Build 'Contactless Connections' with SBI Card

Contactless payment options by SBI Card allows you to make contactless payments anytime, anywhere & spread #ContactlessKhushiyan

With every unlock, the urge to get closer to your loved ones and do something for them increases. While we are still trying to adapt to the new normal or a rather restricted normal, with connections and communications becoming more virtual, making gestures within the strict parameters of safety have been our biggest concern.

SBI Card understands this and is supportive of its customers in these times through their contactless payment options, that brings them closer to their wishes and loved ones by making a beautiful gesture, with just a simple wave of card or smartphone. Their latest ad film is a beautiful depiction of touching someone’s life and promotes the idea of staying connected, while maintaining social distance.

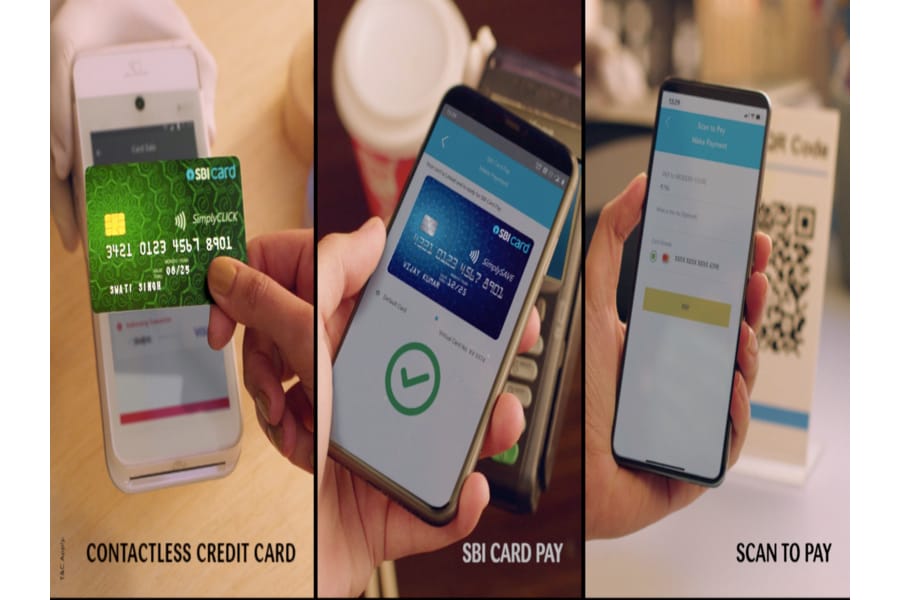

SBI Card provides the opportunity of making secure payments by offering Contactless SBI Credit Card, SBI Card Pay, and Scan to Pay. These payment options are instant, safe and secure. Every transaction is encrypted to keep the card information safe.

Do it the SBI Card way

Contactless SBI Credit Card: With India going the digital way, contactless payments in the times of Covid-19 are the need of the hour. The Contactless SBI Credit Card allow its users to make payments* by just tapping the card on the NFC enabled Point of Sale (POS) machines.

SBI Card Pay: If there is one thing that someone never forgets to carry while stepping out—apart from a mask these days—is a smartphone. The forever companion of every human being these days doubles up as a tool of making easy and secure payments* with the SBI Card Pay option. This option allows the users to make use of their Android smartphone & make easy payments with just a tap on the NFC enabled POS machines.

Scan to Pay: The one payment process which is most chic in today’s times is the scan and pay method. The SBI Card’s Scan to Pay feature helps make payments by scanning the Bharat QR code using a smartphone and experience convenient transactions anytime, anywhere. This feature is accessible through the SBI Card Mobile App where all you need to do is scan the Bharat QR Code at any online/retail merchant, authenticate it with OTP and voila! The payment is done.*Payments up to Rs. 2,000 can be made without entering the PIN. Any transaction above Rs. 2,000 requires the Cardholder to enter the PIN.

Disclaimer: The views, suggestions and opinions expressed here are the sole responsibility of the experts. No Forbes India journalist was involved in the writing and production of this article.

First Published: Oct 20, 2020, 10:34

Subscribe Now