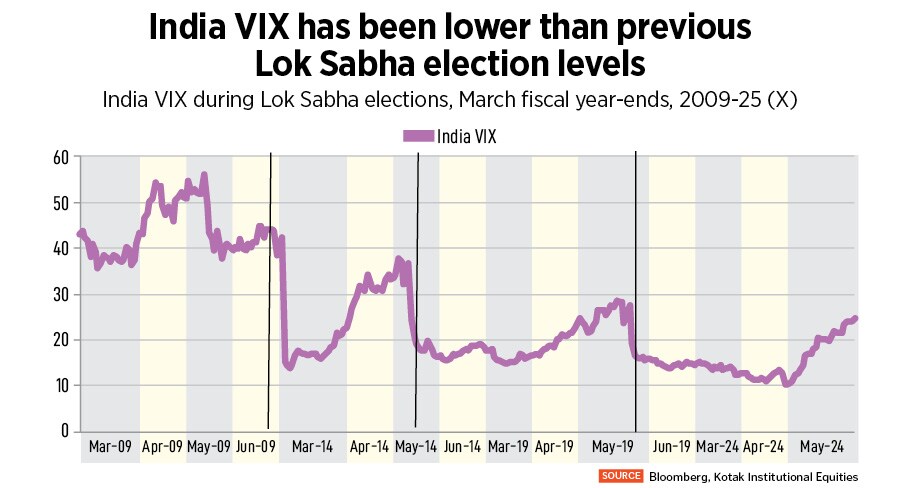

The topsy-turvy nature of Indian equities in the last few months exposes the current fragility of the stock markets. Investor sentiment and confidence were brittle indicating lack of conviction. The Indian volatility index (India VIX), also known as fear gauge, heated up over 100 percent as voter turnout was low in the first three phases in May. If we go beyond the elections, what does this extreme volatility really suggest? A complacency risk?

Perhaps, markets investors were pinning all hopes on a favourable outcome of the Lok Sabha elections to do the heavy lifting while ignoring basic fundamentals like valuations of Indian markets, corporate earnings and, most critical, the monsoon. The markets had already factored-in a third term of Prime Minister Narendra Modi and bets were made on stocks keeping that stance in mind.

“The election verdict of the BJP (Bharatiya Janata Party) lacking a simple majority questions this conviction and raises doubts over a stable government and policy-making styles. These doubts openly question the notable premium of Indian equities versus history, compared to bonds, the near-record premium of small and midcaps, and the recent re-rating of Modi stocks," says Vikas Kumar Jain, analyst, CLSA.

Lofty valuations have always remained a concern. “We find very little value in the market and, in fact, find most sectors and stocks overvalued relative to the fair value of the stocks, with the extent of overvaluation increasing in the inverse order of market capitalisation, quality and risk," says Sanjeev Prasad, MD and co-head, Kotak Institutional Equities.

Prasad adds that the 2024 election results may finally compel investors (institutional and non-institutional) to focus more on numbers and less on narratives. He would watch for any change in the stance of retail investors, who have been the major force behind the market in terms of flows.

![]()

The BJP-led NDA coalition won the elections, with lower-than-expected 292 out of 543 seats in the Lok Sabha which has made investors nervous about political stability. The final numbers did not tally with even a single exit poll prediction of 370 seats and the BJP’s own ambitious target of over 400. After two terms of simple majority, the best-case election result predicts that the BJP will need to depend on its newly inducted coalition partners from Andhra Pradesh and Bihar to get to the required majority to form a government.

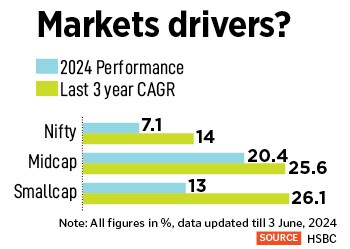

In the shorter time frame, the results will impact risk tolerance of the market, triggering preference for defensiveness, says Amit Sachdeva, India Equity Strategist, HSBC Securities and Capital Markets (India). However, the outcome should not alter India"s long-term attractiveness, explains Sachdeva, adding that he still thinks India’s overall Goldilocks scenario is intact. “Volatility in the market could rise, and hence there could be a decisive move towards large caps," he says.

