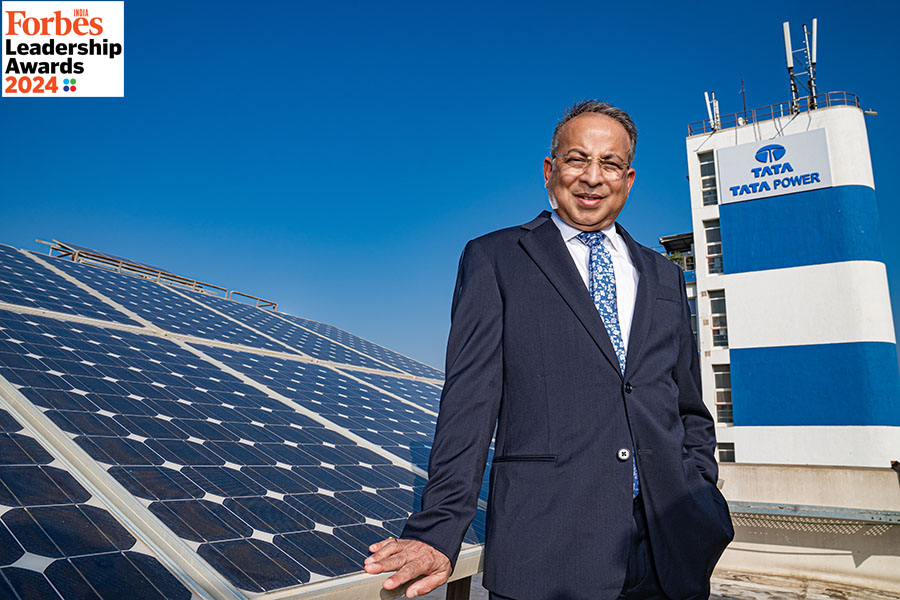

Praveer Sinha: Charting aggressive renewables strategy for Tata Power

Under Praveer Sinha, winner of the Forbes India Leadership Award for CEO of the Year, Tata Power aims to significantly enhance its renewables capacity by 2030 and position itself for a net-zero world

Praveer Sinha, CEO and MD, Tata Power

Image: Mexy Xavier

Praveer Sinha, CEO and MD, Tata Power

Image: Mexy Xavier

In 2020, a year or so before sustainability became a buzzword, Tata Power had already taken its bold step. The company targeted to become net zero by 2050. Importantly, it decided not to add any more conventional [read coal-based] power capacity.

Later, Tata Power went one up on its previous announcement. “We stepped up and then advanced our net zero timeline to 2045,” says Praveer Sinha, CEO and managing director of Tata Power.

It’s not just net zero. Sinha points out that Tata Power has, through its 108-year history, always been at the forefront of trying new technologies. This sets up a culture of experimentation in the company and makes for a business that is not necessarily wedded to old ways of making money. Over a 100 years ago, in 1915, it set up India’s first hydroelectric plant. More recently at the Indian Energy Exchange, an electronic power trading exchange, Tata Power was an initial shareholder and promoter. These were both pioneering concepts at their time and this early-adopter spirit is what has held the company in good stead. “At any given time, we have half a dozen pilots that may or may not work out,” points out Sinha.

Trying new technologies comes with a solid core of power generation, distribution and transmission that has propelled Tata Power to a business that is valued at ₹117,000 crore in February. Its market cap has seen a rapid climb post pandemic when power demand surged. In FY22 and FY23, demand rose by 8.2 percent and 9.6 percent respectively—far above the 5 percent growth seen in the last decade. A heatwave in the summer of 2022 led to a 19 percent year-on-year increase in demand, while 2023 saw demand up by 11 percent year-on-year on account of rainfall uncertainty.

