How Francis Holder baked a billion by cornering the Macaron market

Holder realised that American mechanical production and traditional French techniques were the right ingredients to build a bread-and-pastry empire

Loaves and wishes: Holder plans to create a baking museum in Paris with his collection of paintings and books on the subject

Image: Philip Jintes for Forbes

At his pastry factory in Lille, France, where the air smells like chocolate, Francis Holder is wearing a white baker’s coat, his name embroidered on the front, over a tailored blue suit and red-striped tie. Paintings dating back centuries cover the three walls of his office. One is a portrait of a young baker wearing a stained coat and a floppy toque. Another depicts a dog chewing on a baguette. One more shows a hand coming out of the shadows to steal a loaf, an apparent homage to Jean Valjean’s petty crime in Les Misérables. There’s not a famous artist to be found in his 8,000-work collection. The only requirement is that each painting must focus on Holder’s billion-dollar passion, baking, or his favorite obsession, bread.

The fourth wall is made of glass so Holder can stare across the hall at the research-and-development centre for Château Blanc, the industrial arm of Groupe Holder, the private baking conglomerate he founded and controls. The 77-year-old loves to spend his days watching over the experimental bakeshop’s seven mixers and three countertops, checking in with the chefs throughout the day to sample the test runs. “We are industrialists with the mentality of craftsmen,” Holder says.

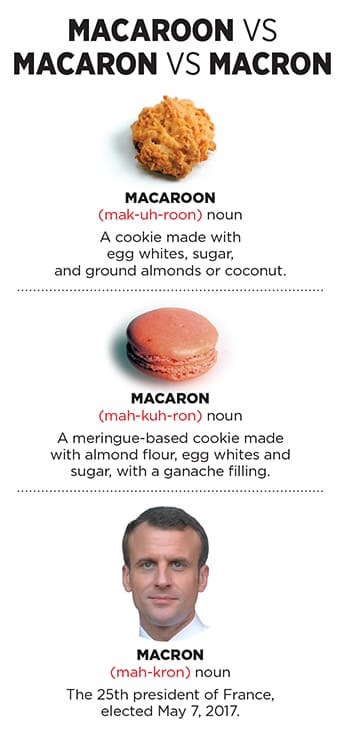

Just down the hall, past dozens of office employees all wearing matching white baker’s coats, is the heart of Château Blanc’s 100,000-square-foot factory, which now makes the company’s most craved product, the macaron. The heart of Holder’s masterful assembly-line operation is a machine with a conveyor belt the length of two football fields that bakes more than 30,000 meringue macaron shells an hour.

Château Blanc’s headquarters—which, as its name implies, is painted white and modeled after a castle—fulfills a boyhood ambition Holder had growing up in Lille. And then some. His original dream was to have a small bread factory with “a chimney with smoke coming out of it.” Since then, Holder has spent six decades perfecting the marriage of industrialisation with artisanal baked goods. Long obsessed with America’s industrial food processes, Holder embraces smooth mass production, and that has propelled his rise. But he balances affordability and speed with a distinctly French attitude about the best ingredients and product quality—still using fresh yellow butter in mass-produced loaves and pastries. “He’s so improved the industrial applications,” says Steven Kaplan, who has spent five decades researching French bread at Cornell University and has worked with Holder as a consultant for Château Blanc. “He’s modeled the industrial by the artisanal mold. It’s through the methodology which he knows like the back of his hand.” Image: Donato Sardella / Getty Images Groupe Holder has three main subsidiaries: Aside from Lille-based Château Blanc, there is the renowned Parisian macaron maison Ladurée, which has 85 shops in 50 countries, and the artisanal bakery-cafe chain Paul with 740 stores in 43 countries. Groupe Holder’s yearly revenue is about $1 billion, and Forbes estimates net profit margins of 14 percent—more than double those of bakery-cafe chain Panera Bread before it acquired Au Bon Pain in 2017. And all that dough has made Holder a billionaire—the 1,867th wealthiest person in the world, with a net worth of $1.2 billion.

Image: Donato Sardella / Getty Images Groupe Holder has three main subsidiaries: Aside from Lille-based Château Blanc, there is the renowned Parisian macaron maison Ladurée, which has 85 shops in 50 countries, and the artisanal bakery-cafe chain Paul with 740 stores in 43 countries. Groupe Holder’s yearly revenue is about $1 billion, and Forbes estimates net profit margins of 14 percent—more than double those of bakery-cafe chain Panera Bread before it acquired Au Bon Pain in 2017. And all that dough has made Holder a billionaire—the 1,867th wealthiest person in the world, with a net worth of $1.2 billion.

