IT services outlook: Strong demand, weak spending story to continue

TCS and HCL Tech will kick off the earnings results season today for the sector's fiscal first quarter

Tata Consultancy Services and HCL Technologies will kick off the earnings results season for India’s IT services sector today, when they report their fiscal first quarter numbers later today, under the overhang of two consecutive recent cuts in larger rival Accenture’s forecast.

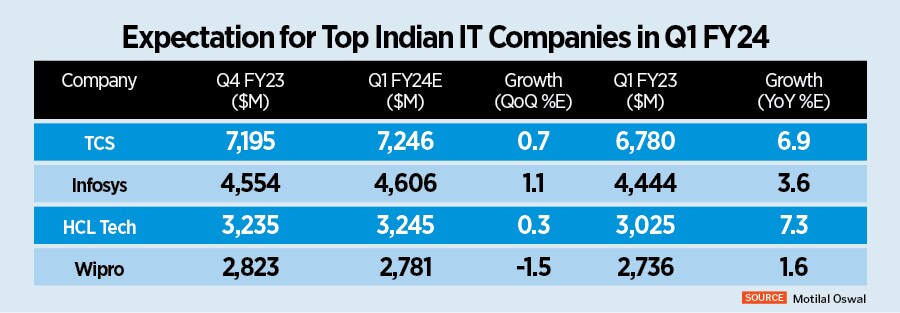

Among the top companies, analysts at the Mumbai brokerage Motilal Oswal expect Infosys to post the most growth from the previous quarter, albeit at a modest 1.1 percent. They expect HCL Technologies to report the highest year-on-year growth at 7.3 percent.

Larger rival Accenture’s recent cuts in its forecast for the rest of its current fiscal that ends in August has strengthened the view that the way forward remains muddy.

Accenture, which follows a September to August fiscal year, started with an 8-11 percent forecast for the year. While it is holding on to the lower end of its forecast, the $62 billion revenue company cut the upper bound by 100 basis points in March and again in June.

It now expects revenue for its fiscal year ending August 31, to increase by 8-9 percent.

Even as a US recession over the next 12 months is seen to be less likely now—financial giant Goldman Sachs, for example, lowered the probability to 25 percent on June 8, compared to 35 percent in March shortly after the failure of Silicon Valley Bank—the gloomy overall macroeconomic outlook remains.

