The friends raised a toast and the ‘bachelor’ continued with his rumination. “You can party hard, you can have a lot of fun and no questions are asked," reckoned Mathrubootham, who rebranded the software as a service (SaaS) company as Freshworks in June 2017. Now, after four years, Freshworks was about to go public, making it the first SaaS company from India to get listed on Nasdaq in the US. His friend Bhatnagar popped up the clichéd question. “How are you feeling," asked the managing director of Sequoia. Accel’s Kirani, who pumped in $1 million as seed capital in 2011 was also curious to find what different hues of emotion the first-time founder from Chennai was feeling.

Mathrubootham stayed mum for a few seconds. “I feel good today," he murmured. The lines are firmly etched on one of the walls of the corporate office of Freshworks in Chennai. Back in New York’s public park, Mathrubootham’s first emotion was of happiness. And it’s natural. After all, an initial public offering (IPO) is once-in-a lifetime opportunity.

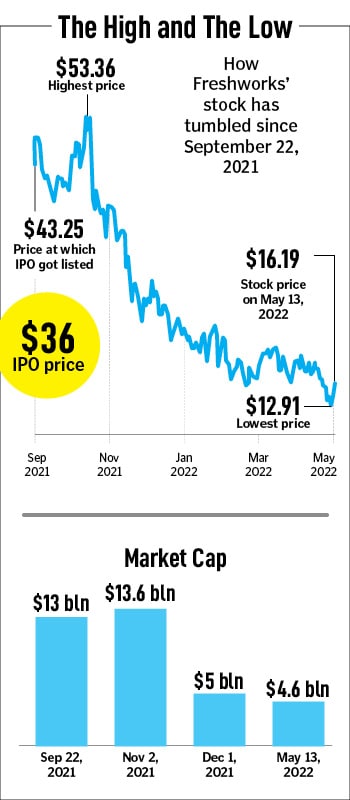

Fear, meanwhile, took a backseat and the grand ‘marriage’ got solemnised on September 22, 2021. Freshworks, which had set an IPO price of $36, had a blockbuster opening and got listed at $43.25. The SaaS hero from India raised over $1.03 billion, and the market capitalisation hit $10.13 billion. The fairy-tale beginning lived up to the code name of the IPO—Project SuperStar, named after superstar actor Rajinikanth, who has a massive global following. When asked by one of the foreign guests attending the IPO party who"s the biggest movie star in India, Mathrubootham took nano-seconds to reply. “Shah Rukh Khan is a star, and Rajinikanth is an emotion," he replied. Naming of the IPO project as SuperStar was indeed an emotional tribute by the SaaS founder who happens to be a hard-core movie buff.

“Pera kettaale chumma adhirudhulla! (Don"t you feel an instant tremor at the mere mention of my name?)," says Mathrubootham, dishing out a blockbuster dialogue from Rajinikanth’s movie Sivaji: The Boss.

The tremors were indeed felt on the dance floor on the IPO night. A hall in New York was plastered with Rajinikanth’s images, and everyone—investors, guests, and the ‘groom’—swayed to Tamil and Hindi songs. “The honeymoon had started," says Mathrubootham. The stock opened at $47.56 the second day, and maintained the $47-mark till late October when the entrepreneur made a quick trip to Chennai.

The occasion was big. The local hero and poster boy of SaaS from India was making a whirlwind trip to his hometown in the week starting October 20. “I was almost treated like a celebrity," he recalls. The plane landed at 2:30 in the morning, over 40 Freshworks’ employees jostled to receive their boss, and an hour later, a party was thrown at a five-star hotel. Mathrubootham cut the cake, and addressed the team. “The emotion I felt at that time was that pressure is a privilege," he says. He underlined that celebrations can wait, requested the staff to focus on work, and reminded everyone that the company needed to continuously perform. “If we drop the ball, then we will lose the focus," he said.

Later in the day, when Mathrubootham was back in office, he meant business. “Introductions can wait," he politely said to one of his employees who was keen to introduce some of the new staff to the founder. Mathrubootham quickly opened his laptop, went to the YouTube page and showed his staff a clip from the Hindi movie Nayak: The Real Hero. “Introductions can wait," thunders the hero in the movie, who gets to be chief minister for a day. The message was conveyed.

On November 2, the day of the first quarterly earnings, Freshworks’ stock rallied to an all-time high of $53.36. In fact, for a few hours, the hero morphed into superhero when Freshworks overtook larger rival Zendesk in market capitalisation: $13.56 billion versus $12.1 billion. There was euphoria all around but Mathrubootham was not elated. “I told the team they can celebrate for a minute, but this is not real," he recounts. “We have to get more revenue and grow faster and bigger," was his message. Becoming bigger in market cap was just the reel.

