Wipro's turnaround is work in progress facing macro spoilsport

With talent acquisition core to its work, India's fourth biggest IT company has seen the sharpest hiring course correction amongst peers

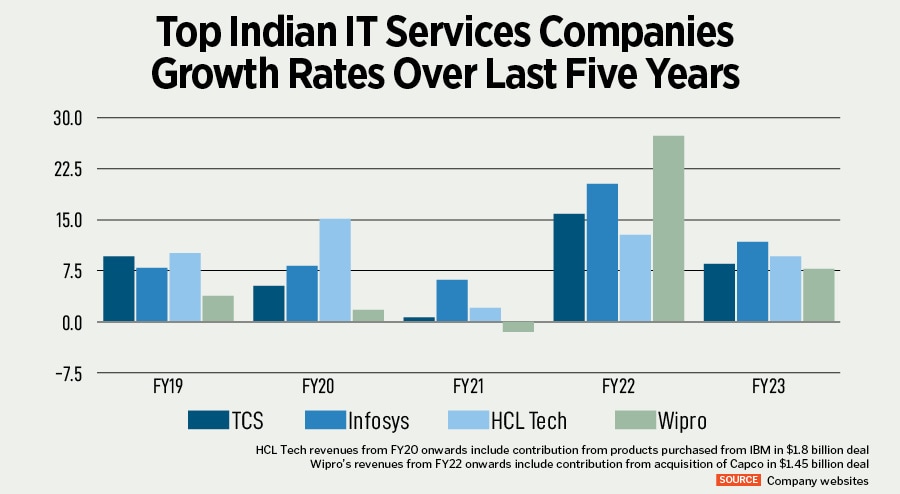

Less than 18 months ago, Wipro concluded a good year. Customers in America, heading out of Covid, were investing strongly in tech services, and even not counting the large contribution from Capco, which Wipro had acquired the previous year, the Bengaluru company’s FY22 was toe-to-toe with its larger peers, whom it had lagged for years.

Fast forward to the company’s latest quarterly results, for the three months ended June 30, and the story is slightly different. Revenues decreased sequentially for the second quarter in a row, missing analysts’ estimates even at the lower end of their expectations.

“Yes, we are seeing some softness in revenues," CEO Thierry Delaporte told analysts in a conference on July 13, discussing the company’s results. “All around us in almost every industry we see businesses that have been reducing discretionary spends in response to the weaker macro environment. That"s had an impact on our revenues as well."

That, plus an organisation-wide restructuring that Delaporte announced earlier this year—the second big re-org since he started at Wipro three years ago—has led Wipro to shed the most jobs among its peers over roughly the last nine months.

That reflects Wipro making the biggest hiring course correction amongst India’s top IT services companies due to the current adverse global macroeconomic conditions.

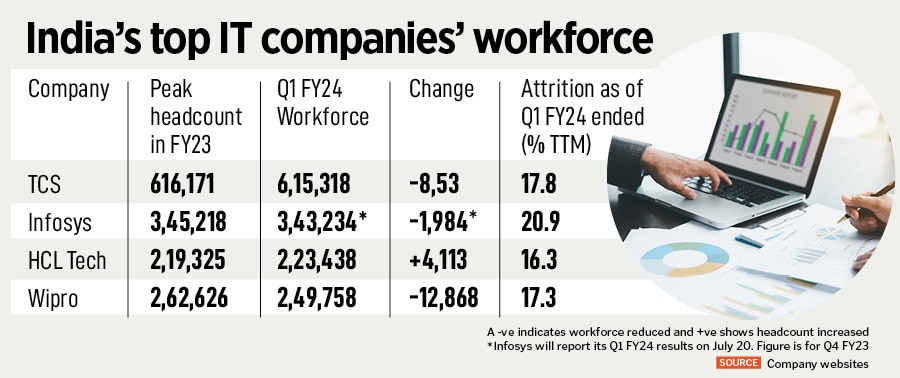

Wipro has reduced its workforce by nearly 13,000 jobs since FY23 hiring peaked through September last—from 2,62,626 employees at the end of Q2 FY23 to 2,49,758 at the end of Q1 FY24, according to the company’s latest analyst data sheet available on its website.

That means, Wipro’s workforce expanded by only about 3,000 jobs since FY22, when it reported a revenue growth of 27.3 percent including Capco, a UK-headquartered financial solutions and consulting company it purchased for $1.45 billion.

