IT services: Growth likely to continue despite tough economic conditions

The demand environment is seen to have become stronger, even as the likelihood of a recession in the US in 2023 remains high

The mixed bag that is the IT services sector’s outlook continues to evolve rapidly. Even as a new, more positive estimate for the sector’s outlook emerged last week, more locally, hundreds of college graduates from 2022, who previously held job offers from LTIMindtree, found those offers in jeopardy.

LTIMindtree, India’s sixth biggest IT services company by revenue, has asked 700-800 graduates to submit to a new training and assessment programme to be eligible for “onboarding" as the process is known in the industry.

This estimate is from Nascent Information Technology Employees Senate (NITES), a Pune-based non-profit that seeks to organise the IT industry’s employees. An email to LTIMindtree had not elicited a response at the time this copy was published.

LTIMindtree’s move was “unethical," Harpreet Singh Saluja, president of NITES, says in a statement.

The Larsen and Toubro group company isn’t alone. Ongoing macroeconomic uncertainties, including the high likelihood of a recession in the US this year—99 percent chance according to the latest estimate from The Conference Board, a non-profit business think tank—have made India’s biggest IT services companies circumspect.

Heading into the last quarter of their fiscal year 2023 that ended March 31, Tata Consultancy Services, Infosys and others brought their recruitment of freshers to near standstill, while the war for experienced talent continues with attrition still in the 20 percent range.

Accenture, the biggest IT services and consulting company, said on March 23 that it was cutting 19,000 jobs, reporting its fiscal second-quarter results for the three months ended February 28, 2023.

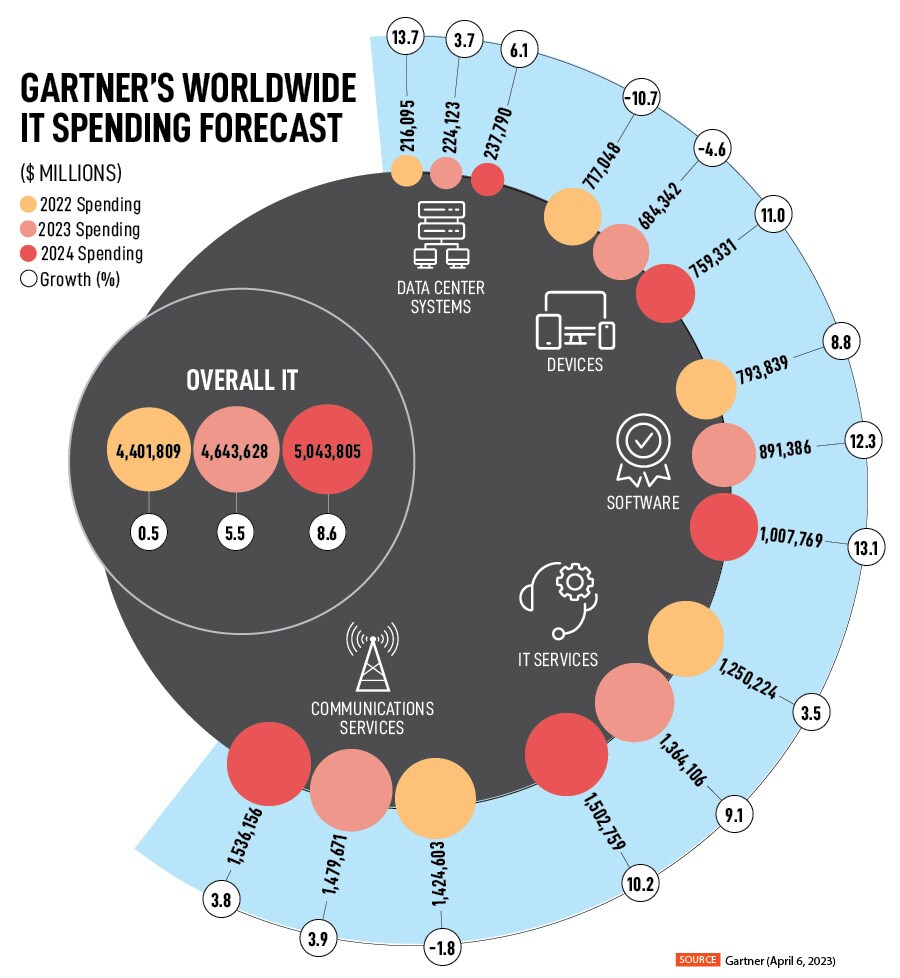

In more cheerful news, worldwide IT spending is projected to total at $4.6 trillion in 2023, an increase of 5.5 percent from 2022, according to the latest forecast by Gartner, widely seen as the top IT market researcher advising enterprise CIOs on their tech spending.

Despite continued global economic turbulence, all regions worldwide are projected to have positive IT spending growth in 2023, Gartner says in a press release on April 6.

The latest forecast is more than double the 2.4 percent estimate from January, and also higher than the 5.1 percent projection Gartner had made six months ago.

The latest forecast is more than double the 2.4 percent estimate from January, and also higher than the 5.1 percent projection Gartner had made six months ago.

Specifically, the IT services segment is now expected to grow faster. Gartner forecasts IT services spending in 2023 to increase by 9.1 percent over 2022, compared with its January forecast of 5.5 percent and its October 2022 estimate of 7.9 percent growth.

“Macroeconomic headwinds are not slowing digital transformation," John-David Lovelock, distinguished VP analyst at Gartner, says in the release. “IT spending will remain strong, even as many countries are projected to have near-flat gross domestic product growth and high inflation in 2023."

Prioritisation will be critical as CIOs look to optimise spend while using digital technology to transform their businesses’ value proposition, revenue and client interactions, notes the analyst.

