Chris Cline: The last coal tycoon

Dark days ahead for coal? Don't tell that to billionaire Chris Cline, who's convinced the dirtiest fuel still has a bright future and is building what he believes will be the last mine standing

Major miner: Chris Cline stands outside his newly opened Donkin mine on Cape Breton Island in Nova Scotia

Major miner: Chris Cline stands outside his newly opened Donkin mine on Cape Breton Island in Nova Scotia

Image: Jamel Toppin Grooming: Suzana Hallili Using Zirh & Sisley, Paris

The masseuse felt the broken bones and the scars and asked Chris Cline what he did for a living. Cline said he was in the energy business. What kind of energy?, she wondered. Maybe solar panels or windmills? No, not that, he said. You’re not a fracker, are you? No, not that either. Then what? “I own coal mines,” said Cline. Without a word she stopped working on him and left the room. He waited a while, but she didn’t return. Cline won’t name the resort (“I might want to go back there”). And the scars? From his years underground in Appalachian mines, where the coal seams have been worked so thin it’s like “crawling under a table all day”. Cuts on his back from a mine’s ceiling “felt like insect bites”.

Cline, 59, is one of the most archaic and unpopular specimens of capitalist: The coal tycoon. He doesn’t mind people not liking him. He knows that coal fuels 40 percent of the world’s power needs. “People deserve the cheapest energy they can get,” he says. “Tell the poor in India and China that they don’t deserve to have reliable, affordable electricity.”