In comparison, TCS was almost unchanged with its workforce, reducing by about 850 employees since Q2 FY23—the period during which the current macro slowdown had affected the sector’s growth. And Infosys had about 2,000 fewer employees by the end of FY23. The company will report its Q1 FY24 numbers on July 20.

Noida-based HCL Technologies, India’s third-biggest IT services provider, actually added about 4,100 jobs in the same period, that is since Q2 FY23, despite a roughly 2,500 reduction during Q1 FY24.

“To put this in context, one should go back to the hyper-hiring phase in the buoyant calendar year 2021 and early 2022," says Kamal Karanth, co-founder at Xpheno, a staffing firm in Bengaluru.

Across those six quarters, Wipro hired close to 70,000 workers on a net basis with record year-on-year additions, Karanth points out. And this reflected a sector-wide phenomenon during 2021 of “over hiring and talent hoarding at high costs".Most IT companies were anticipating stronger growth ahead, he says.

The buoyancy was real to a large extent as reflected in the almost maxed-out net utilisation rates during the same period—utilisation is a measure of the proportion of the overall workforce that is employed in billable work. What most didn’t foresee or prepare for was how quickly things would change as the macroeconomy soured, he says.

As global tech spending dipped over fears of a recession and inflation worries, and with events like some US banks failing, margin pressures mounted fast for all the top IT companies, Karanth says. What Wipro did with its workforce, which reflects this broader change in the outlook for the entire IT sector, was a “necessary corrective resizing", he says.

Irrespective of the headcount and pipeline of orders, it’s the net utilisation rate that defines the health of an IT services company. Wipro’s workforce reduction has helped it to return to a healthy 83.7 percent utilisation for Q1 FY24, after dipping to sub 80 percent levels since Q2 of the previous fiscal year, he says.

Larger rivals like TCS, HCL and Cognizant and smaller, up and coming competitors like LTIMindtree have absorbed significant talent over the last year or so from Wipro, he says.

Because of the global economic slowdown, the talent market in the IT sector has cooled down and staff churn has come down too. Wipro’s Q1-specific attrition was 14.1 percent, the company said in an emailed statement. A 12-14 percent range is healthy, according to staffing experts like Karanth.

Wipro’s churn remains a tad high, at 17.3 percent, on a last-12-months basis, which is how the IT companies report this metric.

As slowdowns often push companies to cut costs, the current one is prompting many large corporations in the US, Britain, and Europe—the IT sector’s top markets—to accelerate plans of expanding their own centres in India or even set up new ones.

India is the destination for the next wave of expansion of what the industry describes as “global capability centres"—in-house software teams in Bengaluru, Chennai, Hyderabad, Pune and Noida, of large companies in the richer economies. They have become another source of growing competition for experienced talent.

In the three months ended June 30, Wipro completed the transition to the four global business line models based organisational structure that it had announced earlier this year, it said in an emailed statement in response to queries sent to Chief HR Officer Saurabh Govil on the factors that contributed to the workforce reduction through Q1 FY24.

Results of the new organisational structure are showing up in the form of faster time-to-market, and “more inclusive wins", meaning customers have more clarity and ease of engagement with Wipro. And the IT company has won more orders on the back of a “one Wipro" approach that translates to the idea that somewhere within Wipro’s broader ecosystem, solutions exist to every tech-led business transformation need of its customers.

The June quarter “was another quarter of robust deal closures for us", CEO Delaporte told analysts on the earnings conference. By total contract value, Wipro closed large deals worth $1.2 billion, which is a 9 percent year-on-year growth and an eight-quarter record.

During the quarter, Wipro landed 10 orders each valued at about $30 million over the life of the contract. Overall, the company added $3.7 billion in orders during the quarter, lower than the $4.1 billion in total contracts won in each of the previous two quarters.It also added two new accounts each contributing more than $100 million in annual revenue, taking the count of such businesses to 21 from 19 at the end of FY23 on March 31, 2023.

More substantially, “the number of $100 million accounts has more than doubled from 10 to 21 in the last two and a half years since we started on this transformation", Delaporte said.

By creating these four business lines, Wipro has achieved two main goals, according to the statement: First, it collaborates better than before on “transformational solutions" that are flexible, show results sooner rather than later, and are more broad or even “end-to-end" in scope.

