Rajeev Jain: Making size count at Bajaj Finance

Fortified by sound asset-liability management and a rapidly expanding diversified portfolio, he is now pushing for leadership in all segments the company lends to

Rajeev Jain, MD, Bajaj Finance

Image: Aditi Tailang

Forbes India Leadership Award 2018: Best CEO-Private sector

Rajeev Jain sits beside a table and hurriedly flips through the pages of a booklet which has the Q2FY19 investor presentation of Bajaj Finance. He pauses at a page that provides the asset-liability management (ALM) snapshot for the company.

“We had been showing ALM data for the past five years. Two years ago, nobody paid much attention to it, so we pushed it back as annexure in our presentations. Now when investors ask for it, I tell myself, ‘Thank God, I did not treat ALM as an annexure to my business model’,” says Jain, 47, who was the CEO of Bajaj Finance for seven years till 2015 and is now the managing director.“Liquidity risk is one of the most important dimensions of running a lending business. Now investors are waking up… in most buckets, my liquidity gap is positive,” Jain tells Forbes India.

Bajaj Finance’s book, as on September 30, 2018, reveals a positive ALM gap of ₹7,202 crore (113 percent) for a month-long cycle. It means the company expects inflows from its assets over that period to be higher than the outflows from its liabilities. Similarly, it is likely to maintain a positive ALM gap across different future maturity time periods, such as 1-2 months, 2-3 months, 3-6 months and up to 12 months.

Effective ALM is key in managing cash flows, whereby a company knows when liabilities have to be paid for. Besides liquidity, in a regime with rising interest rates, prudent ALM practices become that much more important.

Jain’s reason to talk extensively and passionately about Bajaj Finance’s positive ALM gap is justified. After all, it is this factor and a strong focus on innovation and profitability that make it a crown jewel in the financial services conglomerate, which is headed by Rahul Bajaj’s younger son Sanjiv. Sanjiv’s elder brother Rajiv leads Bajaj Auto.

Bajaj Finance now accounts for 72 percent of the consolidated profit of holding company Bajaj Finserv. It is the top lender in consumer electronics, digital and lifestyle products, helping fund one out of four flat screen TV sets in the country. It is present in 1,613 locations across India with over 76,900 distribution points through retailers who sell everything from mobile phones to modular kitchens.

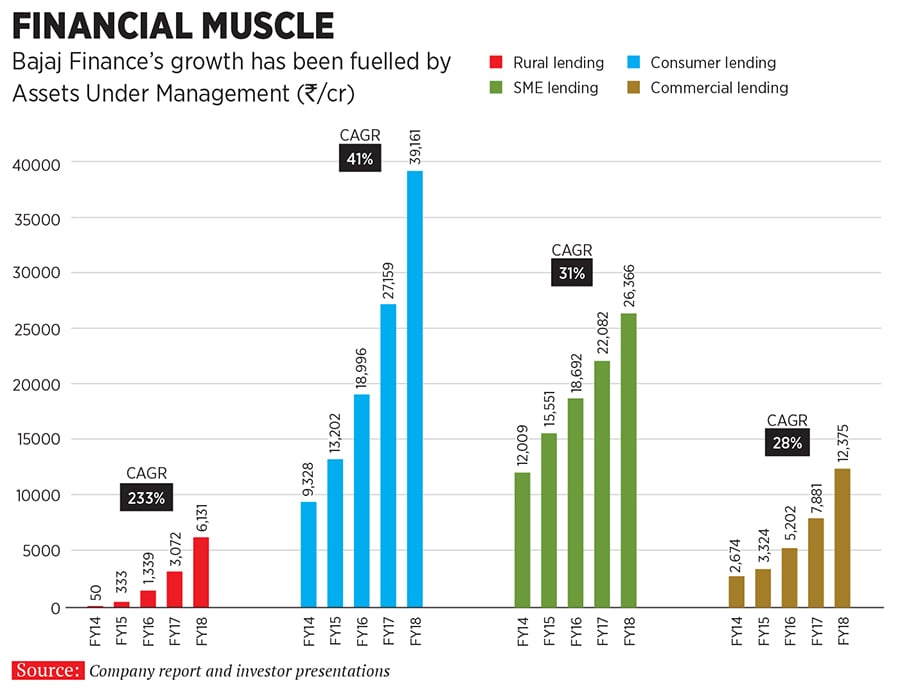

Under Jain’s leadership since September 2007, Bajaj Finance—with a clear strategy to focus on mass-affluent customers and cross-sell its products—has garnered 30.05 million customers to date. Its assets under management which stood at ₹100,217 crore as of September 30, 2018, grew by 38 percent year-on-year.

