“In New York or London, you will not hear a word about the Indian stock market. Most investors, for decades, have had a cynical view of India. They had this wildly bizarrely positive notion about China, which is neither founded on fact, nor on investment returns. I think that anomaly has begun to correct," Mukherjea had said.

Many domestic investment managers have traditionally—for nearly three deacdes—faced unfounded scepticism as foreign investors fancied China over India for big-ticket investments despite the stark underperformance of Chinese equities. A case in point: Since its inception in October 1995, the MSCI China Index has delivered no returns to investors. In contrast, the MSCI India Index returned a whopping 2,000 percent and the MSCI Emerging Market Index rose over 160 percent.

But, one year later, the tide has turned and the big change in perception is noteworthy.

Washington-based global emerging financial markets investment firm Kleiman International’s managing partner Elizabeth Morrissey tells Forbes India, “China has seriously disappointed investors. The reopening trade was wildly enthusiastic in January, but since then has totally turned around."

A recent survey by Bank of America finds out that the mood of investors has quickly changed from “unabashedly bullish" to “fatigued scepticism" as they try to piece the dismal performance of China stocks. In fact, many investors are doubtful if China’s recovery has legs and if they can meaningfully profit from the reopening theme in the medium term.

Its analysts say long-term emerging market investors want some indication of the “new normal" of China’s growth outlook to assess if the past three years have fundamentally impaired business and consumer confidence, and so in this situation, investors are impatient to buy and hold and would prefer to invest when there is more clarity.

Mark Matthews, head of research, Asia, Julius Baer, says, “We view Indian and US equities as long-term investments and Chinese equities as a trade. Chinese retail investors themselves show no affinity to their own share market, beyond occasionally trading in and out of it when government policy turns more or less favourable."

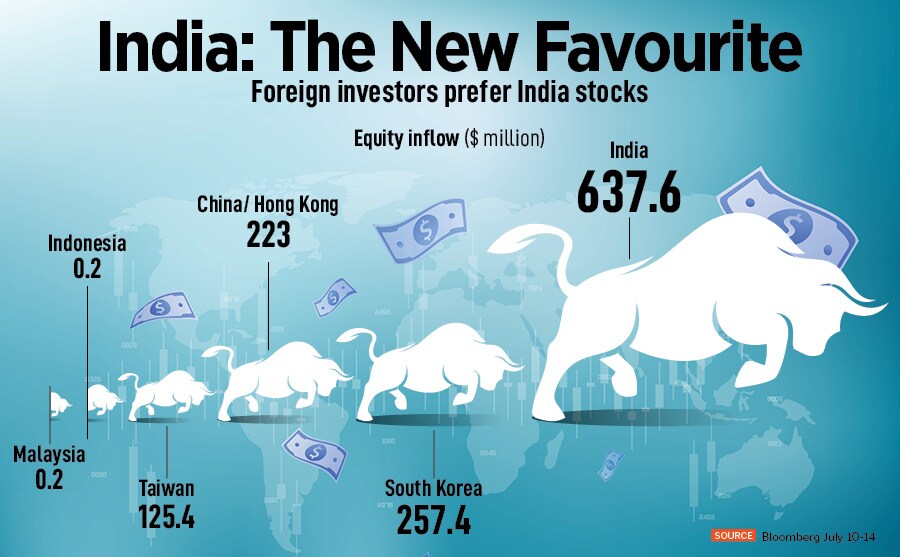

In fact, Bloomberg data of equity inflows into emerging markets in the second week of this month (July 10 to July 14) shows US ETFs favoured India stocks the most among emerging market peers and invested $637.5 million and around one-third of it into China (see table).

![]()

“It is doubtful that many portfolio investors have a medium- or long-term plan for their China strategy. In addition to the domestic stories—including crackdowns on a range of sectors—in the aftermath of the Russian invasion, investors have been wary of exposure in case the West imposes direct or secondary sanctions on state or private companies, including banks. They are fearful that their China exposure will also be trapped with the situation so fluid and the Taiwan threat not receding," Morrissey explains.

