Will the Union Budget boost the economy?

Crisil Intelligence unpacks key budget announcements around the capex thrust, fiscal deficit and consumption boost

The union budget was presented against the backdrop of a slowdown in real gross domestic product (GDP) growth to 6.4 percent in fiscal 2025 from 8.2 percent previous year with investment growth slowing and consumption recovering on weak legs. The budget has tried to support both these demand side drivers, while also sticking to the fiscal consolidation path (targeting fiscal deficit at 4.4 percent of GDP in fiscal 2026, down from 4.8 percent in fiscal 2025). Beyond fiscal 2026, the government has made debt-GDP ratio as the main anchor for fiscal consolidation and aims to attain central government debt-GDP at 50(+/-1) percent by fiscal 2031.

Consumption boost: The key push to consumption in the budget comes from reduction in tax burden for the middle class under new tax regime. About 72 percent of the income taxpayers have adopted this regime. The announcements provide relief by increasing the tax exemption limit to Rs12 lakh from Rs7 lakh, meaning people earning up to Rs12 lakh have nil income tax, which would lead to tax savings of Rs80,000 annually for them. To be sure, middle-class consumption suffered in fiscal 2025 hit by high interest rates and high food inflation.

Higher allocations for key infrastructure and employment creating schemes---such as Pradhan Mantri Awas Yojana (PMAY) to Rs78,126 crore (64.1 percent higher on-year), Pradhan Mantri Gram Sadak Yojana (PMGSY) to Rs19,000 crore (31 percent higher on-year), and maintaining the allocation for Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) at Rs86,000 crore---should support incomes and consumption in fiscal 2026. The total allocation for these schemes rose 23.7 percent on-year after remaining stagnant in fiscal 2025.

First Published: Feb 03, 2025, 13:16

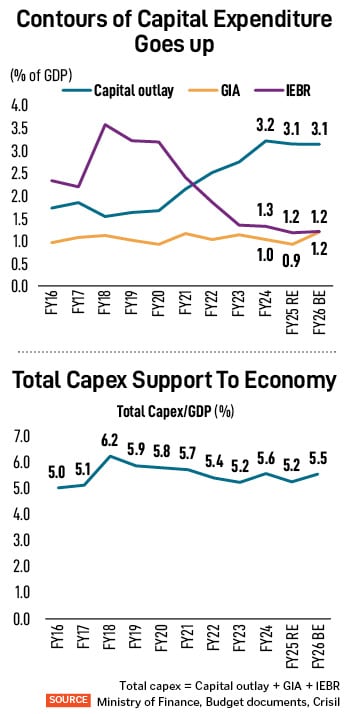

Subscribe Now Capex thrust: Capex for fiscal 2026 is budgeted at Rs11.2 lakh crore, up 10 percent from Rs10.2 lakh crore in fiscal 2025 revised estimates (RE) i.e. the government has maintained its capex support at 3.1 percent of GDP in fiscal 2026, same as in fiscal 2025. At the same time, grants-in-aid (GIA) for creation of capital assets are budgeted to increase substantially to Rs4.27 lakh crore, from Rs2.99 lakh crore in fiscal 2025 RE, a rise of 42.4 percent. This means the effective capital expenditure through the budget rises to Rs15.5 lakh crore, from Rs13.2 lakh crore (up 17.4 percent).

Capex thrust: Capex for fiscal 2026 is budgeted at Rs11.2 lakh crore, up 10 percent from Rs10.2 lakh crore in fiscal 2025 revised estimates (RE) i.e. the government has maintained its capex support at 3.1 percent of GDP in fiscal 2026, same as in fiscal 2025. At the same time, grants-in-aid (GIA) for creation of capital assets are budgeted to increase substantially to Rs4.27 lakh crore, from Rs2.99 lakh crore in fiscal 2025 RE, a rise of 42.4 percent. This means the effective capital expenditure through the budget rises to Rs15.5 lakh crore, from Rs13.2 lakh crore (up 17.4 percent).