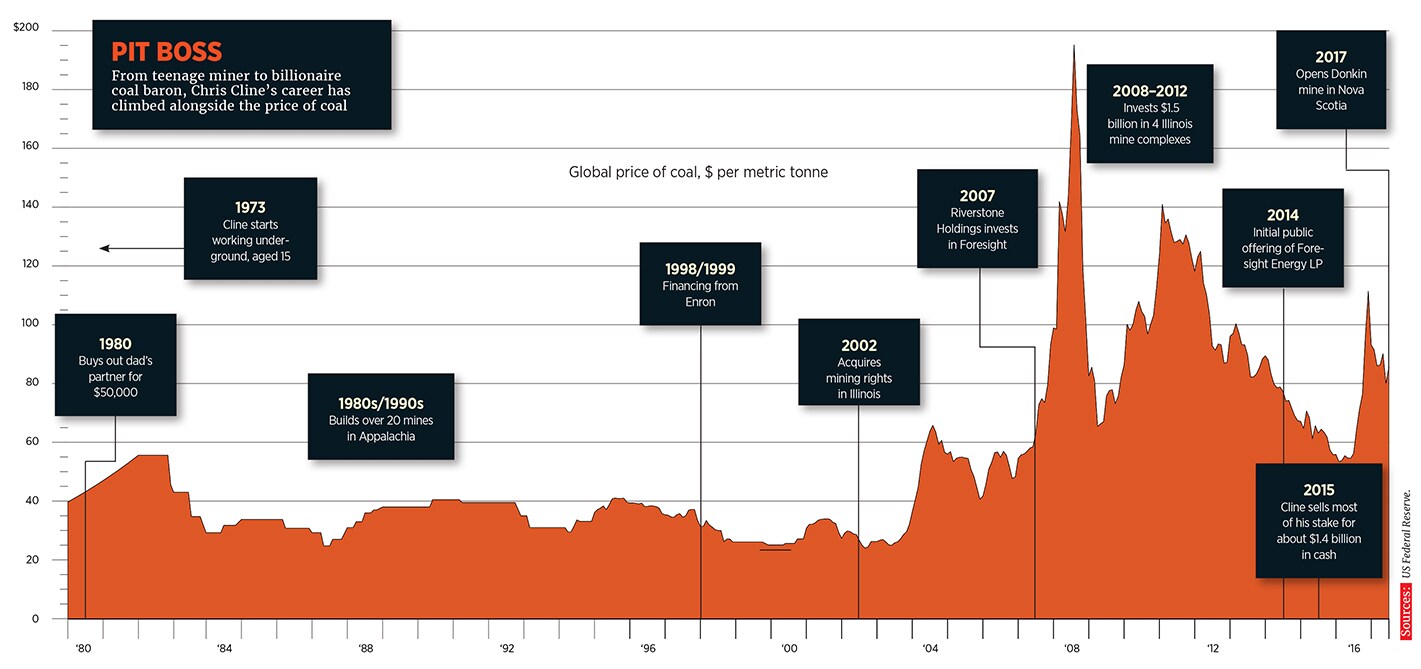

Coal is far from dead. Global demand has dipped because of America’s shale-gas boom and tighter regulations in China, yet it remains 50 percent above its level in 2000, at 7.2 billion tonnes per year, according to the International Energy Agency. Even factoring in a carbon tax of $30 per tonne, coal can compete on price with natural gas and renewables. And Chris Cline, relying on operating efficiencies that he has honed over nearly 40 years of running his own mines, intends to be the last man standing in the industry, supplying low-cost coal from Canada to energy-hungry consumers around the world.  Underground roots: Cline’s father in AppalachiaCline thinks the carbon crusade is folly: “I’m all for getting sulphur and mercury and nitrogen oxide out of the air—that’s common sense”, but ultimately, he posits, “global cooling” will be a bigger threat. (It’s easy to forget that, as recently as the 1970s, fear of a coming ice age was part of the mainstream climate conversation.) Which is why he has no qualms about having built his $2 billion fortune with a series of all-in bets that have taken him from Appalachia to Illinois and now to Canada. He created one of America’s biggest publicly traded coal miners, Foresight Energy, and two years ago, sold most of his interest for nearly $1.4 billion. He’s since sunk $150 million into a new mine in Nova Scotia that may produce 500 million tonnes of high-dollar metallurgical coal by mid-century. And he has permits to develop 1.7 billion tonnes more at the Vista mine in western Canada.

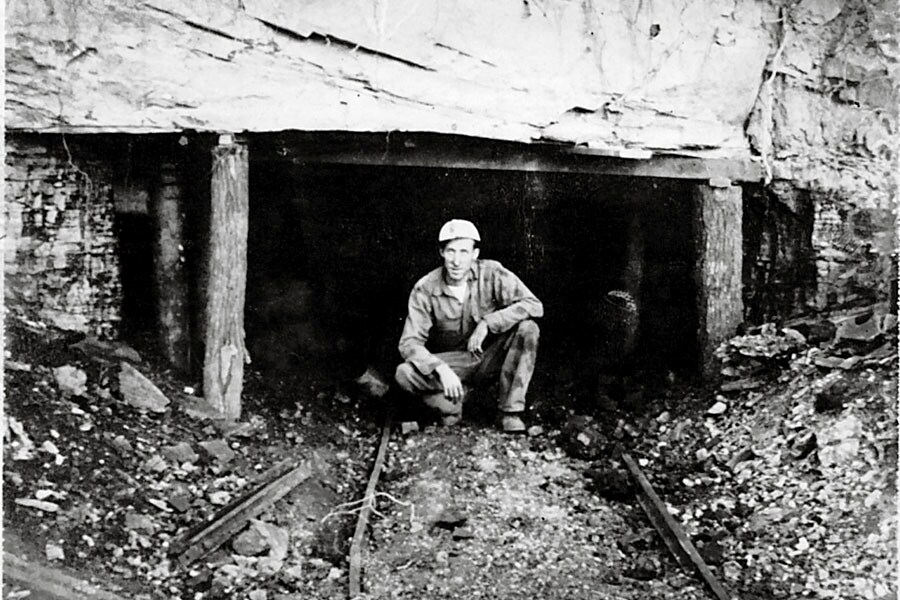

Underground roots: Cline’s father in AppalachiaCline thinks the carbon crusade is folly: “I’m all for getting sulphur and mercury and nitrogen oxide out of the air—that’s common sense”, but ultimately, he posits, “global cooling” will be a bigger threat. (It’s easy to forget that, as recently as the 1970s, fear of a coming ice age was part of the mainstream climate conversation.) Which is why he has no qualms about having built his $2 billion fortune with a series of all-in bets that have taken him from Appalachia to Illinois and now to Canada. He created one of America’s biggest publicly traded coal miners, Foresight Energy, and two years ago, sold most of his interest for nearly $1.4 billion. He’s since sunk $150 million into a new mine in Nova Scotia that may produce 500 million tonnes of high-dollar metallurgical coal by mid-century. And he has permits to develop 1.7 billion tonnes more at the Vista mine in western Canada.

