4 Mutual funds that outperformed the markets

Four money managers handhold us through the volatile markets

A Bottom-Up Approach

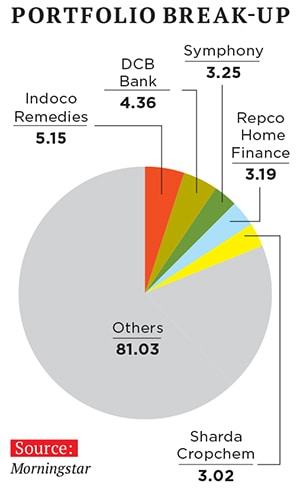

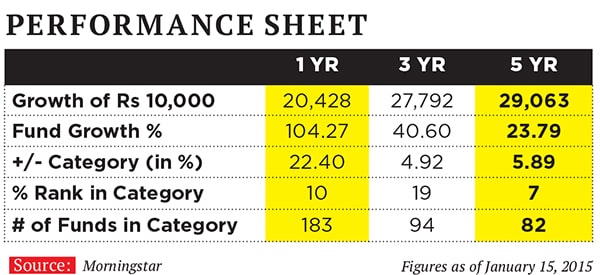

With returns of around 104 percent last year, DSP BlackRock Micro Cap fund, managed by Vinit Sambre, is a favourite with investors. The fund remains consistent in its philosophy of finding small companies to invest in. Sambre talks about investing in small cap companies. Excerpts from the interview:

Q. As the size of your fund grows, how is your investment philosophy changing?

The core investment philosophy remains the same, which is bottom-up stock selection with a focus on high quality management, sound business prospects, superior ROCE, strong cash flows, good dividend payment track record, etc. We also look at some cyclical businesses, which are at the cusp of turnaround, where ROCEs are slated to move up in the forseeable future.  Q. The number of stocks in your portfolio is around 60 today. Won’t that dilute returns?

Q. The number of stocks in your portfolio is around 60 today. Won’t that dilute returns?

The focus is to identify strong businesses that, we believe, have the potential to outperform over the medium to long term. Our belief is that this strategy could work well over a period. On the number of stocks, it will be worth appreciating that the mandate of the fund is to invest in micro cap companies (companies beyond the top 300 by way of market capitalisation). An increase in fund size brings with it the challenge of owning large weight in the micro cap category. Hence, the number of stocks is bound to increase. But our core philosophy will remain the same.

Q. Micro caps look fairly valued. Some of your top holdings have already given high returns. What are the macro factors still working in favour of these companies?

The valuation of micro cap companies has gone up quite significantly. We believe that the returns will depend on the ability of each of these companies to consistently deliver good performances. With the expectation of an uptick in the economic cycle, given the government focus on reforms coupled with declining interest rates, we remain confident about the ability of these companies to keep performing well. Against this backdrop, we hold a positive view on our invested companies. There can be periods of consolidation in the market on account of global factors or near-term earnings pressure but the longer term outlook looks promising. Q. Is micro cap investing a sustainable long term strategy?

Q. Is micro cap investing a sustainable long term strategy?

To the extent one is following a proper investment philosophy and disciplined approach, we feel it is a good strategy. In a bull market, we have observed that small and micro caps generally outperform large caps. To capture the possible outperformance, one may look at higher allocation towards this category, again matching each individual’s risk profile.

Compact And Concentrated

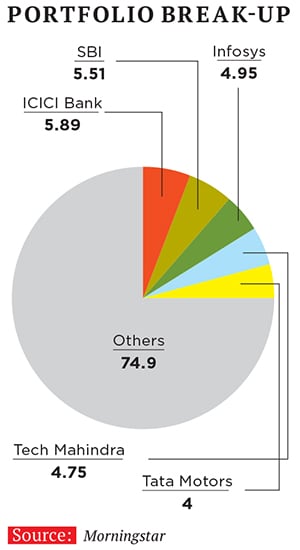

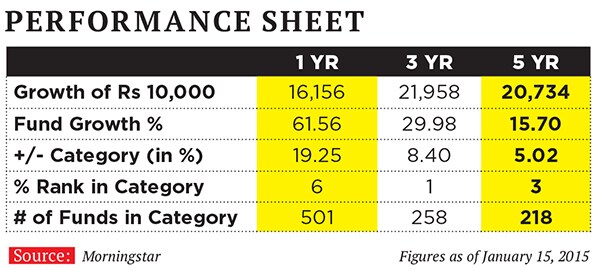

The Kotak Select Focus mutual fund has emerged as one of the leading funds in recent times. CIO-Equity of Kotak Mutual Fund Harsha Upadhyay, who took over that role only three years ago, discusses the decisions that worked for him in 2013 and 2014. Excerpts:

Q. You have been in this role for almost three years. How did you change the portfolio of Kotak Select Focus mutual fund?