“If tomorrow I was 10 times richer, it would not make any difference for me,” says Holder, who declines to comment on his net worth and profits.

That modesty, however, didn’t stop him from embracing the astronomical rise of the macaron—the petite saucers sandwiched together with jelly or ganache fillings. In 1993 he purchased Ladurée, a chic Paris restaurant founded in 1862 that invented the modern macaron and has since collaborated with major fashion houses ranging from Lanvin in 2012 (bubble-gum-flavoured) to Emilio Pucci in 2015 (tangerine-lemon-lavender macarons inside a box wrapped in the company’s signature silk print, Capri), as well as rapper Pharrell Williams in 2014 (peanut butter and another that’s cola-flavoured) and performance artist Marina Abramović in 2017 (Prussian blue and edible gold leaf, stamped with the Abramović family’s coat of arms).

And just as Ladurée produces more than macarons, the cookie has expanded far beyond Ladurée—and Holder is to thank (or blame) for that. Today, he estimates, 60 percent of Groupe Holder’s in-store sales come from macarons. Holder is responsible for France’s top three macaron sellers: Ladurée, Paul and, surprisingly, McDonald’s. McDonald’s McCafé macarons are sold in many countries outside France, including Spain, Italy and Belgium, as well as in Japan.

“Some were surprised about McDonald’s being third,” Holder says. “We said, ‘That’s obvious. We are the one who delivers them.’ Because McDonald’s is really loyal, this baker has factories throughout the world.”

*****

Francis Holder took over his family’s small bakery, below the apartment where he had grown up, when he was 18, after his father, who was abandoned as a child and raised in foster care, died of a heart attack at 51. From there, his ascent can be divided into three distinct phases: Creating a bread factory, building the Paul bakery brand and then melding the two to bring artisanal bread to the masses.  A slice of the business: Holder’s three children each have a domain in Groupe Holder, including the Paul bakery brand and the Ladurée bakery

A slice of the business: Holder’s three children each have a domain in Groupe Holder, including the Paul bakery brand and the Ladurée bakery

Image: Philip Jintes for Forbes

The first starts in 1961, when Holder came back from a brief tour of duty in the Algerian War (with a popped eardrum that left him partially deaf) and found that the way people shopped had drastically changed—mom-and-pop boulangeries had given way to supermarkets. Holder realised where the future lay and within five years persuaded two future multibillion-dollar French supermarket chains—Monoprix and Auchan—to carry his baguettes and loaves.

While he clearly had the ambition, Holder was ill-prepared to manage such a fast-growing company. He had to move factories three times in a year because the company continually outgrew its space. “I never made projections about what it would be in 10, 20 or 30 years,” says Holder, who kept the books himself back then.

Then, in the 1970s, the supermarkets—locked in hypercompetition—began demanding bigger and bigger discounts. His 11 percent discount soon became 45 percent. He also had to buy back unsold bread at the end of the day. Holder’s factory fell below break-even, and he realised he had to diversify beyond the commodity bread business. He reorganised the factory to keep its existing customers, producing about 1 million pounds of bread a month, but he no longer invested in expanding it. During moneylosing periods, he converted areas of the factory into parking spaces and sold them by the month. Over the years, he learned to renegotiate contracts to protect future profits by locking in prices, and he stopped taking back unsold loaves.

With the low-margin industrial bread operations stuck in neutral, Holder refocussed on the Paul bakery, under the family apartment. “I still had nostalgia for craftsmanship,” he explains. Paul was selling thick, chewy, yellow bread with a slight hazelnut taste—drastically different from his factory bread—at a time when the number of local bakeries in France had dwindled by about 25 percent amid competition from supermarkets. He decided to make Paul an artisanal chain and installed himself as head of the company. Holder opened two more stores in Lille before expanding to Paris in 1974. Then came shopping malls: As with supermarkets, Holder was early to the next wave of mass retail. Around the same time he toured the United States and became enamoured of American food-processing methods. Holder helped found a successful chain of French bakeries and cafes, La Madeleine, before being ousted by his partners and returning to France.

