'This Market is nuts': S&P 500 hits record, defying economic devastation

Investors have cast the nearly relentless drumbeat of bad news aside to focus on any signs that the worst of the coronavirus pandemic might be over

“This market is nuts,” said Howard Silverblatt, senior index analyst for S&P Dow Jones Indices.

To those outside Wall Street, the market’s rise may appear inexplicable given the human and economic toll of the virus, and a stalemate in Washington that has paralyzed efforts to provide more relief that many businesses and workers desperately need. Still, investors have cast the nearly relentless drumbeat of bad news aside to focus on any signs that the worst might be over. They have also been emboldened by the Federal Reserve’s steadfast support of the markets and unwavering embrace of low interest rates.

Investors are taking into account the fact that the virus, which had seen a recent surge that threatened to set back much of the country a second time, has shown signs of abating, with the number of new cases declining by 16% over the last 14 days, according to data compiled by The New York Times. Expectations for 2020 corporate profits, formulated by Wall Street analysts, seem to have stopped plummeting. Also, slow but notable progress toward a vaccine, which many manufacturers and public health experts say could be ready by next year, has made many investors bullish.

And the economy is improving, even if the recovery is tepid. Some 1.8 million new jobs were added in July, and weekly state unemployment benefit claims have fallen below 1 million for the first time since March.

Together, these data points have been enough to create an outlook that, while not exactly rosy, is at least no longer pallid. At the same time, the improvements are hardly so significant that they would prompt the Federal Reserve to pull back its support for the economy. The Fed has started new programs to buy Treasury bonds and other financial assets to calm investors and is financing those programs by essentially creating new money.

“It seems to me that markets have decided this economic environment is the best of both worlds: enough economic recovery to support corporate earnings and prevent a substantial recession, but not so much that the Fed would have to raise interest rates and tighten monetary policy,” said Scott Clemons, chief investment strategist for private banking at Brown Brothers Harriman, an investment bank.

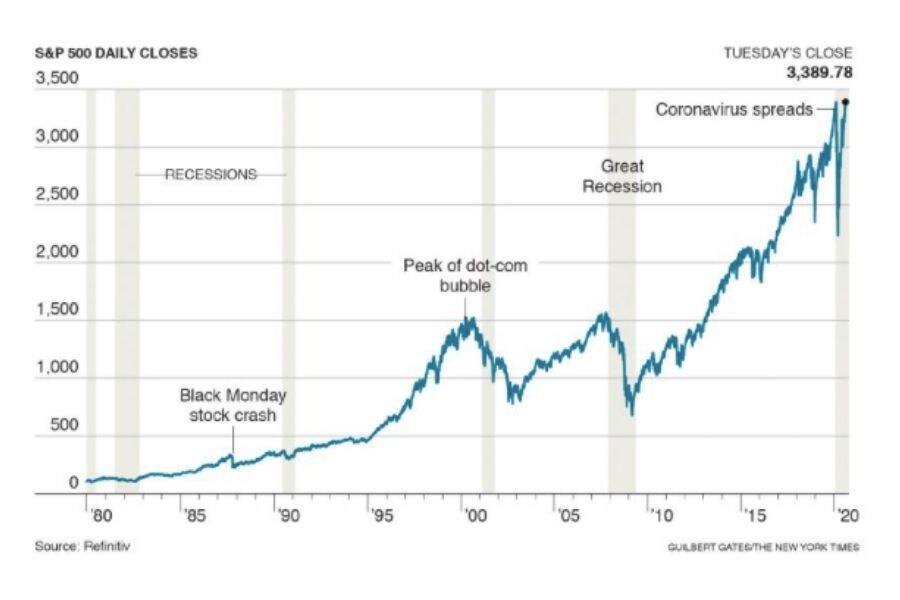

Several times in recent days, the S&P 500 had crisscrossed its Feb. 19 closing high of 3386.15 in intraday trading, before falling below that level to end the trading day. But Tuesday, the blue chip index notched a modest gain of 0.2%, to close at 3,389.78, after another solid performance by major technology companies. Amazon.com rose 4.1%, pulling the Nasdaq composite index to a fresh record as well. The Dow Jones industrial average slipped 0.2%.

