Beating Amazon: The great retail reinvention

Amid the Covid-19 carnage, a handful of innovators have found out how to compete against Amazon and sell in the 21st century. Investors, consumers, and workers are all winning

Target CEO Brian Cornell at a new curbside pickup station in Sarasota, Florida. “You can place an order, drive into over 1,500 parking lots and our team member will walk out and put it in your trunk, contact-free.”

Target CEO Brian Cornell at a new curbside pickup station in Sarasota, Florida. “You can place an order, drive into over 1,500 parking lots and our team member will walk out and put it in your trunk, contact-free.”

Image: Jamel Toppin for Forbes

In late February last year, Target CEO Brian Cornell was sipping coffee in a Manhattan deli—one eye on the keynote address he was soon to give at an investor conference, the other on his phone as news alerts of America’s first confirmed Covid-19 death buzzed in.

Target’s communications, investor relations and special-events teams had spent months agonising over every detail of the speech, given to 200 Wall Street analysts and journalists and able, in a matter of minutes, to send Target’s stock price climbing—or crashing. Three years ago, Cornell, 61, who took over Target’s top spot in 2014 after running Pepsi’s food business, had caused the company’s shares to plunge 12 percent after analysts scoffed at his bid to counter Amazon by investing $7 billion to upgrade Target’s then-1,800-plus stores and raise worker wages.

Cornell’s contrarian moves had been paying off. Target’s stock had nearly doubled since early 2017, but the Covid news had him on edge. In early January, he had created a task force to monitor the virus. Now it had come to America. Cornell shelved the in-person conference and threw together a virtual one in 48 hours. “I’ll always remember how I got only one question about the virus during the conference,” Cornell says, shaking his head. “And it was whether Chinese production delays would impact our spring line.”

Within a few days, America started locking down, and the retail landscape underwent a seismic shift. Panicked shoppers stripped stores of toilet paper, sanitiser, bleach and bottled water. Amazon, overwhelmed by an enormous increase in orders, floundered: Deliveries were delayed shipments of non-essential items became, well, non-essential. Negative customer reviews went up by 50 percent. So did allegations of price gouging, with six-packs of Bounty paper towels going for nearly $60 and a tub of 75 Clorox wipes offered for $40. (An Amazon spokesperson says, “Our systems are designed to meet or beat the best available price amongst our competitors, and if we see an error, we work quickly to fix it.”)

With supply chains seizing up and Amazon temporarily stumbling, millions of customers gave other online stores a shot. Smaller, savvy web retailers such as Wayfair and organic food peddler Thrive Market saw business boom. Millions of mom-and-pop operations were finally compelled to move from storefront-heavy strategies to digital ones. Ditto luxury retail, including brands such as Prada and Tory Burch.

No one took greater advantage than big-box retailers. In the second quarter, Target sales jumped by nearly 25 percent year-over-year, to $23 billion, as online sales tripled, adding 10 million new customers. Home Depot also grew by about 25 percent, to $38 billion, as its online sales doubled. Even at mighty Walmart, where getting revenue to go up significantly is akin to turning an aircraft carrier, online sales doubled and drove a six percent year-over-year increase, to $140 billion.

While no one foresaw the coronavirus, these sudden winners had already been girding for the industry pandemic known as Amazon by embracing the one resource the digital giant lacked—their thousands of physical stores. By hardwiring digital shopping into their locations, Target, Walmart, Best Buy, Home Depot and Lowe’s transformed their stores, long viewed as expensive and fast-ageing liabilities, into hyperlocal distribution hubs that are now powering in-person and digital shopping alike. Early results were looking good. In the wake of the Covid-19 outbreak, they became great.

“We are within ten miles of most Americans,” says Cornell, who saw same-day delivery demand nearly triple and curbside pickup service soar by 700 percent. For years, the retail sector had been losing its way with customer service. Yet this shift was an undeniable consumer benefit. “Target has become truly convenient,” says Paul Trussell, Deutsche Bank’s retail analyst. “It’s taken years of investment, but now you can buy online, pick up in store or use their app to have someone put the product right in the trunk of your car.”