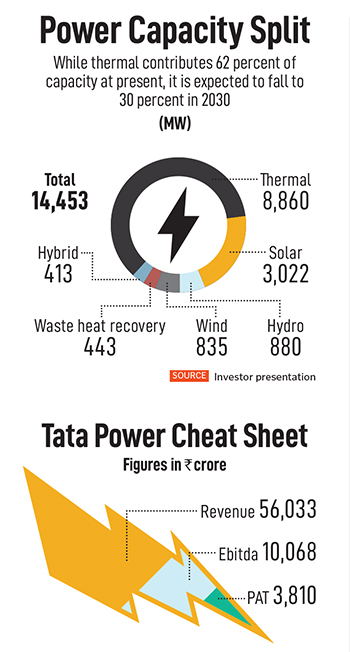

Trying new technologies comes with a solid core of power generation, distribution and transmission that has propelled Tata Power to a business that is valued at ₹117,000 crore in February. Its market cap has seen a rapid climb post pandemic when power demand surged. In FY22 and FY23, demand rose by 8.2 percent and 9.6 percent respectively—far above the 5 percent growth seen in the last decade. A heatwave in the summer of 2022 led to a 19 percent year-on-year increase in demand, while 2023 saw demand up by 11 percent year-on-year on account of rainfall uncertainty. This propelled the market capitalisation of Tata Power 10 times from the lows it saw in March 2020. In the last 12 months, the business has seen profitability of ₹4,000 crore— far higher than the ₹2,600 crore peak it saw in March 2019. Clearly this is a business that the market has rerated.

A leading hedge fund manager who declined to be named due to company policy points out that few other listed players have the sweep of businesses that Tata Power has. “One has no choice but to take a position in the stock,” he says. Next up: Sinha has a plan to double top line, Ebitda and bottom line by 2027.

The Promise of Renewables

In setting up renewable capacity a question that is often asked is whether it is possible to get 24x7 reliable supply through only renewable solutions. There have been times when renewables haven’t lived up to the task with the most famous example being the Polar vortex event in Texas in 2021 when there was a widespread grid failure. Sinha counters this by saying that the answer to whether renewables alone can supply power reliably is an unequivocal yes. “The other point that needs to be understood is that for renewables, the costs are fixed for the next 25 years,” he explains.Currently, Tata Power has 38 percent of its 14,453 GW capacity coming from renewables. By 2030, this figure is slated to rise to 70 percent from a mix of solar, wind and hydro. The business has received a boost on account of a streamlining of power purchase agreements that provide clear visibility on revenues.

Investors are most excited about the portfolio of options that Tata Power has in this space. Take, for instance, its utility scale solar EPC business where it has an order book of ₹15,885 crore. In Q3FY24 alone, the company won orders worth ₹2,894 crore and it executed ₹3,078 worth of orders.

Or the solar rooftop business [which consists of a mix of projects for the Tata group as well as third-party projects] where last year, its revenue has risen from ₹535 crore to ₹952 crore in Q3FY24. These point to a clear sign of new businesses scaling rapidly with the latest being a cell and module manufacturing plant that will scale up to 4.3 GW of manufacturing capacity by Q1FY25. A recent announcement by the government christened PM Surya Dhar Muft Bijli Yojana has received a ₹75,000 crore allocation and this means that Tata Power should have enough demand on its hands.

Or the solar rooftop business [which consists of a mix of projects for the Tata group as well as third-party projects] where last year, its revenue has risen from ₹535 crore to ₹952 crore in Q3FY24. These point to a clear sign of new businesses scaling rapidly with the latest being a cell and module manufacturing plant that will scale up to 4.3 GW of manufacturing capacity by Q1FY25. A recent announcement by the government christened PM Surya Dhar Muft Bijli Yojana has received a ₹75,000 crore allocation and this means that Tata Power should have enough demand on its hands.With renewable a key issue is the round-the-clock supply of electricity. Lack of sun or wind can lead to supply outages and this is managed through ramping up supply from coal-based plants. “These issues can be resolved by adding sufficient storage capacities—either a battery storage system or a pumped storage plant—to the grid,” says Miren Lodha, director research at Crisil Market Intelligence and Analytics.

