Inside MakeMyTrip's $3.1 billion shake-up

The online travel provider raised a record sum to reduce Trip.com's stake amid geopolitical tensions and allegations over Chinese links. The China-based platform says the sale aligns with its strategy

MakeMyTrip’s recent $3.1 billion fundraise is significant in the Indian tech landscape. It’s the largest capital raise by a new-age tech firm in Asia-Pacific since Paytm"s $2.5 billion IPO in 2021, and the largest fundraise by a listed Indian internet company.

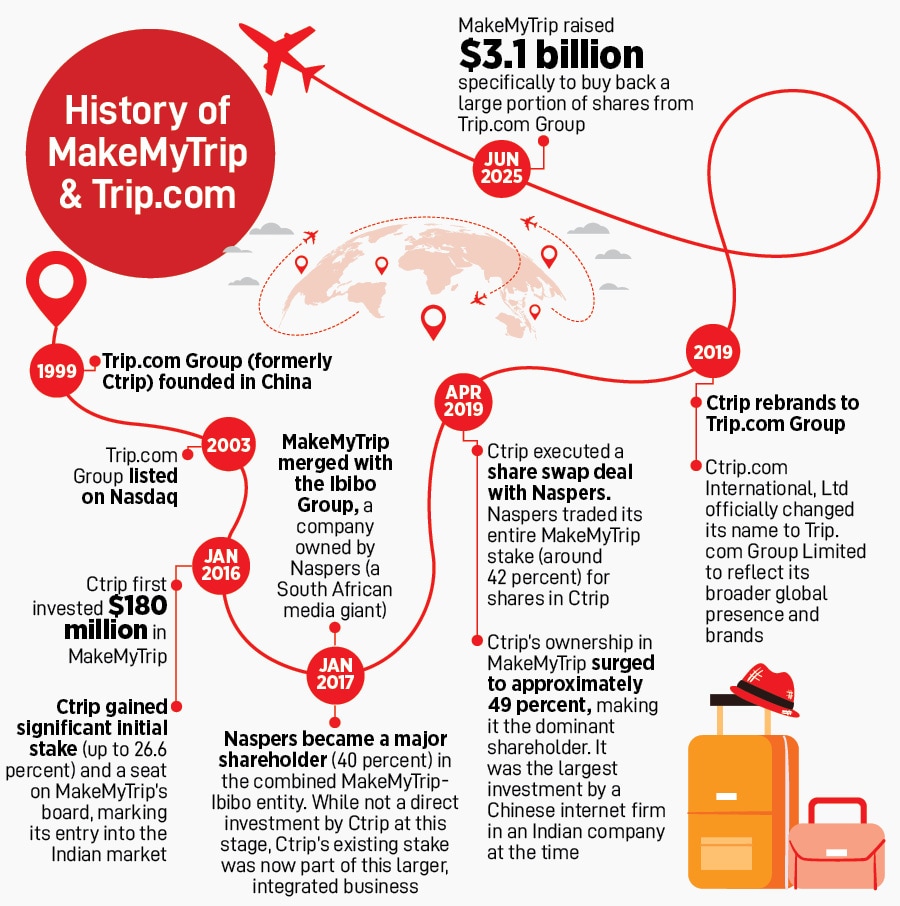

Interestingly, the capital raised is not for business expansion, acquisitions or operational investments. It will be used solely to repurchase shares from the Trip.com Group (formerly Ctrip), a China-based online travel agency (listed in the US on the Nasdaq), that was a major shareholder. “The company plans to use all of the net proceeds from the Notes Offering and the Primary Equity Offering to repurchase a portion of its Class B shares from Trip.com Group Limited," said the press release by MakeMyTrip.

This $3.1 billion fundraise will comprise a primary equity follow-on offering (meaning the company is selling newly issued shares directly to investors to raise money) and zero-coupon convertible senior notes (essentially loans taken by the company with no interest, but can be converted into company shares by the lenders later, and hold a high priority for repayment).