Tuesday’s rise was the latest chapter in remarkable rebound for the stock market following a nearly 34% collapse in February and March. It was the fastest-ever nosedive of more than 30% from a peak, reflecting the depths of panic as investors began to consider the economic costs of the pandemic. Those fears were warranted. Since March, the economy has suffered the sharpest collapse since the Great Depression. An estimated 28 million Americans are receiving unemployment benefits. The economy has been almost decimated, as GDP shrank nearly 10% during the second quarter of the year, wiping out nearly five years of economic growth.

After that initial steep decline, however, the stock market began to recover and has done so steadily since, in a marked display of what analysts describe, by turns, as optimism, hubris or sheer speculative greed that is heavily reliant on federal spending, easy monetary policy and continued signs of progress in the hunt for virus vaccines. The result has been a remarkable rally of more than 50% that has underscored the dissonance that sometimes exists between the markets and the economy.

During the deep recession that followed the financial crisis of 2008, financial markets recovered faster than employment, wages and business activity. The S&P 500 was hitting record highs by early 2013, a year before the U.S. job market replaced all the jobs lost in the downturn.

In part, that reflects the forward-looking nature of the stock market, where — in theory — investors buy stocks based on long-term expectations for profits and dividends they expect companies to generate, rather than how they’re faring when the shares are purchased.

The U.S. economy continues to struggle, but investors widely believe that the worst of the coronavirus-related downturn is over. Earlier this month, economists at Goldman Sachs upgraded their outlook for economic growth in 2021, writing that they “now expect that at least one vaccine will be approved by the end of 2020” and be widely distributed in early 2021. Last week, stock market analysts at the firm raised their year-end estimates for the S&P 500, saying the broad index could rise to 3,600 or a further 6% or so.

But the divergence between the path of financial markets and the current health of the economy also highlights the fact that, despite looming large in the American psyche, the stock market is not a particularly good reflection of the broader U.S. economy or the mood of the American middle class.

Many Americans own stock, but the vast majority of shares owned by households are controlled by the wealthiest people in the country, making them less likely to feel the pain of the economic slump.

And only a tiny fraction of U.S. businesses — less than 1% of those with 20 employees or more, according to one finance professor — are publicly traded. Those whose shares trade on the open market tend to be much larger and better financed than a typical firm.

Even among publicly traded companies, almost all the gains in major stock market indexes this year are attributable to the surging share prices of a few giant technology companies, foremost among them Apple, Amazon and Microsoft.

These megacompanies — Apple appears poised to become the first company to reach a market value of $2 trillion — are exerting an enormous influence over major stock market indexes such as the S&P 500. Since such indexes are weighted by the market value of their constituents, the largest companies hold sway over their direction.

Tech giants have fared incredibly well through the crisis as investors bet the stay-at-home economy plays to many of their strengths. Amazon is up about 80% this year. Apple is up almost 60%, while Microsoft has risen more than 34%.

Without those three companies, the return on owning S&P 500 stocks — including dividend payments — would have been negative 4.1% this year through the end of July. Instead, investors captured an actual return of 2.4%, according to data from S&P Dow Jones Indices.

The stock market is also incredibly sensitive to actions by the Federal Reserve, with stocks often soaring when the central bank eases monetary policy, typically in response to an economic slump. That means a weak economy can actually be quite good for Wall Street, if it means that the Fed keeps the river of freshly created money — what’s known on Wall Street as liquidity — flowing into financial markets. That could help explain why empirical studies of the relationship between economic growth and stock market performance often show little connection between the two.

“Nothing matters but liquidity,” wrote Michael Hartnett, chief investment strategist at Bank of America Global Research, in a recent research note describing what he called the “nihilistic” bull market of 2020.

The performance of the market in the face of such dire expectations for growth, he wrote, is just the latest example of investors betting that low growth will prompt the Fed to continue to pushing money into the financial system, ultimately bolstering stocks. In other words, stocks are going up not because of economic optimism but because the future looks fairly grim. Hartnett titled his report, “I’m so bearish, I’m bullish.”

First Published: Aug 19, 2020, 10:58

Subscribe Now