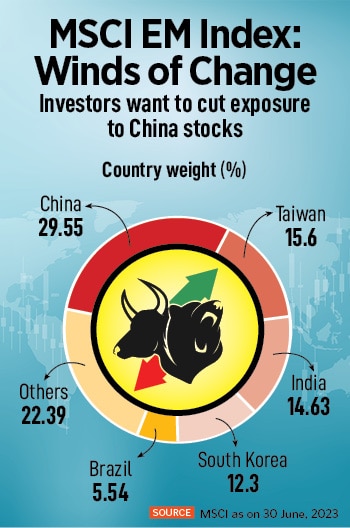

The MSCI Emerging Markets Index providers say countries have been added and removed from the MSCI EM Index based on its market classification framework that assesses economic development, size, and liquidity, and market accessibility. In 2023, the MSCI EM Index has 24 countries. Presently, China has the largest index-weight at 29.55 percent (see table) and covers about 85 percent of its stocks across large and mid-caps.

![]()

“While China’s reopening provides a silver lining to the lack of global economic growth projected for 2023 and beyond, a smooth path towards recovery is by no means guaranteed. China may also need to strike a fine balance by reversing policies in key sectors (real estate tightening and internet platform regulation) and promoting a more sustainable growth model," it states.

That China has been a drag on the emerging market index is evident. It has underperformed the MSCI EM Index while India has consistently beat MSCI EM Index and MSCI China Index. For example, as on 30 June, MSCI China posted a negative return of 16.82 percent and MSCI India returned 14.15 percent over a one-year period. During the same period, the MSCI EM Index rose 1.75 percent (see table).

![]() Moreover, China’s weight on the MSCI EM Index has reduced to 29.55 percent from 38.7 percent in 2020 whereas exposure to India stocks has increased from 8.3 percent in 2020 to 14.63 percent currently. Clearly, investors are looking to reduce exposure to China stocks for better returns. Global brokerages, including Goldman Sachs and Morgan Stanley, cut their targets for Chinese stock indices. For example, Morgan Stanley trimmed its MSCI China Index target to 70 from 80 and reduced its target for the Hang Seng China Enterprises Index to 7320 from 8250.

Moreover, China’s weight on the MSCI EM Index has reduced to 29.55 percent from 38.7 percent in 2020 whereas exposure to India stocks has increased from 8.3 percent in 2020 to 14.63 percent currently. Clearly, investors are looking to reduce exposure to China stocks for better returns. Global brokerages, including Goldman Sachs and Morgan Stanley, cut their targets for Chinese stock indices. For example, Morgan Stanley trimmed its MSCI China Index target to 70 from 80 and reduced its target for the Hang Seng China Enterprises Index to 7320 from 8250.

“Investors are increasingly tracking MSCI-ex China. The index weightings have long been questioned and especially with increased attention to global economic and geopolitical issues the main EM Index is not representative. For retail investors, ETFs are increasingly attractive, but interest has definitely shifted from Global Emerging Market (GEM) funds to GEM-ex-China," says Morrissey.

She points to data indicating that foreign investors sold mainland shares worth $1.7 billion in May and $659 million in April. “They continue to sell bonds as the country slides into deflation," she adds. Foreign investors have dumped Chinese government debt to the tune of $31 billion in the last seven months and around $130 billion since early 2020. A ~4 percent fall in China’s currency hasn’t helped. “Investors have been expecting a large-scale—albeit smaller than 2008—stimulus package and have been disappointed by minor adjustments in rates so far."

The impact of a low base effect aside, by and large, the economic data has failed to meet consensus and indicates weak momentum and an uneven recovery. Despite the surge in pent-up demand for services, domestic consumption is likely to remain tepid. “Households are reducing their leverage. That’s not a good sign for consumption, which is over half of GDP. It suggests they lack confidence in the future," Matthews says.

The slower-than-forecast second quarter GDP growth of 6.3 percent on a year-on-year basis further dented the confidence of investors. As per government data, in comparison the corresponding period last year, exports and imports declined 12.4 percent and 6.8 percent respectively in the June quarter.