The real picture, though, started a day after the first quarter results. The stock price started sliding. A month later, on December 2, Freshworks opened at $31.28, and had lost a staggering $5.45 billion in market cap. The marriage party was over, the guests had left, and honeymoon too came to an abrupt end. “Then you really start to think, oh, what did I get myself into," says Mathrubootham. So what do you do now? Simple, you start talking to other married couples. Interestingly, all IPO founders were in the same boat. “That becomes a comfort," he smiles.

Fast forward to May 12. The stock hit a low of $12.91, though the next day it opened at $14.96 and closed at $16.19. In three quarters of public listing, the stock and market cap of Freshworks has got battered. Let’s start with the market cap. From a high of $13.56 billion on September 22 last year, it has crashed over 65 percent to $4.6 billion on May 13 this year. The stock price, which got listed at $43.25, closed at $16.19 during the same period.

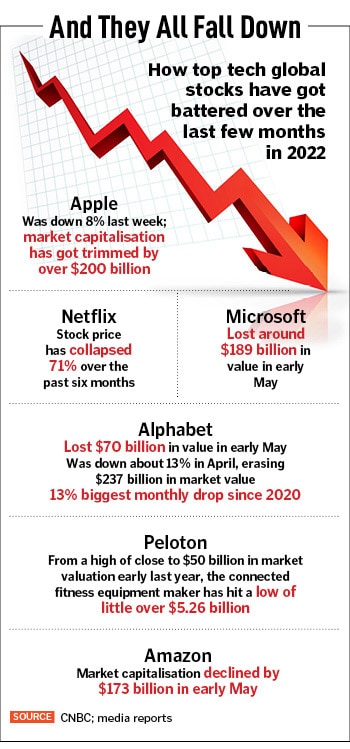

![]() How does the ‘groom’ feel now? Mathrubootham smiles. “I know how to separate passion and emotion," he says. Globally, stock markets have got battered over the last few months on the back of rising inflation, the US Fed’s interest rate hike, geo-political uncertainty over the Russia-Ukraine crisis, and the possibilities of a larger fallout, but bears have mauled the tech stocks the most. “Every company is going through this," he says, giving a simplified definition of how stock market performs. “When people are buying, the price goes up. And when people are selling, price comes down," he says. Now, he underlines, everybody is selling all the tech stocks, especially the new IPOs.

How does the ‘groom’ feel now? Mathrubootham smiles. “I know how to separate passion and emotion," he says. Globally, stock markets have got battered over the last few months on the back of rising inflation, the US Fed’s interest rate hike, geo-political uncertainty over the Russia-Ukraine crisis, and the possibilities of a larger fallout, but bears have mauled the tech stocks the most. “Every company is going through this," he says, giving a simplified definition of how stock market performs. “When people are buying, the price goes up. And when people are selling, price comes down," he says. Now, he underlines, everybody is selling all the tech stocks, especially the new IPOs.

The reality that everybody is having a free fall might be comforting for over a decade-old SaaS company that is still into early days of trading as a listed entity. “We have been dealt with the first three cards of poker," Mathrubootham tries to explain the situation by coming up with an analogy. The first three cards are same for everybody. “They are lousy," he smiles.

Though the markets are crashing, Mathrubootham points out the many silver linings. First, the macro indicators are intact. The Freshworks’ IPO prospectus talks about the bigger opportunity. According to the International Data Corporation (IDC), by 2025, the markets within CRM (customer relationship management) will represent a $76 billion opportunity for Freshworks. Another $44-billion opportunity comes from the SSM (system and service management) market. “We are operating in really large markets," says Mathrubootham.

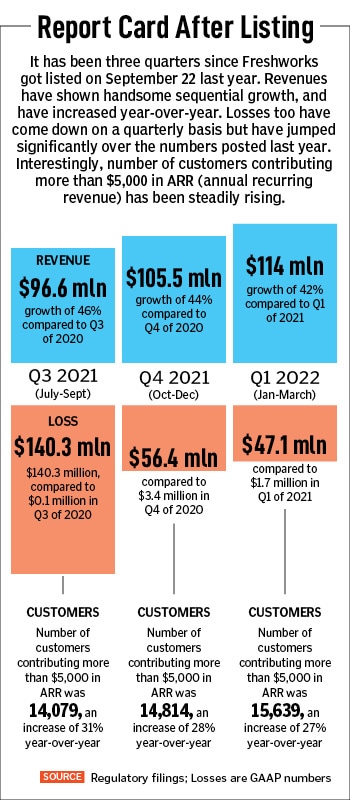

Confidence to tide over the crisis also stems from fiscal performance. There has been a sequential growth in quarterly revenues of the company, and losses too are coming down. Freshworks, Mathrubootham reckons, has relevant products and money in the bank to make most of the opportunity. “We just need to put our head down and execute. The company, he underlines, is not getting killed or crushed by competition. “It’s not that Apple has come and Nokia and BlackBerry are getting crushed. We are the Apple," he says. “So why should we worry."

