Scorching summer may derail rural recovery, lead to a spike in inflation and int

Along with heat stresses, the growing possibility of an El Nino condition may need a policy response, hit fiscal buffer

Scorching temperatures are likely to burn a hole in the pockets of Indian consumers this year as a cycle of heat waves, the early onset of summer and abnormal rainfall threaten to increase food prices, create short-term spikes in power prices and overall derail rural economy recovery. These climate risks and abnormalities may consequently need a policy response, thereby hitting key interest rates and toppling an already limping economy. Experts warn that heat stresses along with the growing possibility of an El Nino condition may not only impact inflation but also severely hit the fiscal buffer of the country.

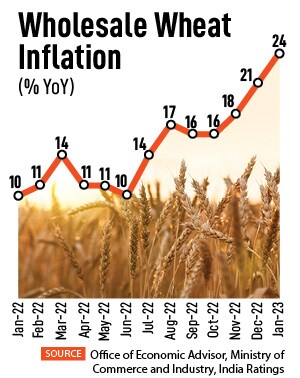

“We are once again witnessing an early onset of summer with February temperatures being the warmest in nearly 122 years. This could possibly shrivel wheat grain, akin to last year. Despite traction in Rabi sowing continuing to surpass comparable levels from a year ago all through the season to end 3.5 percent higher, there could be downside to wheat output pegged at 112.2 metric tonne as per the second advance estimates of the government. On the price front, any shortfall in output is likely to keep price pressures seen in cereals inflation over the last one year somewhat persistent," says Yuvika Singhal, economist, QuantEco Research.

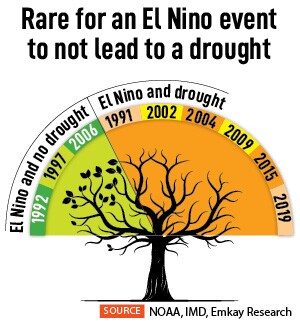

India has enjoyed a good Southwest monsoon successively over the last four years, but there could be a possible risk of El Nino conditions developing in the latter months of the summer in 2023.

“Typically, there is seen to be an adverse impact of El Nino on Southwest monsoon performance. While it is still early yet and we will continue to monitor El Nino risks closely, given the early warnings, policy efforts should be channelised to enhance straggling irrigation capacities in some of the agri-producing states such as Chhattisgarh, Karnataka, Maharashtra, Odisha and West Bengal," Singhal adds.

Last month was the warmest February since 1877 with average maximum temperatures touching 29.54 degrees Celsius, India Meteorological Department (IMD) said. It has warned that most parts of the country are expected to experience above-normal temperatures while the southern peninsula and parts of Maharashtra are likely to escape the brunt of harsh weather conditions.

According to the IMD, average rainfall in India is most likely to be normal (83-117 percent of long period average) in March. Below normal rainfall is expected in most areas of northwest India, west-central India and some parts of east and northeast India. Normal to above-normal rainfall is likely over most parts of peninsular India, east-central India and some isolated pockets of northeast India.

According to the IMD, average rainfall in India is most likely to be normal (83-117 percent of long period average) in March. Below normal rainfall is expected in most areas of northwest India, west-central India and some parts of east and northeast India. Normal to above-normal rainfall is likely over most parts of peninsular India, east-central India and some isolated pockets of northeast India.

“While the economy grapples with high food (cereals and protein) inflation, potentially adverse climate conditions are posing a fresh threat to India"s agriculture output. Heat stresses are building up again like last year, putting pressure on the production of Rabi crops like wheat, oilseeds and pulses," says Madhavi Arora, lead economist, Emkay Global Financial Services Ltd. She is worried that a combination of heat waves and El Nino will worsen an already concerning situation.

“We have observed that rainfall deficit is a major factor that catalyses rural slowdown," says Abneesh Roy, Executive Director, Nuvama Institutional Equities. According to Roy, rainfall deficit due to an El Nià±o year could derail recovery in rural FMCG as rural India constitutes 36 percent of the sales pie for a typical consumer company and is a weighty focus area given the much lower per-capita consumption.

In FY23, pan-India rainfall was 6 percent higher than the long-term average rainfall but populous states such as UP, Bihar, Bengal and Jharkhand reported a deficit, affecting paddy sowing. The proportion of dip in rural volumes have started easing–currently declining at 5-6 percent for the FMCG sector compared to 9 percent earlier, El Nià±o could exacerbate a prolonged rural recovery, Roy cautions.

US government weather agency National Oceanic and Atmospheric Administration. (NOAA) has indicated the possibility of El Nià±o conditions developing this year. El Nià±o refers to a phase of an abnormal heating up of surface ocean waters in the east and central equatorial Pacific region, leading to changes in wind patterns that impact the weather across many parts of the world. It usually occurs every three to six years. El Nià±o conditions, often associated with a poor monsoon in India, may set in around July. The last El Nià±o event was in 2018, which coincided with below-normal rainfall in India. Since then, India has witnessed four good monsoons in succession.

