Budget 2023: Economic Survey projects decade of sustained growth

The annual state of the economy document likens India's current situation to 1998-2002, when India was at the cusp of an acceleration in growth

Expect India’s growth to be steady, even as the rest of the world slows down, is the unambiguous message that comes out of the Economic Survey. It pegs FY24 growth at 6.5 percent, even as it expects the world economy to slow. More importantly, it expects growth to stay steady at about 7 percent through the rest of the decade, positioning India as among the fastest growing economies.

“[The] survey highlights future growth triggers for the economy to be private consumption, higher capex, strengthening corporate balance sheets and credit growth revival (especially to small businesses)," says Amnish Aggarwal, head of research at Prabhudas Lilladhar Pvt Ltd, a brokerage. “In terms of fiscal prudence, the government is on track to achieve the estimated fiscal deficit of 6.4 percent in FY23."

A significant reason behind India’s growth numbers staying intact is the country managing to tackle three major economic shocks since 2020. First, the pandemic-induced lockdowns led to a contraction in the economy. Second, the Ukraine war—it sent prices of oil, agricultural inputs and commodities soaring—led to a worldwide surge in inflation, and the subsequent global rate tightening cycle drove capital away from India and other developing economies. The economy has weathered all three factors reasonably well, with only the balance of payments situation being a cause for concern.

Now, as the global economy prepares for life after the pandemic, the Survey stresses on the fact that the government sees our current economic progress as similar to the progress India made between 1998 and 2002. “The situation is analogous to the period 1998-2002, when transformative reforms undertaken by the government had lagged growth returns due to temporary shocks in the economy," the Survey says.

It lists the progress made in a host of areas, from digital payments to the cleaning up of corporate balance sheets and legislative reforms, like the introduction of the Insolvency and Bankruptcy Act and the Real Estate Regulation Act.

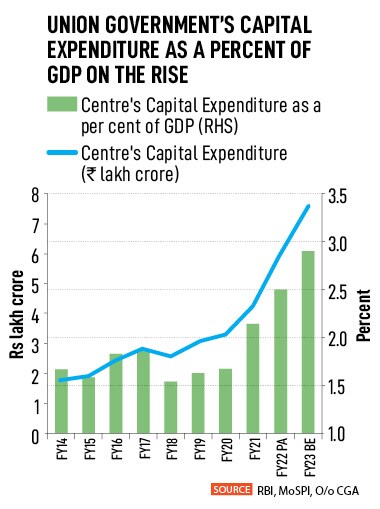

At the same time there has been a concerted effort to push the creation of physical infrastructure, much like the Golden Quadrilateral project in the early 2000s. Capital expenditure as a percentage of GDP has risen from 1.9 percent in 2014 to 2.8 percent in the FY23 Budget estimates. This should lay a good platform for crowding in private investments in the coming decade.

At the same time there has been a concerted effort to push the creation of physical infrastructure, much like the Golden Quadrilateral project in the early 2000s. Capital expenditure as a percentage of GDP has risen from 1.9 percent in 2014 to 2.8 percent in the FY23 Budget estimates. This should lay a good platform for crowding in private investments in the coming decade.

While there is little doubt that the reforms of the last five years have laid the groundwork for an acceleration in growth, Suvodeep Rakshit, senior economist at Kotak Institutional Equities, points out that this is only possible if there are no growth shocks to the global economy. He says that the 2000s were a very different decade, with global growth on steroids after China’s entry into the World Trade Organisation in the early 2000s.

Still, the Survey points out that India has a large consumption base that has low rates of leverage compared with other countries. Also, improvements made to the digital economy through the JAM (Jan Dhan accounts, Aadhaar and mobile phone penetration) trinity should see 0.3 to 0.5 percent incremental growth. Add to that a robust services sector, as well as an impetus to manufacturing through production-linked incentive schemes, and this could turn out to be India’s decade.

First Published: Jan 31, 2023, 18:55

Subscribe Now