Agriculture in Budget 2023: An accelerator fund for startups and a focus on digi

Besides a hike in the agriculture credit target, Budget 2023 looks to solve issues that both farmers and agritech startups face

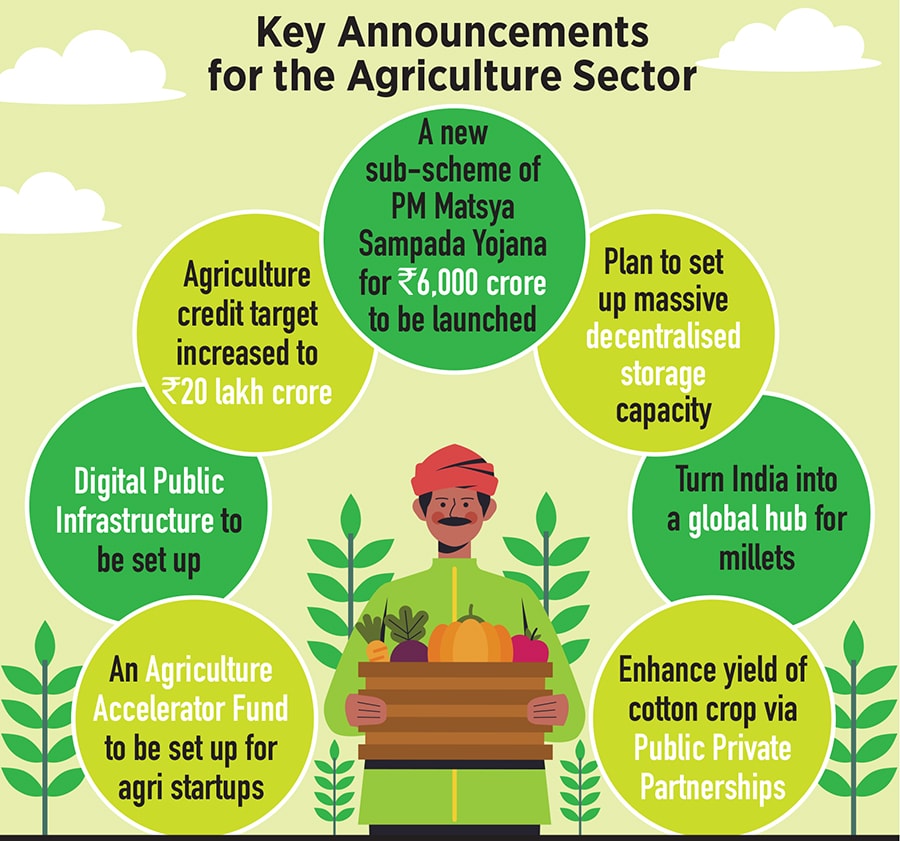

Finance Minister Nirmala Sitharaman’s Budget 2023 speech had some major announcements for the agriculture sector—an accelerator fund for agri startups, higher agri credit allocation and digital public infrastructure for agriculture.

The Agriculture Accelerator Fund is expected to hugely benefit agritech startups and provide them with a much-needed boost, in turn transforming agricultural practices, increasing productivity and profitability. By encouraging young entrepreneurs in rural areas to set up startups, the fund aims to bring innovative and affordable solutions for challenges faced by farmers. “This will certainly encourage a greater number of startups to emerge and scale up their unique solutions, fast-tracking innovation in the sector," says Rajesh Ranjan, CEO of Krishify, which is a social network and commerce platform for farmers.

The agriculture credit target has been increased by 11 percent to Rs 20 lakh crore for FY24 with a focus on animal husbandry, dairy and fisheries. The agricultural credit target for the current 2022-23 fiscal is Rs 18 lakh crore. Hemendra Mathur, venture partner, Bharat Innovation Fund believes that though this is a good step, “I would also like to see use of digital tools and cashflow-based financing while lending to farmers so that majority of farmers can get access to institutional credit."

He adds that farmers’ access to institutional credit remains a constant challenge, despite a year-on-year increase in budgetary allocation under Priority Sector Lending (PSL) for agriculture. “Approximately 30 percent farmers have access to institutional credit and balance 70 percent remain dependent on informal credit (annual interest rate ranging from 24 to 60 percent in informal credit against 7 percent under PSL)," he adds.

Another big announcement was the plan for setting up digital public infrastructure for agriculture, to enable inclusive, farmer-centric solutions through relevant information services. “Indian agriculture needs digitisation to make the supply chain efficient, transparent, market-driven and traceable. Digital technology can play an important role in enabling access of high-quality inputs to farmers, farmers’ linkages to the market, reduction in post-harvest losses, enabling access of institutional credit, insurance and direct benefit transfer to farmers," says Mathur.

Bankers are wary of lending to farmers and other value chain players primarily because of lack of data, market linkages, the high transactional costs of lending as well as recovery, as well as the unpredictable loan waivers by state governments from time to time. “Though technology cannot solve for loan waivers, it can certainly solve for other challenges faced by bankers in farmer financing. Data on crop health, input usage, soil health, prices, quality of produce etc. helps build the credit worthiness of a farm as well as the farmer which is key for risk assessment, monitoring and mitigation," says Mathur.

One of the major challenges the agriculture sector in India faces is that of lack of storage capacity. In order to fix this, the finance minister has announced plans to set up massive decentralised storage capacity, which according to Vivek Khurana, founder, Neercare Agro, “will help farmers in storing their produce, selling it at appropriate times at the right prices and reduce wastage".

A new sub-scheme, the PM Matsya Sampada Yojana, with a targeted investment of Rs 6,000 crore, will also be launched to further enable the activities of fishermen, fish vendors and MSMEs in the sector. “The Rs 6,000 crore infusion to promote fisheries would help shrimp farming the most. Decreasing import duties on feed ingredients is going to help the feed manufacturers and help formalise animal agriculture but would lead to reduced margins for domestic feed ingredient manufacturers," says Ankit Alok Bagaria, co-founder of agri-biotechnology company Loopworm.

Sitharaman also stated the aspiration to turn India into a global hub for millets. India, she said, is the largest producer and second largest exporter of “Shree Anna" (millets) in the world.

Besides, the government is promoting a cooperative-based economic development model for which a new Ministry of Cooperation was earlier formed. For the same, “the government has already initiated computerisation of 63,000 of Primary Agricultural Credit Societies (PACS) with an investment of Rs 2,516 crore," said Sitharaman.

First Published: Feb 01, 2023, 16:15

Subscribe Now