“If you had any idea where I started,” Cline says wistfully. Trim, powerfully built, 5-foot-11, he speaks in a quiet growl from the back of his throat. Cline’s father, Paul, was a contract miner in Beckley, West Virginia he operated rich men’s mines in exchange for a cut of what his team pulled up. When Cline was six, his dad paid him a penny for each little bag he filled with dirt, which would be used to pack explosives into coal seams. When their front porch collapsed, it became clear young Chris had been excavating dirt from under the house. “It taught me the importance of engineering roof supports,” he says. He first went to work underground at the age of 15 the miners would hide him when inspectors came.

Cline’s first, battered hard hat sits above the fireplace in his mansion in Beckley. He created a lake here by damming up the hollow it’s big enough for waterskiing and features a 400-foot waterslide. There’s also a go-kart track and a pasture, where 150-pound Italian sheepdogs keep tabs on livestock—including Fabio, a white stallion. Cline has four kids, now grown. His first wife died of cancer he’s divorced from his second. For four years, he dated Tiger Woods’ ex-wife, Elin Nordegren.

Cline’s gun vault holds more than 50 firearms, including a Magnum .44 and a Gatling gun.

Today he’s armed with a sheaf of papers. There are architectural renderings for his island in the Bahamas and photocopies of old pics. A black-and-white shot shows a young Cline outside the little house where for fun he’d flatten bottle caps under the rails of the coal trains that ran a stone’s throw from the front door. “I’d hitch a ride on a train, hang on for a few miles, then grab one coming back.”

Cline has since upgraded his transportation. He spends 400 hours a year in the air—most of it on his $50 million Embraer Lineage 1000—shuttling between his homes, making due-diligence tours of mines in Australia and Colombia, or hauling a Forbes camera crew to Nova Scotia, where he has been operating the Donkin mine since April. He applies the same philosophy to his planes as he does to his capital equipment: “We buy the best and run it hard.”Underground, 1,000-horsepower mining machines rip the coal face with rotating claws roof bolters hammer steel rods into the ceiling to hold the rock in place. Cline saw early on how much more coal he could produce with reliable equipment. If a vital machine breaks down and needs parts, Cline thinks nothing of sending one of his jets to fetch spares from anywhere on the continent. The math is easy: Every minute his crews are not ripping coal out of the earth equates to hundreds of dollars in lost revenue. And, yes, it’s dangerous. “It used to be brutal,” he says. “We’re trying to get all the hard work out of it.”

In 1980, when Cline was 22, his father had a bypass surgery, and his partner offered $50,000 to buy him out. “My dad was going to do it.” But Cline had no doubt he could work harder and smarter than anyone else. “I said, ‘Why don’t we buy him out?’” And so they did, borrowing every penny. The first two weeks he worked 16-hour days and never saw sunlight—whatever it took to make his payments. With every success he doubled down. His first big success came with Pioneer Fuel, a mine he acquired for $1 million and flipped for $17 million.

He bought a Lamborghini and a 200-foot yacht called Mine Games, but most of the money went back into the Appalachian ground. He implemented worker-friendly innovations like air-conditioned cockpits for mining machines. And he began handing out daily bonuses in the form of dollar coins, based on how many feet of coal a team had mined that day. At year’s end, he’d hand out cheques to cover taxes due. “Those guys would run through a wall for him,” says Andy Fox, an independent mining engineer who first met Cline when Cline pulled up to his office in a red Porsche 928 on the way to the beach and unloaded five bags of coal he needed Fox to analyse.

Still, it’s not enough to be innovative. “You need a little luck,” Cline says. In the late 1990s, he had acquired enough reserves to build six new mines. Enron was big in natural gas and wanted to diversify into coal, especially coal trading. Cline got $85 million in loans and equity from Enron to build three mines. After Enron’s 2001 collapse, he bought back the interests for $13 million, then turned around and sold a similar stake to ArcLight Capital Partners for $151 million. By 2003, he was out of Appalachian coal altogether.