The software segment will see double-digit growth this year as enterprises prioritize spending to capture competitive advantages through increased productivity, automation and other software-driven initiatives.

As software spend continues to rise, CIOs will increasingly look to their IT services vendors to provide the experts for implementation and support, according to Gartner. For example, spending on consulting is expected to reach $264.9 billion in 2023, a 6.7 percent increase from 2022, Gartner estimated in January.

These deals, however, will likely be in the form of larger transformational projects on the back of the need to build the “digital core" of the customers’ IT systems, Julie Sweet, chief executive of Accenture had told analysts in a conference on March 23.

Accenture also expected to have “lighter bookings" in its Q3, following record sales in its Q2, CFO KC McClure told analysts at that conference.

Of all the categories that make up the total IT projection from Gartner, hardware is the worst hit. The devices segment will decline nearly five percent in 2023, as consumers defer device purchases due to declining purchasing power and a lack of incentive to buy new gear, according to Gartner.

And businesses, which shipped huge numbers of laptops and other equipment during Covid to remote workers, will likely now not spend more on hardware as they embrace a hybrid work policy.

As enterprises navigate continued economic turbulence, the split of technologies being maintained versus those driving the business is apparent in their position relative to overall average IT spending growth, Lovelock says in the release.

“CIOs face a balancing act that is evident in the dichotomies in IT spending," he adds. For example, there is sufficient spending within data center markets to maintain existing on-premises data centers, but new spending has shifted to cloud options, as reflected in the growth in IT services.

The IT services segment will continue its growth trajectory through 2024, largely driven by the infrastructure-as-a-service market, which is projected to reach over 30 percent growth this year. For the first time, price is a key driver of increased spend for cloud services segments, rather than just increased usage, according to Gartner.

An important factor contributing to growth is that the exposure from recent bank failures remains contained, according to Gartner. However, tech company CEOs must prepare for disruption, the market researcher notes.

The collapse of Silicon Valley Bank, Signature Bank and Credit Suisse created a shockwave within the banking and tech industries. While exposure remains relatively contained, tech startups are likely to face renewed questions and scrutiny from stakeholders, clients and prospects.

“These banks lent money to all forms of startups – not just IT," Lovelock says. Tech CEOs must first ensure that their companies have enough money and employee morale is high – then they can go after market opportunities.

Even as layoffs continue to impact the tech industry at large, there is still a critical shortage of skilled IT labour, according to Gartner. The demand for tech talent greatly outstrips the supply, which will continue until at least 2026 based on the forecast IT spend.

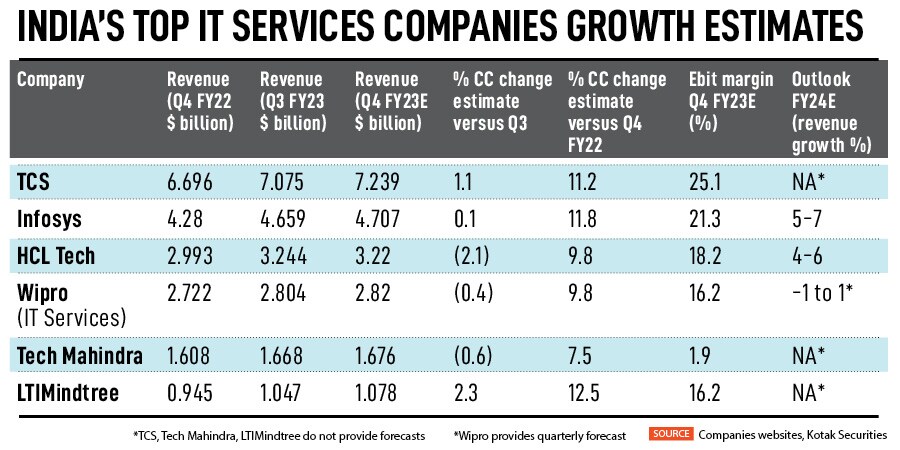

India’s top two IT services companies are expected to report their earnings this week. Tata Consultancy Services, amid a transition to a new CEO, will report its Q4 and FY23 results on April 12, and Infosys on April 13.

For quarter four, which is the January to March 2023 period, TCS will likely lead its peers, analysts at Kotak Securities write in their latest IT preview report, dated March 31. The analysts expect TCS to report fiscal Q4 revenue growth of 1.1 percent versus the previous quarter, and 11.2 percent increase over the same period a year earlier, in constant currency terms, which eliminates the impact of currency exchange rate fluctuations.

Growth will likely be led by spending on cloud and digital programs, cost take-outs and wallet share and vendor consolidation gains. Exposure to impacted banking clients will not materially impact revenue growth in our view in the quarter, the analysts write.

The analysts expect Infosys to report 0.1 percent sequential growth for Q4 and 11.8 percent year-on-year. While TCS does not provide a forecast, the analysts expect Infosys to project fiscal 2024 revenue growth of 5-7 percent and EBIT margins of 21-23 percent.

“A front-ended growth guidance will give a lot more comfort and even create scope for upgrades," the analysts write, as such a forecast would be evidence of clearer visibility into IT services spending. “A back-ended growth guidance may not be viewed favourably," they say, because that would reflect the ongoing uncertainty.

At LTIMindtree, the students, who’ve been waiting for onboarding since graduating in June 2022, have until 6 pm on April 12 to accept the company’s three-part, 6–7-week programme, called IGNITE. If they decline, their job offers from last year stand “auto cancelled," according to an email the company has sent them, seen by Forbes India.

Candidates need to score at least 60 percent in each of the three assessments to be considered for onboarding, which the company expects to make based on business requirements.

First Published: Apr 10, 2023, 13:28

Subscribe Now