In 2023, Tata Power announced plans to enter the pump storage space with an investment of ₹12,550 crore in Maharashtra in Bhivpuri and Shirawata. Water would be pumped to an upper reservoir and utilised for electricity production. Innovations like this would help the company supply more dependable power through renewable sources. The plan is to offer a combination of solar, renewable and pump storage to meet demand through the day.

Also read: Padma Shri Ashok Jhunjhunwala: The deep tech doyen

Legacy Business

On the thermal power front, Tata Power has an installed capacity of 8,860 MW. In this business, the demand for power has played a key role in its profitability and the coal-based plants have been the largest contributor to its profits. In 2023, the company received a shot in the arm when the Mundra project, which had been shut on account of unviable electricity prices, was reopened under Section 11 of the Electricity Act, 2003 to meet high power demand. While the plant made an Ebitda profit, it is still losing money on account of IND As 115 accounting norms.On the power distribution front, Tata Power supplies electricity to 12.5 million consumers in Delhi, Mumbai, Ajmer and Odisha. Sinha expects several new cities to open up for bidding once the general elections are over. This business gives it insight into consumer demand, what patterns are likely to evolve and the manner in which collections are done. It also helps the company in forecasting demand. In Odisha, the company has a unique advantage as it supplies to both rural and urban consumers. Add to that the transmission business where power lines are laid.

Tata Power installed 2,280 solar panels in Mumbai’s Brabourne Stadium, generating 11 lakh units of electricity annually

Tata Power installed 2,280 solar panels in Mumbai’s Brabourne Stadium, generating 11 lakh units of electricity annuallyThe Road Ahead

As he begins his second term at the helm of Tata Power, Sinha acknowledges the attention to focus that the board has brought to the business. Anything that is non-core needs to be exited is the mandate from parent Tata Sons. This has brought in some much-needed cohesion to the company, allowing it to focus on technologies of the future.A key part of the re-rating has been on account of the demand for power which, post pandemic, has done much better than expectations. How power companies do depends on the pace of growth of demand—an external factor that they have no control over. In the past, capacity addition has been in excess of demand and that caused the business to go through an extended downcycle post 2012.

Sinha points out that power demand in India has roughly doubled every decade. The total capacity was 105 GW in 2001. This rose to 210 GW in 2012 and to 425 GW today. Plans announced so far include taking this to 900 GW by 2030, including 500 GW of clean energy. While a doubling in 10 years equals an annual growth rate of 7.2 percent, the new capacity additions point to a doubling in seven years, implying a growth rate of 10.2 percent.

While this might be ambitious from a demand point of view, in the short run, there could be some over capacity in the system, but this should sort itself out quickly. It pays to remember that renewables operate at a much lower plant load factor (PLF). “Renewable energy plants run at a PLF of 20 to 25 percent which is significantly lower when compared with coal-based plants with PLFs of 60 to 70 percent, which leads to more capacities of renewable energy to be installed for generating the same amount of power using a coal-based plant. Typically, for generating the same amount of power, we would need to install 2.5 to three times more capacity for solar versus coal-based power plants,” says Lodha of Crisil.

In the run up to 2030, Tata Power plans to add 20 GW of capacity at an investment of ₹100,000 crore. There are also transmission lines to be laid, solar modules to be manufactured, charging stations to be installed, city distribution contracts to be bid for.

All in all, it points to a busy decade for the company that has seen a marked improvement in its return on equity to 13 percent in 2023, up from an average of 5 percent in the last decade. It was probably this increased profitability window that prompted Tata Sons to increase its stake from 37 percent to 47 percent in 2020 after infusing ₹2,600 crore. In hindsight, the parent got a great deal as the market cap has risen nearly seven times since. All this while keeping debt at below two times equity so that interest costs don’t bite. Still, at 36 times earnings, the business is not cheap at present. The business will have to keep expanding apace for shareholders to get a good deal in the next decade.

(This story appears in the 08 March, 2024 issue of Forbes India. To visit our Archives, click here.)

Post Your Comment