The coal industry had watched intently as the EPA cracked down on emissions of acid-rain ingredients like sulphur dioxide in the early 2000s. The quickest way for many power companies to comply was to stop buying high-sulphur coal (example, from Illinois) in favour of low-sulphur varieties (like those from Wyoming). Panicked holders of high-sulphur reserves just let their leases lapse and walked away.

Through a new company, Foresight Energy, Cline started accumulating 3 billion tonnes of high-sulphur reserves in Illinois for less than 30 cents a tonne, some of it from the likes of Exxon Mobil. What did Cline know that they didn’t? He believed in technology and was encouraged by power-plant innovations like scrubber systems that capture toxins before they go up the smokestack, enabling them to keep right on burning high-sulphur coal. Plus, he was used to making money on mines with seams just 3 feet thick. Those Illinois seams were 6 feet or thicker.  Empty lockers: Cline hoped to create 200 mining jobs for distressed Nova Scotia. After layoffs, there are now only 81 at the Donkin mine

Empty lockers: Cline hoped to create 200 mining jobs for distressed Nova Scotia. After layoffs, there are now only 81 at the Donkin mine

Image: Jamel Toppin Grooming: Suzana Hallili Using Zirh & Sisley, Paris“I didn’t see it as a huge risk,” Cline says. He took on private-equity capital on one condition: No second-guessing. “He didn’t want to be tinkered with,” says Bartow Jones, a partner at Riverstone Holdings, which invested $600 million between 2007 and 2008. Not only did they acquiesce, Jones says, “we insisted on it”. Cline put $2 billion into four mine complexes, which soon became the most productive underground operations in the nation, averaging 13 tonnes per man-hour at costs of $23 per tonne with output of 20 million tonnes per year.

Cline had created a market for high-sulphur Illinois coal. “Coal is not a commodity,” Jones says. “You can’t just shove it into a pipeline like natural gas.” Cline swayed power plants to his coal by paying for their sulphur-catching upgrades out of his own pocket. He acquired docks on the Mississippi and built rail spurs to load coal from 100-car trains directly onto ships bound for India and Europe. Cline needed an exit for his investors. In early 2014, Foresight held an IPO and hit a market cap of $2.5 billion. By early 2015, Riverstone had exited, having nearly doubled its money at a time when many coal giants like Peabody Energy and Alpha Natural Resources were headed toward bankruptcy. Foresight’s relative soundness made it an attractive target for Robert Murray, a 77-year-old coal magnate whose privately held Murray Energy paid Cline a little less than $1.4 billion cash in 2015 for most of Cline’s Foresight stake. The two coal barons had been at odds for years in Illinois, blocking each other via strategic land purchases. Cline stepped down from the Foresight board of directors last March, though he still owns 2 billion tonnes of Illinois reserves, a slug of Foresight bonds and around 29 percent of Foresight shares—which have traded down 75 percent since the Murray deal.

In 2010, as Foresight was hitting its stride, Cline was hungry for something new. He formed a company called Gogebic Taconite that tried to get permits for a Wisconsin iron ore mine on the shores of Lake Superior. But in 2013 the plan ran afoul of the Bad River Band of the Lake Superior Tribe of Chippewa Indians, who farm wild rice in the area. Cline cancelled the plans, he says, because of low iron prices. “It will be mined someday.”

Canada was more hospitable. On the day of Foresight’s IPO in 2014, Cline rang the bell on the floor of the New York Stock Exchange, then hopped on his plane and three hours later landed in Nova Scotia to go down into a mothballed mine shaft on the eastern tip of Cape Breton, in a town called Donkin. He was drawn to the huge 12-foot-thick seam and the coal’s high energy content, which at 14,000 British thermal units per tonne can be readily turned into high-value coke for steelmaking.

The Donkin Project was a Hail Mary by the Canadian government to prop up a dying industry it spent $50 million in the 1980s to bore twin tunnels 2 miles out under the Atlantic Ocean to tap a massive 500 million tonne coal bed. By the time the shafts were cut in the late 1980s, benchmark coal prices had dropped. When 26 miners died in a 1992 explosion at Nova Scotia’s Westray mine, it seemed like the end of the industry. But time—and higher commodity prices—heals all wounds. And Donkin was the perfect size for Cline, who bought 75 percent of it in late 2014 for an estimated $20 million (he’d snap up the remaining 25 percent the following year).