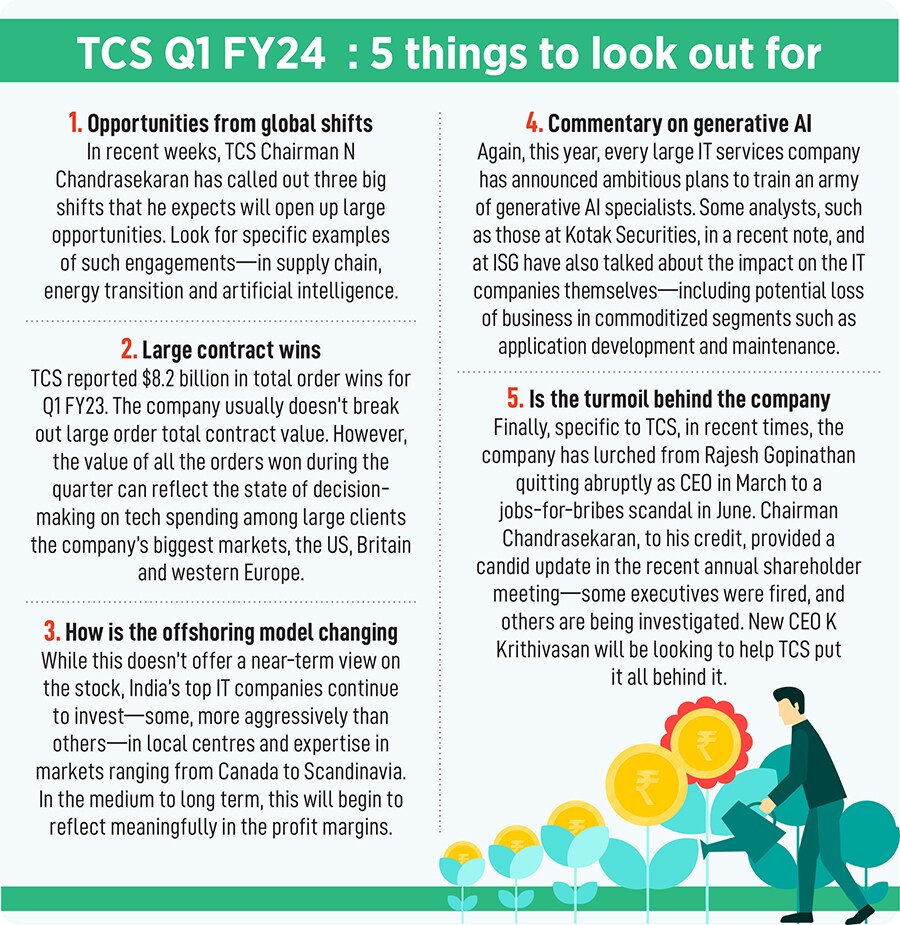

For example, TCS said it mutually agreed with insurance provider Transamerica to end a $2 billion contract, citing reasons including a challenging macro environment, Reuters reported on June 16.

Overall, the weakness in demand likely continued in the quarter gone by “with a significant hit on discretionary spends", the analysts at Motilal Oswal wrote in their results preview note.

The IT companies’ clients continue to focus on cost and efficiency-driven projects, while keeping the discretionary—meaning good-to-have but not urgently necessary—projects on hold. The deal pipeline remains healthy, the analysts note. Both TCS and Infosys, for example, have reported winning large contracts in recent weeks.

However, the “weak macro will continue to impact revenue conversions, thereby creating near-term pressure on revenues", according to the analysts.

Some of the biggest sectors that contribute the most revenue to the Indian IT services companies’ revenues, including BFSI (banking, financial services and insurance), retail, hi-tech, and manufacturing remain sluggish when it comes to spending on tech services.

Demand in the US has worsened due to increasing inflation and declining consumer spending, whereas demand in Europe remains relatively stable, similar to the levels in the January-March period this year, and deal closures are progressing at a faster pace than in the US, they write.

“We do not anticipate a recovery in the second half of the current fiscal year," the analysts say in their note. They have a ‘buy’ rating on TCS, Infosys and HCL Tech and a ‘neutral’ rating on Wipro.

They also anticipate the likelihood that Infosys will lower its already anaemic forecast for the current fiscal year that ends March 31, 2024. Infosys said in April it expects growth in the current year to be as low as 4 percent and may touch 7 percent at the higher end of the range.

From the euphoria of the beginning of 2022, when the IT companies proclaimed an irreversible trend in terms of the post-Covid step up in tech spending, The S&P BSE Information Technology index is now down about 23 percent.

HCL Tech, in April, estimated it would grow revenue in the range of 6-8 percent for the current fiscal year, including a small proportion of products related revenue. The Noida-based company expects its pure services revenue to increase in the range of 6.5 percent to 8.5 percent. While TCS doesn’t provide a forecast, its top executives do provide some forward-looking commentary, which will be keenly analysed.

“Deceleration doesn’t mean decline," observes Yugal Joshi, a partner at Everest Group, an outsourcing advisory. India’s top IT companies are “so core" to the operations of many of the world’s biggest corporations that, barring another black swan, the future can only hold growth, he says.

“We continue to see very strong demand for cost optimisation," write Steve Hall, president, and Stanton Jones, distinguished analyst at ISG, a market researcher and consultancy that tracks outsourcing contracts worth $5 million or more around the world.

Within this context, extension and renewal activity continue to be very robust, and mega deal activity came in strong in the second quarter of the calendar year 2023 as well, they note in a post, ahead of a call on June 13 to discuss ISG’s latest quarterly index on outsourcing contracts. These quarterly reports provide a comprehensive view of spending on tech, including managed services, IT outsourcing, software as a service and cloud.

In cloud spends, growth in IaaS (infrastructure as a service) and SaaS (software as a service) remains under pressure due to the macroeconomic situation. Enterprises are focussed on using what they already committed to in their IaaS contracts and are delaying discretionary SaaS projects, they said.

In a related trend with respect to outsourcing, large global companies historically used captive operations for labour arbitrage to deliver internal support services, the ISG experts note. Captive centres are now increasingly providing more sophisticated internal capabilities, especially in areas like product engineering, they said.

First Published: Jul 12, 2023, 09:36

Subscribe Now