The mandate of the fund is to take concentrated bets on sectors, based on top-down investment approach. The same approach continues to be followed. However, the overall investment focus has been sharpened further. When I came in, there were 60-plus stocks in the portfolio. We brought the number down to 45. We wanted to make it a more compact portfolio, and take meaningful bets. We also brought in another positive change in the form of long-term investment approach. The portfolio turnover ratio of the fund was in excess of 200 percent in the past, which we reduced to less than 50 percent. This meant that we got the average holding period up from less than six months to over two years. Overall, the conviction bets in the fund have gone up significantly. Q. You went in for high beta (volatility) stocks.

Q. You went in for high beta (volatility) stocks.

We did not make a high beta portfolio by design. It was more of a byproduct. In early 2013, the current account deficit started to expand and the rupee was volatile. In mid-2013, the rupee depreciated sharply. In the run-up to that event, we were focusing on investing in export-oriented sectors, including IT and pharma, which brought down the portfolio beta. The selection of the sectors was based on the macro environment and in line with the mandated top-down investment approach. In 2014, we were focusing on the recovery in the domestic market and gradually reduced exposure to export-oriented and low beta sectors. Portfolio beta went up comparatively due to this. We are not judging a company or a sector based on its beta. The changed portfolio beta is merely an outcome based on our portfolio actions.

Q. Your fund’s biggest bets are on banking and auto, which are interest rate-sensitive. Hasn’t the market factored in the interest rate cut?

In our opinion, the rate cuts are not fully factored in the stock prices. First, we have just seen one rate cut. Only now could there be a lag effect that will result in demand pickup and better profitability. When economic cycles turn, they last for longer time periods and not just a few months or quarters. The business fundamentals of any industry don’t change suddenly. We are betting on the next cycle and feel that there is a lot of growth to be expected. Q. What were the decisions that you got right?

Q. What were the decisions that you got right?

We benefited from both sector allocation and stock selection calls. If you look at the last one year, we took calls on the auto sector and the cement sector. These two have outperformed the market.

Also, the oil and gas sector call that we took before the Lok Sabha election results in May 2014 helped us because diesel got deregulated.

In the last quarter of 2014, we moved to an overweight stance on banking, which has also added to performance since then. In addition, we also benefited from our absence in some of the large underperforming sectors such as utilities, metals and telecom.

Research And Analyse

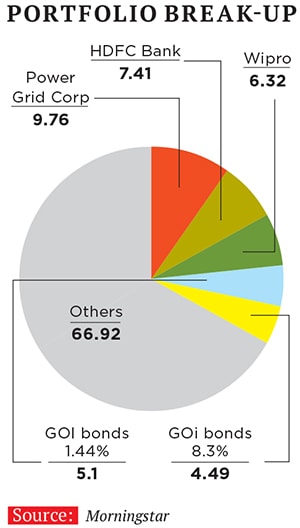

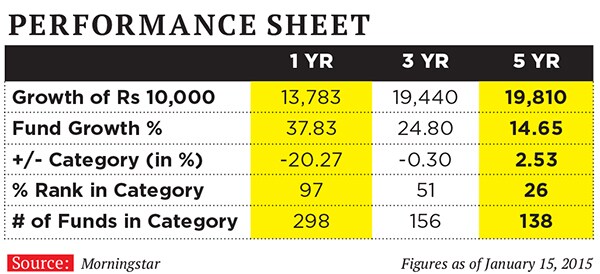

ICICI Prudential Dynamic fund is a leading equity diversified fund. S Naren, CIO of ICICI Prudential Mutual Fund, talks about his bets on fixed income and the fund’s challenges. Excerpts:

Q. You have placed a huge bet on government securities. But if we consider that long-term debt has given a return of 20 percent over the last year and might have discounted, say, around two interest rate cuts in bond prices, how will it perform over the next two years?

India’s current account deficit has corrected and inflation numbers have come down making way for potential interest rate declines. Further, the falling crude prices are yet another factor benefiting the fixed income market. Therefore, it is a very attractive time to bet on fixed income in 2015. Q. You have taken concentrated bets in the Dynamic fund. Be it Bharti and later on Cairn Energy, they have all worked. What are the central aspects of stocks that become big bet candidates?

Q. You have taken concentrated bets in the Dynamic fund. Be it Bharti and later on Cairn Energy, they have all worked. What are the central aspects of stocks that become big bet candidates?

