SaaS outlook: No more castles in the cloud

Indian SaaS companies are focusing on delivering cost savings and improved efficiency to enterprise customers as the going gets tough

Zoho’s $1 billion revenue milestone has put the spotlight again on India’s software as a service (SaaS) sector, even as enterprises around the world are focusing more on cutting costs and improving efficiency.

So far so good. That’s the message from entrepreneurs and investors alike, on the outlook for India’s SaaS sector, while there are some slivers of hope that the war in Ukraine is a step closer to ending, or the global economy might turn around because some of the most recent US inflation data was better-than-expected.

“Fundamentals matter now more than ever, and our industry has to learn to lower the friction of technology, so that technology becomes far more affordable," Zoho’s co-founder and CEO Sridhar Vembu said in a press release on November 8.

“Growth has slowed down quite a bit in 2022 over 2021," Vembu says, but companies such as Zoho, offering diversified product portfolios and saving money for customers, are winning.

“The markets are speaking more loudly some of the fundamental truths about any market," says Hemant Mohapatra, a partner in India at global venture capital firm Lightspeed.

Undifferentiated technologies in crowded categories are not attractive inefficient scaling of SaaS/tech is not attractive—for example, paying one’s way into product-market-fit or scale with high-churn-low-retention and so on and distracted founders are not ones who will inspire market confidence, he says.

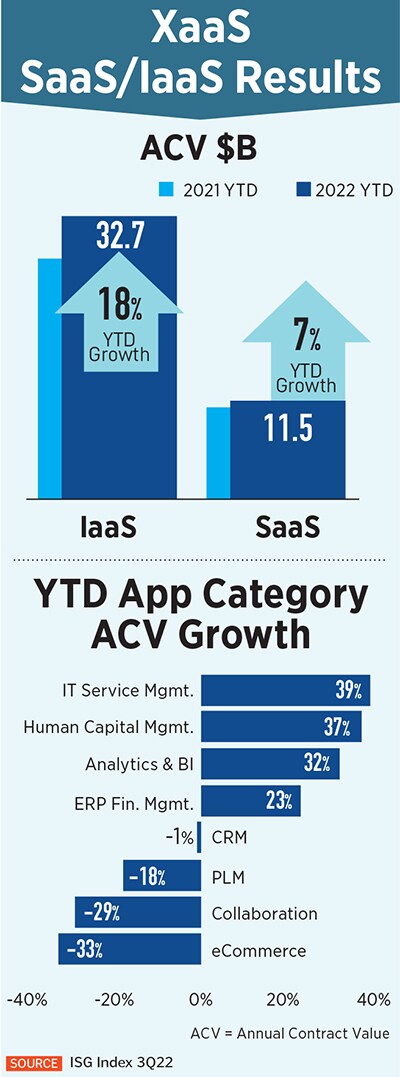

“Cloud-based x-as-a-service market saw its first down quarter since the beginning of 2015," global outsourcing research and advisory company ISG noted in its latest quarterly index report, for the three months ended September 30. The ‘x’ comprises cloud infrastructure and SaaS.

Third-quarter annual contract value declined by 4 percent versus the prior year to $14.1 billion. Of that, at $10.5 billion, infrastructure-as-a-service was flat versus the prior year, while SaaS declined by 12 percent to $3.6 billion, according to ISG.

Third-quarter annual contract value declined by 4 percent versus the prior year to $14.1 billion. Of that, at $10.5 billion, infrastructure-as-a-service was flat versus the prior year, while SaaS declined by 12 percent to $3.6 billion, according to ISG.

Overall, annual contract value of the cloud infra and software market for the nine months through September rose by 15 percent versus the same period in 2021, but that was “the slowest growth rate for this period since ISG began tracking the market for cloud-based services in 2015", the advisory company noted.

ISG has also revised its forecast for this segment to 10.5 percent for 2022 versus 2021—from 18 percent at the beginning of the September quarter.

While problems in China and the stronger dollar contributed to much of this, even the big three American hyperscalers—AWS, Microsoft Azure and Google Cloud—saw some slowdown, Steve Hall, president of ISG, said in a press release on October 13.

Growth in SaaS spending has also slowed, despite strong demand in areas such as IT service management, HCM, analytics and business intelligence, and “ISG sees the potential for even more slowing, as companies grow more cautious about spending on big, complex implementations", Hall said.

The slowdown is showing up at the largest global SaaS companies and at smaller Indian ones alike. Chargebee, a provider of subscription management software, has laid off 140 employees, or about 10 per cent of its workforce, The Hindu BusinessLine reported on November 3.