The nature of the verdict—with a coalition government dependent on alliances—is expected to result in some populist measures to address rural stress and lift sentiments at the margin. Markets are anticipating the new coalition government to possibly dilute its unequivocal supply side policymaking style to also accommodate the rural and agriculture-related push as BJP has underperformed in the three biggest states predominantly with rural and agriculture-related voters. State elections in Maharashtra are also scheduled in less than six months.

“It takes a lot to change the ideology and policies of a government hence, despite the opposition offering more sops, the BJP showcased a pro-growth, investment-focussed manifesto ahead of the elections. The setback may, however, be enough to change the focus: Push the government to tweak some of its policies and increase spending towards direct social schemes," says Venugopal Garre, MD, Bernstein.

Meanwhile, Congress leader Rahul Gandhi has demanded a joint parliamentary committee (JPC) to look into the "biggest stockmarket scam" in which retail investors lost Rs30 lakh crore on results day. This came a day after the markets surged on the back of mostly inaccurate exit polls that predicted a landslide win for the BJP and NDA. Trinamool Congress (TMC) leader Saket Gokhale has also written to market regulator Securities and Exchange Board of India (Sebi) demanding an investigation into the exit polls.

Hot Valuations

Despite the drastic fall of stocks, India is still one of the most expensive markets in the world, Currently, India’s premium to Asia (excluding Japan) and emerging markets peers is more than 1 standard deviation above the historical average. Even after the recent pullback, the Nifty continues to be 19 times above its 18-year historical average price-to-earnings (PE). “Even the premium of mid and small caps versus the Nifty is near-record highs. These data points suggest that the Indian markets moved into this event with a lot of conviction which makes them vulnerable to a pullback given the less-certain political outcome," says Jain.

Jain explains that the Nifty’s earnings yield to 10-year bond yield suggests stretched equity valuations versus bonds. “Confidence in a stable government and predictable policies have dramatically pulled down expectations of rupee depreciation. This has assisted Indian bond yields to trade at the lowest premium to US yields in two decades," he elaborates.

Higher valuation of markets relative to the past combined with a government falling short in the majority may pose some challenges to the premium valuation of Indian equities.

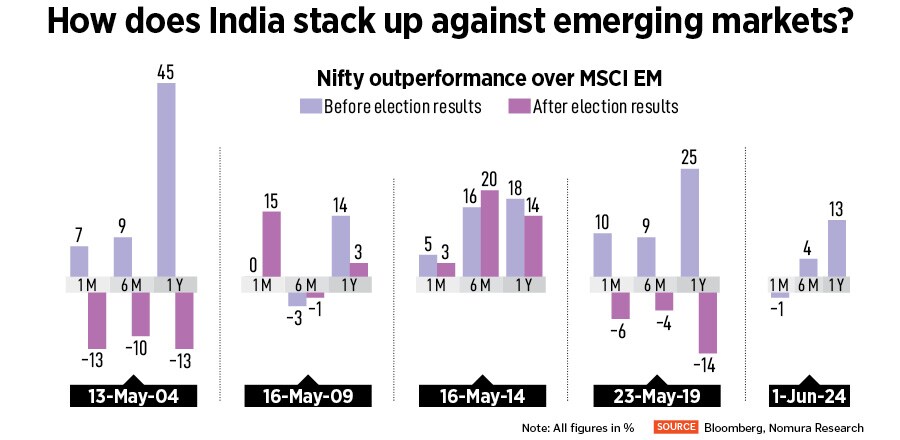

![]() However, Sachdeva feels India’s valuation premium over the region is a tough backdrop that triggers consolidation, but deep correction is unlikely. Earlier in the 2004 election, when the incumbent witnessed a surprise loss, markets saw a correction of 20 percent (in two days post results as a knee-jerk reaction, but even then, the markets had rebounded relatively quickly).

However, Sachdeva feels India’s valuation premium over the region is a tough backdrop that triggers consolidation, but deep correction is unlikely. Earlier in the 2004 election, when the incumbent witnessed a surprise loss, markets saw a correction of 20 percent (in two days post results as a knee-jerk reaction, but even then, the markets had rebounded relatively quickly).

Varun Lohchab, head, institutional research, HDFC Securities, expects this corrective phase to continue as valuations in domestic cyclicals are stretched compared to historical levels, making risk-reward unattractive, particularly in light of the election outcome. “While we expect that the NDA forming government and delivering a pro-growth budget will soothe investors’ nerves and help stabilise markets in the near term, any disappointment could result in a further sharp correction," he cautions.