Faster results are very important, especially when clients are cutting discretionary projects— which are good to have but aren’t immediately necessary. TCS, HCL Tech and Wipro have all pointed to these cuts as contributing to their slower growth currently.

Second, the four-business-lines-based structure has streamlined operations and reduced overheads. “We are able to reduce the layers of non-productivity and be more efficient as an organisation, which is reflected in our headcount," Wipro said in its statement.

The company aims to improve the uptime and productivity of its entire workforce and sustain high performance. It is paying out the variable component of compensation to most staff but has deferred pay hikes until later in the fiscal year.

When Delaporte announced the new organisational structure in February, Wipro had “outgrown" the existing two-business-line model, which he had instituted starting November 2020, he’d said in a video message on the company’s website.

The company had added 45 percent in revenue in the preceding 10 quarters. Its cloud business accounted for a third of its sales and its consulting business had grown 2x. And so, it was time for the next overhaul. With that exercise complete, Delaporte has turned his attention to the hottest topic in tech today—artificial intelligence.

“Every industry is undergoing a seismic shift with the advancement of artificial intelligence. AI can and will fundamentally change every aspect of business" the CEO told the analysts.

Wipro has been investing in AI for a decade and has delivered over 2,000 AI engagements he said. On July 12, it announced a $1 billion investment over the next three years to build out its AI capabilities, under an initiative called ai360.

That won’t immediately mean anything specific in terms of recruitment. Hiring is based more on the macro environment—meaning the demand for Wipro’s services. The company will continue to hire in critical areas it anticipates large investments in AI, data, security, and engineering. Actual recruitment will be calibrated to the demand on a quarterly basis.

Currently, Wipro has about 30,000 experts, such as data scientists, with AI skills. And “over the next 12 months, we will train our entire workforce, nearly 250,000 employees, in AI," Delaporte told the analysts.

The ai360 investment will add new capabilities, solutions, platforms, partnerships, as well as talent.

As the company looks to take an AI-led approach to everything it does, the top priority will be the upskilling and reskilling of its workforce, so it can deploy AI-based solutions within the organisation as well.

Further, there are about 1.7 million engineers and developers on Wipro’s talent cloud platform, Topcoder. This pool of workers will be “critical" in the upskilling and reskilling efforts, helping clients scale up and accelerate AI projects, the company said.

Wipro will also tap its broader network, including Wipro Ventures, its venture capital arm, and its partnerships with academic institutions to expand its base of workers with multi-disciplinary skills.

The company has a generative AI seed funding programme, as part of the ai360 investments, to partner early-stage startups and help them develop their solutions to match the needs of Wipro’s enterprise customers.

Wipro reported IT Services revenue of $2,778.5 million for the three months ended June 30, 2023, a 1.1 percent increase in constant currency terms from the same period a year ago. Sales fell 2.8 percent from the March quarter, just making the lower end of the company’s April forecast of -3 percent to -1 percent.

This was lower than the consensus view of -2.2 percent and their view of -2.7 percent, analysts at Japanese financial giant Nomura wrote in a note to clients on July 13. TCS’s Q1 growth was flat, and HCL Tech’s was down 1.1 percent.

While Wipro reported strong order book wins during the quarter, “translation to revenues remained sluggish, driven by clients’ focus on upfront cost savings and delay in ramp-ups", they wrote.

“Lower discretionary demand continued to affect an early cycle business like consulting," they noted. The analysts have a “neutral" rating on Wipro’s stock, which has gained about six percent since the company’s results came out.

Wipro doesn’t provide a full-year forecast, unlike Infosys and HCL Tech. Its estimate for the current quarter ranges between -2 percent and +1 percent growth over the June quarter in constant currency terms, which eliminates exchange rate fluctuations.

This is “marginally better than our estimate of -2 percent to zero percent", the Nomura analysts wrote. However, “we think the weak guidance reflects demand headwinds, particularly in discretionary business-like consulting," they wrote, anticipating Wipro’s full-year revenue growth to fall by 0.8 percent over FY23 in US dollar terms.

That will mean Wipro will likely continue to lag companies like Infosys, at least for this year.

Delaporte told analysts at the earnings conference: “On one end, we were aligning to market needs and on the other, undergoing a deep internal transformation."

With the re-org done, workforce optimised, focus trained ahead towards an AI-led transformation approach, only the results are awaited in the quarters to come.

First Published: Jul 19, 2023, 14:51

Subscribe Now