Shares of Infosys slumped 9 percent during the day as investors interpreted its lowering FY24 revenue guidance as discretionary demand weakening and slowdown in client decision-making. Infosys slashed its revenue growth guidance to 1-3.5 percent from 4-7 percent (year-on-year) in constant currency terms for full financial year 2024, while posting net revenue of $4,617 million, which is a 1 percent growth in sequential basis and a jump of 4.2 percent (YoY) in the June quarter.

Surprise lowering of revenue growth guidance for FY24 is premised on weaker discretionary demand (transformation projects) leading to lower than expected volumes and slow client decision-making, as per management, says Abhishek Bhandari, analyst, Nomura. He adds that growth is likely to be back-ended in FY24 driven by a ramp-up of some large deals and winning a few in the pipeline. “Required revenue growth rate to achieve revised guidance is -0.2 percent to +1.2% quarter-on-quarter for Q2-Q4," Bhandari says.

That is not all.

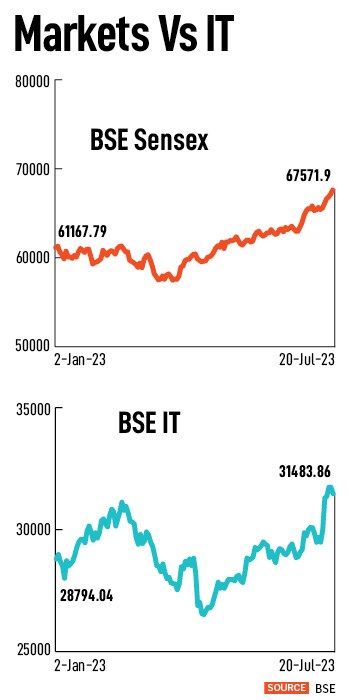

The decline in Infosys shares had a spillover effect on all IT major stocks on Friday, dragging the benchmark indices majorly. The BSE IT index slumped over 5 percent during the day while shares of TCS slipped 3 percent. Wipro and HCL Tech also fell.

![]() “From a near-term perspective, we believe global uncertainties and economic slowdown may impact the automation spend and result in delays in investment decisions in North America from where Infosys earns majority of its revenue (around 40 percent). IT services are expected to have lower demand in the near term. As compared to North America, Europe is expected to have resilient demand and positive investment to continue," Omkar Tanksale, research analyst, Axis Securities says. As these uncertainties settle down in the next two to three quarters, Tanksale feels the demand scenario is likely to gain momentum once again and would be backed by consistent deal wins.Tata Consultancy Services Ltd (TCS) reported a revenue growth of 0.4 percent on a (QoQ) basis (in rupee terms) and a jump of 12.6 percent on annual basis but it was the lowest in the last 12 quarters.

“From a near-term perspective, we believe global uncertainties and economic slowdown may impact the automation spend and result in delays in investment decisions in North America from where Infosys earns majority of its revenue (around 40 percent). IT services are expected to have lower demand in the near term. As compared to North America, Europe is expected to have resilient demand and positive investment to continue," Omkar Tanksale, research analyst, Axis Securities says. As these uncertainties settle down in the next two to three quarters, Tanksale feels the demand scenario is likely to gain momentum once again and would be backed by consistent deal wins.Tata Consultancy Services Ltd (TCS) reported a revenue growth of 0.4 percent on a (QoQ) basis (in rupee terms) and a jump of 12.6 percent on annual basis but it was the lowest in the last 12 quarters.

“TCS noted that customers have been re-assessing tech spends, especially where return-on-investment (ROI) was low, and it avoided giving any indication of the timing of a demand recovery. However, TCS is optimistic about Generative AI (GenAI) as it is currently working on multiple proof of concepts, with 100 opportunities in the pipeline," says Kumar Rakesh, analyst, BNP Paribas.

Rakesh sees TCS benefiting, both on demand and cost, from GenAI’s new use cases and higher productivity and expects subsiding macro concerns as key to demand recovery as deal signings and pipeline remain strong. “Continued strong deal signings give us confidence that the slowdown is transient and we think TCS will gain revenue market share in a cost-focussed demand environment," Rakesh adds.

Is it all hunky-dory for IT stocks?

Yes, it may appear so if one just observes the rally in IT stocks both in Nasdaq in the US and India, albeit a bit late in the Asian sub-continent.

![]() Nasdaq, which is a tech-heavy index, jumped over 30 percent from beginning of January, while Nasdaq 100 rallied over 42 percent. The Nasdaq 100 index, which tracks the 100 largest non-financial stocks on the Nasdaq stock exchange, is concentrated on seven major stocks (Microsoft, Apple, Nvidia, Amazon, Meta, Tesla and Alphabet) which constitute 55 percent of the weightage of the index. Hence, the rally in that index was not really showing the right picture leading Nasdaq to implement a special rebalance of the Nasdaq 100 index on July 24.

Nasdaq, which is a tech-heavy index, jumped over 30 percent from beginning of January, while Nasdaq 100 rallied over 42 percent. The Nasdaq 100 index, which tracks the 100 largest non-financial stocks on the Nasdaq stock exchange, is concentrated on seven major stocks (Microsoft, Apple, Nvidia, Amazon, Meta, Tesla and Alphabet) which constitute 55 percent of the weightage of the index. Hence, the rally in that index was not really showing the right picture leading Nasdaq to implement a special rebalance of the Nasdaq 100 index on July 24.

