any spike in the same, it could delay market returns. “Short-term monsoon and general election results in May 2024 would be the key factors to watch out for," he quips.

The Reserve Bank of India (RBI) kept its key interest rates unchanged, signalling the rate hike cycle peaking. The RBI’s baseline projection is that inflation will move back up above 5 percent (from 4.6 percent in April-June), while growth will remain resilient at 6.5 percent in FY24. The monetary policy committee (MPC’s) optimism has been underpinned by higher rabi crop production, expected normal monsoon, sustained buoyancy in services, a moderation in commodity prices, robust credit growth, and a focus on public capex. It flagged downside risks from weak external demand, and geopolitical tensions.

Meanwhile, the global central bank, US Federal Reserve, also kept interest rates unchanged in its latest policy for the first time, following 10 rate hikes since March 2022. This has led to the return of foreign institutional investors’ (FII) money back to emerging markets like India.

Since January, FIIs have bought Indian shares worth $6.92 billion while domestic institutional investors (DIIs) invested Rs89,862 crore in equities.

![]()

Madanagopal Ramu, fund manager and head-equity, Sundaram Alternate Assets, says the post-Covid market rally in India is predominantly defined by three factors—huge FPI flows in 2020 due to large liquidity infusion by developed economies to support economic recovery post Covid.

Secondly, India’s earnings in the formal sector saw a benefit due to supply chain issues globally, leading to a jump in corporate cash profits in FY21 and FY22, and thirdly, China’s economic slowdown resulted in a higher allocation to India by global funds in 2022. “The first factor was a major driver for significant rerating in India’s valuations, particularly in the mid and small cap space. The other two factors continued to support valuations despite volatile FPI flows in the last 12 months," he adds.

Ramu is optimistic that markets have more legs to the rally, as the earnings growth leg of the rally continues, but it may not be as broad-based as it was in the last two years. It is, however, expected to be much better than pre-Covid levels.

“Global inflation and a slowdown in overall markets, especially in the developed nations remain key concerns to look out for. While India’s market share in global merchandise trade is less than 2 percent, the slowdown in the growth of developed markets would only impact our growth marginally, not significantly affecting majority sectors except the IT sector which is vastly export dependant," Ramu elaborates.

One thing to watch out for would be crude oil price levels remaining rangebound at $80 levels reversion to higher levels of $100 per barrel could harm valuations, while the second would be rural consumption—a weaker monsoon could end up hurting the consumption story.

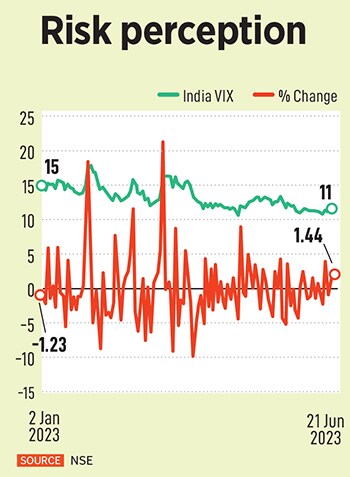

Narrowing risk perception

The India volatility index (VIX), often referred to as a fear gauge, has been on the edge. The National Stock Exchange’s (NSE’s) India VIX index tracks investors’ perceptions of volatility for at least a month ahead.

In this year so far, India VIX has cooled off 23 percent, indicating that investor perception of risks is low. However, in June, the VIX is almost flat, hovering around 11.29 percent. The volatility index typically has an inverse correlation with the markets. The index at lower levels indicates investors do not expect any major correction at least over the next month.

![]()

“In pockets, valuations have started to look expensive across market capitalisation. This means that volatility in stock prices could be on the higher side. However, if earnings continue at a healthy double-digit pace, one need not worry of short-term market movements," Padiyar adds.

“From a value perspective, the markets have factored in a 25 percent discount and are trading at 17 times FY25 price-earnings (PE) and 19.5 times FY24 PE. Markets have traded at similar multiples, but with much lower earnings visibility during the 2018 and 2019 period," Ramu says.

With crude at $75, inflation heading to lower levels and macro growth looking strong and being supported by manufacturing and services, Ramu sees a limited downside and expects markets to deliver a decent return over the next two years. He expects the positive momentum to continue, and the positive news flow around a rate cut from the Fed can be a trigger point.

According to Meenakshi Dawar, fund manager, equity investments, Nippon India Mutual Fund, the markets rally is likely to continue as long as earnings growth remains intact. “Earnings growth for FY24 is expected at 14-15 percent. As long as it sustains, markets will remain fundamentally strong. However, elections may bring volatility in the short term," she adds.