The tech-travel company generated a revenue of $978.3 million in FY25, an increase of 25 percent over $782.5 million in FY24. “We delivered record gross bookings and revenue this fiscal with robust growth and expanding margins underscoring the strength of our platform, the popularity of our brands, and the sustained momentum in both domestic and international travel demand. Our investments in new demand segments and personalised customer experiences across our platform have helped us to grow our customer base as well as drive high repeat bookings," said Rajesh Magow, group chief executive officer, MakeMyTrip.

Given the company’s financial performance, the timing of this fundraise raises a critical question: What strategic purpose does it serve? Before this fundraise, the Trip.com Group held 45.95 percent stake in MakeMyTrip. News reports state that this fundraise will reduce Trip.com Group"s ownership to between 16.9 percent and 19.99 percent, and their board representation will be reduced from five directors to two.

The decision comes amid increasing geopolitical tensions between India and China. Market analysts suggest this realignment could enhance MakeMyTrip’s appeal to global institutional investors, especially those wary of geopolitical entanglements.

"Indo-Chinese relations have been volatile since the Galwan Valley incident. In such a case, it is natural for any company to reduce its dependence on Chinese funds given the geopolitical risks. This is more so with the recent realignment taking place in the Middle East. MakeMyTrip is comfortably dominant in the "search, compare and booking (SCB)" market in India, so mobilising funds shouldn"t be much of an issue," says Sumit Jain, director, Centre for Competition Law and Economics.

The move comes close to a month after EaseMyTrip"s co-founder Nishant Pitti criticised MakeMyTrip for its alleged Chinese ties and called it a security concern when Indian Armed Forces personnel book tickets on the latter"s platform. Pitti wrote on X: "Indian Armed Forces book discounted tickets via a platform majorly owned by China, entering defence ID, route & date. Our enemies know where our soldiers are flying."

MakeMyTrip issued a clarification soon after: "We don"t comment on malicious or motivated accusations and remain focussed on offering our best services to our customers as a responsible Indian corporate." A company spokesperson says MakeMyTrip is "a proud Indian company, founded by Indians, headquartered in India, and trusted by millions of Indian travellers for over 25 years".

The company also emphasised its adherence to "stringent corporate governance standards, fully complying with all applicable Indian laws and data privacy frameworks".

MakeMyTrip has been compliant with all Indian data privacy laws and regulations, as well as with international data protection frameworks like European Union’s stringent General Data Protection Regulation and California Consumer Privacy Act to serve its global customer base.

EaseMyTrip’s operating revenue decreased by 15 percent to Rs139 crore in Q4FY25 from Rs164 crore in Q4FY24, as per EnTracker. Its FY25 operating revenue remained stable at Rs587 crore in FY25 compared to Rs590 crore in FY24.

Pitti has significantly reduced his stake in the company. After multiple sales, including a 14 percent stake in September 2024 and another 1.41 percent in December 2024, his individual holding now stands at 12.8 percent. This has also led to a decline in the overall promoter holding (Nishant, Rikant and Prashant Pitti) from the earlier highs of over 71 percent to around 49 percent currently.

Forbes India reached out to EaseMyTrip for comments, but the company had not responded at the time of publication.

While Trip.com was founded in China in 1999, it was listed on Nasdaq in 2003.

In fact, Trip.com Group in its news release dated June 16 (the same day the Share Repurchase Agreement with MakeMyTrip was signed), explicitly stated that the sale of a portion of its MakeMyTrip shares is: "part of the company"s efforts to optimise its investment portfolio and enhance shareholder returns".

What does this mean? As an investment matures or as the market landscape changes, large investors like Trip.com may decide to reallocate capital to other opportunities that they believe offer better returns or align more closely with their current strategic priorities.

MakeMyTrip"s stock has performed well in recent years, so it could be a strategic time for Trip.com to realise some of those gains. By selling a portion of a valuable asset, Trip.com can potentially free up capital that can be used for various purposes that benefit its own shareholders, such as: Investing in its core businesses (Trip.com, Skyscanner, Qunar, etc) funding new acquisitions or expansion projects elsewhere and returning capital to its own shareholders through dividends or share buybacks.

First Published: Jun 25, 2025, 12:16

Subscribe Now