![]()

Analysts too are not worried about the performance of Freshworks. "The company reported decent first quarter results despite facing difficult year," pointed out Oppenheimer in its latest equity research. Though Freshworks is navigating a challenging operating environment, it also has good levers for growth this year, the note underlined. For Morgan Stanley, the standout feature in the latest quarterly result is Freshworks’ movement towards better profitability. “The company delivered Q1 operating margins that were near breakeven," says the equity report. Freshworks, it points out, continues to build out product portfolio, there is we see plenty of room for the company to upsell into its existing install base and organically drive customer ARR (annual recurring revenue) growth.

For Mathrubootham, meanwhile, personal and professional growth lies in happiness. On a recent family vacation, his cousin spotted the free fall in stock price and market cap. “You have lost thousands of crores and you"re eating bhajji and asking for coconut chutney," he exclaimed. Mathrubootham smiled. “On paper, I might have lost, but I have been performing," he replied.

![]() "My happiness," the founder qualified his statement, "is also to ensure that the coconut chutney is well-made." His cousin looked bemused. And to all his rattled employees, who might be worried about the stock performance, he reassures them in his inimitable style. “This is like an interval scene in a Rajini movie," he says. And everybody knows what happens next. “When everything looks down, the hero stages a comeback," he smiles.

"My happiness," the founder qualified his statement, "is also to ensure that the coconut chutney is well-made." His cousin looked bemused. And to all his rattled employees, who might be worried about the stock performance, he reassures them in his inimitable style. “This is like an interval scene in a Rajini movie," he says. And everybody knows what happens next. “When everything looks down, the hero stages a comeback," he smiles.

Is the hero not bothered about years of losses that Freshworks has posted since inception? Mathrubootham explains the ‘growth versus profitability’ puzzle. “It"s not a simple, straightforward line," he says. In SaaS businesses, investors want companies to invest in growth if the company has been posting efficient growth. “In a SaaS business, net dollar retention is crucial," he contends, adding that over the years the company has raised money to chase growth. “At the end of the day, you want a good balance of growth and profitability," he says. Though investors have started to look at companies that are profitable, for a longest period of time, growth was valued. “But we"ve never been believers of growth at all cost. Such thinking is damaging."

Ask him how he stays calm in choppy markets, and Mathrubootham shares his secret sauce, or, in his case, chutney. “To most of my family and friends, even if I tell them that I have a $1-billion company, it would be an achievement," he says.

For an entrepreneur, who made a humble beginning in 2010, it has always been about dreaming in increments. “Freshworks is the company that wasn’t supposed to win," he pointed out in his letter in the IPO prospectus. The doubts were always there. The sceptics kept asking questions about capabilities to differentiate in crowded market, or compete with larger players, or build a global SaaS company from India. “Yet, we kept our heads down and focused on executing," he wrote, taking inspiration from Steve Jobs: “Stay hungry, stay foolish."

Mathrubootham was understandably delighted. “

Mathrubootham was understandably delighted. “ How does the ‘groom’ feel now? Mathrubootham smiles. “I know how to separate passion and emotion," he says. Globally, stock markets have got battered over the last few months on the back of rising inflation, the US Fed’s interest rate hike, geo-political uncertainty over the

How does the ‘groom’ feel now? Mathrubootham smiles. “I know how to separate passion and emotion," he says. Globally, stock markets have got battered over the last few months on the back of rising inflation, the US Fed’s interest rate hike, geo-political uncertainty over the

"My happiness," the founder qualified his statement, "is also to ensure that the coconut chutney is well-made." His cousin looked bemused. And to all his rattled employees, who might be worried about the stock performance, he reassures them in his inimitable style. “This is like an interval scene in a Rajini movie," he says. And everybody knows what happens next. “When everything looks down, the hero stages a comeback," he smiles.

"My happiness," the founder qualified his statement, "is also to ensure that the coconut chutney is well-made." His cousin looked bemused. And to all his rattled employees, who might be worried about the stock performance, he reassures them in his inimitable style. “This is like an interval scene in a Rajini movie," he says. And everybody knows what happens next. “When everything looks down, the hero stages a comeback," he smiles.