The curious case of China's confidence trap

Investors, sceptical of China's macroeconomic data as corporate guidance remains tepid and stock returns disappointing, are looking to shift allocations to India for higher long-term returns

The biggest global investment theme of the year seems to have gone sour. When China reopened its economy, six months ago, after nearly 1,000 days of lockdowns due to draconian zero-Covid policies, investors widely expected the year of the rabbit to mark a strong revival of the world’s largest economic juggernaut. Broadly, the underlying thesis was that excess savings to the tune of RMB 7 trillion accrued over the past three years would boost China’s consumption levels to the pre-pandemic level of 8 percent and GDP growth of 5 percent in CY23.

But the mood of investors has quickly changed from “unabashedly bullish" to “fatigued scepticism" as they try to piece the puzzling disconnect between the strong headline economic data and the dismal performance of China stocks. In fact, many investors are doubtful if China’s recovery has legs and if they can meaningfully profit from the reopening theme in the medium term.

“Confusingly, most top-down numbers are good, but bottom-up feedback from companies is very negative, and investors generally believe in the company feedback more. A second main concern is geopolitics. Investors worry that if relations continue to deteriorate, it might be difficult or impossible to take their money back out of China," says Mark Matthews, head of research, Asia, Julius Baer Group.

Moreover, a recent investor survey shows that less than half the respondents are hopeful of a strong revival of the Chinese economy in comparison to 79 percent investors a month ago (see table). For years, China has been the favourite emerging market for foreign investors despite lacklustre returns. But, as the survey indicates, investors overweight China dipped by 19 percentage points to 9 percent in May from 27 percent in April and 39 percent in March (see table).

Moreover, a recent investor survey shows that less than half the respondents are hopeful of a strong revival of the Chinese economy in comparison to 79 percent investors a month ago (see table). For years, China has been the favourite emerging market for foreign investors despite lacklustre returns. But, as the survey indicates, investors overweight China dipped by 19 percentage points to 9 percent in May from 27 percent in April and 39 percent in March (see table).

Citibank sees China on the brink of a confidence trap. “There seems to be a persistent lack of confidence among consumers, homebuyers, corporates and investors. Weak expectations could be reinforcing each other and become entrenched and self-fulfilling," it says in a report.

Against this bleak backdrop, investors, giving China the cold shoulder, are re-shuffling their portfolio allocations to other countries in Asia. Notably, India, Indonesia, and Japan have emerged as attractive markets for fund managers in the last couple of months. As per the survey mentioned earlier, in April and March, 19 and 16 percent investors said they were underweight India. In a turnaround, in May, 4 percent investors were overweight India.

For example, even though the valuation of Chinese equities is cheaper than Indian equities, Matthews expects India to give better returns in the long term. “In Asia we like India, we also like high quality Japanese companies that are world leaders in their sectors," he adds. In general, however, he continues to prefer the US market over emerging markets.

Bank of America says long-term emerging market investors want some indication of the “new normal" of China’s growth outlook to assess if the past three years have fundamentally impaired business and consumer confidence, and if not property, then which other themes could drive growth in the coming years, and so in this situation, investors are impatient to buy and hold and would prefer to invest when there is more clarity. “European investors are frustrated with the sluggish performance of the China markets," state its economists.