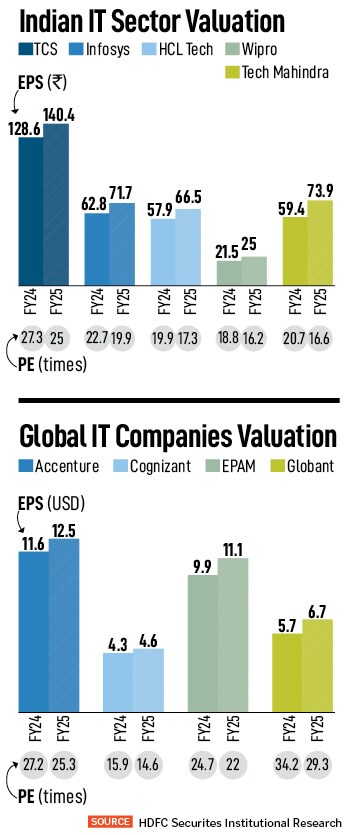

Back home in India, the party in tech stocks started late as analysts started pencilling a recovery in demand with fears of recessionary warnings fading in the US. ISG, a leading global technology research and advisory firm, said in an analysts call to HDFC Securities Institutional Research that there is recovery in the business environment ahead. ISG has maintained its managed services growth outlook at 5 percent with expectations of recovery in the BFS vertical in the second half of FY24 and strong demand for cost optimisation deals. Overall annual contract value (ACV) guidance has been reduced from 11 percent earlier to 9 percent in 2023.

Enterprises have accelerated their push to set up captives and service providers’ pipelines are supported by some of this demand, says Apurva Prasad, analyst, HDFC Securities Institutional Research.

“The nature of captive demand is shifting from a cost centre focus (HR, finance) to product development and engineering services….There’s significant productivity opportunity from GenAI across ADM, IT operations and CX. GenAI has so far not had an impact on proposals, business cases and pricing but the opportunity is large," Prasad adds.

Benchmark Sensex has gained 10 percent in this year so far while the BSE IT index jumped 9 percent in the same period, but in July technology stocks outpaced other stocks.

What also led to the markets fall?

Shares of index heavyweight Hindustan Unilever also tanked 4 percent during the day as investors remained concerned on its low volume growth in the June quarter. “HUL’s revenue grew 6.1 percent held by 3 percent volume growth. Management opined it was a stable performance given growth in rural markets has now turned positive on a negative 4 percent in base quarter," says Shirish Pardeshi, research analyst, consumer, Centrum Broking.

In a rising inflationary scenario HUL could grab market from local/ and regional players across portfolios, but with the easing of commodity inflation there is a risk of such competition to hit back, Pardeshi adds. “To remain relevant and retain consumer confidence HUL may need to provide superior value and invest more in consumer promotions and ad-spends," he says.

On Friday, the BSE Sensex ended at 66,684.26, down 887.64 points or 1.31 percent. The 50-share index closed at 19,745, down 234.15 points or 1.17 percent.

“Disappointing demand outlook and the sharp cut in growth guidance by Infosys seems to have finally triggered some profit booking and broken the six-day streak of handsome gains in the equity markets. Interestingly, the sentiment in the broader market remains positive. Overall, we continue to have high conviction in the multi-year economic upcycle in India and consequent opportunity for equity investors to create wealth over the next three-five years," says Gaurav Dua, head capital market strategy, Sharekhan by BNP Paribas.

“From a near-term perspective, we believe global uncertainties and economic slowdown may impact the automation spend and result in delays in investment decisions in North America from where Infosys earns majority of its revenue (around 40 percent). IT services are expected to have lower demand in the near term. As compared to North America, Europe is expected to have resilient demand and positive investment to continue," Omkar Tanksale, research analyst, Axis Securities says. As these uncertainties settle down in the next two to three quarters, Tanksale feels the demand scenario is likely to gain momentum once again and would be backed by consistent deal wins.Tata Consultancy Services Ltd (TCS) reported a revenue growth of 0.4 percent on a (QoQ) basis (in rupee terms) and a jump of 12.6 percent on annual basis but it was the lowest in the last 12 quarters.

“From a near-term perspective, we believe global uncertainties and economic slowdown may impact the automation spend and result in delays in investment decisions in North America from where Infosys earns majority of its revenue (around 40 percent). IT services are expected to have lower demand in the near term. As compared to North America, Europe is expected to have resilient demand and positive investment to continue," Omkar Tanksale, research analyst, Axis Securities says. As these uncertainties settle down in the next two to three quarters, Tanksale feels the demand scenario is likely to gain momentum once again and would be backed by consistent deal wins.Tata Consultancy Services Ltd (TCS) reported a revenue growth of 0.4 percent on a (QoQ) basis (in rupee terms) and a jump of 12.6 percent on annual basis but it was the lowest in the last 12 quarters. Nasdaq, which is a tech-heavy index, jumped over 30 percent from beginning of January, while Nasdaq 100 rallied over 42 percent. The Nasdaq 100 index, which tracks the 100 largest non-financial stocks on the Nasdaq stock exchange, is concentrated on seven major stocks (Microsoft, Apple, Nvidia, Amazon, Meta, Tesla and Alphabet) which constitute 55 percent of the weightage of the index. Hence, the rally in that index was not really showing the right picture leading Nasdaq to implement a special rebalance of the Nasdaq 100 index on July 24.

Nasdaq, which is a tech-heavy index, jumped over 30 percent from beginning of January, while Nasdaq 100 rallied over 42 percent. The Nasdaq 100 index, which tracks the 100 largest non-financial stocks on the Nasdaq stock exchange, is concentrated on seven major stocks (Microsoft, Apple, Nvidia, Amazon, Meta, Tesla and Alphabet) which constitute 55 percent of the weightage of the index. Hence, the rally in that index was not really showing the right picture leading Nasdaq to implement a special rebalance of the Nasdaq 100 index on July 24.