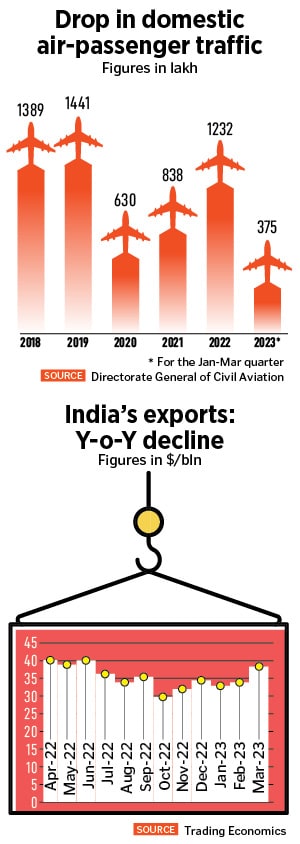

The commentary, which has come out of . Infosys has estimated a 5 to 7 percent revenue growth for FY24E and Wipro has indicated almost flattish growth. Exports, which have been on the decline over the past year (see table), constitute over a fifth in share of India’s GDP as of FY23, data shows. IT contributed about 7.4 percent to India’s GDP in FY22, according to the India Brand Equity Foundation (IBEF).

“We have a global slowdown staring at us. India can’t really buck the trend, it will have to face some of the slowdown," says HSBC’s Chief India Economist Pranjul Bhandari. She said the economy is seeing a “bit of a growth relay". The formal sector is starting to slow down on the back of the rate cycle. The informal sector, which was weak through the pandemic— impacted by GST, lockdowns, demonetisation and poor cash reserves—has been growing in recent months. Rural demand seems to be recovering on the back of rising real wages, she adds.

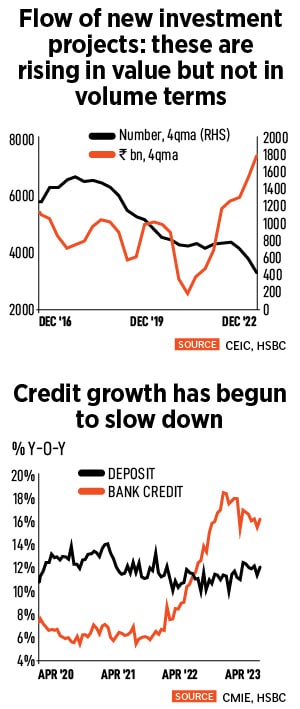

But, eventually, both the formal and informal sectors will have to slow down. “I am hoping it will not be a sharp slowdown," Bhandari further says. That said, indicators of formal sector activity, like bank credit and consumer imports (see charts), have begun to slow. New investment intentions are rising in value terms, but falling in volume terms, she says.

![]() Axis Bank’s Chief Economist Saugata Bhattacharya says, currently, most high frequency indicators the bank tracks—GST collections, e-way bills, Purchasing Managers Indexes (PMI) and fuel consumption—are still strong, but these are largely rear view or concurrent signals. “There are some anecdotal and on-ground signs that demand may be moderating, in automobiles and affordable housing," he says. “We need to monitor retail loans offtake from banks and NBFCs over the next few months to substantiate these early signals. The Q4 FY23 corporate results will provide an early look at demand moderation."

Axis Bank’s Chief Economist Saugata Bhattacharya says, currently, most high frequency indicators the bank tracks—GST collections, e-way bills, Purchasing Managers Indexes (PMI) and fuel consumption—are still strong, but these are largely rear view or concurrent signals. “There are some anecdotal and on-ground signs that demand may be moderating, in automobiles and affordable housing," he says. “We need to monitor retail loans offtake from banks and NBFCs over the next few months to substantiate these early signals. The Q4 FY23 corporate results will provide an early look at demand moderation."

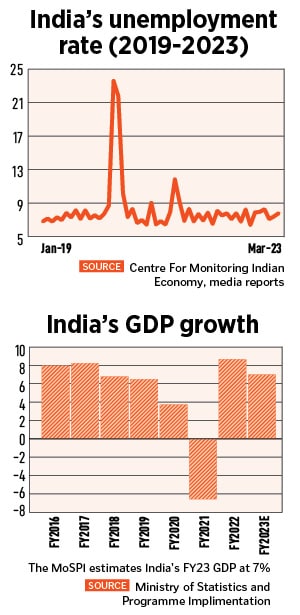

Bhattacharya has kept a FY24 GDP growth forecast at 6 percent, given the emerging risks over the next year. “First, given the expected slowdown in the developed markets, especially the US and Europe, which are large export markets for India, merchandise trade growth is likely to remain moderate and services export growth is likely to moderate from FY23 levels," he says. HSBC’s Bhandari has pegged India’s GDP growth at an even lower 5.5 percent for FY24.