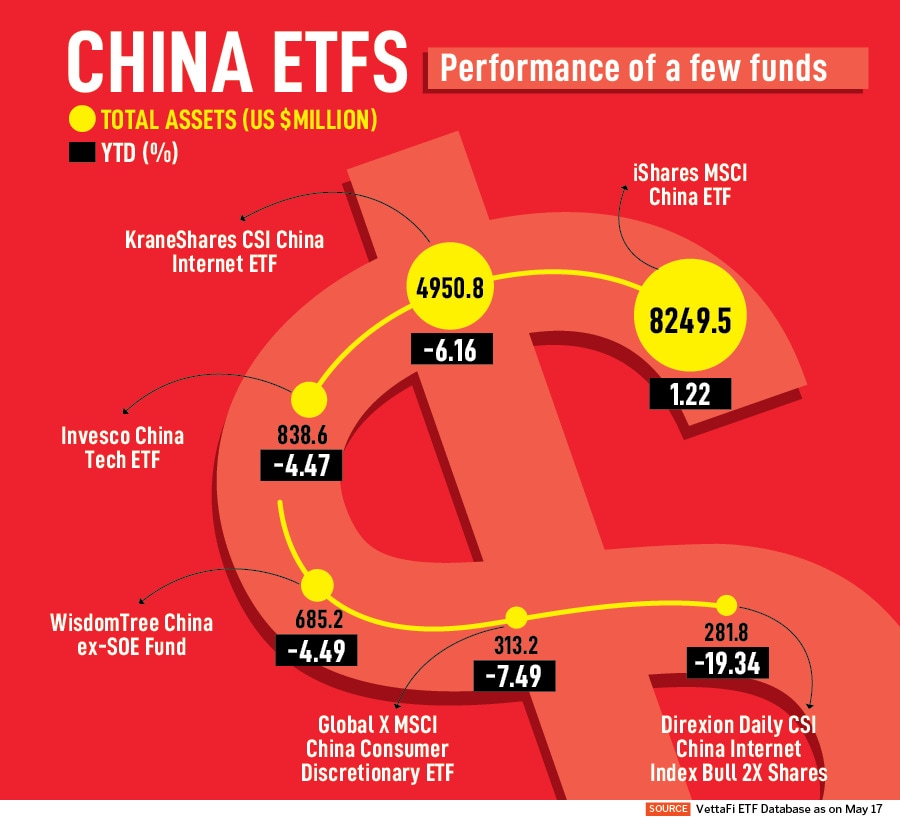

As of last week, China stocks had lost most of the gains since January and the Shenzhen Component Index had shed 9.5 percent from its peak in early February. The MSCI China Index covers about 85 percent of China’s stocks across large and mid-caps. Its one-month returns, as of April 28, traded down over 5 percent while MSCI Emerging Markets Index fell by 1.13 percent (see table). China ETFs were also under pressure. For instance, KraneShares CSI China Internet ETF, Global X MSCI China Consumer Discretionary ETF were down 6.16 percent and 7.49 percent each (see table).

“People (are) questioning the accuracy of the macro data, as bottom-up corporate earnings and guidance remain soft. Also, some investors are tracking high frequency data closely which showed some weakness in April. We expect the debate on the bull/bear case to continue, and (the) market may only get more clarity by June/July, when base effect normalises, and corporates provide Q2 earnings guidance," Bank of America’s economists add.

In this mayhem, the top investment themes in China over the medium term largely hinge on consumption recovery, artificial intelligence, internet, green economy and reform measures to improve state-owned enterprises (see table). For instance, over the past one month, Matthews points out, share prices of the three big telecom companies rose after the government said it would raise their dividend payout ratios.

“Shares in state-owned enterprises have been outperforming the broader market. They have lower profit margins and returns on equity than private sector companies in general, but the government has been clear it believes they are undervalued, and wants to see their valuations boosted. Even if the price-earnings ratio of state-owned enterprises only rises from 6x to 8x, that is still a 30 percent return," Matthews adds.

“Shares in state-owned enterprises have been outperforming the broader market. They have lower profit margins and returns on equity than private sector companies in general, but the government has been clear it believes they are undervalued, and wants to see their valuations boosted. Even if the price-earnings ratio of state-owned enterprises only rises from 6x to 8x, that is still a 30 percent return," Matthews adds.

Nomura’s chief China economist, Ting Lu, believes Beijing may have to introduce a new round of support measures for the economy in the second half of the year, including lowering the benchmark lending rates, to rekindle the economy’s animal spirits. Barclays noted concerns around the sustainability and recovery in housing and consumption and pared China’s GDP forecast to 5.3 percent from 5.6 percent.

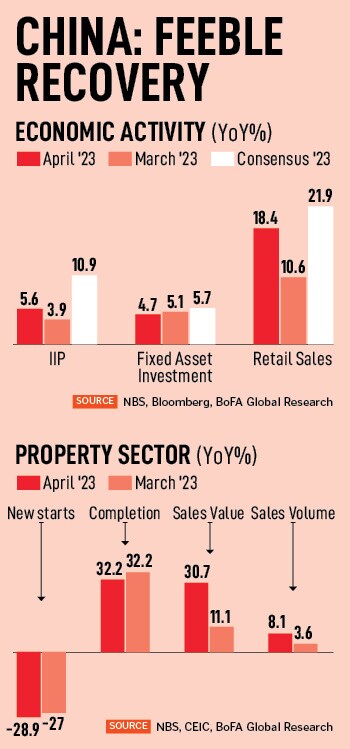

In April, industrial production, fixed-asset investment, and retail sales growth disappointed on the downside and stoked jitters in the market. Despite a low year-ago base, investment and consumption were weak: Industrial production increased to 5.6 percent y-o-y in April but was below consensus of 10.9 percent fixed-asset investment dropped to 3.9 percent y-o-y in April from 4.8 percent in the previous month (see table). Besides, the record high level of youth unemployment at 20.4 percent poses a big economic and social concern for the government.

To add to the woes, the slowdown in the property market continues, declining 16.2 percent in April against a drop of 7.2 percent in March. China’s National Bureau of Statistics, reportedly, changed the base for property sales data, distorting the interpretation of the numbers.

In March, China’s GDP growth of 4.5 percent y-o-y beat analyst estimates by a wide margin since many economists and brokerages had forecast the economy would contract by 0.5 percent y-o-y in Q1. The faster than anticipated recovery in the first quarter, coupled with robust high frequency economic indicators, led the IMF to raise its GDP growth outlook for China to 5.2 percent from 5 percent earlier. Also, the IMF estimates that Asia will contribute 70 percent to global growth, and it believes China will contribute half of this growth to the world economy.

Yet, impact of a low base effect aside, by and large, the economic data has failed to meet consensus and indicates weak momentum and an uneven recovery. Despite the surge in pent-up demand for services, domestic consumption is likely to remain tepid. “Households are reducing their leverage. That’s not a good sign for consumption, which is over half of GDP. It suggests they lack confidence in the future. Having said that, if the Chinese economy really were to take a turn for the worse, the government would respond with stimulus measures," Matthews says.

First Published: May 19, 2023, 12:55

Subscribe Now