For stock selection, both the macro- and bottom-up factors are taken into consideration. Deep fundamental research is conducted to identify its value if there is a long term view on the stock. The fund gradually builds/brings down a sector or stock skew based on the relative valuation or contrarian view. If there is a negative view about the company, we conduct a thorough analysis of the thought process of sellers before taking a contra-call. We also look for companies with temporary difficulties but having growth potential.

Q. What were the decisions that worked for you in 2013 and 2014?

In 2013, the rupee hit a record low because of factors like high fiscal deficit, current account deficit and sluggish growth. To add to the woes, the US Fed tapering weakened the global outlook. Based on the macro view, we were overweight on export-oriented and global commodity sectors that benefit from currency depreciation. Leveraging on the 2014 economic revival, we inclined our portfolios towards mid- and small caps and domestic cyclical sectors. With macro-economic indicators on an improving trend, this call has played out well.

Q. What are the big challenges for the next year? What if low oil prices mean low growth for the world economy? Should we be worried?

In the near term, the fall in crude prices has created instability at the macro-economic level in countries like Russia and Brazil. The correction in the market is the collateral impact of the current situation in these countries. But the long term story for India looks robust. In the light of declining crude prices and good growth prospects, India is the most attractive emerging market in the world. Correction due to global cues is an opportunity for people to invest now and spread their investments over six to nine months for a long-term [play] in Indian equities. Q. In the software segment, you are invested in one of the underdogs. Isn’t it better to be with the leaders?

Q. In the software segment, you are invested in one of the underdogs. Isn’t it better to be with the leaders?

Two things that we are very positive about, with a three-year view, are India as an economy and the US dollar as a currency. Companies that are export-oriented are more likely to benefit. The recent correction in technology offers an opportunity to invest. We are well-invested across the sector on the basis of relative valuation in companies having strong growth potential.

Large And Lively

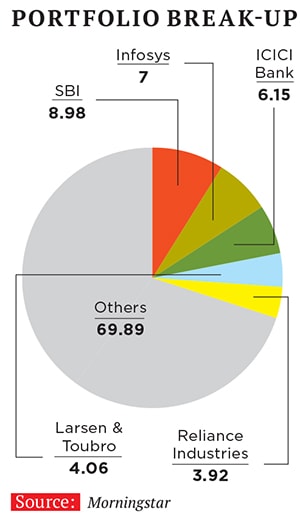

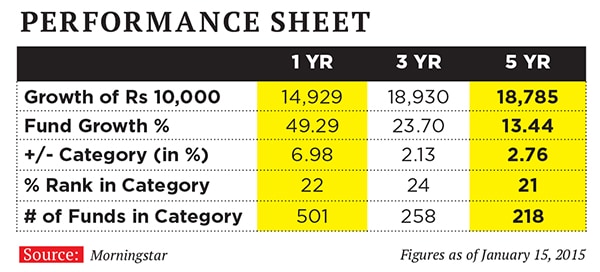

Prashant Jain, executive director and chief investment officer at HDFC Mutual Fund, manages HDFC Top 200 and HDFC Equity fund with assets worth Rs 14,000 crore and Rs 18,000 crore, respectively. These are the biggest equity funds in the country.

The Top 200 fund was not in its best form between 2011 and 2013. Investors started questioning the fund’s philosophy as returns dwindled but Jain wanted them to give him a little more time. Those who did managed to reap the benefits. For 2014, HDFC Top 200 delivered a return of 46 percent making it one of the best funds in the large cap category. Delivering high returns on a big portfolio is not easy. These funds may charge relatively lower fees but impose several restrictions on investing. The size of the fund does not allow the fund manager to venture into stocks that are not liquid or cannot be sold quickly. Despite these, Prashant Jain has managed to give high returns over the long term. Forbes India spoke to Jain about his challenges of managing a big fund. Excerpts from the interview: Q. HDFC Top 200 is back with a strong performance. What really worked for you over the last two years?

Q. HDFC Top 200 is back with a strong performance. What really worked for you over the last two years?

HDFC Mutual Fund has followed a consistent approach to managing investments over the years. Focus on quality, good understanding of underlying investments, emphasis on valuations and diversification have been the cornerstones of the investment philosophy. This approach has worked well most of the time but sometimes, in extreme market conditions, it may not for short periods.

Tapering (US Fed) fears and its aftermath impacted performance temporarily in 2013. As such concerns receded and normalcy returned, performance has recovered. In summary, nothing has changed at the fund. Specifically, overweight positions in banking, oil companies and select pharmaceuticals companies and underweight positions in FMCG companies have helped in 2014.

Finally, a one-year timeframe is not sufficient to judge the performance of an equity fund. Equities are a long-term asset class, with cycles of typically 5-10 years therefore, three-, five- and 10-year periods for performance measurement are more appropriate than one- or two-year periods.