If the prevailing high temperatures continue through March, the Rabi wheat crop will be impacted and yields would at best be on par—or marginally lesser—than last year’s low, Crisil Market Intelligence & Analytics (MI&A) Research’s on-field interactions suggest. While wheat prices have been on a downward trend in the past 20 days, if these high temperatures persist for the next 20 days, there could be a turnaround in prices, it warns.

Since 1950, there have been 26 global El Nino years and 15 Indian drought years. However, the association between the two climatic phenomena appears to have strengthened since the 1980s, with an even stronger co-relation in the last 20 years. The year 1997 was an exception, where the worst El Nià±o on record saw Indian rainfall at 2 percent above normal.

Similarly, the El Nino year of 2007 also did not result in a drought, with rainfall at normal levels. However, all instances of drought in India over the last 20 years have been in El Nino years. In 2022, a scorching heat wave in March reduced wheat yield in the north and central Indian states. India produced 106.84 million tonnes of wheat in the 2021-22 crop season — less than the 109.59 million tonnes produced in 2021.

Similarly, the El Nino year of 2007 also did not result in a drought, with rainfall at normal levels. However, all instances of drought in India over the last 20 years have been in El Nino years. In 2022, a scorching heat wave in March reduced wheat yield in the north and central Indian states. India produced 106.84 million tonnes of wheat in the 2021-22 crop season — less than the 109.59 million tonnes produced in 2021.

“Warm weather will likely impact wheat yield, while a drought will hit the kharif crop," Arora adds. She explains that recent El Nino events have led to droughts, and thus sharp drops in foodgrain production. However, the inflationary impact has been mixed, with the average food inflation in El Nino years being lower than that in non-EN years. The impact on cereals has also been less pronounced than that on pulses.

According to Arora, a drought this year is likely to lead to worse price fluctuations, given the already tight supply situation and entrenched price pressures. “This will tighten the fiscal situation further as minimum support price (MSP) hikes will need to be higher to ensure fair returns to the farm sector–but this will further reduce the state’s ability to procure grains, as retail prices are likely to move higher as well (they are currently higher than the MSP)," she adds.

This also implies a potential impact on fertiliser prices, with usage likely to increase during a poor monsoon year to maintain crop yields. Thus, even with a record fertiliser subsidy bill in FY23, the payout this year could be elevated as well, further reducing the government’s fiscal wiggle room.

Heat waves in northern and central parts this summer may also result in a rise in power prices in the short term due to high demand of electricity. “A hotter-than-usual summer, with a high probability of multiple heat waves, is expected to keep power demand growing even next fiscal at 5.5-6 percent," Hetal Gandhi, director-research, Crisil Market Intelligence & Analytics, elaborates.

Elevated wheat prices and the onset of summer whereby fruit and vegetable prices begin to harden may first keep the food inflation and then the headline inflation under pressure. However, stabilisation of global commodity prices in combination with the base effect may still check the upside of inflation and India Ratings expects the retail and wholesale inflation to average 5.4 percent and 1.1 percent, respectively, in FY24. Even the Reserve Bank of India (RBI) expects retail inflation to average 5.3 percent in FY24.

The RBI, in its monetary policy review on February 8, raised the repo rate by 25 basis points. “However, two developments since the February 2023 Monetary Policy Committee have cast a shadow on the rate hike cycle. First, the retail inflation for January 2023 at 6.5 percent reversed the declining trend of the past two months in retail inflation. Secondly, the detailed minutes of the monetary policy was released on 22 February. Against this backdrop, any further surprise on the upside in retail inflation in February/March 2023 and likely decline in wheat production due to ‘terminal heat stress’ mean the pause on the policy rate may not be a done deal yet," India Ratings explains.

The RBI, in its monetary policy review on February 8, raised the repo rate by 25 basis points. “However, two developments since the February 2023 Monetary Policy Committee have cast a shadow on the rate hike cycle. First, the retail inflation for January 2023 at 6.5 percent reversed the declining trend of the past two months in retail inflation. Secondly, the detailed minutes of the monetary policy was released on 22 February. Against this backdrop, any further surprise on the upside in retail inflation in February/March 2023 and likely decline in wheat production due to ‘terminal heat stress’ mean the pause on the policy rate may not be a done deal yet," India Ratings explains.

To combat the dual factors of heat and erratic monsoon, more policy responses are needed from states on the supply side, as agriculture and irrigation are state subjects, enhancing agriculture and irrigation capex.

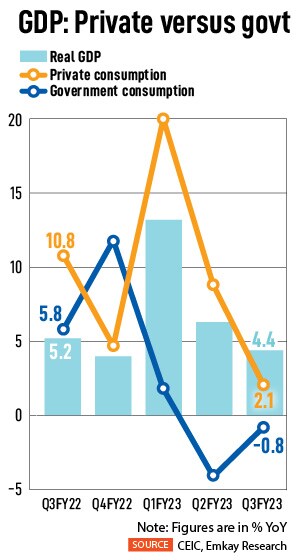

Overall, consumption demand has been slowing down. Both rural and urban consumption grew at a three-quarter low in the September to December period. Despite the government’s focus on the rural sector, weak income growth combined with higher interest rates are feared to further hit overall consumption demand.

First Published: Mar 03, 2023, 16:32

Subscribe Now