So shoppers and shareholders have benefited. But something even more profound has occurred with a third set of winners: Workers. To say that high-stress, low-pay retail gigs have lived at the bottom of the economic food chain is an insult to plankton. In 2019, the median annual wage for a retail worker was $25,250, with little upward mobility and turnover rates running about 60 percent a year. All this dysfunction was subsidised by you, the taxpayer—the Economic Policy Institute estimates that more than 35 percent of retail workers receive public assistance. Little wonder that no brick-and-mortar retail company has ever before appeared on our Just 100 list, created in partnership with non-profit Just Capital, which spotlights America’s best corporate citizens.

But something happens when clerks and salespeople suddenly become essential frontline workers. In July, Target accelerated a plan to raise its minimum wage by two dollars to $15 an hour. Best Buy and Walmart soon followed—and upped the ante, with Walmart pledging to pay some store managers up to $30 an hour. Bonuses, paid sick days and stricter safety measures came next. Yes, respect and consumer demand prompted the wage hikes. More critically, though, the stores of the 21st century need better-trained, multitasking employees to make them run. “Our workforce will need to evolve in a way that meets the needs of customers,” says Best Buy CEO Corie Barry.

The result: Five brick-and-mortar retailers debut on the 2021 Just 100, led by Target at number 15. “As an essential business, if we were going to take care of America,” CEO Cornell says, “we had to take care of our team first.”

As in any pandemic, there have been victims. Long-suffering companies like JCPenney, JCrew, Bed Bath & Beyond and Pier 1, none of whom shifted fast enough, have filed for bankruptcy. At the same time, Target shares are up by 60 percent since their late-March low. Lowe’s is up by 140 percent, Home Depot 75 percent and Best Buy 105 percent—all trouncing the S&P 500’s 43 percent gain. Allowed to stay open while most businesses were shuttered, these mega merchants absorbed demand from millions of bored shoppers flush with nearly $300 billion in stimulus cheques and few places to spend it. “All those dollars have to go somewhere,” says Citi analyst Paul Lejuez.

The victors, in this case, actually shared the spoils amid something of an arms race for workers. Walmart, the world’s largest private employer, raised wages, paid more than $1 billion in bonuses and added 14 more annual paid sick days. “Our emergency-leave policy has safeguarded upward of hundreds of thousands of associates who knew that they could take time off and be secure with their job,” says Donna Morris, Walmart’s chief people officer.

Home Depot, too, has paid out $1 billion–plus in bonuses and extended paid leave. “Spring is our Christmas season, but we cancelled all our promotions because we didn’t want a traffic surge in our stores. Safety came before sales,” says CEO Craig Menear. “We let our team know Home Depot had their back. Take care of your workers, they take care of your customers and the rest takes care of itself.”

In addition to Covid pay, corporations are investing resources to promote racial equality and increase diversity. In June, Walmart’s foundation pledged $100 million for a centre to promote health, education and training for underrepresented groups. People of colour make up 47 percent of Walmart’s 1.4 million US employees. Women represent 55 percent of its workforce, including about half of store managers.

Target, whose Minneapolis headquarters sit less than four miles from where George Floyd died, pledged to increase the number of black employees across the company by 20 percent. Black staffers currently make up 15 percent of its workforce. Among Target’s 350,000 employees, 50 percent are people of colour 58 percent are women, accounting for nearly half of its executives. “It’s important that our team, leaders and board reflect the 30 million–plus families we serve each week,” Cornell says. “Diversity is critical to bring that to life.”

Going all in on physical stores requires investing billions in employees. “You can be digital, but you’ve got to deliver digitally with a human,” says Walmart’s Morris. As stores become more digital and jobs more complex, companies must increase pay and perks to attract and keep employees. The latter is extremely tricky (and expensive) in an industry with such high job churn. “Your employees must feel as much differentiation working at Target as customers feel shopping at Target,” says Brandon Fletcher, a retail analyst at Sanford C Bernstein.