Chargebee’s co-founder and CEO Krish Subramanian, who is based in the Netherlands, says the difficult decision was driven by external market forces and the company’s need to address debt accumulated in the last few years, according to the report.

Netcore Cloud, a marketing technologies provider, and one of India’s biggest SaaS companies, has put off its initial public offering (IPO), Economic Times reported on November 10, citing founder and group managing director Rajesh Jain.

Uncertain macroeconomic factors and a perceived “softness" in customer decision-making in the SaaS market are among the reasons, Jain told Economic Times.

Netcore started the IPO process in August, with the listing slated for February-March next year. After conversations with bankers, the company decided that it would review IPO prospects again by February, according to the newspaper report.

The company will focus on building new products and bolstering its presence in the US market, where it made a $100-million acquisition in March.

In some areas, such as artificial intelligence (AI), customers are also frustrated that tens of millions of dollars spent on data scientists, tools and solutions haven’t really yielded results, says Ashwini Asokan, co-founder and CEO of Mad Street Den, which offers AI solutions for companies, especially in the retail sector, to organise and make sense of their data and automate various business processes.

“They are done with the bull#$@*," she says.

With such sentiment adding to the macroeconomic uncertainty and business volatility across the board, “SaaS spend is completely being capped", Asokan says.

“All of our SaaS companies have a clear return-on-investment proposition for enterprise customers," says Mohanjit Jolly, a partner at venture capital firm Iron Pillar. “They reduce costs and deliver operational efficiency." As a result, “at least at this time, they continue to see robust customer demand", with companies clocking year over year growth in annual recurring revenue at 100 percent to 1,000 percent, he says.

For example, CoreStack, a company that Iron Pillar has invested in, provides cloud management solutions, including a strong financial operations module that can help businesses lower their expenses on multiple cloud requirements and options.

Strong topline growth at stable or improving gross margins is still a fundamental metric that investors and startup founders equally track. A 3-5x growth rate is very much needed to raise successive rounds of funding from the best investors, Mohapatra says.

High net dollar retention for enterprises (120+ percent) and SMBs (90-110+ percent) is another number to track closely. And numbers that can reveal how efficiently a company’s sales machine is working is another metric. For example, expect account executives to hit 60 percent or more versus their quota, “at full ramp-up" and an under-three-month time period for such an employee to be firing on all cylinders.

Usually, companies would look for a sales quota that is 3-5x the salary of the account executive in the enterprise segment. With mid-market customers, these ratios would be higher but at lower salary and absolute quota ranges, he says.

At Freshworks, where, incidentally, Ganesan worked previously, a lower net dollar retention has become a point of contention in a lawsuit.

The company, India’s first SaaS venture to list on the Nasdaq, is facing a class action lawsuit in the US that says Freshworks knew its business was facing “obstacles", but withheld that information leading up to its IPO last year.

Scott+Scott, which describes itself as an international shareholder and consumer rights litigation firm, has filed a securities class action lawsuit against Freshworks and some of its directors and officers, and the underwriters of the company’s September 2021 listing, according to a press release on November 1.

The firm is asking people who purchased Freshworks’ common stock to get in touch and join the class action.

According to the complaint filed in the US District of California, Northern District and captioned Sundaram versus Freshworks, the company’s IPO documents were false and misleading and omitted to state that, at the time of the offering, the company’s business had encountered obstacles.

Freshworks’ net dollar retention rate—an important growth metric for SaaS companies that rely on subscription revenue—was plateauing, and its revenue growth rate and billings were decelerating, the complaint alleges.

“We don"t comment on pending litigation and intend to defend this and any similar case vigorously," Freshworks said in a statement.

This year, a global tech-led selloff by investors wiped out significant chunks of market capital—from the world’s biggest tech companies to smaller software vendors. However, the law firm says Freshworks’ stock, at the time of the class action filing, had lost as much as 70 percent of its value in comparison with the IPO price of $36.

Following the September 2021 listing, Freshworks traded as high as $50.25, but since then has lost much of its value. It’s currently at around $14.3.

The Silicon Valley- and Chennai-based cloud software provider for customer support beat its own guidance for its fiscal Q3 revenue that rose by 37 percent in constant currency. The company raised its full-year projection, although the December quarter growth is expected at a slower, 27-28 percent range, according to a company press release on November 1.

Sales for the three months ended September 30 rose to $128.8 million, a 33 percent increase in reported terms, year-on-year, and 37 percent growth in constant currency terms, which eliminates the effect of fluctuating currency rates. Freshworks had projected an increase of 31-33 percent in August.

First Published: Nov 16, 2022, 09:32

Subscribe Now