“Investors were counting on a bounce in domestic consumption for recovery but the decline in imports points at weakening domestic demand as the economy slides into deflation. While tech stocks have rallied in recent days after government officials indicated a shift in stance after the recent crackdown, the ailing property sector and local governments continue to weigh on sentiment," Morrissey says.

In March, China’s GDP growth of 4.5 percent y-o-y beat analyst estimates by a wide margin since many economists and brokerages had forecast the economy would contract by 0.5 percent y-o-y in Q1. The faster-than-anticipated recovery in the first quarter, coupled with robust high frequency economic indicators, led many brokerages and global banks to raise their growth forecast to 5.2-5.7 percent. Now, for instance, Citigroup, JP Morgan, and Morgan Stanley have reduced their GDP estimates for the current year to 5 percent.

In the last couple of years, emerging markets bore the brunt of rising interest rates and global volatility as foreign investors flocked out of high-risk markets. But emerging markets, particularly India, have regained their sheen and are expected to outshine developed markets. For example, the World Bank, in its latest forecast, projects emerging markets to grow at 3.9 percent this year and 4 percent next year versus 1.2 percent and 2 .2 percent for developed markets in 2023 and 2024 respectively. It pegs India as the fastest growing major economy and predicts its GDP to grow at 6.4 percent in the current year and 6.5 percent next year.

“Discounting 2021’s post-Covid-opening bound in EMs—shares are cheap and economic growth is rebounding. The World Bank, in its June update, is projecting EM economies will growth 3.9 percent and 4 percent this year and next, while DM will advance only 1.2 percent and 2.2 percent, led by India at 6.4 percent and 6.5 percent," Morrissey says. “We would argue that there are only four top emerging markets for investors right now- India, Mexico, Brazil, and Greece. Other smaller markets, like Vietnam and Uruguay, are also attracting interest as they come to grips with inflation, as are the markets in Central/Eastern Europe and Latin America more broadly."

India has managed to rein in inflation levels at below 6 percent and economists widely believed that interest rates have peaked. Big-bang reforms over the past decade such as the Make in India programme, UPI, the Insolvency and Bankruptcy Code, GST, and PLI schemes have improved India’s business environment. There is a thrust on infrastructure and manufacturing to boost growth and India’s startup ecosystem is flourishing too.

"India is known as the market that has confounded optimists and pessimists alike. Could this be its decade to shine? From our recent travels around the country, we believe indications are pointing in the right direction: Corporate confidence is high, the economy is expanding at a decent clip and technological innovation is leading to new areas of growth," Capital Group"s equity portfolio managers say in a recent report.

Its fund managers note that the path of India’s equities has never been a straight line, but over longer periods, the stock market has delivered some of the best returns among emerging and developed markets. A case in point: As of May 31, over a twenty-year period, MSCI India returned 13 percent, MSCI Emerging Markets returned 8.3 percent, and the S&P 500 returned 9.1 percent.

Moreover, China’s weight on the MSCI EM Index has reduced to 29.55 percent from 38.7 percent in 2020 whereas exposure to India stocks has increased from 8.3 percent in 2020 to 14.63 percent currently. Clearly, investors are looking to reduce exposure to China stocks for better returns. Global brokerages, including Goldman Sachs and Morgan Stanley, cut their targets for Chinese stock indices. For example, Morgan Stanley trimmed its MSCI China Index target to 70 from 80 and reduced its target for the Hang Seng China Enterprises Index to 7320 from 8250.

Moreover, China’s weight on the MSCI EM Index has reduced to 29.55 percent from 38.7 percent in 2020 whereas exposure to India stocks has increased from 8.3 percent in 2020 to 14.63 percent currently. Clearly, investors are looking to reduce exposure to China stocks for better returns. Global brokerages, including Goldman Sachs and Morgan Stanley, cut their targets for Chinese stock indices. For example, Morgan Stanley trimmed its MSCI China Index target to 70 from 80 and reduced its target for the Hang Seng China Enterprises Index to 7320 from 8250.