“We are not a full Benz but at least we’re halfway there. The doors and headlights are shining, gears and the airbags are better," Srinivasan says, recounting the incident when he took charge 14 years ago.

Srinivasan and his top leadership team, a lot of whom have helped the bank grow from a regional to a national, digital focussed bank, appears to have done things right over the past seven-eight years.

A transition of leadership for banks in India, particularly by those from the outside, has always been a challenge for the individual and the institution. In recent years, Axis Bank, Kotak Mahindra Bank and Yes Bank, all faced a string of issues prior to their chief executives taking charge.

The change was a little smoother for leadership who rose from the ranks to become heads in the last four-five years, particularly at institutions such as State Bank of India, HDFC Bank, ICICI Bank and IndusInd Bank.

Federal Bank will see former Kotak Mahindra Bank veteran KVS Manian take charge as managing director and CEO of the bank on September 23, 2024, a day after Shyam Srinivasan’s term ends after a 14-year productive term.

![]()

Conservative Approach

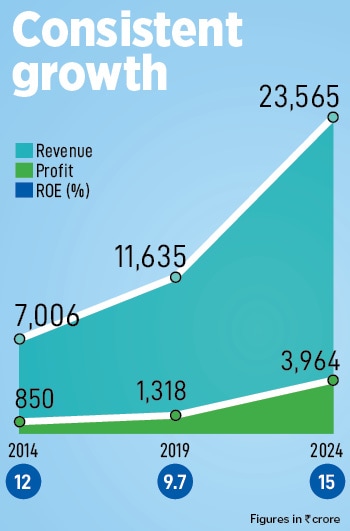

Manian obviously has a task set out (see infographic), considering that the banking ecosystem still has its challenges. Federal Bank, while on a growth strategy, will want to see its income margins and valuation improve. Federal Bank has seen its net interest margin (NIM) stagnate to 3.16 percent in the Q1FY25 ended quarter, from 3.49 percent in the Q3FY23 ended quarter. Federal Bank is up 27.5 percent in the past year to Rs 185 at the BSE, trading at just 1.5 times its book.

![]() Srinivasan chose, at various points, in Federal Bank’s journey, to “be a boring, consistent good bank" which should be the story going forward, Srinivasan said. A case to the point was that in 2013 Srinivasan decided to reduce bulk deposits by Rs3,000 crore. “It was not practical to hold bulk deposits when our credit-deposit (CD) ratio was 68 percent," he recounts. For a bank, bulk deposits are always high-cost compared to retail deposits.

Srinivasan chose, at various points, in Federal Bank’s journey, to “be a boring, consistent good bank" which should be the story going forward, Srinivasan said. A case to the point was that in 2013 Srinivasan decided to reduce bulk deposits by Rs3,000 crore. “It was not practical to hold bulk deposits when our credit-deposit (CD) ratio was 68 percent," he recounts. For a bank, bulk deposits are always high-cost compared to retail deposits.

For several years, under Srinivasan’s leadership Federal Bank did not opt for unsecured lending, until just four years ago. “I felt it was prudent to go after a better credit profile at a relatively lower credit cost. I did not want to enter the unsecured market because I thought it would lead to problems for us," says Srinivasan.

Unsecured loans—largely personal loans, loans on credit cards and some forms of consumer durables and student education loans—are high margin lending products which do not have collateral and thus are considered riskier than secured loans (auto, home, loan against property). Add to that a still high interest rate regime and it raises risks to the lending system.

The Reserve Bank of India had, in 2023 tightened lending norms on unsecured lending, which has resulted in an overall slowing in credit growth for this segment.

Federal Bank’s unsecured book forms just 4.8 percent of the total advances (Rs10,956 crore—comprising personal loans, credit cards and microfinance loans—from total advances of Rs2,24,161 crore, as of Q1FY25 data). “Technically, we can go up to 10 percent and life will still be fine, but we may not take it there. We may take it to seven percent and still grow," he suggested.

The research arm of Nomura Holdings in India initiated coverage on Federal Bank in December 2023, saying loan growth for the bank would increase due to a rise in the unsecured lending. Its loan is expected to grow at a 19 percent CAGR between FY24 to FY26, the note had said.

While credit growth continues to outpace deposit growth for the banking industry, analysts are of the view that maintaining a 25 percent growth in the loan book will be a challenge.

“The industry is concerned as NIMs have peaked out, the best of asset quality is behind us and there are regulatory challenges ahead. Corporate lending is not picking up as AAA corporates go to the bond market directly," says Amit Khurana, head of equities at Dolat Capital. Khurana adds that a falling interest rate cycle is not always beneficial for banks as NIMs contract and liability book reprices (faster than the asset book). “There could be situations for some banks where treasury gains offset the NIM contraction," says Khurana.

Federal grew its loan book by 20.3 percent year-on-year for Q1FY25, but while it is likely to maintain steady growth it will be difficult to grow its loan book at a faster pace.

Also read: Lessons and reforms for a fragile financial system

![]()

KVS Manian, Managing Director and CEO of Federal BankImage: Courtesy Federal Bank

Deposit Growth Strategy

Indian banking is in a phase where credit growth has outpaced deposit growth, warranting the RBI to voice its concern. India’s finance minister Nirmala Sitharaman, in a meeting with bankers in August this year, called on banks on to focus on smaller deposits that may come in “trickles" but are the “bread and butter" of the banking system, according to media reports.

Federal Bank, being a mid-sized bank has a near 1.3 percent market share of overall deposits. Srinivasan is confident that their share of deposits will continue to increase even while deposits have become more “wholesalized" (moving from retail to wholesale). In recent years, people continue to invest in alternative avenues beyond bank deposits, seeking better returns.