Q. The fund has been consistently performing for almost two decades. But in most bull rallies, it has played a muted role. This is the first time that the fund has done exceedingly well when the markets are at a P/E of 19.

The fund has outperformed its benchmark in 16 out of 19 calendar years—across bullish and bearish market conditions and across three equity market cycles. It is one of the select few funds in the country to have done so. It would thus be fair to say HDFC Top 200 Fund has added value in both good and in not-so-good times: Rs 10,000 invested in the fund at its inception in October 1996 is today approximately Rs 4,20,544 versus approximately Rs 1,09,332 for the benchmark (CAGR of 22.76 percent versus 14.02 percent all figures as of December 31, 2014).

However, it is true that in the last phase of the 2003-2007 bull market, which was characterised by excessive market conditions and high P/E multiples, the fund underperformed its benchmark. In line with HDFC Mutual Fund’s approach of investing in quality and sustainable businesses at reasonable valuations, HDFC Top 200 avoided exposure to real estate, greenfield power, etc, sectors that led the markets in 2007. While this impacted performance temporarily in 2007, the rewards were very good when the markets turned.

Tolerating temporary underperformance is a price that a disciplined investor has to occasionally pay. But the rewards over the long term more than compensate for the short term pain.

Interestingly, what I said in the context of the HDFC Top 200 Fund is true for almost all our equity funds. This has been possible because of a grounded and long-term approach to investments. Q. Since it has been a bull run where many of the stocks that have moved up are cyclical in nature, funds with high betas have done exceedingly well. HDFC Top 200 has a beta of 1.2. How will you change the portfolio of this fund if the market becomes flat?

Q. Since it has been a bull run where many of the stocks that have moved up are cyclical in nature, funds with high betas have done exceedingly well. HDFC Top 200 has a beta of 1.2. How will you change the portfolio of this fund if the market becomes flat?

HDFC Top 200 Fund is a large cap oriented fund with a well defined investment universe (BSE 200/Top 200 capitalised companies). Our approach to investing is consistent —quality, sustainability, diversification, reasonable valuation, etc. Sometimes this approach takes us closer to consensus views and sometimes it makes us contrarian investors. Thus, the beta keeps on changing. We will continue with this approach in future as well. In our experience and as the track record of this fund and other HDFC funds demonstrates across multiple market cycles, this is a sustainable approach to investing.

Q. With a total fund size of more than Rs 14,000 crore, HDFC Top 200 is now a mammoth fund. What are the challenges that come with the size?

HDFC Top 200 Fund, with around Rs 14,000 crore assets under management (as of December 31, 2014) is just 0.14 percent of the market capitalisation. True, it is large compared to other funds, but it is small relative to the market. Size is thus not a constraint.

The outperformance of HDFC Top 200 Fund in 2014 is close to its best in the last 8-10 years. This suggests that there are no large funds in India yet, and current sizes are not a constraint to performance. In fact, larger schemes offer some advantages —they are more likely to be managed by more experienced managers and also have lower expenses. A mere 0.5 percent saving per annum makes a meaningful difference over long periods.

Q. With falling oil prices and a new government in place, how do you look at the prospects of the Indian economy in the long run?

We have consistently maintained—even at the time of the Lehman crisis— that oil prices matter more to India in the medium- to long term than global GDP growth. This is because while oil imports are a massive 5 percent of the GDP, India’s share of global trade is so low that growing exports are more dependent on execution rather than on the growth of the global economy. Given the sharp fall in oil prices, the impact of external factors on India is positive.

India is a key beneficiary of lower crude oil prices. The savings are likely to be nearly two percent of GDP on a run-rate basis at current oil prices over the 2013 average. The current account can thus be near balanced in 2015. A lower current account deficit should, in turn, aid a stable rupee, lower inflation and lower interest rates.

Apart from lower oil prices, a strong, growth-oriented and business-friendly government bodes well for growth and businesses.

Key decisions of the new government, so far, give confidence that the lower fiscal deficit is a priority and it should continue to fall. The government has shown with its actions that it will prioritise the quality of supply of essential things like electricity over the price of supply. It will put a transparent framework in place so that India can harness the potential of its vast mineral resources. It will also simplify tax structures and improve tax compliance, as well as follow policies that will aim towards healthy and sustainable economic growth.

India is in a unique position, as one of the few countries that is fighting inflation, to benefit from lower commodity prices and expect to see lower interest rates and faster economic growth. India is likely to emerge as the 6th or 7th largest economy in the world by around 2020, and also as the fastest growing.

First Published: Feb 05, 2015, 06:07

Subscribe Now