By the end of the 1980s, Paul had 120 shops, about a dozen times more than at the start of the decade. Holder’s experience left him better prepared for growth this time. To cope with high rents, he opened small retail locations without full kitchens and supplied them from a centralised bakery, delivering fresh loaves three times a day. That way, he avoided having to prebake or freeze bread—common among Holder’s competitors, like Louis Le Duff (No. 822 on the Billionaires list, worth $2.9 billion).

With the Paul brand thriving—so much so that the head of McDonald’s Europe tried to acquire it, with plans to increase growth from 80 openings a year to 2,500—Holder was ready to go back to building the bread factory of his dreams, but with an important twist. “Some companies are interested in producing a lot, without quality,” he says. “Moving away from the craft was never a question.”

Building on what he learned in America, he spent millions on designing customised machines that would assemble the products the same way a baker would by hand. For croissants, the machine rolls out dough and spreads butter onto each piece. The layers are then stacked to make the flaky pastry. But these assembly lines don’t change the amount of time the dough needs to set (especially necessary for breads that ferment with yeast) and cook. That was an important lesson from Holder’s days baking with his father most food companies have scaled up quickly by adding preservatives or chemicals that cut the length of time and increase production without adding storage demand.

*****

Though macarons mint money for his company, Holder says he still doesn’t really enjoy eating them. “I love flaky pastries,” he says with a shrug. His fortuitous foray into pastel cookies began 25 years ago when he purchased Ladurée, the 19th-century Parisian tea salon known for its gilded dining room and pastel ceiling frescoes. The Holders were Saturday regulars, snacking on tea sandwiches and mushroom omelettes. “I wasn’t going to Ladurée for their macarons,” he admits. But he sure loved the baba au rhum pastry, despite not drinking alcohol. So when Ladurée’s heirs wanted to cash out, Holder was the first person they asked.

At the time, he was in the market for a diversion. When he turned 51—the age his father died—he begged his oldest son, David, to apprentice in case he should die. David accepted and spent the next two years working 15-hour days and losing 15 pounds. When he emerged from his apprenticeship, David started pushing his father to retire. And Francis realised that acquiring Ladurée, and sidelining David to run it, gave Francis more time for Paul and Château Blanc.Going from brunch regular to boss, 25-year-old David supplemented Ladurée’s four flavours of macarons with a seasonal menu, including passion fruit and salted caramel. In 1997, Ladurée opened a 14,000-square-foot flagship on the Champs-Élysées. The first international location opened in 2005 at Harrod’s in London, followed by Tokyo and the US two years later.

The more ubiquitous the macaron became, the more David faced a knockoff problem. He responded by positioning Ladurée as a bakery-inspired luxury lifestyle brand with a product line that included $65 candles (the first scent was brioche), $75 fragrances with atomisers and $20 boxes of teas.

While Ladurée took the high ground, Francis saw the macaron’s mass-market potential and grew bullish on the cookie. “It wasn’t a trend at all,” he recalls. “Then we said to ourselves, ‘Why don’t we make macarons in Paul bakeries and elsewhere?’ From that point, it became huge”—literally and metaphorically. One petite macaron, about an inch wide, costs about $3. Paul locations in France started selling larger macarons in 2005, and international stores adopted them soon after. Château Blanc had gone all in by 2007, when it built the automated macaron production line in Lille, the first in the world. It was just in time for McDonald’s in France to launch its McCafé version the next year. Today’s Château Blanc macarons are in more than 300 McDonald’s in Europe. Then came similar white-label offerings for American customers—such as a limited-edition run at Starbucks and a line at Sam’s Club.

The gamble paid off. Over the past decade, the macaron has replaced the cupcake as the pastry du jour in America, where there are nine Ladurée locations (run by Holder’s 45-year-old daughter, Elisabeth, from New York) and 12 Paul shops (overseen by Paul International’s head, 48-year-old son Maxime, from London). Under Maxime, Paul has added over 250 stores outside France.

And despite more than 60 years as a baker, Holder remains hungry. He dreams of opening a Château Blanc factory in the United States, where he hopes to replicate his success in Europe. “In France, people tend to forget that when we become successful, it is because we are brave,” Holder says of his all-American ambition. “In the United States, someone who takes risks and succeeds is a hero.”

First Published: Apr 13, 2018, 16:05

Subscribe Now