“It is easier for midsized, than larger banks, to boost the pace of deposit growth," Srinivasan says, following the assumption that a bank with a small share of total deposits can continue to grow faster than giants such as HDFC Bank and SBI, which will need to do more heavy-lifting to grow their deposits.

As a consequence of it becoming wholesalized, the cost of money may go up. “The growth is there in the industry. But we have to calibrate credit growth to meet deposit creation, so that the CD ratio does not get skewed," he says. In Q1FY25 their credit growth grew 5.45 percent and deposit growth rose 5.36 percent sequentially. Federal Bank’s CD ratio is currently at 82 percent.

Even while the cost of deposits goes up, Federal bank has ensured that its credit costs are very low 0.27 bps for Q1FY25. So, they have traded off high margin and high credit cost for a modest lower margin and more predictable credit costs.

Federal Bank is a significant lender catering to the non-resident Indian (NRI) community, where money comes in the form of remittances, but also flows out towards other financial savings products. “We have a shot at growing our deposits as the pie is growing. It can be done through our reach, client experience, product offering, digital focus and services. But we have to make sure that the share of money flowing out is reduced," he said.

![]() Federal Bank branch in New Delhi, India.Image: Pradeep Gaur/Mint via Getty Images

Federal Bank branch in New Delhi, India.Image: Pradeep Gaur/Mint via Getty Images

Achieving Goals

Srinivasan believes the Bank’s strategy is well set out as it continues with its secured lending, solutions for micro-and small-businesses and providing gold loans. His often-quoted statement to media houses of wanting to be seen as “the most admired bank" in India, is focussed towards small businesses.

![]() Business banking, which has MSME lending at the smaller end of the segment, grew 20.4 percent year-on-year and 6.15 percent sequentially for the June-ended quarter to Rs18,165 crore for Federal Bank. Commercial banking, which includes the lower end of corporate banking, grew 24 percent year-on-year and 6 percent sequentially to Rs22,687 crore in the same period. “These businesses can be scaled up a lot faster as they are RM and branch-led," Srinivasan says.

Business banking, which has MSME lending at the smaller end of the segment, grew 20.4 percent year-on-year and 6.15 percent sequentially for the June-ended quarter to Rs18,165 crore for Federal Bank. Commercial banking, which includes the lower end of corporate banking, grew 24 percent year-on-year and 6 percent sequentially to Rs22,687 crore in the same period. “These businesses can be scaled up a lot faster as they are RM and branch-led," Srinivasan says.

He said the heartening aspect of banking to these segments was that the paranoia about the quality of credit to small-businesses – which lessened when the Guaranteed Emergency Credit Line (GECL) was available – has “nicely stabilised", Srinivasan says. Slippages in the commercial banking and small-business banking have reduced in the Q1FY25. “Clients realise that if they don’t pay up their outstanding dues, their access to credit will be hit," he says.

Federal Bank is also focused on expanding its gold financing book. A high-margin lending product, gold loans as part of its portfolio, grew 31 percent year on year and 9 percent sequentially in Q1FY25 to Rs27,431 crore. This is one of the largest in size amongst private banks, Federal Bank claims, offering loans at a low interest rate.

It is quite likely that Manian, who takes charge as CEO today, is unlikely to indulge in any ‘cowboy’ stuff such as spending Rs500 crore and loading up the cost structure to set up more branches. Decisions for expansions and chasing growth will be well thought out and calibrated.

Srinivasan has, in his 14-year term, created a credible franchise, a cohesive team that works well and has executed the Bank’s growth strategy. All without major scratches. Sure, the task of closing the gap between itself and the nearest rival (IndusInd Bank) will be tough, but Manian, a veteran banker himself, will have to be at it. He will need to nimble, think of new lines of businesses but retain the mantra that has worked for the Bank: Of keeping banking boring.

Srinivasan chose, at various points, in Federal Bank’s journey, to “be a boring, consistent good bank" which should be the story going forward, Srinivasan said. A case to the point was that in 2013 Srinivasan decided to reduce bulk deposits by Rs3,000 crore. “It was not practical to hold bulk deposits when our credit-deposit (CD) ratio was 68 percent," he recounts. For a bank, bulk deposits are always high-cost compared to retail deposits.

Srinivasan chose, at various points, in Federal Bank’s journey, to “be a boring, consistent good bank" which should be the story going forward, Srinivasan said. A case to the point was that in 2013 Srinivasan decided to reduce bulk deposits by Rs3,000 crore. “It was not practical to hold bulk deposits when our credit-deposit (CD) ratio was 68 percent," he recounts. For a bank, bulk deposits are always high-cost compared to retail deposits.

Business banking, which has MSME lending at the smaller end of the segment, grew 20.4 percent year-on-year and 6.15 percent sequentially for the June-ended quarter to Rs18,165 crore for Federal Bank. Commercial banking, which includes the lower end of corporate banking, grew 24 percent year-on-year and 6 percent sequentially to Rs22,687 crore in the same period. “These businesses can be scaled up a lot faster as they are RM and branch-led," Srinivasan says.

Business banking, which has MSME lending at the smaller end of the segment, grew 20.4 percent year-on-year and 6.15 percent sequentially for the June-ended quarter to Rs18,165 crore for Federal Bank. Commercial banking, which includes the lower end of corporate banking, grew 24 percent year-on-year and 6 percent sequentially to Rs22,687 crore in the same period. “These businesses can be scaled up a lot faster as they are RM and branch-led," Srinivasan says.