Former chief statistician of India Pronab Sen expects FY24 GDP to reduce by a percentage point. Given that consumption makes up two-thirds of growth, exports are not firing, investments are not picking up and government spending is what it is, Sen remains pessimistic about our growth prospects.

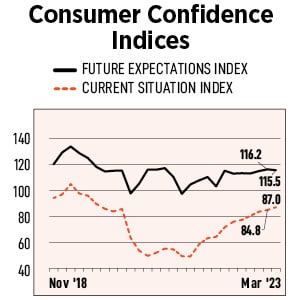

Also, while rural incomes have been on the rise, rural discretionary spending is yet to see a pick-up to the same level. This is being reflected in the sluggish trend being seen in the RBI’s March Consumer Confidence Survey (see chart).

![]() “Incomes have been hit badly for a long time and they require more confidence before they [rural India] can spend on non-essentials. They are spending but not towards durables. Which means that the recovery is not complete and does not give people as much of confidence as is required to dip into savings and spend on non-essentials," says Mahesh Vyas, managing director and CEO of Centre for Monitoring Indian Economy (CMIE).

“Incomes have been hit badly for a long time and they require more confidence before they [rural India] can spend on non-essentials. They are spending but not towards durables. Which means that the recovery is not complete and does not give people as much of confidence as is required to dip into savings and spend on non-essentials," says Mahesh Vyas, managing director and CEO of Centre for Monitoring Indian Economy (CMIE).

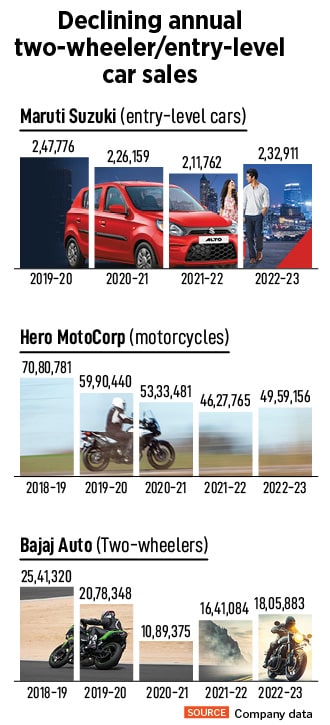

We continue to see discretionary spending towards the hospitality, media and entertainment and some pockets of retail but it has yet to deepen and recover to pre-pandemic levels. Sales for entry-level passenger cars for manufacturers such as Maruti Suzuki and two-wheelers sold by Bajaj Auto (see charts) are still weak.

![]() The debate of whether India has already overtaken China as the most populous can continue, but in the consumer electronics space of mobile smartphones—where many of the phones are being made by South Asian giants but some parts are manufactured locally – the shift in demand towards premiumisation is being seen. Mobile phone exports have more than doubled to $10 billion in FY23.

The debate of whether India has already overtaken China as the most populous can continue, but in the consumer electronics space of mobile smartphones—where many of the phones are being made by South Asian giants but some parts are manufactured locally – the shift in demand towards premiumisation is being seen. Mobile phone exports have more than doubled to $10 billion in FY23.

The smartphone market in India, which had seen rapid growth in 2021 and then a marginal upswing in 2022, has had three consecutive quarters of decline (see infographic), starting June 2022. The mass market—of first-time users—has seen a drop in demand, where feature phone users are wary to upgrade and existing users are not keen to spend, but the premium market continues to grow.

Sen argues there is a circularity effect among consumers of entry-level items. It is their incomes that are recycled to buy entry-level two-wheelers, cars and other consumer goods. As their incomes have been hit on account of the after-effects of the Covid-19 lockdowns, they have been unable to consume. "It is the after-effects of these actions that we are seeing with a lag," he says.

But what’s making the RBI bullish?

The World Bank and the International Monetary Fund (IMF), have both, in March, lowered their growth forecasts for the twelve months ending March 2024 to 6.3 percent and 5.9 percent respectively, where both the agencies have cited weak external macro-economic conditions.

