What does the Modi 3.0 government need to do to scale India's electronics manufa

Experts anticipate a greater thrust on creating a component ecosystem and enabling a skilled workforce to further scale the industry

[br]

In his speech at the BJP headquarters in New Delhi after the general election results on Tuesday, Prime Minister Narendra Modi said India is the second-largest mobile manufacturing country, and the focus will now be on electronics and semiconductors. The last 10 years of the Modi-led government have focussed on improving the electronics manufacturing ecosystem, particularly via the Production Linked Incentive (PLI) scheme. “The last 10 years have ensured Indian companies revitalise themselves the prime minister’s call for ‘Aatmanirbharta’ has been met with much appreciation together with on-the-ground action," says Ajai Chowdhry, co-founder, HCL founder & chairman, EPIC Foundation, and chairman-Mission Governing Board, National Quantum Mission.

Now as Modi is set for his third term as prime minister, will the new coalition dynamics slow down what has been going on in the electronics manufacturing industry for the past 10 years? Experts don’t think so. In fact, they expect the newly formed government to double down on investments in this sector and turn India into an electronics manufacturing powerhouse over the next decade. This will mainly be driven by increasing domestic demand and improving export competitiveness. Domestic production has nearly doubled from $41 billion in FY17 to $81 billion in FY22, and is expected to further increase at a CAGR of 24 percent between FY22 and FY27, as per an EY report.

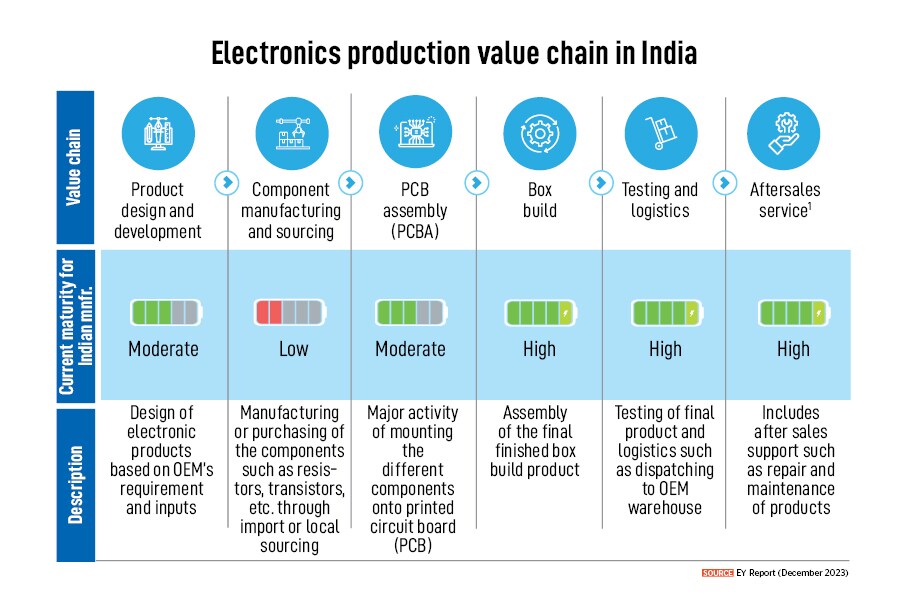

Yet, there are various key drivers that the new government will need to address in the electronics production value chain.

India imports electronic components from China (62 percent), Vietnam (2 percent), South Korea (10 percent), Japan (2 percent) and other Southeast Asian countries, resulting in increased lead time and costs, as per an EY report from December 2023. Of the total components, India can only source 12 to 13 percent of the components locally, in terms of value. Whereas countries like China can source close to 50 to 55 percent locally, and Vietnam, about 30 percent, as per Counterpoint Research.

So far, the PLI scheme has worked extremely well for most sectors, and manufacturing in particular. Case in point, Dixon Technologies. “The PLI scheme has been hugely beneficial for certain sectors such as smartphone manufacturing. But, as an industry, we need to start looking beyond that: The sector needs to start becoming more self-reliant," Sunil Vachani, co-founder and executive chairman of Dixon Technologies, told Forbes India in March.

India has been exporting electronics, particularly smartphones, to developed markets, including the UK, Italy, France, Middle East, Japan, Germany and Russia. But there is a further need to scale this. “This can only be sustainable if we have a components ecosystem," explains Vachani, “And in that, Dixon [and other private players] will have to take the lead with some investments." The largest electronics manufacturing services (EMS) company plans to make substantial investments into the components ecosystem—particularly mobile components—since there is still high reliance on imports for the same.

The PLI scheme has been the most successful in addressing challenges associated with India’s high cost of capital. But the push for PLI in other sectors within electronics manufacturing needs to continue. It is no longer simply phones that are being assembled in India, we also have tablets, laptops and consumer electronics. “Earlier, only 30 percent of assembling used to happen in India. But that is inching towards 80 percent. And in scaling this, an extension of the PLI scheme will definitely help—especially the components ecosystem," explains Tarun Pathak, research director, Counterpoint Research.

“So far we have been looking only at the low-end of the assembly line," says Pathak. “We need to start moving up the value chain, and bring large anchor companies to India. Once you bring them here, the ecosystem will automatically fall into place." However, you can’t attract the biggest players through a duty uptick, experts reckon. For instance, in China, the majority of development is state-funded. “Similarly, India needs to find and fund the right expertise and talent pool. For instance, we already have good PCB (printed circuit board) makers. But they are making for other products and not smartphones. With the right funding, they can scale up too," explains Pathak.

There is also a need to invest in innovation and R&D in this sector. Says Chowdhry, “This is our time to develop design and manufacturing capabilities, thereby reducing dependence on China. It is time now to transition and add focus on value-added manufacturing as well as ‘design in India’ products, thereby positioning India as a creator of global brands."

However, this is not going to be an easy transition. “We have strong design skills available, but converting that to manufacturing will take a massive effort and enablement of investments," says Shekhar Sanyal, country head and director, Institution of Engineering and Technology (IET) India.

Small and medium enterprises (SMEs) will play a pivotal role in scaling up. Vachani said, “In China, the bulk of component manufacturing is done by SMEs. This is where, as an industry, a lot needs to be done to ensure that SMEs invest in this sector. While there is a huge demand, not too many companies have invested in this segment."

Sanyal agrees, “We expect the focus to expand to include enablement of investments from SME manufacturers, removal of regulatory bottlenecks to make investing more viable, technological and material-enabled… and strong support for the uptake of output from the SME sector."

The biggest challenge in the sector remains skilled workforce—not only for engineers, but also technicians. To scale up the electronics manufacturing industry further, skill development will be a key factor. “There is a need to upskill the workforce to create this pool of specialised workers. We can’t be dependent on bringing those workers from China or Taiwan… we need to create that," explains Pathak of Counterpoint.

Even with job creation, the PLI scheme has incrementally boosted 5 lakh jobs creation in the mobile manufacturing industry alone. Dixon’s team has been working with Industrial Training Institutes to see how the curriculum can evolve to make it more industry ready. “The workforce needs to be trained on quality system processes, industry 4.0, and dashboard management, among many others," explains Vachani. Dixon’s team is also setting up centres of excellences to provide in-house training.

Clearly, there are a number of pieces that need to fall into place. Pankaj Mohindroo, chairman, India Cellular & Electronics, says, “The world has great confidence that India can gradually replace China as the major manufacturing nation in the world. A lot of movement has happened for China already, so it will be challenging for us, but we are confident that we will achieve our vision."

First Published: Jun 06, 2024, 14:27

Subscribe Now