Since then, ten of Cline’s old Foresight lieutenants have jumped to Donkin, where they’ve overseen $150 million of investments. Legendary coal trader Ernie Thrasher is Cline’s partner on the logistics side. He says Donkin’s location, nearly halfway across the Atlantic, makes shipping costs to Rotterdam at least 30 percent ($5 per tonne) less than they would be from central Appalachia. The best coking coal fetches more than $200 a tonne today. The simplest way to sum up Cline, according to Thrasher: “He sees value in assets others overlook.”

Environmental opposition in economically depressed Nova Scotia is restrained. “Even those protesting the trucks know the coal is a good thing for the community,” says Paul Carrigan of the Port of Sydney Development Corp. European settlers mined the first coal here 300 years ago. Through the 1970s mining and steelmaking thrived, employing 20,000 before competition from the likes of China wiped it all out. There’s talk of using some of Donkin’s output to fuel Nova Scotia’s remaining coal plants. With plentiful wind and hydropower, Nova Scotia is well within Canada’s emissions standards.

Even First Nations peoples, like the Mi’kmaq, have been placated with jobs and a royalty on every tonne. The mining jobs, paying $100,000 a year, are “an economic lifeline”, says Geoff MacLellan, a rep in the Nova Scotia legislature. But how many jobs will there be? At first, Cline had said 200. But in early November, the mine laid off 49 of 130 workers. Just a bump at the start of a long road, Cline says. He has no equity partners or outside financing on Donkin. Once the mine is rocking and rolling, within ten years it could be generating $500 million in annual revenues and putting $100 million in cash into Cline’s pocket.

Is there anything that keeps Chris Cline up at night? “Sago,” he says, the name of a West Virginia mine then owned by International Coal Group where in 2006 a methane explosion killed a dozen miners. Then in 2010 came the disaster at Massey Energy’s Upper Big Branch Mine, also in West Virginia, where 29 died. Cline had nothing to do with either incident, though over the years four workers have died in his mines, including his best friend. There are other risks. The Illinois attorney general sued and settled with Foresight for just $300,000 (plus $6.9 million in mine “retirement obligations”) over the pollution of groundwater with toxic coal slurry. Lisa Salinas, a critic of Cline who owns a farm 100 yards from an unlined slurry pond in Carlinville, thinks the settlement is a joke because it “calls for little to no valid mitigation of the existing pollution and, in fact, only encourages more damage”. A Foresight mine near Hillsboro, Illinois, has been shut since 2015 because of a dwindling coal fire.

Cline is amused by the popular misconception that coal is on its deathbed. Yes, coal-fired power plants do continue to close, and US coal output, currently 700 million tonnes a year, is down by 30 percent from its peak. And yet, the US still relies on coal for 30 percent of its electric power, compared with just 7 percent for wind and solar combined. Worldwide demand for coal continues to grow. Policy and technology are the wild cards Paul McConnell at energy consultancy Wood Mackenzie figures that advances in solar and battery technology plus worldwide carbon taxes have the potential to erode coal demand by 8 percent a year.

But the death of coal—if it comes at all—will be long and slow. Cline aims for his next project, in Alberta, to be a survivor. He acquired the Vista project via his takeover of the Toronto-listed company Coalspur in 2015 for an estimated $75 million. The seam is 70 feet thick on the surface, so Cline will build Vista as a pit mine, then go underground to tap 1.7 billion tonnes. By 2022, it could be doing 10 million tonnes per year. Cline’s Illinois mines took business away from Appalachia. His Canadian projects will take business away from Illinois. “I think [Vista] could be the last mine operating after they’ve shut down all the rest of the coal in the world,” he says.

Cline plans to enjoy the rising sea levels in splendour. He recently acquired Big Grand Cay, a 280-acre archipelago in the Bahamas that used to be owned by Bob Abplanalp, inventor of the aerosol spray can. On his iPad, Cline scrolls through plans for a serene resort amid azure waters and non-judgemental massage therapists. It’s too expensive even for this billionaire to haul in enough diesel to keep the generators running, so he’s installing solar panels and researching Tesla batteries, and has three wind turbines on order. “Where it makes sense,” Cline says, “I’m absolutely for it.”

First Published: Jan 24, 2018, 08:17

Subscribe Now