Rising borrowing costs and slower income growth will weigh on private consumption growth, and government consumption is projected to grow at a slower pace due to the withdrawal of pandemic-related fiscal support measures, the World Bank said in a press statement issued on its website. “Spillovers from recent developments in financial markets in the US and Europe pose a risk to short-term investment flows to emerging markets, including India," said Dhruv Sharma, senior economist, World Bank, and lead author of the report.

![]() The minutes of the RBI MPC show that while the bank is concerned over growth, its focus would not shift from tackling inflation. The RBI has raised interest rates by 250 basis points since May last year. “The time was to pause and reflect on this action," HSBC’s Bhandari says. Over one year, the RBI action has been influenced deeply by the currency, which has been steady against the dollar, hovering in the 80-81 range since October 2022. This gave it the confidence to pause and see how it could move from here on.

The minutes of the RBI MPC show that while the bank is concerned over growth, its focus would not shift from tackling inflation. The RBI has raised interest rates by 250 basis points since May last year. “The time was to pause and reflect on this action," HSBC’s Bhandari says. Over one year, the RBI action has been influenced deeply by the currency, which has been steady against the dollar, hovering in the 80-81 range since October 2022. This gave it the confidence to pause and see how it could move from here on.

Emkay Global’s Lead Economist Madhavi Arora, in her latest note to clients, highlights the concerns which RBI’s deputy governor Michael Patra made in the MPC meeting: That (elevated) inflation is "inimically harmful" for growth—as seen in the slowdown in private consumption and corporate sales growth—and requires pre-emptive policy.

But other members such as Jayanth Varma have also observed that while “early signs of a growth slowdown are emerging, in the current high inflation environment, monetary policy cannot respond to these headwinds"

The RBI’s bullishness to raise the growth forecast takes into account some deductions. Real GDP growth is calculated using nominal GDP growth minus broad inflation. Axis Bank’s Bhattacharya explains that in the GDP context, inflation is calculated using both WPI and CPI inflation and is called the GDP Deflator. “In broad terms, 40 percent of this deflator comprises WPI inflation. WPI inflation is forecast to plummet in FY24 from an average 9 percent in FY23 to around 1.9 percent in FY24. Hence, with any given nominal GDP growth rate, the real GDP growth will be higher."

Also, real GDP—and growth—increases when the Current Account Deficit (CAD) is lower. “One of the continuing surprises over the course of FY23 had been a much lower CAD than estimated early in the year. Axis Bank’s CAD forecast for FY24 is -2 percent, which is lower than earlier estimates," Bhattacharya says.

One concern which has continued to play out is the drag caused by weak global demand on India’s exports, particularly goods.

The one variable which is likely to impact rural demand and spending is the upcoming monsoon season. HSBC’s Bhandari says it is tough to say when the informal sector will start to slow down but adds that stress to the rural economy “may come back" if there is erratic rainfall. Meteorologists are predicting that India will see the El Nino effect this year, which could mean lower-than-expected rainfall, but it does not guarantee a drought. An effect called the Indian Ocean Dipole can counter the El Nino but one will have to wait to see if this takes place.

Beyond growth

Several economists now believe that India’s interest rate tightening cycle has most likely peaked out and the RBI could keep rates on hold for a few more months.

![]() Bhattacharya says the balance of probability is that monetary policy rate hikes have peaked, unless there is a strong shock that pushes up core inflation. We think that even if a poor monsoon disrupts farm output and pushes up food prices, the MPC will be on hold. “A resumption of rate hikes will depend upon the trajectory of core CPI inflation, which in turn is likely to depend upon corporate results showing continuing pass throughs of previous input costs to end consumer prices, which will indicate demand resilience and pricing power."

Bhattacharya says the balance of probability is that monetary policy rate hikes have peaked, unless there is a strong shock that pushes up core inflation. We think that even if a poor monsoon disrupts farm output and pushes up food prices, the MPC will be on hold. “A resumption of rate hikes will depend upon the trajectory of core CPI inflation, which in turn is likely to depend upon corporate results showing continuing pass throughs of previous input costs to end consumer prices, which will indicate demand resilience and pricing power."

Growth forecasts do make for compelling media headlines and this is where the focus needs to shift towards macro-stability factors, including price stability, exchange rate stability and rate stability which track inflation, CAD and the fiscal deficit. Bhandari says, “History shows that high growth has never sustained in India because macro stability gives up. Growth needs to be rising at a pace which is not necessarily leading to a surge in inflation."