According to Lohchab, the margin of safety in valuations of key benchmarks was very low after the last 12-month retail liquidity-driven rally. “This overvaluation of indices was already unsustainable, and the election results only acted as a trigger for them to correct," he explains. Lohchab doesn’t expect any significant earnings downgrade due to the election outcome as India has historically been able to grow real GDP by 6 to 8 percent under coalition governments as well.

“However, it could lead to a contraction in PE multiples, given the high PE premium enjoyed so far by Indian markets due to political stability and continuity. Nifty valuations at 18.7 times FY26 PE still don’t offer much upside for 12 percent earnings CAGR over FY24-26. Mid and small-cap indices are trading even at a premium to the Nifty, which could keep the broader market under pressure in the near term. Retail flows into equity markets need to be monitored over the next three to six months as they could witness some slowdown, which we believe would be positive for the markets’ long-term health," Lochab says.

Eyes on budget, monsoon, earnings

What’s not priced in the markets now after the surprising election results? Unresolvable disagreements within the NDA coalition are not priced in by the equity market, Ridham Desai, equity strategist, Morgan Stanley, says.

Besides, government and cabinet formation will be key. The markets will keep a sharp eye on a few critical events. First is the monetary policy review by the Reserve Bank of India (RBI) on June 7. The central bank is widely expected to bring no change in policy rate with a hope that liquidity conditions will improve as government spending resumes after elections.

Second is the onset of the monsoon, which is an important factor for economic growth and corporate earnings. The Indian Meteorological Department (IMD) expects "above normal" monsoon rainfall this year. Well-distributed rainfall will be critical for bringing down currently elevated food inflation and support a revival in rural consumption. The IMD has forecast cumulative rainfall at 106 percent of long-period average (LPA). Private forecaster Skymet has a slightly lower projection of 102 percent, which suggests rainfall will be within the normal range (96-104 percent of the LPA).

![]()

Third is the Union Budget which is likely in early July: The interim budget pegged the deficit at 5.1 percent with capital spending growth exceeding social expenditure. Since then, the actual trailing deficit was 20 basis points lower than estimate and the RBI dividend cheque has added about 30 bps to revenues.

“We would watch out for the upcoming Union Budget announcement. Our base case is for the government to stick to a medium-term fiscal consolidation roadmap but with a populist bias. The higher-than-expected RBI dividend transfer to the government would create fiscal leeway to increase populist spending to support consumption for lower income strata (cash transfers, higher rural spending, income tax rationalisation, affordable housing etc) while continuing its thrust to boost public capex," says Tanvee Gupta Jain, chief economist, UBS India.

According to Fitch Ratings, weaker fiscal metrics relative to peers are a significant constraint for India’s sovereign rating. Currently, Fitch has ‘BBB-’ rating on India sovereign with a stable outlook in January 2024. “The next government’s ability to address high fiscal deficits and reduce debt will be important considerations for the rating in the next few years. Sustained deficit reduction, particularly if underpinned by durable revenue-raising reforms, would be positive for India’s sovereign rating fundamentals over the medium term," says Fitch.

The ratings agency adds that the elections marginally increase risks of higher spending or slippage in capex to accommodate greater social spending.

Fourth, corporates will start declaring their earnings of the April to June period in the second week of July. Corporate earnings will indicate business growth prospects and if there are any green shoots in consumer demands. In the March quarter of fiscal 2024, companies showed rise in profitability and cash flows, but consumer segment remained in stress.

However, Sachdeva feels India’s valuation premium over the region is a tough backdrop that triggers consolidation, but deep correction is unlikely. Earlier in the 2004 election, when the incumbent witnessed a surprise loss, markets saw a correction of 20 percent (in two days post results as a knee-jerk reaction, but even then, the markets had rebounded relatively quickly).

However, Sachdeva feels India’s valuation premium over the region is a tough backdrop that triggers consolidation, but deep correction is unlikely. Earlier in the 2004 election, when the incumbent witnessed a surprise loss, markets saw a correction of 20 percent (in two days post results as a knee-jerk reaction, but even then, the markets had rebounded relatively quickly).