India receives highest FII inflows among emerging markets in 2020

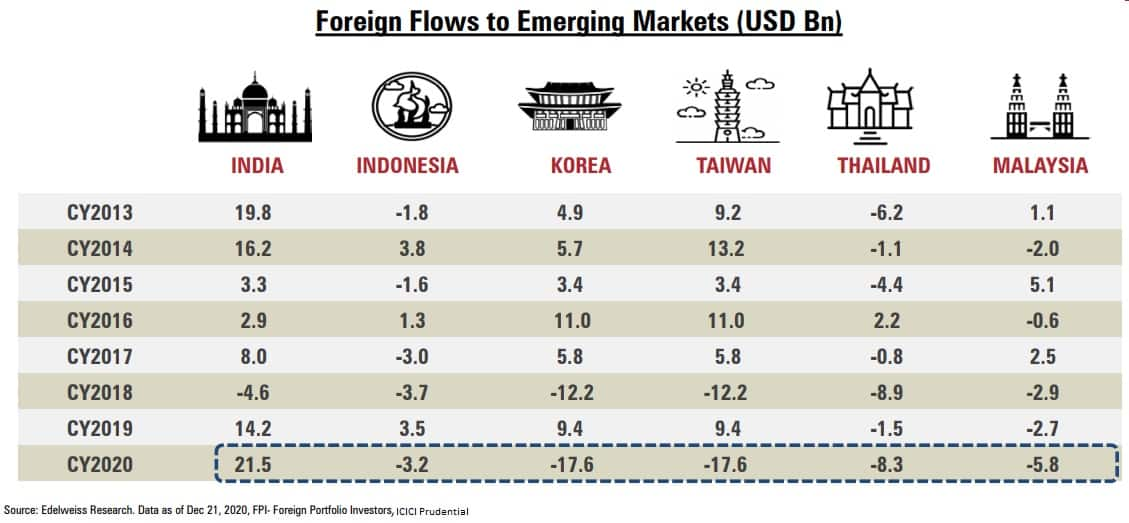

2020 was the second year in a row when FII inflows into Indian equities were highest among emerging markets. In 2019, the inflow was $14.2 billion

Image: Shutterstock

Image: Shutterstock

Indian equities received more than Rs 1.6 lakh crore ($23 billion) from foreign institutional investors in 2020, the highest among emerging markets. In fact, most Asian and emerging markets witnessed outflows in the year gone by.

This was the second year in a row when FII inflows into Indian equities were highest among emerging markets. In 2019, the inflow was $14.2 billion.

Some of the factors that are attracting FIIs to the India story are rising hopes for strong economic recovery and earnings growth in coming years, significant decline in COVID-19 cases at a time when the western world (especially US and European nations) is still struggling with second wave, weak dollar index, vaccine progress, and government & RBI policy stimulus measures.

Globally, central banks announced stimulus measures worth trillions of dollars during 2020 to boost their economies which were hit by the outbreak of COVID-19 and lockdown measures.

"More than $10 trillion worth of stimulus measures were initiated across the globe to overcome the challenges thrown by the pandemic and it will take at least 1 to 2 years for most of the central banks to recover the debt and revive their balance sheets back on track," Sunilkumar Katke, Head - Commodity and Currency at Axis Securities said.

"India received more than $23 billion in FII flows last calendar year when most Asian and emerging markets witnessed outflows. The flows were a combination of India's stronger economic recovery, weakness in Dollar Index and steady currency," Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities told Moneycontrol.

The dollar index, which measures the dollar value against a pool of six key currencies - euro, Japanese yen, Swiss franc, British pound, Canadian dollar and Swedish krona - fell sharply by 13 percent to trade around 89.5 from 102.8 levels seen on March 20.

Generally, weakness in dollar index is considered as a positive sign for emerging market currencies and indicates FII money flow into emerging markets.

Experts feel given the Fed indication of keeping lower interest rates for a longer time along with widening fiscal and current account deficits, the dollar index may continue to weaken which may support emerging markets in terms of inflow.

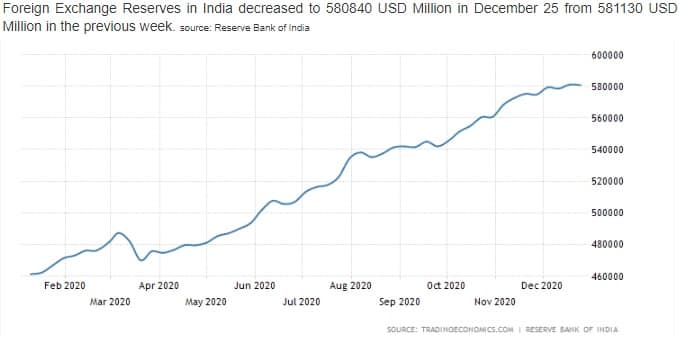

The foreign exchange reserves were at $580.84 billion at the end of December 25, 2020, which increased quite sharply by 46.6 percent compared to $396.08 billion seen at the end of January 4, 2019.

"We expect FII flows to remain strong and be in range $15-20 billion in CY21. More than $100 billion accretion to India's Forex reserves should provide stability to India's currency and help RBI manage any weakness in the INR in future. The stable currency outlook and a weak bias towards to Dollar Index should help FII flows into India," said Rusmik Oza.

"In CY21/FY22 India will witness one of the highest real GDP growth in the world. This coupled with availability of vaccine, healthy earnings growth and low bond yields will also favour FII flows into India," Oza added.

Given the consistent FII inflow, benchmark indices - BSE Sensex and Nifty50 - gained around 15 percent in 2020, though both rallied 84 percent from March 23's low. The broader markets also participated in the run and outperformed frontline indices, with the Nifty Midcap and Smallcap indices climbing more than 21 percent each in the year gone by.

India was the third biggest gainer in equity among emerging markets. South Korea's Kospi topped the list with 30 percent gains and Taiwan 22 percent.

Following stellar returns in the year gone by, experts do not expect healthy returns from Indian equities in the current year, though FII inflow may remain strong.

"Since valuations are extremely rich not sure whether the gains that accrue at the start of the calendar year may sustain in the second half. We expect central banks to pause on their loose monetary policies in the second half which could lead to some spike in bond yields. On these thesis we are not expecting any major gains in the Nifty-50 by the end of the year. We are sure to see good FII flows in CY21 but not sure whether that will translate into healthy returns for the market," Rusmik Oza said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Original Source: https://www.moneycontrol.com/news/business/markets/india-receives-highest-fii-inflows-among-emerging-markets-in-2020-6308321.html