It has products whose tenors range from one month (for purchase order and retailer finance), three months (retail financing through EMI spends), eight (B2B auto finance) to 12 months (loan against securities), 2-3 years (for two-wheelers, personal loans, unsecured SME) to five years (commercial lending).

Bajaj Housing Finance (BHF), a 100 percent subsidiary of Bajaj Finance, offers products for longer than 15-20 years maturity, through its mortgages business.

Riding The Storm

Diversification across 38 product lines has helped Bajaj Finance keep its head above water in one of the worst liquidity crises that non-banking financial companies (NBFC) and several housing finance companies (HFC) have been facing since August 2018.

In the three months to November 8, stock prices of Indiabulls Housing Finance have fallen by 38 percent to ₹831.9 apiece, L&T Housing Finance’s by 24.5 percent to ₹136.5, Motilal Oswal Financial Services’ by 23.16 percent to ₹701.2, DHFL’s by a hefty 62.5 percent to ₹230.5 and Aditya Birla Capital’s by 28.8 percent to ₹106.6.

In the same period, Bajaj Finance’s stock fell by 20 percent to ₹2,349 at the BSE. Along with Gruh Finance and HDFC, it is among the stocks that have been least battered.

What Bajaj Finance has is a natural hedge due to its diversified portfolio, something that analysts find attractive. “No company would be having 7 percent of its balances as inflows in a given month,” says Jain, who credits his stints as business development manager at GE Capital between 1994 and 1998 and as business head (personal lending) at American Express between 1999 and 2005 for building his professional acumen.

Besides the positive ALM gap, it has a strong parentage and commands an AAA rating—indicating a strong credit worthiness—for its long-term debt from agencies such as Crisil, Icra and CARE.

“A diversified loan book allows flexibility to scale back growth in lower RoA (return on assets) segments, if liquidity stays tight,” research analysts at Jefferies wrote in a note to clients.

“Despite this, loan growth should sustain at over 30 percent in the next two years. We expect modest net interest margin compression, but Bajaj Finance has cost levers too.”

Commenting on the crisis that the sector faces, Jain says: “We have seen in the previous crises of 2008 [due to global slowdown] and 2013 [taper tantrum] that these liquidity events tend to persist for 55-60 days in which time the government or the regulator steps in and fixes the dislocation. I foresee that the repayments confidence in the commercial paper market will come back by November-end.”

Bajaj Finance continues to get access to funding from money markets, banks, retail and corporate depositors. In the first three weeks of October 2018, Bajaj Finance and the housing subsidiary collectively raised over ₹5,395 crore in the money markets and ₹2,900 crore from banks, at rates which are 50-60 basis points higher than prior to the period before the IL&FS crisis.

Bajaj Finance’s cost of funds (COF) remains steady at 8.2 percent as of September 30, 2018—same as much of FY18—compared to around 9.9 percent in FY14 and FY15. However, Jain is aware that in a period where interest rates are on the rise, its COF will climb. For the industry as a whole, Jain expects COF to increase by 100 to 150 basis points over the next 15-18 months.

Innovation Push

One of Jain’s—and Sanjiv Bajaj’s—strategies has been to push its managers to constantly innovate and urge them to think of the business like an entrepreneur, rather than just an employee.

The company’s early brush with innovation came in 2015 with the launch of Experia, the country’s first EMI-finance app, where loans up to ₹3 lakh could be approved in 30 seconds. These EMI cards operate like credit cards but offer customers the option of converting payments into EMIs over a period of 3, 6, 9 or 12 months. There are 15.4 million EMI cards in use, but the company will now issue them as virtual cards, not physical cards, as it did in the past.