India"s macro-stability factors are better than the previous year: Inflation is starting to fall off, the CAD is narrowing and the fiscal deficit, though wide [6.4 percent in FY23], is being monitored well by the government, who is committed to reducing it.

The RBI will continue to watch what emerges from the US Federal Reserve in May, both in terms of possible rate action and commentary on a shallow economic recession there. By this time, governor Shaktikanta Das will also get a little bit of clarity on the progress of monsoon activity in India and resultant lower inflationary pressures. The deeper concern at this stage will be when the private capex investments and improved employment opportunities will start to kick in.

Axis Bank’s Chief Economist Saugata Bhattacharya says, currently, most high frequency indicators the bank tracks—GST collections, e-way bills, Purchasing Managers Indexes (PMI) and fuel consumption—are still strong, but these are largely rear view or concurrent signals. “There are some anecdotal and on-ground signs that demand may be moderating, in automobiles and affordable housing," he says. “We need to monitor retail loans offtake from banks and NBFCs over the next few months to substantiate these early signals. The Q4 FY23 corporate results will provide an early look at demand moderation."

Axis Bank’s Chief Economist Saugata Bhattacharya says, currently, most high frequency indicators the bank tracks—GST collections, e-way bills, Purchasing Managers Indexes (PMI) and fuel consumption—are still strong, but these are largely rear view or concurrent signals. “There are some anecdotal and on-ground signs that demand may be moderating, in automobiles and affordable housing," he says. “We need to monitor retail loans offtake from banks and NBFCs over the next few months to substantiate these early signals. The Q4 FY23 corporate results will provide an early look at demand moderation." “Incomes have been hit badly for a long time and they require more confidence before they [rural India] can spend on non-essentials. They are spending but not towards durables. Which means that the recovery is not complete and does not give people as much of confidence as is required to dip into savings and spend on non-essentials," says Mahesh Vyas, managing director and CEO of Centre for Monitoring Indian Economy (CMIE).

“Incomes have been hit badly for a long time and they require more confidence before they [rural India] can spend on non-essentials. They are spending but not towards durables. Which means that the recovery is not complete and does not give people as much of confidence as is required to dip into savings and spend on non-essentials," says Mahesh Vyas, managing director and CEO of Centre for Monitoring Indian Economy (CMIE). The debate of whether India has already overtaken China as the most populous can continue, but in the consumer electronics space of mobile smartphones—where many of the phones are being made by South Asian giants but some parts are manufactured locally – the shift in demand towards premiumisation is being seen. Mobile phone exports have more than doubled to $10 billion in FY23.

The debate of whether India has already overtaken China as the most populous can continue, but in the consumer electronics space of mobile smartphones—where many of the phones are being made by South Asian giants but some parts are manufactured locally – the shift in demand towards premiumisation is being seen. Mobile phone exports have more than doubled to $10 billion in FY23. The minutes of the RBI MPC show that while the bank is concerned over growth, its focus would not shift from tackling inflation. The RBI has raised interest rates by 250 basis points since May last year. “The time was to pause and reflect on this action," HSBC’s Bhandari says. Over one year, the RBI action has been influenced deeply by the currency, which has been steady against the dollar, hovering in the 80-81 range since October 2022. This gave it the confidence to pause and see how it could move from here on.

The minutes of the RBI MPC show that while the bank is concerned over growth, its focus would not shift from tackling inflation. The RBI has raised interest rates by 250 basis points since May last year. “The time was to pause and reflect on this action," HSBC’s Bhandari says. Over one year, the RBI action has been influenced deeply by the currency, which has been steady against the dollar, hovering in the 80-81 range since October 2022. This gave it the confidence to pause and see how it could move from here on. Bhattacharya says the balance of probability is that monetary policy rate hikes have peaked, unless there is a strong shock that pushes up core inflation. We think that even if a poor monsoon disrupts farm output and pushes up food prices, the MPC will be on hold. “A resumption of rate hikes will depend upon the trajectory of core CPI inflation, which in turn is likely to depend upon corporate results showing continuing pass throughs of previous input costs to end consumer prices, which will indicate demand resilience and pricing power."

Bhattacharya says the balance of probability is that monetary policy rate hikes have peaked, unless there is a strong shock that pushes up core inflation. We think that even if a poor monsoon disrupts farm output and pushes up food prices, the MPC will be on hold. “A resumption of rate hikes will depend upon the trajectory of core CPI inflation, which in turn is likely to depend upon corporate results showing continuing pass throughs of previous input costs to end consumer prices, which will indicate demand resilience and pricing power."