Make money in commodities

Commodities might be an ideal asset class to diversify investments and mitigate portfolio risk in such volatile times

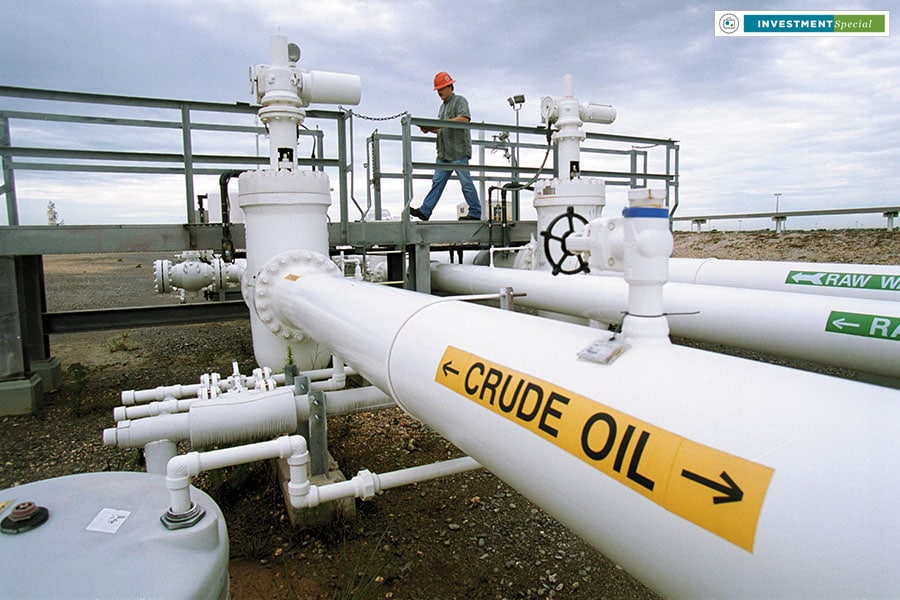

Crude oil demand has been on the rise for a few years

Crude oil demand has been on the rise for a few years

Image: Joe Raedle / Getty Images We have seen investors getting bruised in both debt and equity markets. Further, the realty sector has been in a bearish phase over the past few years. The question, therefore, is ‘Should the investor look beyond the traditional asset classes?’ My experience is that in such volatile times, commodity as an investment opportunity is worth considering. Recently, gold crossed the ₹34,000 per 10 gram mark in the Indian market, attracting investor attention. Barring this, investors hardly think of commodity as an asset class.

We have seen investors getting bruised in both debt and equity markets. Further, the realty sector has been in a bearish phase over the past few years. The question, therefore, is ‘Should the investor look beyond the traditional asset classes?’ My experience is that in such volatile times, commodity as an investment opportunity is worth considering. Recently, gold crossed the ₹34,000 per 10 gram mark in the Indian market, attracting investor attention. Barring this, investors hardly think of commodity as an asset class.

Investment in commodities such as gold, silver, crude oil, and copper, widely traded in international markets, can help one diversify their portfolio and mitigate risks. For the sake of simplicity, we will call such commodities as ‘international commodities’. When one invests in international commodities in the domestic market, they also invest in the US dollar, because Indian prices of international commodity are a function of international prices of the commodity in US dollars, as well as value of the US dollars in terms of the Indian rupee.

Rising commodity prices

In the event of a trade war (which is currently brewing between the US and China), geopolitical turmoil (Gulf region, Brexit), cross-border tension etc, currency valuations (more so, the greenback) are bound to get impacted, resulting in higher prices of international commodities in the domestic market. During such events, all other asset classes take a hit, exposure to international commodities in domestic market comes in handy to an investor to help mitigate portfolio risks (protect overall portfolio losses).

Investors can look at the commodity market to hedge their specific exposure to the equity market. For example, an investor with airline stocks or oil marketing companies’ stocks in his portfolio can buy crude oil futures and protect the overall risk of a portfolio. In the likelihood of a rise in crude oil prices, the stock of airline companies or oil marketing companies might fall, but the purchase position on the crude futures can generate profit.

Following is a commodities report card:

Crude oil in a broad range, with an upside bias

Crude oil price slumped by nearly 25 percent in 2018 but has rallied more than 20 percent in the first two months of 2019. Going ahead, we expect crude oil price to be in a broad range, as the Organization of the Petroleum Exporting Countries (Opec) will work to keep a floor to price while global economic challenge and higher US crude production will limit any major upside. The general bias may be on the upside.

Crude oil demand has been on the rise for a few years: The low price boosted demand from India and China. While global demand is expected to set new highs this year, the pace of growth will slow down, owing to slower growth in India and China which will dent demand for crude oil.

high demand for Copper, zinc

In case of metals like copper and zinc, demand is expected to grow this year, albeit at a slower pace, with China continuing to lead global demand. With the economy showing signs of a slowdown, the pace of demand growth from the nation may be low. China may be hurt amid the faltering pace of growth in Europe and slower than that in the US in 2018. After last year’s double digit decline, metal pack may stabilise this year with prices showing improvement in the second half of 2019 amid global central banks’ measures to shore up growth and supply-side fundamentals of most metals.

Edible oils show robust demand, cotton upbeat

Demand in the world’s largest edible oil importer and second largest consumer is expected to remain robust in FY19-20 as the country’s population is expected to inch closer to 1.4 billion. India quenches 70 percent of its demand for vegetable oils by imports. The dependency on overseas supplies is likely to persist in the coming year in spite of the all-time high production of soybean and mustard seed. Despite upbeat demand growth, edible oil prices are expected to remain under pressure on the back of higher production of soybean and mustard.

Cotton demand outlook remains upbeat as mills are expected to reinitiate their raw material purchases which had paused due to financial stress and lower demands, resulting in rise in demand. Meanwhile, China and other eastern countries in the past fortnight have conveyed interest in Indian cotton. Higher purchase interest may support cotton prices.

Participate through futures at local exchanges Liberalised Remittance Scheme (LRS) for international commodities One can trade in futures and options on various commodities through an existing stock trading account. Some of the commodities which are actively traded on Indian exchanges include gold, silver, crude oil, copper, zinc, nickel, natural gas, rubber, aluminum, edible oil, soybean and castor seed. Investors can undertake delivery of various commodities through future contracts on domestic exchanges and hold the delivery in electronic form (equivalent to demat). One can invest in commodity exchange-traded fund (ETFs) in the domestic market. Currently, only gold ETFs are available, while ETFs on other commodities like silver, copper etc are expected to be allowed by the regulator over time.

Recently the Securities and Exchange Board of India (Sebi) has permitted Alternative Investment Funds (AIFs), mutual funds and portfolio management services (PMS) to enliven the commodity market. With this, we may see various opportunities being made available to investors. Other avenues for investment include the Reserve Bank of India’s (RBI’s) sovereign gold bond to get exposure to gold without physically holding it. One can look at earning some interest along with price appreciation opportunity. These bonds are also listed on the stock exchanges.

While the domestic market offers a wide option for trading in commodities, one can invest in various products in the international market under LRS of the RBI (such as ETFs) through this route on international exchanges.

While macro and micro global economic factors make commodities volatile, they are nonetheless an ideal asset class to diversify investments and mitigate portfolio risk. With the unpredictability of returns from other asset classes, it is vital to look at new avenues of diversification through commodities.

The writer is a senior executive vice president (corporate division) with Kotak Securities

First Published: Mar 20, 2019, 11:55

Subscribe Now