Bajaj Finance now offers pre-approved personal loans to its existing customers without asking them to submit any documents. They can log on to the company website to check their pre-approved limit by entering their name and mobile number. They can even be accessed on the Bajaj Finserv wallet, which is powered by MobiKwik. Bajaj Finance and MobiKwik entered into an alliance in mid-2017 to offer a debit and credit wallet. From December 1, 2018, Bajaj Finance will launch the country’s first credit/debit/EMI card, offering various options through one card.While giving insights into his company’s progress, Jain reminds us that he has a Bajaj Finserv internal performance meeting to attend, which would take stock of how the company has been faring in the festive season. He does not reveal numbers, but says, “Each day is important. Two good or bad days can determine the season. But I will say that the GDP numbers reflect the momentum of the economy.”

India’s GDP grew at 8.2 percent in Q1FY19 while the RBI has projected the economy to grow at 8.4 percent for the current fiscal.

Jain points to the fact that growth is evenly spread across segments, with India’s two-wheeler industry growing by 11.5 percent and commercial vehicle sales by 40 percent in the first five months of 2018. Mobile phone sales continue to mount, growing by an estimated 10-11 percent each year. Market research provider Euromonitor International projected sales for 2018 in India to touch ₹1.2 lakh crore.

The biggest challenge for Jain will be preserving a non-tangible element, the company’s work culture. “We are the outcome of a strong culture led by entrepreneurship, no short-term vision, high on ambition and constant innovation. It got us to where we are,” he says.

Apart from fostering a positive culture, in a move to improve operational strategy, the Bajaj Group has now separated leadership for its NBFC and the housing finance arm, BHF. While Jain heads the former, the latter is helmed by Atul Jain, who built the company’s rural business and also managed risk operations and collections at Bajaj Finance earlier. This is reflective of the group’s strategy to run businesses as smaller units.

Nearly a third of Bajaj Finance’s balance sheet is mortgages.

Jain says housing finance companies in India, including BHF, will need to alter some segments of their business models. “If you are into long-term lending, you should be in long-term borrowing,” he explains. HFCs will then need to borrow more through the bond markets and banks.

“I tell the housing finance team that it is great that something like this [the liquidity crunch] has happened. They will now be able to create a durable and sustainable ALM business. Those who emerge from this will be stronger,” says Jain. But this business could take more time to recover. In a scenario where operating margins stand to get squeezed further, he believes housing finance companies will have no option but to raise prices for customers.

New Goal

Bajaj Finance has for more than a decade followed the Sanjiv Bajaj mantra of focusing on profit share, not market share. Jain is now focusing on increasing market share, which he insists is not contrary to the earlier policy. “The aim is to be a dominant non-bank (with a 6 to 8 percent market share in all asset classes) across all lending business. In the retail business, if you are not among the top three companies, you will not have a disproportionate profit pool,” he says.

Competition does not hesitate to accept that Jain has succeeded in building a successful business model. “One of the achievements of Jain has been the ability to achieve steady growth and return on equity and launch newer products each year, over an 11-year period. What is equally remarkable is that the company’s market cap is higher than the loan book size… this is unique when we compare NBFCs in India,” says Dinanath Dubhashi, MD and CEO of L&T Finance. Bajaj Finance’s market cap was about ₹132,068 crore as of November 13 compared to the AUM of around ₹100,217 crore as of Q2FY19.

When Jain had joined the Bajaj Group, he wanted to be heading the most profitable business among the three Bajaj Finserv businesses—Bajaj Finance and the general and life insurance businesses through their tie-up with Allianz. He achieved this with a higher pre-tax profit than the insurance businesses in 2014. In 2016, he told Forbes India that his next goal was to make more profit than both the insurance companies put together. He managed to do that in mid-2017.

Jain has now set his sights on a new goal: To make Bajaj Finance among the top 25 most profitable companies in India in the next five years, from the current 45th. Going by his record, this could well be achievable.

First Published: Nov 22, 2018, 17:47

Subscribe Now