Few felt good about Target in 2014 when Brian Cornell was named CEO. At the company, which traditionally promoted from within, he was an outsider in more ways than one. He grew up in Queens, New York, under tough conditions. His father died when he was in elementary school. Heart disease put his mother out of work and his family on welfare. Grandparents pitched in school and sports offered salvation. Cornell graduated from UCLA in 1981 and spent the next 30 years as retail’s version of a career military officer, relocating 15 times as he climbed the corporate ladder at Tropicana, Gallo Wines, craft store Michaels, Sam’s Club and two different tours at PepsiCo. He took over a Target in tatters. The previous year, a data breach had exposed the credit-card numbers of 40 million customers. Meanwhile, a poorly executed launch of 124 stores in Canada was racking up hundreds of millions in losses. Target, which had earned the upscale nickname “Tarjay” thanks to its high-quality products, was now saddled with shabby stores and stale brands. “They were quickly going the way of Kmart,” says Barclays analyst Karen Short. “The stores were messy and out of stock. Employees were unhappy.”

Cornell acted quickly, jettisoning the Canadian business and selling a chain of pharmacies to CVS to focus on fixing the US operation. The $7 billion plan that had sunk the stock in 2017 refreshed stores, gave customers new digital buying options and turned locations into warehouses for online orders. Target also launched dozens of fresh brands like clothing lines Goodfellow & Co and Universal Thread. “Target’s whole existence is to sell stuff that wasn’t Walmart fall-apart, but Target Tarjay,” Fletcher says. “Cornell went back to Target making really good stuff—good enough that people again call it Tarjay.”

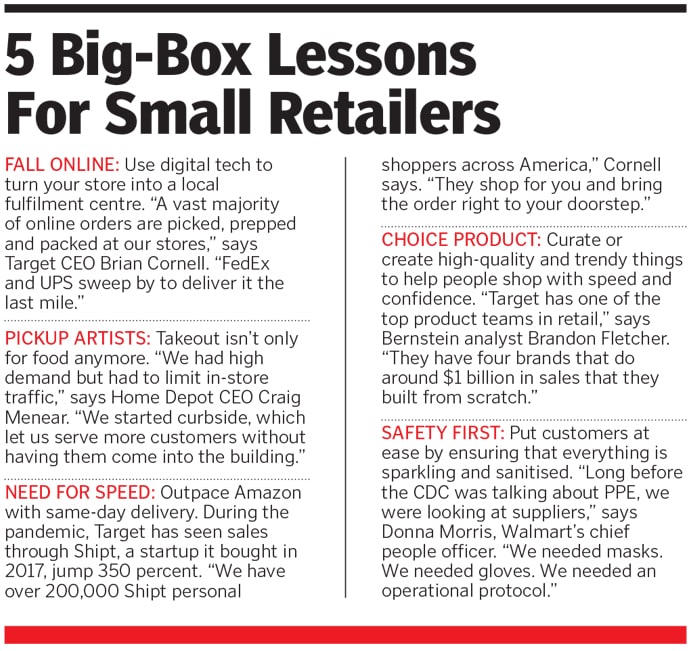

Whatever you call it, Target’s ability to sell high-quality stuff via a high-quality experience is crucial if the company is to hold the ground it has won during the pandemic. Big-box retailers have found a formula that works—for now—with lessons for smaller retailers and other industries. The challenge: What happens when government stimulus recedes and a stir-crazy country can return in full force to restaurants, bars, hotels and travel.

And then, of course, there’s Amazon, which remains the elephant in every CEO’s home office. After its initial pandemic stumble, Amazon quickly hired more than 175,000 new employees and fortified its logistics network to get back on track. Second-quarter sales (which includes large non-retail divisions like AWS and advertising) exploded 40 percent. Even as these big-box retailers enjoy a stock boost, Amazon’s soaring valuation of $1.5 trillion is double the size of their market caps—combined. That gives it more than enough firepower to compete and disrupt on every front. The pandemic and its impact on consumer habits have only increased Amazon’s power and reach.

Cornell sees his edge both in his Tarjay cachet—and his arsenal of thousands of upgraded stores. “A few years ago, everyone said stores were obsolete. We took the other path, not because it was our opinion—it was what consumers were telling us,” he says. “Even during the pandemic, about 85 percent of all retail spending happened in stores. And now, I have 1,900 fulfillment centers across the country. That speed is essential.”

Click here for the Forbes "The Just 100" list, the third edition of the 100 companies showcasing the best corporate citizen

First Published: Feb 06, 2021, 09:00

Subscribe Now